Sterling Elementary Forecast: Barely Bullish

- UK Prime Minister releases sanctions on Russian banks and Russian billionaires

- UK shoppers beneath stress as power, taxes and NHI contributions all set to extend

- Massive speculators flip net-long, what does this imply for the Pound?

Boris Johnson Declares Sanctions on Russia

In keeping with different NATO alliance members, the UK introduced that 5 banks have had their belongings frozen, together with three Russian billionaires – who’re additionally mentioned to have obtained journey bans. Such measures have been described because the “first barrage” which could possibly be prolonged if want be.

As well as, Russian parliamentarians who voted to acknowledge the breakaway areas of Donetsk and Lugansk as impartial territories would even be sanctioned. Within the coming weeks, British companies can be prevented kind doing enterprise in Donetsk and Lugansk as is the case in Crimea which was annexed from Ukraine in 2014.

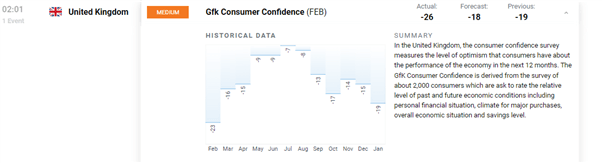

UK Customers Pessimistic concerning the UK Financial system

The UK shopper confidence survey, compiled by Gfk recorded its sharpest month on month drop in February for the reason that begin of the pandemic. The determine has been trending decrease since November and dropped from -19 to -26.

UK shoppers expressed concern over power and meals worth rises, elevated taxation and rising rates of interest, placing stress on disposable earnings and the potential for better ranges of indebtedness. UK Prime Minister Boris Johnson has introduced measures to strive soften the burden on the patron however has did not rule out will increase in social welfare contributions as it’s essential to pay for well being care.

Customise and filter stay financial knowledge through our DaliyFX financial calendar

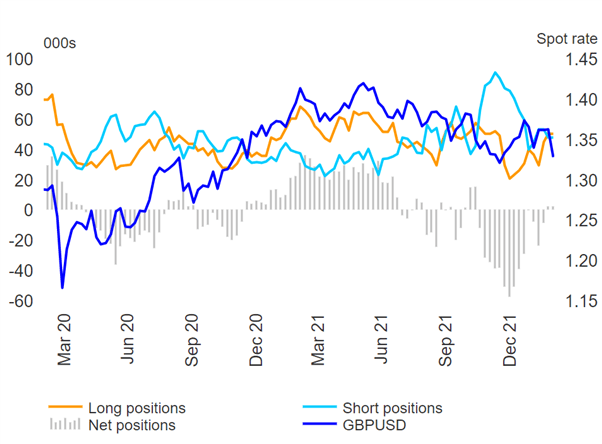

Massive Speculators Flip Internet-Lengthy on Sterling (GBP)

After an extended interval the place hedge funds and different giant speculators piled into Sterling quick positions, we at the moment are seeing a change in ‘sensible cash’ sentiment as lengthy positions narrowly outweigh shorts. This nonetheless, could merely be the results of revenue taking from excessive quick positioning as a substitute of an outright sentiment reversal. The above level turns into clearer after analyzing the drastic discount in shorts whereas longs picked as much as a a lot lesser extent.

Lengthy and Quick Sterling Positions and GBP/USD Overlay, CFTC Information

Supply: Refinitiv, CFTC, CoT Report ready by Richard Snow

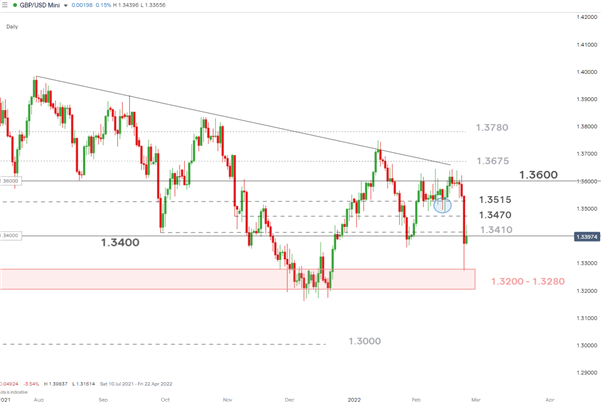

GBP/USD Day by day Chart

Supply: IG, ready by Richard Snow

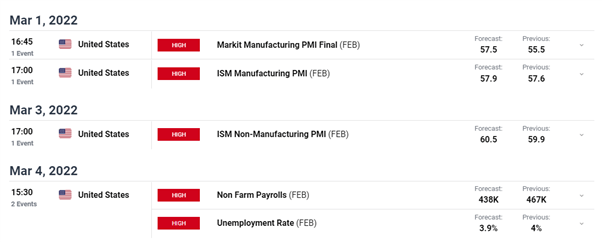

Main Threat Occasions for the Week Forward

Admittedly, the financial calendar has taken a again seat for a lot of this week as battle broke out in Ukraine. The unfolding navy motion been the principle driver in international markets however the fast pullback in gold, oil, and risk-correlated FX currencies just like the AUD and GBP counsel that we could have already reached the interval of ‘peak shock’.

Barely Bullish GBP/USD

The bullish bias heading into subsequent week relies on the just about fast restoration in threat belongings and the early levels of a return to talks because the Kremlin expressed it’s open to talks in Minsk.

Nevertheless, financial knowledge of excessive significance remains to be unlikely to considerably transfer markets because the geopolitical scenario stays unsure. Subsequent week we see US PMIs and NFP knowledge within the absence of excessive significance GBP scheduled occasions.

— Written by Richard Snow for DailyFX.com

Contact and observe Richard on Twitter: @RichardSnowFX