bjdlzx

On November ninth, Reconnaissance Vitality Africa (OTCQX:RECAF) (TSXV:RECO:CA) – the oil and gasoline firm that’s exploring for hydrocarbons in Northeast Namibia and Northwest Botswana – filed a fabric change report the place it introduced the long-awaited outcomes of the 8-2 exploration nicely. The outcomes weren’t comforting, and the inventory plunged by 46% in a single day. On this article, I’ll present an summary of the nicely end result and I’ll present my funding recommendation on the inventory.

When you have by no means heard of Reconnaissance Vitality Africa (also called ReconAfrica) earlier than, you’ll be able to take a look at my first article on the corporate the place I supplied a deep description of the corporate’s operations.

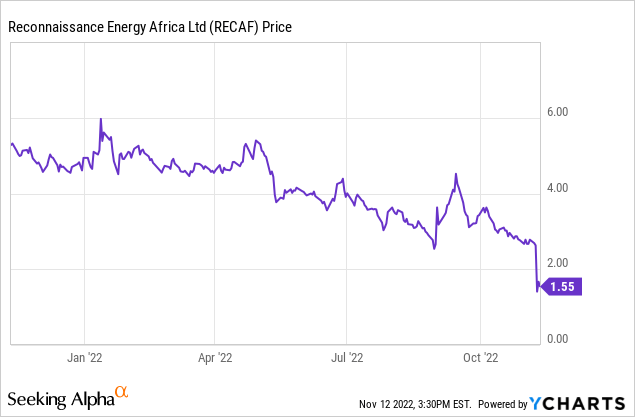

Inventory efficiency

Trying on the inventory worth chart of the final 12 months of buying and selling, one can instantly discover that ReconAfrica is a inventory characterised by robust volatility for the reason that inventory worth actions are principally motivated by expectations of exploration wells outcomes and forecasts of hydrocarbon discovery.

ReconAfrica is presently buying and selling at $1.55/share, equal to a market cap of $311M. The inventory is down 71% year-to-date and 68% year-on-year. The 52-week most is $5.97/share, recorded on January twelfth, 2022, whereas the 52-week minimal is $1.41/share and was recorded on November ninth after ReconAfrica introduced the outcomes of the 8-2 nicely.

8-2 nicely outcomes

The 8-2 nicely, also called Makandina, was spud in the direction of the tip of June 2022 and reached the whole depth on August fifteenth, however the press launch with outcomes was revealed just some days in the past, on November ninth. The truth that the corporate took greater than standard to announce outcomes might have already been interpreted as an indication of suboptimal outcomes. The nicely confirmed the presence of a petroleum system and encountered intervals with gasoline and (methane) gasoline liquids (ethane, propane and butane). The nicely may be thought of a hit from a geological viewpoint, nonetheless, financial accumulations of oil and gasoline weren’t discovered.

There have been excessive expectations across the 8-2 nicely however the introduced outcomes had been clearly disappointing, and the inventory plunged by 46% within the hours after the press launch solely to re-gain 19% the next day. My private view is that the market overreacted: it’s price reminding that Makandina was solely the third nicely drilled by ReconAfrica in an enormous basin with a number of different targets already recognized. As well as, the nicely was in a position to generate additional useful geological data that’s now being analyzed

Catalyst forward

Regardless of the adverse 8-2 nicely outcomes, ReconAfrica is already shifting forward with different drilling targets and extra actions. Within the subsequent months, there might be many catalysts to watch that would drive the inventory worth:

- 5-1 nicely: ReconAfrica has already began preparations for drilling the 5-1 nicely with spudding anticipated for mid-December 2022. Nevertheless, the truth that the corporate continues to be constructing the entry street and the drilling pad makes me assume that there might doubtlessly be some delays. The aim of the 5-1 nicely is to penetrate an prolonged Karoo stratigraphy with supply rock, trapping intervals and a reservoir.

- Seismic: throughout 2021 and the primary half of 2022, ReconAfrica carried out two seismic acquisition applications that coated 497 and 761 linear kilometers respectively. These information are all within the section of being analyzed with the built-in interpretation that’s being finalized: the 2 seismic campaigns had been useful for figuring out further leads and drilling targets thus increasing the corporate portfolio. Furthermore, ReconAfrica obtained all of the authorizations for buying a further 1500 km of 2D seismic information: this program is predicted to start in November and proceed till H1-2023.

- JV companions: in September 2022, ReconAfrica employed Alvarez & Marsal and Hannam & Companions to begin the method of looking for a number of companions keen to create a JV with ReconAfrica with the aim to speed up exploration actions. The VDR was opened in Q3-2022 and outcomes of the method are anticipated for the primary half of 2023.

Environmental points

In my earlier article about ReconAfrica, I discussed my considerations about environmental activist protests that would decelerate ReconAfrica’s operations. Regardless of the Namibian Authorities appears to be supporting ReconAfrica with the Excessive Courtroom of Namibia that, in August 2022, dismissed some prices in opposition to the corporate, the native inhabitants doesn’t quit. In the course of the COP27, ReconAfrica was on the middle of some dialogue with a former Anglican Bishop of Namibia that spoke with BBC calling ReconAfrica’s undertaking a sin. Furthermore, a Botswana activist from the River San folks, a neighborhood tribe that lives near the Okavango River, defined that the native inhabitants doesn’t need the undertaking to occur. Regardless of the Namibia and Botswana authorities appears to not care about all these statements, I imagine that the “activism” threat can’t be fully neglected.

Conclusion

General, regardless of the disappointing 8-2 nicely outcomes, I imagine that the market overreacted, and the present inventory worth discount can characterize a great entry level for buyers. ReconAfrica shouldn’t be a inventory that may present excessive returns in a brief interval, moderately it requires persistence and a long-term funding strategy since exploration actions in such an enormous space require time. Within the subsequent months, there might be many occasions that would drive the worth up together with the 5-1 nicely end result, the seismic interpretation report and potential companions that would be a part of forces with ReconAfrica.