We just lately mentioned the recession alerts from the NFIB (Nationwide Federation Of Impartial Enterprise) and the inverted .

“As in 2019, we see most of the similar recession alerts from the NFIB survey once more mixed with a excessive share of yield curve inversions. Notably, out of the ten yield spreads we monitor, that are probably the most delicate to financial outcomes, 90% are inverted.”

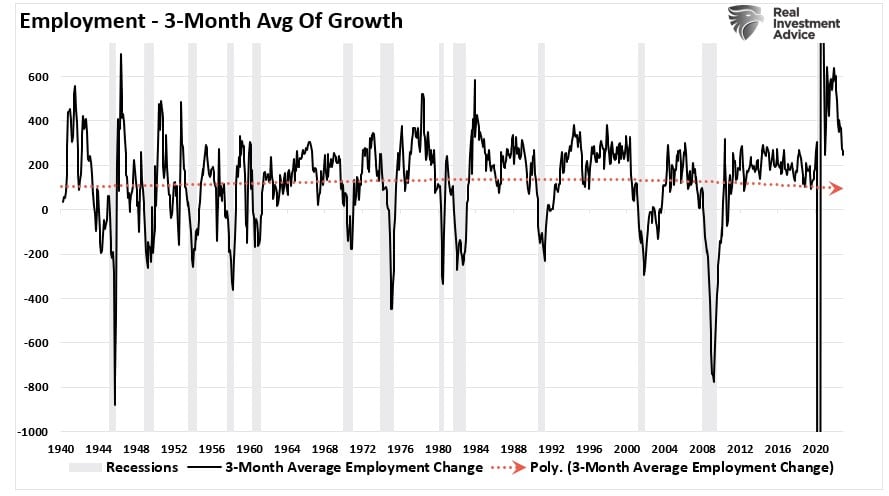

As we famous, many analysts recommend the economic system might have a “tender touchdown.” Or, slightly, keep away from a recession, primarily as a result of continued energy within the month-to-month employment studies.

Whereas these employment studies stay sturdy, the speedy decline in development has been a recession sign in and of itself. As we have now said earlier, the pattern of the info is much extra necessary than the month-to-month quantity.

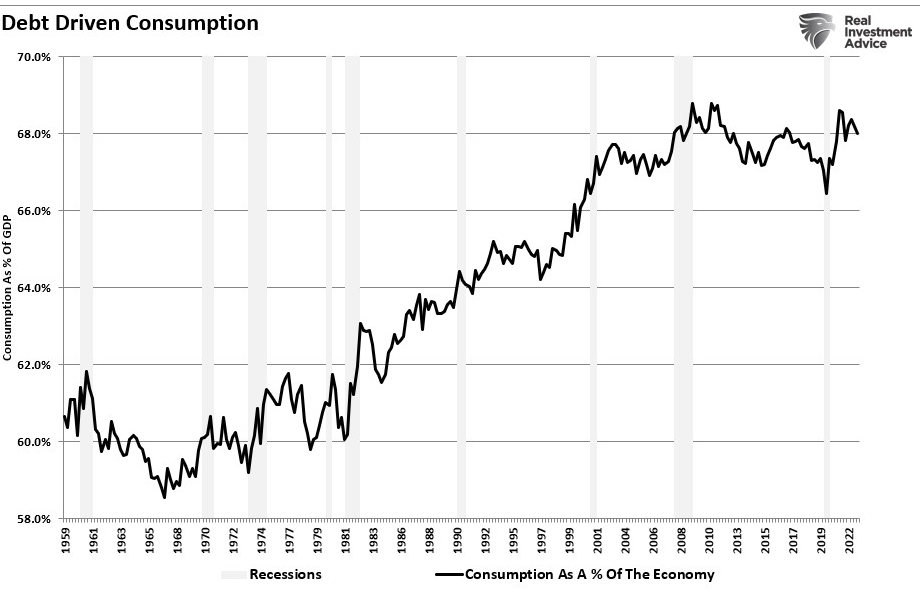

Employment is a important issue within the recession equation as a result of the U.S. economic system includes roughly 68% of .

In different phrases, what people purchase and use every day drives financial exercise. Additionally it is the majority of income and earnings development for companies.

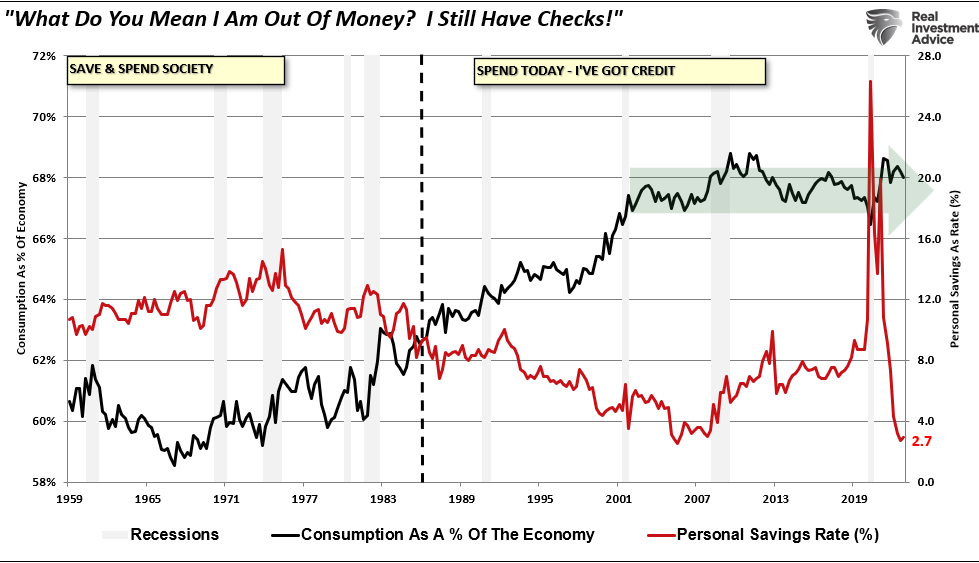

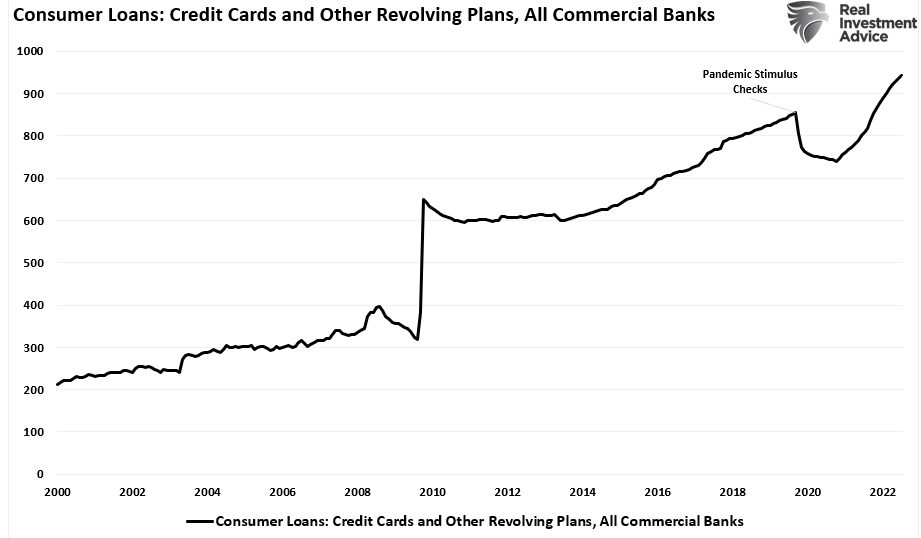

The huge drawdown in financial savings and rise in bank card debt supported the consumption surge within the U.S. economic system. Nonetheless, for the reason that flip of the century, consumption slowed together with .

A specific recession sign comes from the huge surge in financial savings as a result of “stimulus checks.”

That increase has absolutely reversed as shoppers wrestle to pay payments. At the moment, almost 40% of People are having hassle paying payments, and virtually 57% of People can’t afford a $1000 emergency.

“68% of individuals are fearful they wouldn’t be capable of cowl their dwelling bills for only one month in the event that they misplaced their main supply of revenue. And when push involves shove, the bulk (57%) of U.S. adults are presently unable to afford a $1,000 emergency expense.

When damaged down by era, Gen Zers (85%) and Millennials (79%) usually tend to be fearful about overlaying an emergency expense.

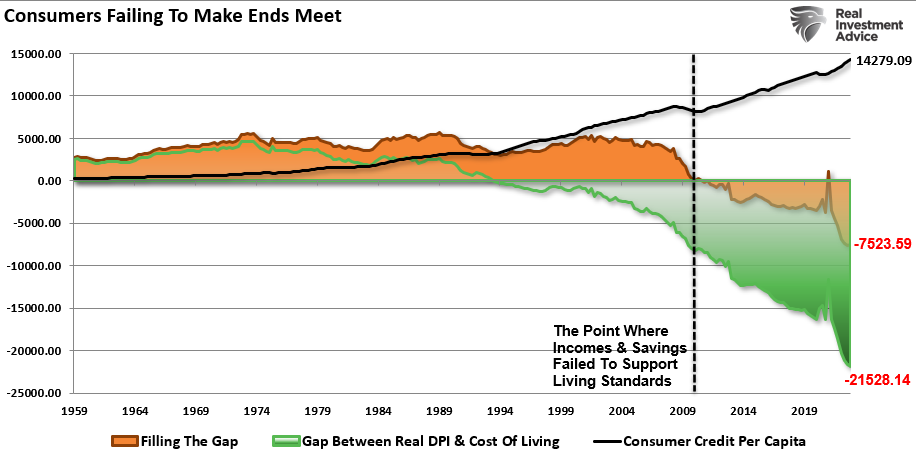

Such isn’t a surprise contemplating the present hole between the inflation-adjusted price of dwelling and the unfold between and financial savings. It presently requires greater than $7500 of debt yearly to fill the “hole.”

This is the reason almost 75% of middle-income households are battling the impression of , in line with a CNBC report.

“Almost three-quarters, or 72%, of middle-income households say their earnings are falling behind the price of dwelling, up from 68% a yr in the past, in line with a separate report by Primerica based mostly on a survey of households with incomes between $30,000 and $100,000. The same share, 74%, stated they’re unable to save lots of for his or her future, up from 66% a yr in the past.”

The Recession Sign From Credit score Playing cards

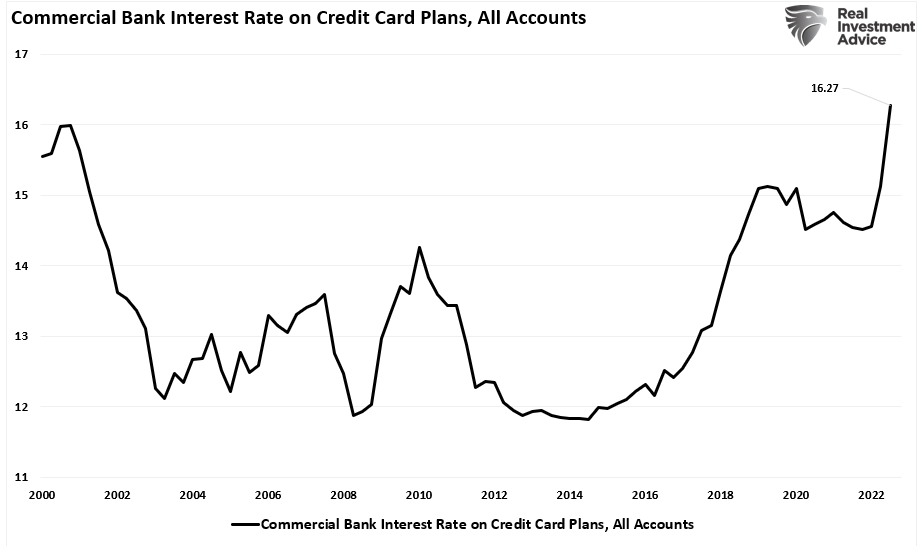

The “recession” sign from shoppers ought to actually not be dismissed, given their contribution to financial development. Nonetheless, the danger of deeper recession will increase because the continues to hike rates of interest.

Bank cards are now not only for luxurious gadgets and journey. For a lot of People, bank cards are actually the distinction between shopping for meals and gasoline or not.

Notably, as proven above, since 2000, consumption has flatlined as a p.c of financial development. Nonetheless, bank card loans have continued to rise to help the usual of dwelling.

As shoppers demand bigger homes, luxurious items, vehicles, journey, and leisure, actual incomes have did not sustain with demand. With near-zero rates of interest, shoppers leveraged themselves on the again of low cost debt, significantly for the reason that monetary disaster.

Nonetheless, because the Fed continues its aggressive price mountaineering marketing campaign, these short-term charges feed via to variable price debt, akin to bank cards.

This is the reason a recession sign we should always take note of is the sharp spike in bank card funds which additional detracts financial savings and wages from consumptive spending to debt service.

In fact, with regards to the economic system, dangerous financial outcomes all the time begin with the patron.

“The mixture of document excessive bank card debt and document excessive bank card curiosity is nothing in need of catastrophic for each the US economic system, and the strapped shopper who has no selection however to maintain shopping for on credit score whereas hoping subsequent month’s invoice will one way or the other not come. Sadly, it is going to and in some unspecified time in the future within the very close to future, this can even translate into large mortgage losses for US shopper banks; that’s when Powell will lastly panic.” – Zero Hedge

As proven within the shopper spending hole chart above, the non permanent surplus shoppers had in 2020 following the deluge of stimulus resulted in an enormous reversal.

Such was exactly what we suspected can be the case, as mentioned in , to wit:

“Social packages don’t enhance prosperity over time. Sure, sending checks to households will enhance financial prosperity and reduce poverty for 12-months. Nonetheless, subsequent yr, when the checks finish, the poverty ranges will return to regular, and worse, because of elevated inflation.

In a rush to assist these in want, financial fundamentals are almost all the time forgotten. If I enhance incomes by $1000/month, costs of products and providers will regulate to the elevated demand. As famous above, the economic system will rapidly take in the elevated incomes returning the poor to the earlier place.“

That consequence was evident with the eruption of inflation all through 2022, which left the poor in poverty. In 2023, the results of tighter financial coverage will doubtless have an effect on many extra.

Recession Coming In 2023

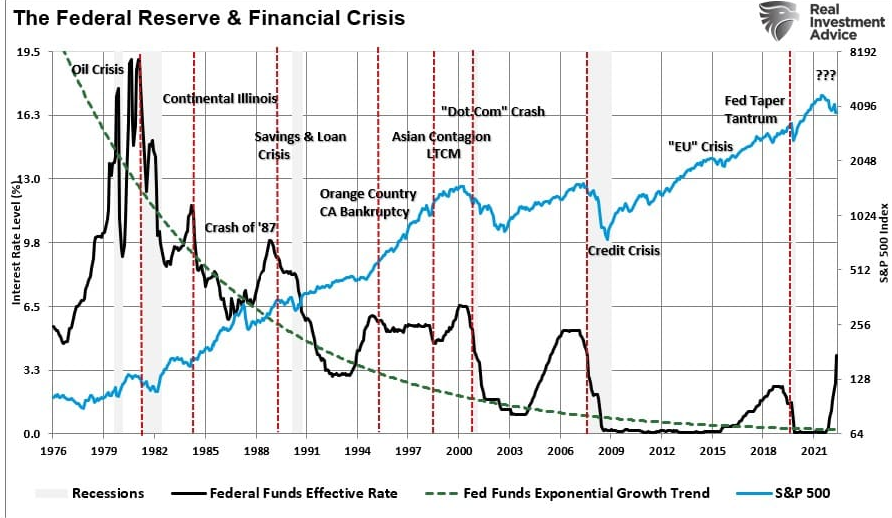

Whereas the market is defiant that the Federal Reserve will engineer a “tender touchdown.” The Federal Reserve has by no means entered right into a price mountaineering marketing campaign with a ”constructive consequence.”

As a substitute, each earlier journey to regulate financial outcomes by the Federal Reserve has resulted in a recession, bear market, or some “occasion” that required a reversal of financial coverage. Or, slightly, a “exhausting touchdown.”

Given the steepness of the present marketing campaign, it’s unlikely that the economic system will stay unscathed as financial savings charges drop markedly. Extra importantly, the speed enhance instantly impacts households depending on bank card debt to make ends meet.

Whereas buyers might not assume a tough touchdown is coming, the danger to consumption because of indebtedness and surging charges recommend in a different way. Importantly, what issues most for buyers is the coincident repricing of property as earnings decline as a result of contraction in consumption.

The entire level of the Fed mountaineering charges is to sluggish financial development, thereby lowering inflation. As such, the danger of a recession rises as increased charges curtail financial exercise. Sadly, with the economic system slowing, further tightening may exacerbate the danger of a recession.

Therein lies the danger. Since earnings stay correlated to financial development, earnings decline as price hikes ensue. Such is very the case in additional aggressive campaigns. Subsequently, market costs have doubtless not discounted earnings sufficient to accommodate an extra decline.

The media, and the White Home, have proclaimed victory by stating the primary two quarters of 2022 weren’t a recession however solely an financial slowdown. Nonetheless, given the lag impact of adjustments to the cash provide and better rates of interest, indicators are fairly clear recession threat may be very possible in 2023.

The buyer is prone to be the most important loser.