TERADAT SANTIVIVUT

By Padhraic Garvey, CFA; Benjamin Schroeder; Antoine Bouvet

Fed minutes sounds suitably hawkish – in tune with the market temper of late

Fed minutes are sustaining the hawkish tilt that has been dominating coverage dialogue of late. The Fed paused in June, however some contributors would have most popular a hike. There was acknowledgement of ongoing agency GDP progress and excessive inflation, with core inflation particularly exhibiting no tendency to point out any materials fall this 12 months up to now. The stability is considered one of a hawkish Fed, with some seeing the potential for avoiding a fabric downturn. Workers nonetheless see a gentle recession forward.

The Fed additionally famous that credit score stays out there to extremely rated debtors, however that lending circumstances had tightened additional for bank-dependent debtors. Aside from clearly greater borrowing prices, the Fed additionally notes a tightening in lending requirements within the business actual property area. There was additionally a tightening in credit score circumstances for decrease rated debtors within the residential mortgage market. However general vulnerabilities to funding dangers are deemed average by the Fed.

There was extra in help of the danger of one other hike past the July one

On liquidity circumstances the Fed famous the construct in US Treasury balances publish the debt ceiling suspension by means of extra invoice issuance, and for that to coincide with a tightening in circumstances. The Fed anticipated the rise within the Treasury money account to be offset by falls in reverse repo balances, and that financial institution reserves would additionally fall. Nonetheless, the Fed sees financial institution reserves remaining ample by means of to the tip of 2023. The latter is an fascinating perception, because it suggests the Fed isn’t involved as of but that liquidity circumstances are at some extent the place they might show troubling for the system.

This seems to pave a secure route for additional funds fee hikes. A 25 foundation level hike is now 85% discounted for July, and there was nothing within the minutes to negate that low cost. The truth is there was extra there in help of the danger for an additional hike past the July one. At this juncture the Fed doesn’t see sufficient on the market to ship any sense that it’s completed with hikes.

Our newest view on US market charges is contained right here, rationalising the persistent drift in the direction of a 4% deal with for the 10yr Treasury yield.

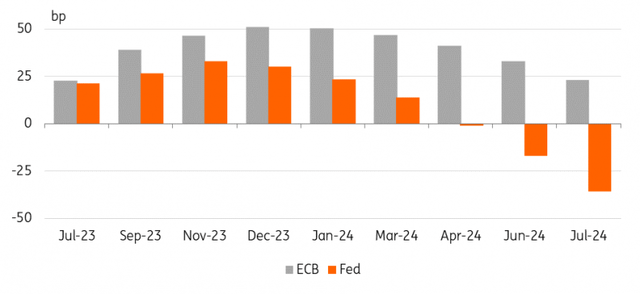

Cash market pricing of Fed and ECB key fee adjustments

Refinitiv, ING

The ECB is holding its hawkish line

The Bundesbank’s Joachim Nagel, one of many extra outstanding hawks of the European Central Financial institution, has been on the wires over the previous few days pushing the recognized narrative that charges must rise additional and that the battle towards inflation was extra akin to an extended distance run than a dash.

The transmission of financial coverage appears to be working with the most recent ECB financial institution curiosity statistics exhibiting a powerful pass-through. On the inflation entrance there are additionally some extra encouraging disinflationary indicators. The PPI dipped into destructive territory yesterday coming in decrease than anticipated and pointing to lessening pipeline strain. The ECB’s personal client survey additionally noticed an extra drop in inflation expectations. On the similar time the macro backdrop is getting gloomier, with the ultimate PMIs having been revised decrease simply this week.

Some will warning that the ECB fashions are usually not as dependable these days as earlier than, so there must be an rising deal with present inflation dynamics. Whereas falling value expectations of customers are constructive, they’re normally carefully correlated to what occurs with present inflation. Some extra dovish ECB members, similar to Italy’s Visco, have spoken out towards the hawks’ calls to err on the facet of doing an excessive amount of on charges.

For now the market continues to be shopping for into the story that extra hikes are wanted

For now the market continues to be shopping for into the story that extra hikes are wanted and is now totally discounting two extra fee hikes from the ECB by the tip of the 12 months. However there are additionally query marks, and these will solely get bigger with extra disappointing information, as to how tenable that hawkish ECB place is. Markets are discounting the primary fee reduce by summer time 2024, although not but totally discounting three cuts from the height in whole by the tip of 2024.

The longer outlook is exhibiting rising cracks. It is not simply that the curve stays deeply inverted. It is also actual charges as an example which have not likely recovered from their 40bp hunch in late Might to late June. Hitting a low round zero, the 5y5y actual ESTR OIS continues to be beneath 10bp. The flipside although is a 5y5y inflation ahead nonetheless at 2.55%, and nonetheless on an unbroken, basic upward pattern since mid-2020. That is one thing the ECB might be watching extra carefully.

Right this moment’s occasions and market views

US information stays the primary focus. At the beginning of the week the ISM manufacturing once more painted a dark image, however the ISM for the companies sector out as we speak represents the bigger share of the economic system. Right here the consensus is to see a rebound from the dip to the 50 stage, and we predict this could assist a terrific deal in getting 10Y UST yields to 4%.

Forward of tomorrow’s official US jobs report the ISM’s employment sub element can even get extra scrutiny – it had dipped beneath 50 final month, contrasting with the later robust payrolls quantity. In fact, the ADP estimate can even have some (restricted) bearing on expectations tomorrow, whereas the preliminary jobless claims and JOLTs job openings information ought to enable a extra contemporaneous sense of the present labour market state of affairs within the US. Up to now it has been surprisingly resilient.

The primary information occasion within the eurozone are the retail gross sales numbers following Germany’s manufacturing facility orders this morning. The Bundesbank’s Nagel has his fourth scheduled look this week.

Sovereign bond provide will come from France and Spain as we speak. Being geared to the longer finish of curves provide might have helped the curve bounce off the acute lows in previous periods.

Content material Disclaimer

This publication has been ready by ING solely for data functions no matter a selected person’s means, monetary state of affairs or funding targets. The data doesn’t represent funding advice, and neither is it funding, authorized or tax recommendation or a suggestion or solicitation to buy or promote any monetary instrument. Learn extra.

Unique Publish