The inflation charge – no less than the headline charge – which has fallen sharply within the final 4 reviews (from 10.1% in March to six.8% in July) has actually contributed to the Previous Woman’s expectations of aggressiveness waning, bringing the terminal charge for the English Central Financial institution down from shut to six.5% to the present 5.585% anticipated by the markets in December. Core inflation, then again, remains to be stubbornly excessive at 6.9%, and so is wage development: solely this morning we heard of an 8.5% quarterly/year-on-year improve in July common earnings Together with Bonus.

Nevertheless, it needs to be thought-about that the equation of the instrument we’re analysing right here additionally consists of the USD, which has been on an eight-week optimistic streak and solely this present week appears to have gotten off on the unsuitable foot: very robust development, labour market and client knowledge have continued to drive up probably the most used foreign money in worldwide commerce. The results of all that is that Cable has been retracing strongly since mid-July from a stage of 1.3142 to the present 1.2480 (-3.64%).

Tomorrow’s US CPI knowledge will likely be essential on this respect and let’s not neglect that from Thursday onwards there will likely be seven days of fireplace for central banks around the globe, together with the BOE and FED.

TECHNICAL ANALYSIS

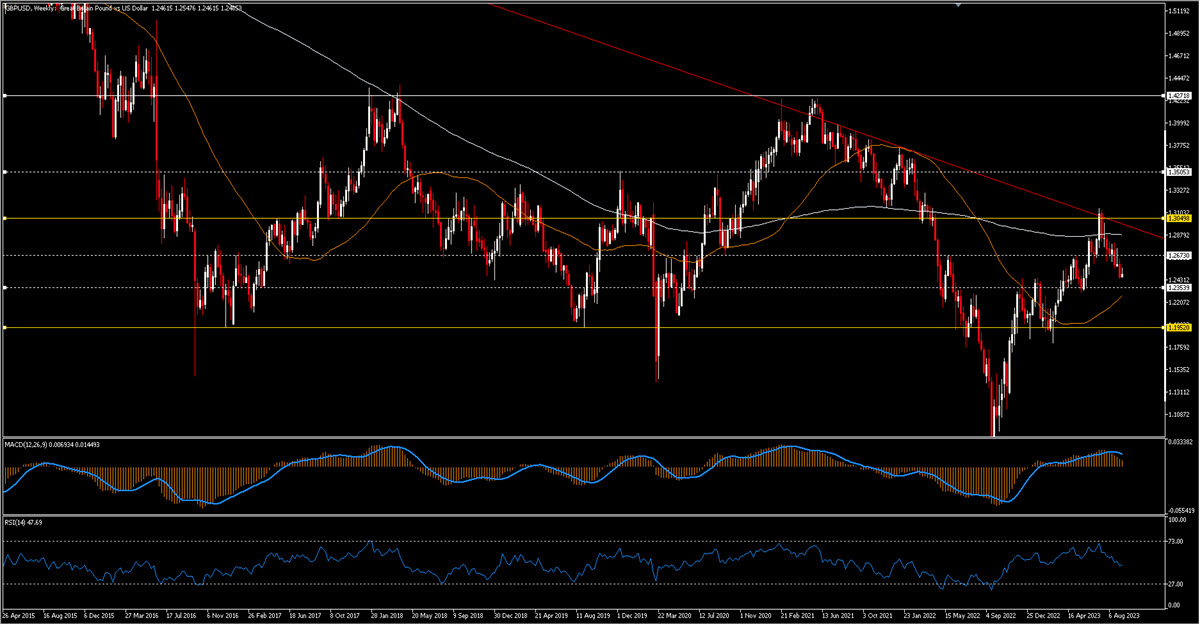

GBPUSD, Weekly

It isn’t straightforward to get an concept of the long run path of the GBPUSD for varied causes, not least the virtually insignificant rate of interest differential, so let’s take a really long-term view with this weekly chart the place we see the relevance of some static values such because the 1.305 space from which the worth roughly began the pullback. The 1.2675 space is one other essential static space nevertheless it has already been breached, the following one appears to be round 1.2350. The chart additionally reveals {that a} common downtrend began in 2006 (pink line).

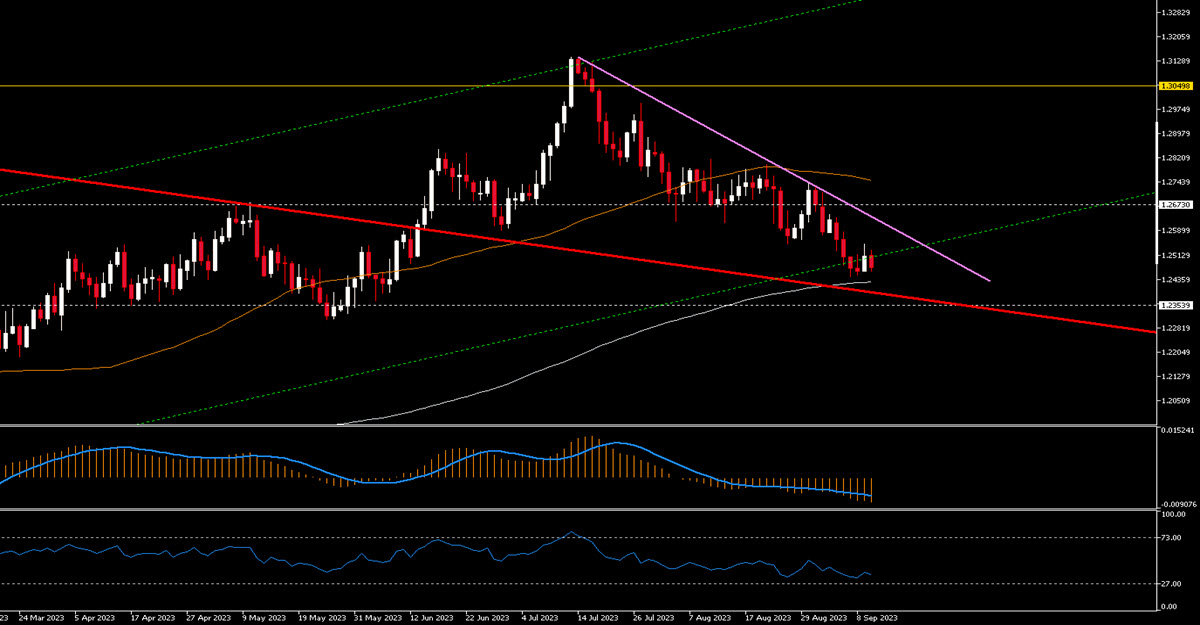

GBPUSD, Every day

The every day chart is attention-grabbing: in April, Cable broke the downtrend which began initially of 2021 and in the previous couple of weeks it has come again right down to retest it. It isn’t far now from that stage of 1.2350 and the MA200 (1.2425 at present) additionally passes very near it; this might trace at a bullish channel (dashed inexperienced). MACD is actually damaging and RSI beneath 50. The ultimate end result can range however one in all these may very well be that the GBPUSD may fall comparatively little additional, say one other 1% to 1.235. From there, varied forces may trigger it to bounce, with the purple trendline now passing close to 1.26 as preliminary resistance; a definitive affirmation of a bullish transfer would come on the break of the MA50, which ought to happen close to 1.27. It will occur -it is clear- if the King USD begins to deflate within the coming weeks.

GBPUSD, Every day, ST

Click on right here to entry our Financial Calendar

Marco Turatti

Market Analyst

Disclaimer: This materials is supplied as a common advertising communication for info functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication incorporates, or needs to be thought-about as containing, an funding recommendation or an funding suggestion or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info supplied is gathered from respected sources and any info containing a sign of previous efficiency is just not a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive stage of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the data supplied on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.