Jorg Greuel

With Labor Day having handed on Monday, some say this marks the tip of summer season, whereas the official finish date is September 22 this yr. Because the calendar speeds in the direction of the tip of the yr although, traders can look again and see fairness returns (the S&P 500 Index) have been robust thus far in 2024, up 19.53%.

For the total trailing one-year interval, the S&P 500 Index is up over 27%. Even bonds and money are offering traders an inexpensive return over the previous yr, with the Bloomberg U.S. Combination Bond Index up 7.3% and money returning over 5%.

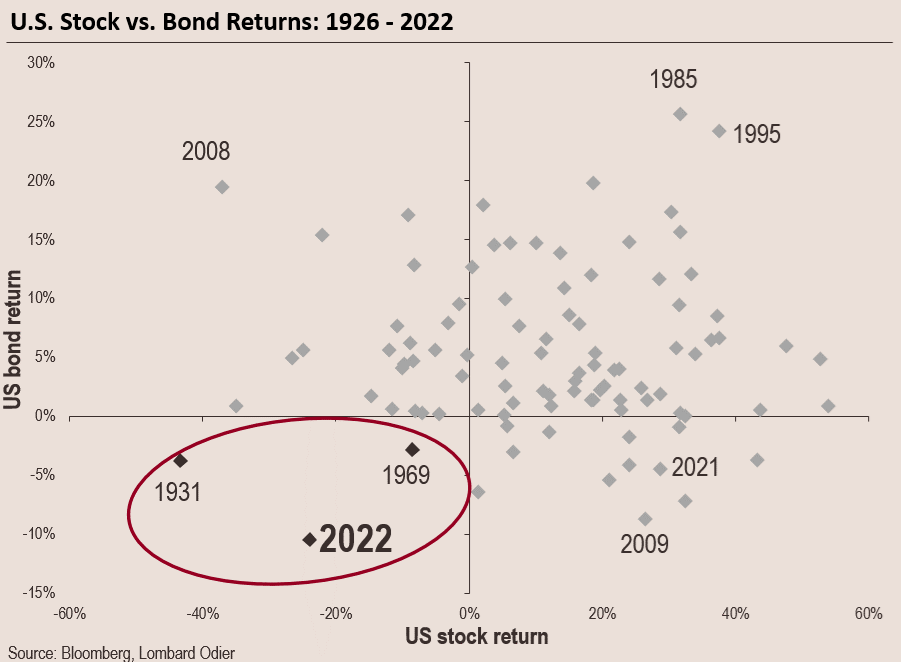

This can be a much better consequence than traders skilled in 2022 when virtually all asset lessons have been down, a uncommon incidence merely to have each shares and bonds ship traders damaging returns in the identical yr.

With the calendar now rolled into September, the subject of seasonality tends to be a standard one. One purpose for that is the truth that September is traditionally the weakest performing month of the yr.

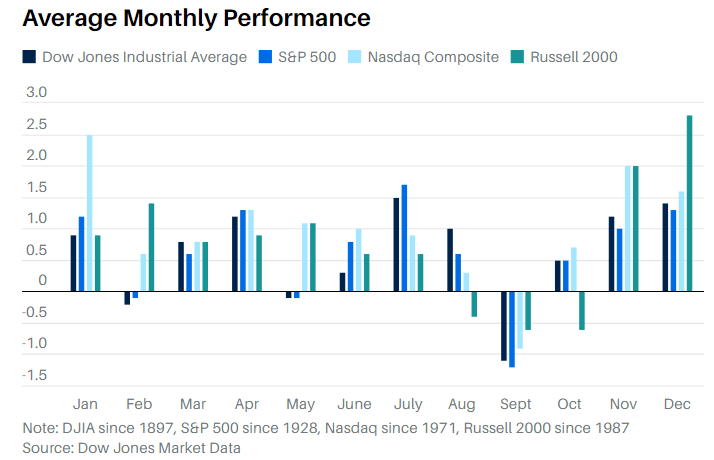

A current Barron’s article highlighted month-to-month fairness and bond returns for the reason that inception of varied indices, as seen beneath. Because the article factors out although, “the information does not at all times look so dangerous in presidential election years.” Additionally, the magnitude of the typical decline just isn’t massive both. Then again, massive market selloffs have tended to happen in September.

This raises the query of whether or not an investor ought to increase money at this cut-off date. What’s necessary for an investor is to periodically overview their asset allocation, the allocation of the investments between shares, bonds and alternate options, together with different obtainable asset lessons.

This analysis ought to incorporate one’s total targets and targets. Generalizing, one might need three to 6 months money put aside for unexpected emergencies, like the acquisition of a brand new fridge, a brand new automotive, and many others.

With respect to at least one’s funding portfolio, allocating funds to brief time period mounted revenue investments that may fund one’s way of life for one and a half to 2 years is sensible, as this reduces the probability of the necessity to promote shares when they’re down. A current Morningstar article, What Function Ought to Money Play in Your Portfolio?, supplies good info for traders on the money matter.

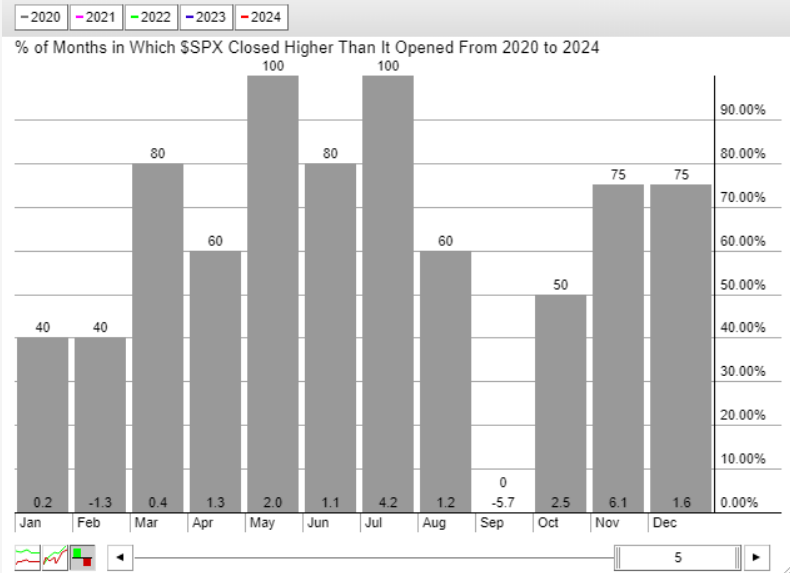

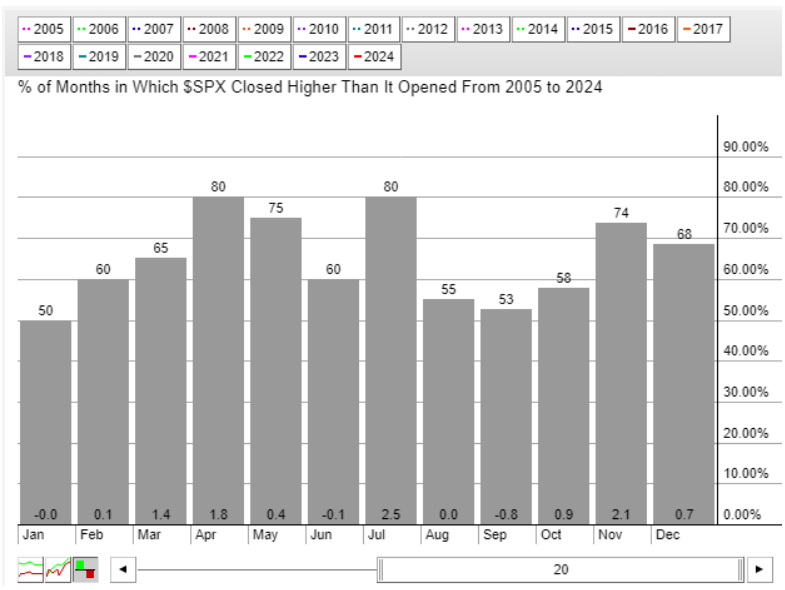

Lastly, September is usually a weak interval for shares relying on how far again one appears. As the primary chart beneath exhibits, within the final 5 Septembers, the S&P 500 Index generated a damaging return. The second chart goes again twenty years and simply 47% of the Septembers have been damaging for the S&P 500 Index with a median decline of simply -.8%.

This time of yr tends to be a extra risky one versus different durations. Importantly, reviewing one’s asset allocation every so often is an effective follow and with the market up strongly this yr, now is an effective time to have that overview.

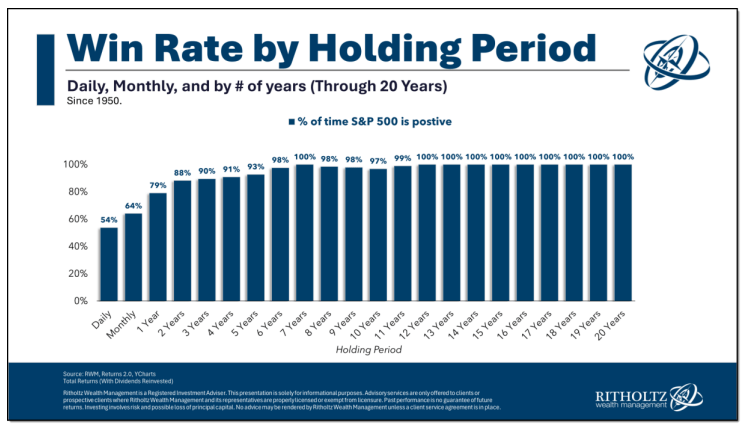

Take into account although, market timing is troublesome to do, and it’s time out there that tends to be extra necessary for many traders. The beneath graphic exhibits market returns by holding interval and clearly shares are extra variable within the brief run, however traditionally longer time frames present favorable outcomes.

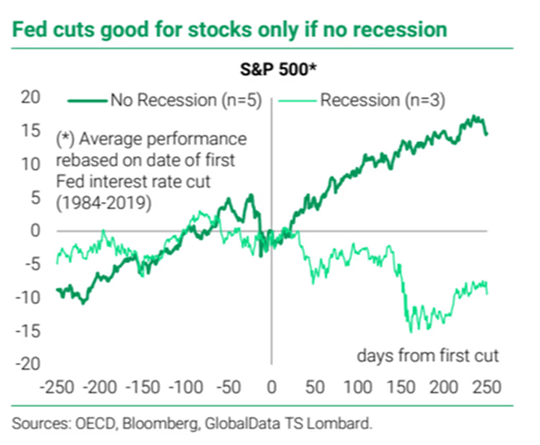

Moreover, the Federal Reserve is intimating they might decrease short-term rates of interest on the September FOMC assembly. Decrease charges have been favorable for shares as long as the financial system just isn’t in a recession.

Authentic Put up

Editor’s Observe: The abstract bullets for this text have been chosen by Looking for Alpha editors.