mobile radar devices are getting smaller and essential for defense and homeland security z1b/iStock via Getty Images

Bad News Feeds RADA

RADA Electronic Industries Ltd (NASDAQ:RADA) is a defense and homeland security public company. Granted, RADA is a small-cap ($725M market cap) minor player in a monster industry. We think the shares have great potential to rise further on future revenue, profits, and a potential buyout. We’re sticking to our bullish position.

Multiples are high. For example, the forward PE is +26, which means the stock is trading at a premium. The stock passes above the 200-day moving average of nearly $11. The share price has risen strongly in six years and recently outpaced market gains. There’s a consensus the stock is “overvalued.”

The share price rose dramatically after Russia invaded Ukraine. Lithuania, Slovakia, Estonia, Romania, Poland, Sweden, and Finland became fearful and eager to spend more on military defense and homeland security technologies. The last Israel-Gaza conflict was all technology-driven with nary a rifle shot or boots on the ground crossing borders.

The Company

RADA Electronic Industries Ltd. is an Israel-based company. RADA designs, manufacturers, and sells innovative defense, aerospace, and homeland security electronic technologies. Other countries without the talent, budgets, or time turn to companies like RADA, especially Israeli contractors, that sport a global and noble reputation for keeping the tiny nation safe from existential threats.

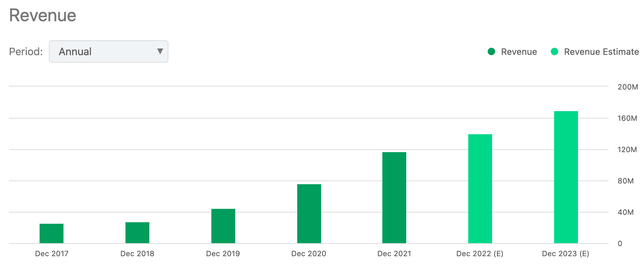

Revenue as of December ’21 was $117.24M. It was $76.22 the year before. Revenue is forecast to top $140M in FY ’22. CEO Dov Sella reported that “2021 was RADA’s best year ever with top-line growth of 54%, higher margins across the board (41% up from 39% in Q4 ’20), and our adjusted EBITDA almost tripled.”

Worldwide, new sales for military defense and homeland security products and services dwarf those of RADA. But that’s the point. RADA is carving a safe space in this highly complex, dynamic industry sensitive to security and political conditions resulting in unpredictable effects.

- “The global homeland security market valued $514.38 billion in 2020 and is projected to reach $801.01 billion in 2028, registering a CAGR of 5.7%,” according to Allied Market Research.

- The US DoD budget is nearing $1T with annual growth topping 4%.

- Private corporate investment in aerospace and parts is about $100B.

- The US new sales of defense equipment to foreign nations is $55B (2021).

- Add an additional $60B to $75B in sales per year for technologies and services.

Revenue Chart (seekingalpha.com)

RADA’s proprietary products are pioneering and combat proven. They include avionic systems, high-definition digital video, audio, and recording devices for training craft, fighter jets, drones, and land-based, tactical, multi-mission radars. Radar products are compact and can be secured to lightweight platforms. They detect and track land vehicles like tanks hiding in deep forests, camouflaged sea-going vessels, and people on foot. The products can be land-based, mounted to mobile vehicles, and ships.

RADA is pioneering technology to protect militaries and civilians from high-speed and slow-moving drones. Their Ground Debriefing System is already installed on thousands of aircraft transferring data for debriefing and flight performance improvements.

The SPDR S&P Aerospace & Defense ETF’s (XAR) shares are up 12% in 2022. RADA shares popped almost 40% this year. They sold at $3.05 at the beginning of 2018 and closed this past week at over $15. Our 12-month target price is $18.50. The next report date is May 24, ’22, when the consensus is for Q1 EPS to be $0.12 up from $0.08 in the same period last year.

Hedge funds sold 3.4K shares last quarter but the total number of shares they own stayed relatively the same for the past seven months. The stock price is up in the last year, so it was inevitable funds will take some profits.

Pushing Momentum

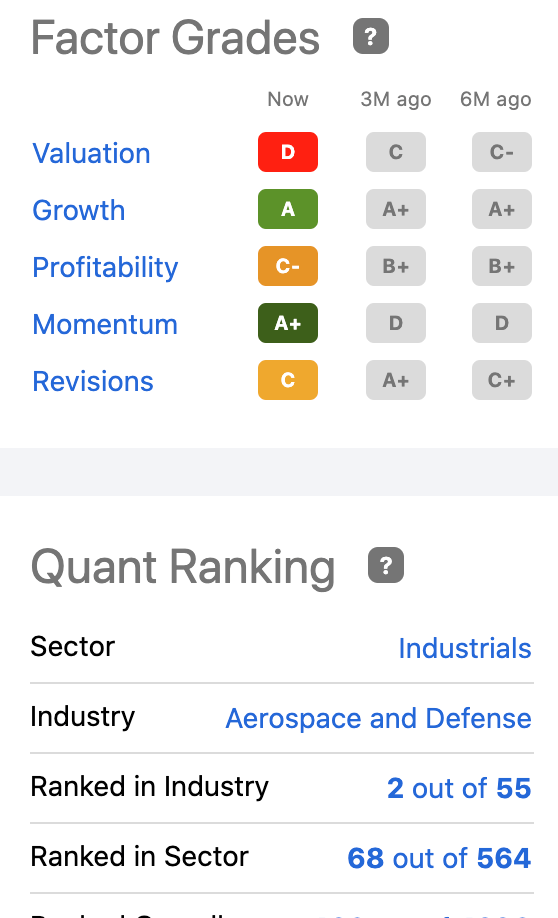

Despite the shares selling near their 52-week high ($16.57), Seeking Alpha authors are bullish. Wall Street analysts rate RADA a strong buy. The SA Quant Rating is a buy. Short interest is below 2%. You can subscribe to SA here if you want to read the reasons and other articles about RADA.

Factor & Quant Ratings (seekingalpha.com)

There’s talk about a potential sale of the company. The board retained an investment bank, but the company had no comment. Shares have a levered beta rating of 1.02 today, meaning the stock is no more volatile than the stock market.

Takeaway

RADA Electronics is in an essential industry. It’s carving a niche for itself in a growth industry with innovative products from R&D. Products are tested in real time and proven effective. RADA’s drone business is cutting-edge technology for which there are military, commercial, and civilian markets. The company has high growth potential and is profitable with healthy margins. The share price is not much at risk. Any dip presents a buying opportunity for retail value investors.