travelpixpro

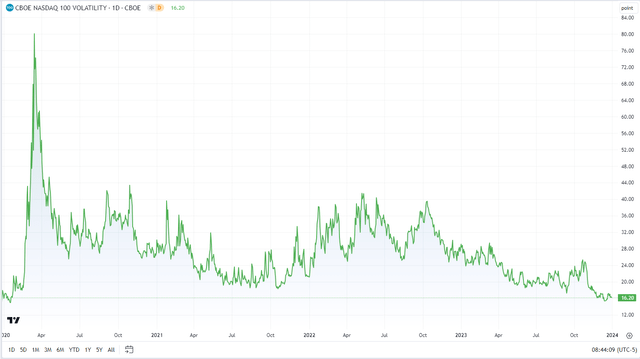

I used to be smooth on tech heading into the second half of 2023. The outlook was based mostly on a really sturdy rally by means of June final yr, and the third quarter is infamous for its bouts of volatility and dashing good points from earlier months. What’s extra, implied volatility on the Nasdaq 100 was very calm, so promoting name choices wasn’t producing the identical type of revenue stream as was seen throughout the first handful of months in 2023.

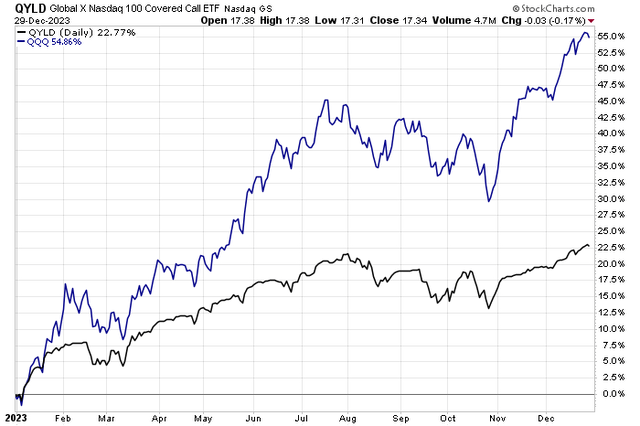

In the present day, I reiterate my maintain ranking on the World X NASDAQ 100 Lined Name ETF (NASDAQ:QYLD). Following a yr wherein the fund returned about half of what the Nasdaq 100 delivered, traders could also be questioning if this lined name technique continues to be value it. Implied volatility stays low, however the first quarter typically brings about some bearish bouts as seen in Q3, in response to historical past.

2023 complete returns: QQQ +55%, QYLD +23%

Stockcharts.com

In accordance with the issuer, QYLD is an funding product that goals to generate revenue by participating in lined name writing. This yield-focused technique with a bent towards decrease volatility in comparison with proudly owning the QQQ outright has traditionally yielded greater returns in periods of market volatility, as famous by World X. Being a lined name fund, traders ought to anticipate QYLD to do comparatively nicely when the Nasdaq 100 trades sideways to modestly greater, significantly when implied volatility, or the price of choices, is excessive.

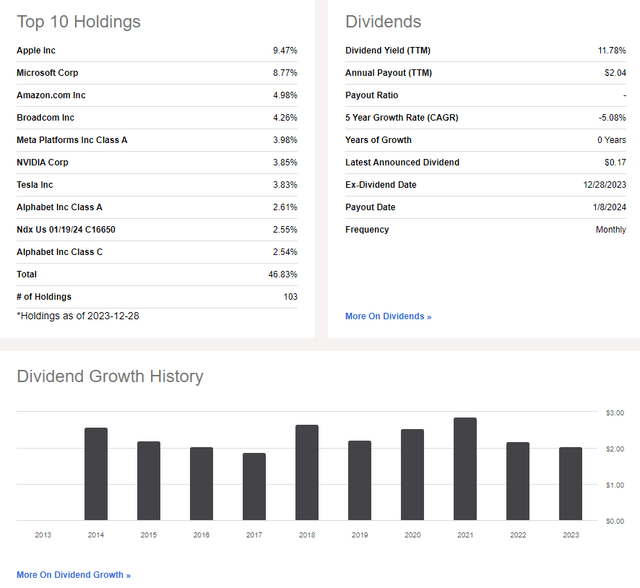

QYLD is a big ETF with $7.8 billion in property below administration and it pays a excessive 11.8% trailing 12-month dividend yield as of December 29, 2023. It is vital to acknowledge that the yield is primarily generated from the ETF promoting name choices on the Nasdaq 100, not from a typical assortment of firm dividends.

Share-price momentum has been weak within the final a number of months whereas the ETF’s 0.60% annual expense ratio is average. QYLD is taken into account a dangerous fund by Looking for Alpha’s ETF Grades because it has a excessive focus and monitoring error is reportedly excessive, although I see it as a much less dangerous product in comparison with proudly owning the Nasdaq 100 outright. As you may anticipate, QYLD earns a excessive dividend grade for its double-digit yield.

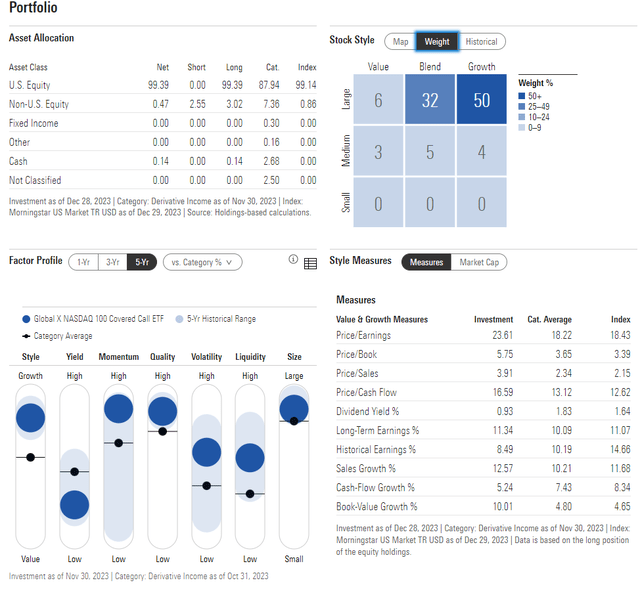

Digging into the portfolio, the 3-star rated ETF by Morningstar plots on the prime of the fashion field given its market-cap weighting construction. Holding a number of the very largest US tech shares, half the fund is taken into account large-cap development and there may be simply 12% publicity to mid-caps (no small-cap publicity).

Furthermore, simply 9% of the allocation is assessed as worth. With only a 3.6% complete return over the second half of final yr (+11.3% for the Nasdaq 100), the ETF has a price-to-earnings ratio of twenty-two whereas long-term earnings development is stable at 11.3, so the PEG ratio of two.0 is a bit dear, however not outlandish.

QYLD: Portfolio & Issue Profiles

Morningstar

What makes QYLD considerably dangerous is that 47% of its complete property are housed within the prime 10 positions, with Apple (AAPL) and Microsoft (MSFT) commanding greater than 18% of the ETF. Additionally check out the whole dividend payouts by yr – 2021 was the top-yielding yr and final yr’s cumulative dividend quantity dropped from 2022’s complete. If we see greater implied volatility this yr, I’d anticipate the whole distribution determine to rise. Because it stands, the CBOE Nasdaq 100 Volatility Index (VXN) is traditionally low at simply 16.2.

QYLD: Portfolio Positioning & Dividend Information

Looking for Alpha

Nasdaq 100 Volatility Close to 4-year Lows

TradingView

Seasonally, QYLD tends to carry out in mediocre vogue by means of the primary 5 months of the yr, in response to information from Fairness Clock. The month-to-month positivity fee is 60% every in January, February, and March earlier than returns flip a bit higher within the second quarter. Nonetheless, January averaged a acquire of simply 0.3% and February featured a median lack of 0.1% with volatility generally persisting all through a lot of March within the fund’s historical past.

QYLD: Impartial to Barely Bearish Season Dangers By way of early Might

Fairness Clock

The Technical Take

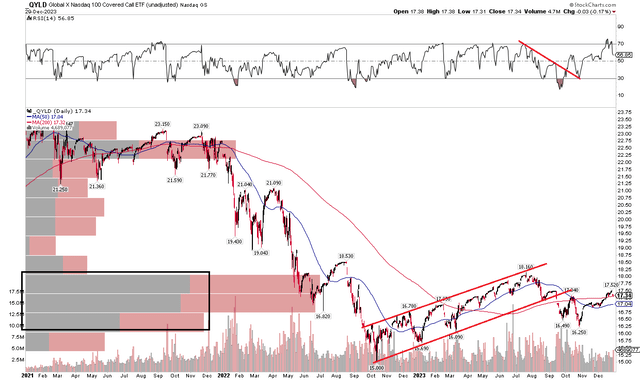

Readers know that I’m much less assured in technical evaluation on high-yield merchandise, significantly lined name funds. Nonetheless, traders keep in mind what they paid for a safety, so historic value and quantity information nonetheless matter. Discover within the chart beneath that QYLD has not executed a lot from a price-only perspective since late 2022 whereas the QQQ ETF has surged from its October 2022 low. Again in June final yr, I famous {that a} key uptrend help line was in play, and that monitoring it might be vital for future value motion. That upward pattern channel proved to falter, and momentum fell over the again half of 2023. In the present day, shares are bouncing across the long-term 200-day transferring common, although the RSI momentum gauge on the prime of the graph is definitely at a powerful degree after breaking by means of a downtrend line again in This autumn.

With a excessive quantity of quantity by value within the $16 to $18 zone, it might be powerful sledding for the bulls to get the fund by means of this space of excessive congestion. If the ETF can rally above the July peak of $18.16, nonetheless, there aren’t many shares traded till you get to about $22.50. One other encouraging information level is that the 200dma has turned greater, however I want to see the short-term 50dma rise above the 200dma to assist affirm some upside value power.

Total, the technical state of affairs stays unimpressive, and traders aren’t gathering a really excessive yield proper now given low implied volatility within the Nasdaq 100.

QYLD: Improved Momentum, However Impartial Traits Following A Lackluster 2H23

Stockcharts.com

The Backside Line

I reiterate my maintain ranking on QYLD. The Nasdaq 100 outperformed this lined name technique sharply final yr, and I don’t see sufficient definitive indicators to counsel the pattern will change.