Pgiam/iStock by way of Getty Photographs

4Q Estimates & Consensus Rankings For 31 Huge Banks

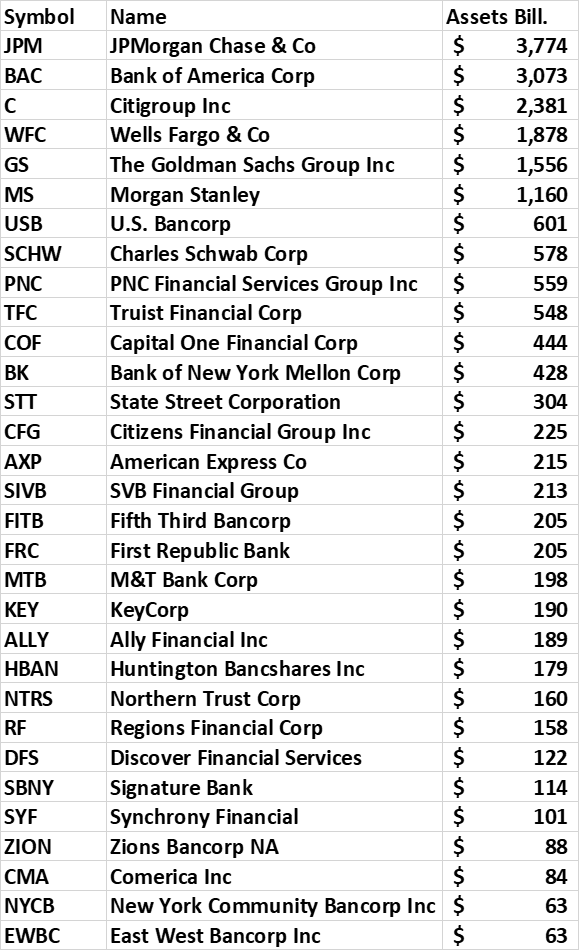

This publish covers 31 large banks.

31 Massive Banks (Ycharts)

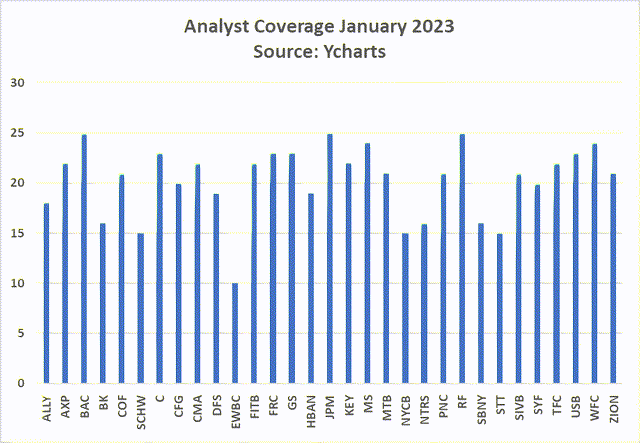

Analyst Protection

Financial institution analysts closely comply with these large banks. The biggest three are particularly in style amongst Looking for Alpha writers who’ve rendered the next variety of opinions over the previous 30 days: JPM 16, BAC 15, and Citi 15.

Analyst Protection (Ycharts)

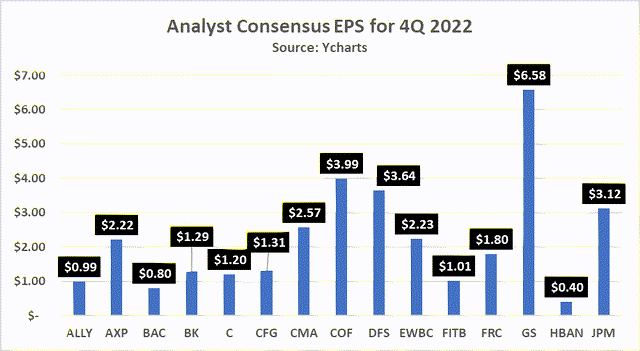

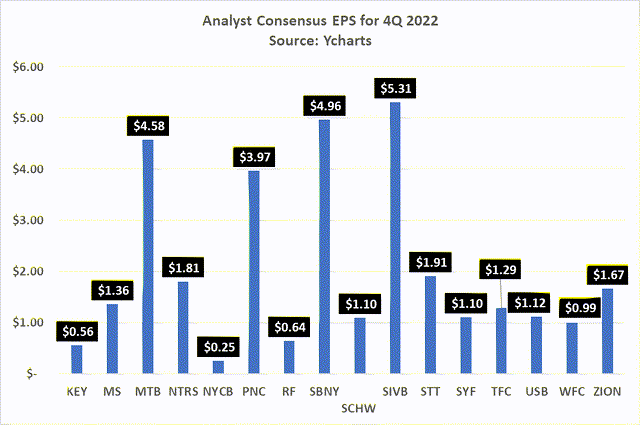

4Q analyst EPS Estimates Cheat Sheet

This coming Friday is an enormous day with JPMorgan Chase & Co. (JPM), Financial institution of America Corp (BAC), Citigroup Inc. (C), and Wells Fargo & Co (WFC) reporting.

Morgan Stanley (MS), and The Goldman Sachs Group, Inc. (GS) report January 17, adopted the following day by PNC Monetary Providers Group, Inc. (PNC) and Charles Schwab Corp (SCHW). Truist Monetary Corp (TFC) is scheduled to report on January 19. The final of the massive ten banks to report 4Q earnings will probably be U.S. Bancorp (USB) on January 25.

Est EPS 4Q 2022 (Ycharts)

EPS Est. 4Q 2022 (Ycharts)

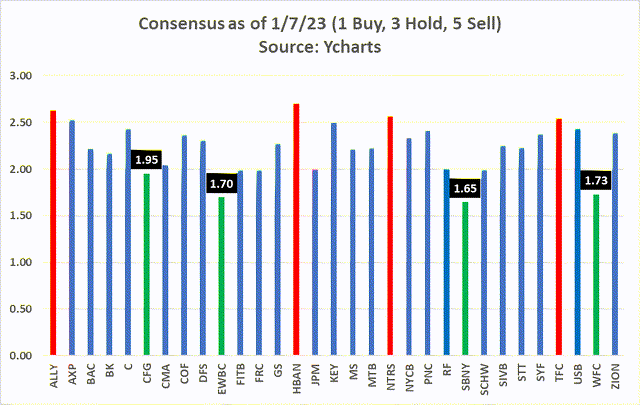

Consensus Opinions

Analysts’ favourite banks are Signature Financial institution (SBNY), East West Bancorp, Inc. (EWBC), Wells Fargo, and Citi.

Consensus (Ycharts)

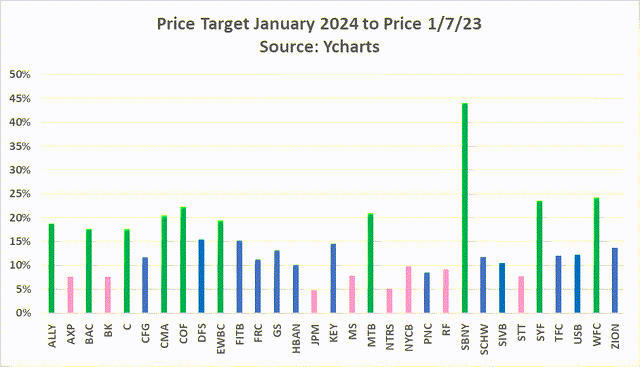

Worth Targets January 2024

This subsequent chart, at the very least theoretically, is the cash chart. It reveals consensus (common) value goal one 12 months from now as a proportion of a financial institution’s present value. A number of key observations:

- Analysts count on all banks to point out inventory value appreciation a 12 months from now.

- Median value enchancment is 12%, common is 15%.

- Main the way in which are Signature Financial institution, Wells Fargo, and Synchrony Monetary (SYF).

- Anticipated backside dwellers for the 12 months forward are Northern Belief Corp (NTRS) and JPMorgan Chase.

Jan 24 Worth Goal to Jan 23 Worth (Ycharts)

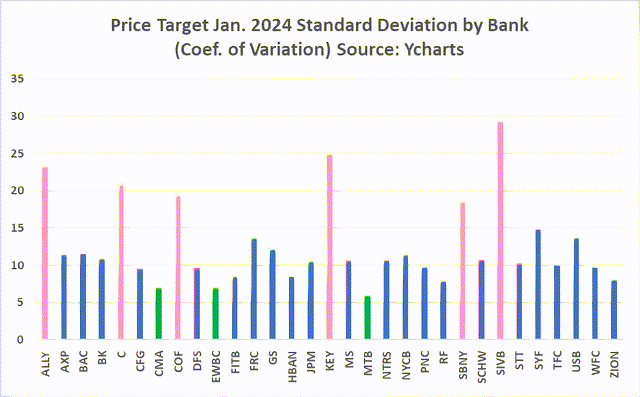

Beware: Lack of Consensus within the Consensus

I take the foregoing with a grain of salt for 2 causes:

- Analyst consensus high picks prior to now couple of years have been notoriously poor, a theme I could cowl in an upcoming article. I say that to not choose on the analyst neighborhood, however to underscore how tough it has been to foretell financial institution earnings and inventory value motion since COVID struck in its full fury in the course of the first half of 2020. Some readers might recall that I analyzed the accuracy of financial institution analyst picks overlaying 2016-2020. Here’s a hyperlink to that article.

- Maybe much more necessary from an investor perspective, it’s important to appreciate simply how little “consensus” there may be within the consensus as the following chart reveals. I’ve examined this theme prior to now, and I don’t recall seeing such a large disparity in value targets (i.e., coefficient of variation) amongst financial institution analysts as we see in January 2024.

Banks famous with inexperienced bars present a reasonably tight vary of value goal forecasts: M&T Financial institution Corp (MTB), East West, and Comerica Inc (CMA).

The banks famous with crimson bars present the widest variation. On the high of the record is one my long-time holdings, SVB Monetary Group (SIVB). Following SIVB are three extremely unstable banks (i.e., excessive beta): KeyCorp (KEY), ALLY Monetary Group (ALLY), and heartbreak Citi.

Std. Dev. Worth Targets Jan. 2024 (Ycharts)

Talking of heartbreak, ALLY did simply that to me in the course of the first half of 2022 once I ambitiously bought Places a pair occasions, a transfer I chronicled on these pages in February 2022. Not a very good transfer because it value me a reasonably penny once I lastly threw within the towel in June.

I suppose that is my punishment for deviating from my funding coverage of solely investing in high-quality (banks with double-digit Danger-Adjusted Return on Fairness). I’m doubly troubled by my transfer since I had accurately warned myself (and different financial institution traders) in October 2021 to keep away from banks having shopper mortgage concentrations and unstable funding. That mentioned, the buybacks and succesful administration lured me in. My dangerous.

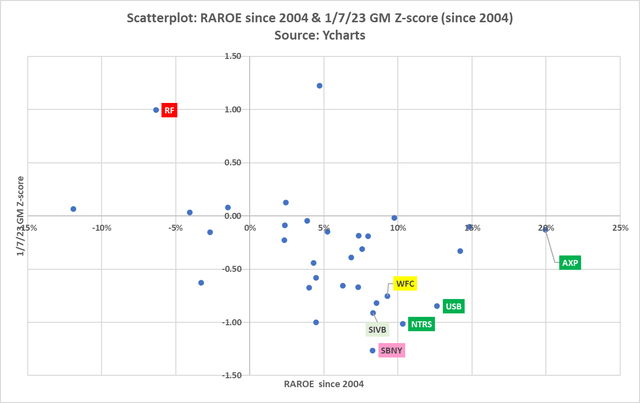

Favourite/Least Favourite Financial institution Funding

I’m sticking with high-quality banks and avoiding banks principally geared to the enterprise cycle.

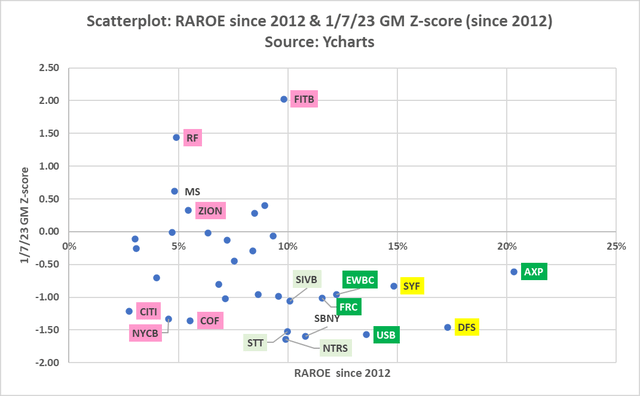

The scatterplot under reveals two information factors: X-axis the Danger-Adjusted ROE calculated as the typical rolling four-quarter ROE by quarter since 2004 minus the usual deviation; the Y-axis is the January 2023 Z-score which is calculated because the product of the quarterly Worth/Earnings ratio and Worth/TBV since 2004.

Three banks look fascinating: Northern Belief Corp (NTRS), USBank, and American Categorical Co (AXP). American Categorical is now on my watch record given its superior earnings historical past. Its ahead P/E is near 15x, which is modestly decrease than its 20-year and 10-year common P/E of 17x. I might want to monitor AXP this 12 months earlier than shopping for.

RAROE and GM Z-score (Ycharts)

This subsequent scatterplot is similar because the prior however, on this case, information covers 2012-2022.

The drawback of this view is that it excludes the tough down-cycle of 2008-2009.

One benefit is that it contains banks like First Republic Financial institution (FRC), one other long-time holding, which went public since 2010. One other benefit is that it provides some banks the advantage of the doubt; by that I imply, some banks have modified their enterprise fashions, and presumably, are much less susceptible to a downcycle within the financial system than they have been in 2008-2009.

American Categorical, once more, stacks up properly on this chart as does USBank, East West, and First Republic. Card issuers, Synchrony Monetary and Uncover Monetary Providers (DFS) look downright low-cost given their 10-year superior RAROE. However each are geared to the patron, and I stay cautious because the financial system is vulnerable to slowing and finally going right into a recession.

RAROE & GM Z-score 2012-22 (Ycharts)

Shopping for BAC.PL and First Republic

Over the previous month, I’ve nibbled on First Republic (<$120) and a Financial institution of America Most well-liked (BAC.PL) underneath $1200. My most present view of Financial institution of America was lined in September. I see each as long-term holds.

I’m not promoting banks right now, however I’m cautious, and conservative given the place the Fed appears to be making an attempt to take the financial system.

Banks I’m avoiding are the “haven’t” banks, these being banks with costly, unstable funding and comparatively excessive loan-to-deposit ratios. That mentioned, sooner or later, in all probability this 12 months, a few of these banks might turn into engaging as turnaround alternatives. The most effective instance might be Capital One Monetary Corp (COF), a financial institution I labeled a “Robust Promote” in September 2021 when it was promoting for $157, not removed from its Covid-induced excessive of $170+.

Huge Questions

Heading into earnings calls this week, a number of questions are top-of-mind:

- Credit score High quality? Analyzing Provision is at all times my first order of enterprise.

- Funding Prices? Affect on web curiosity margin for the “Have” and “Have Not” banks.

- Unrealized Losses on Funding Securities? An enormous situation for some banks, an enormous affect on ROE calculations, and presumably on EPS.

- Mortgage Development? 2022 lastly broke the lengthy spell of moribund lending. However might that current progress come again to hang-out some banks in 2023-24?

Caveat

The foregoing is my opinion which I share for the aim of getting suggestions and questions that problem my concepts and assumptions.

Each investor must do his/her personal due diligence earlier than investing in addition to decide their threat profile. I’m risk-averse, preferring to put money into the nation’s greatest banks which reliably earn returns exceeding value of capital.