This week, traders will likely be wanting on the earnings studies of two giants of the retail trade, House Depot and Walmart. Typically, House Depot sells instruments, constructing merchandise, home equipment, lighting, paint, flooring, plumbing provides, outside tools and providers, whereas Walmart operates a series of big-box shops, low cost shops and grocery retailers. The 2 rank third and second, respectively, by world retail market capitalization, behind Amazon. House Depot and Walmart will report their second quarter 2023 earnings earlier than the market opens on Tuesday, 15 August and Thursday, 17 August, respectively.

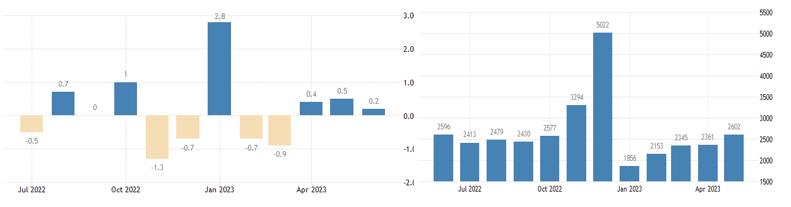

U.S. retail gross sales progress and chain store gross sales (in tens of millions of {dollars}). Supply: Buying and selling Economics

General, US retail gross sales within the second quarter of 2023 signalled resilient shopper spending, albeit nonetheless nicely beneath the extent seen in January of this yr. Gross sales improved at miscellaneous store retailers, non-store retailers, furnishings, electronics and home equipment, attire, motorcar and components sellers, meals providers, and ingesting institutions. In distinction, fuel stations, constructing supplies and gardening tools, sporting items, music and books, meals and beverage retailers, well being and private care retailers, and shops skilled gross sales declines. As well as, chain store gross sales have been rising steadily up to now this yr and are up greater than 40 p.c from the low level in January ($1.856 billion).

House Depot

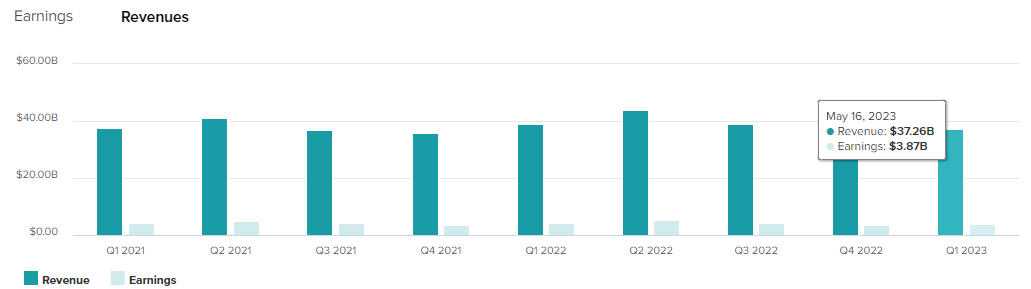

For the primary quarter of 2023, House Depot reported income of $37.26 billion, lacking Wall Avenue expectations for the second consecutive quarter (and the most important margin of lacking expectations in additional than 20 years). The determine was down -4.2% from the identical interval final yr. Different gadgets that underperformed in comparison with Q1 2022 have been working revenue ($5.55 billion, down -6.4%), web revenue ($3.87 billion, down -8.5%), and diluted EPS ($3.82, down -6.6%).

The corporate mentioned a few of the causes for the weak outcomes final quarter included chilly climate and lumber deflation, rising rates of interest dampening the urge for food of potential homebuyers and cooling house values, and a shift in shopper spending patterns (in the direction of travelling, consuming out, and so on.).

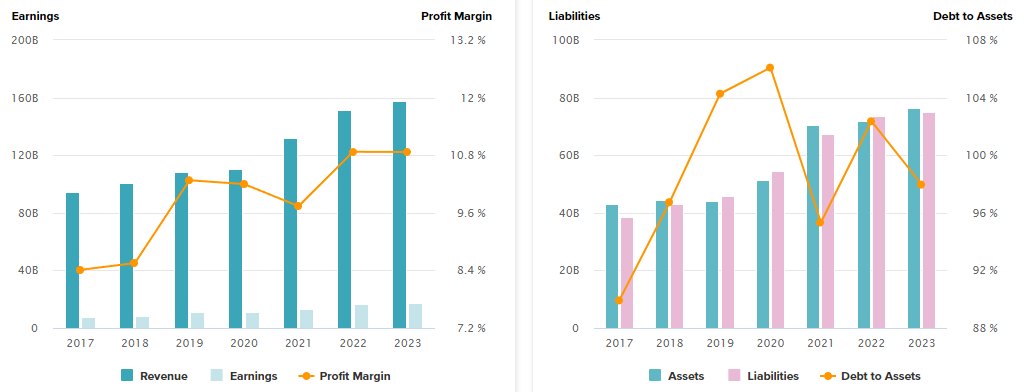

In FY2022, House Depot recorded a revenue margin of 10.87%, its highest stage in a long time. As of the primary quarter of 2023, its revenue margin reached 10.75%. In distinction, gearing was over 100% final yr, however lately dropped to 97.96%. Whereas the corporate does carry debt, it doesn’t appear to be a problem of undue concern as analyses present that the corporate has sturdy free money move equal to 60% of EBITDA and may simply pay down and scale back debt when wanted.

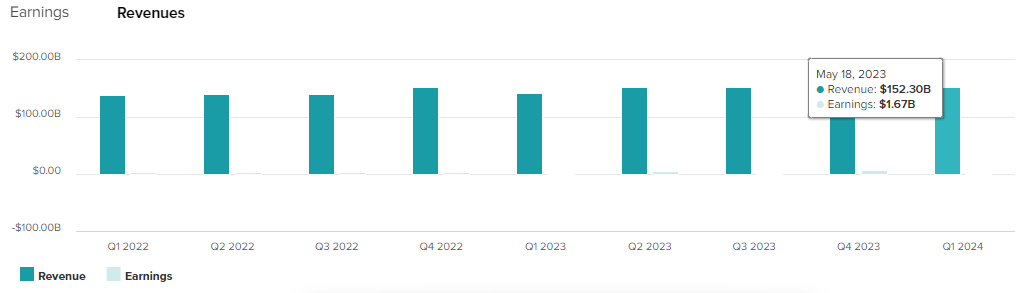

Within the upcoming announcement, the final estimate for House Depot gross sales is $42.2 billion, up greater than 13% from the earlier quarter. If the reported numbers are according to expectations, this could be the corporate’s greatest reported gross sales for the reason that second quarter of 2022 (up 3.7% to $43.8 billion).

Within the upcoming announcement, the final estimate for House Depot gross sales is $42.2 billion, up greater than 13% from the earlier quarter. If the reported numbers are according to expectations, this could be the corporate’s greatest reported gross sales for the reason that second quarter of 2022 (up 3.7% to $43.8 billion).

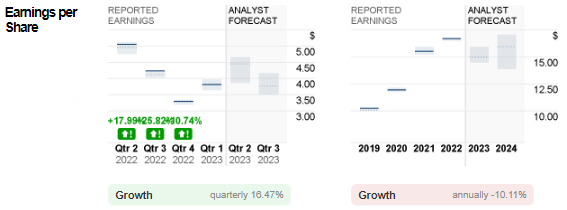

Then again, earnings per share is anticipated to extend by about 16.5 per cent from the earlier quarter to $3.82. In the identical interval final yr, the corporate reported earnings per share of $5.05.

All in all, administration expects 2023 to be a “stable yr”. In comparison with fiscal 2022, the corporate expects gross sales and comparable gross sales to say no by -2% to -5% and diluted earnings per share to say no by -7% to -13%. Working margin is anticipated to be within the vary of 14.0 to 14.3 p.c.

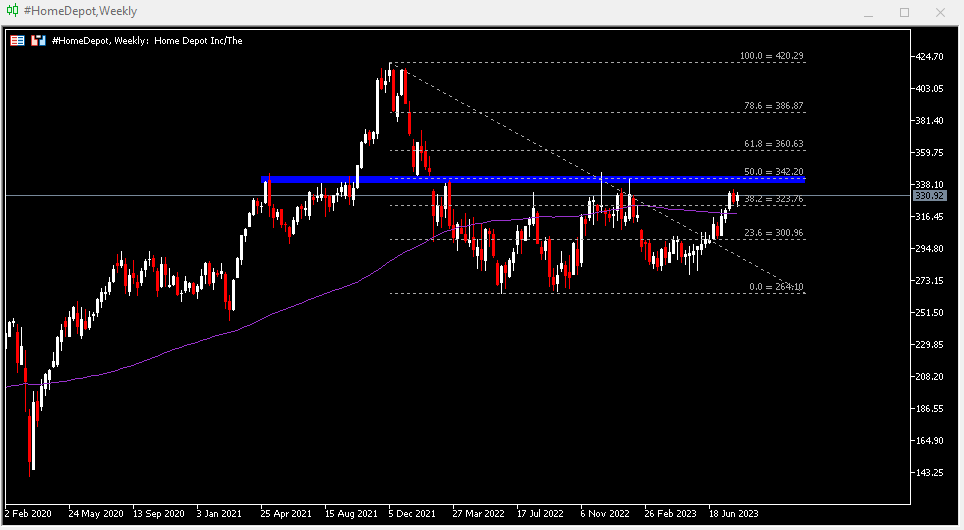

HOME DEPOT Techical Evaluation

#HomeDepot inventory hit a low of $264.10 final yr. This yr, it fashioned a better low of $277.05 earlier than persevering with increased. As of final week’s shut, the corporate’s shares remained supported above its 100-week shifting common and above $324 (38.2% of the FR extending from the December 2021 excessive to the June 2022 low). The closest resistance is at $342 (FR 50.0%) and the December 2022 excessive ($346.12), adopted by $361 (FR 61.8%). In any other case, assist is at $301 (FR 23.6%) round $324 and the 100-week SMA, then at $264.10.

Walmart

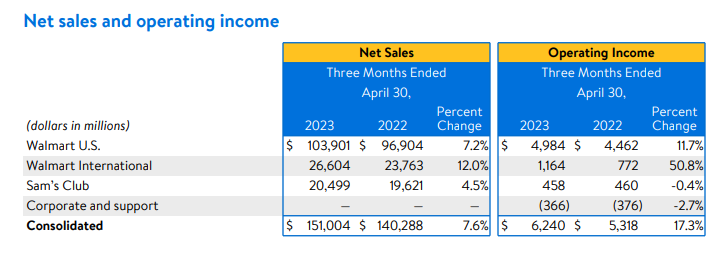

Walmart’s key monetary metrics have been stable final quarter in comparison with House Depot. Gross sales income elevated 7.6% year-over-year to $152.3 billion. The corporate continued to see progress in native e-commerce (up 27% year-over-year) and worldwide e-commerce (up 25% year-over-year, pushed primarily by China, Walmex, and Flipkart) – the previous pushed by power in pickups, deliveries, and promoting, and the latter pushed by power in store supply and promoting. Moreover, a division of Walmart – Sam’s Members (a paid membership warehouse that sells groceries and family items in bulk) reported a 4.5% year-over-year improve in web gross sales to $20.5bn, document membership and Plus penetration, and greater than 50% progress in energetic advertisers (year-over-year), on the again of sturdy progress in membership revenues. (Supply: Walmart Q1 FY2024 Earnings Report).

Working revenue rose 17.3% year-over-year to $6.2 billion. When it comes to enterprise segments, the principle contribution got here from Walmart US ($4.46 billion, up +11.7% year-over-year), however we additionally noticed nice progress in Walmart Worldwide, the place working revenue jumped greater than 50% year-over-year. Sam’s Membership and Company & Help reported small losses barely offsetting the previous’s constructive outcomes.

Walmart’s steady innovation and progress within the e-commerce house is obvious to all. A few of the milestones achieved embrace Walmart GoLocal, Walmart Luminate, Walmart Join, Walmart+, Spark Supply, Market, and Walmart Achievement Companies. General, the corporate has strengthened its aggressive edge by way of varied partnerships, investments and acquisitions to reinforce its aggressive benefit. One other power is its digital becoming room know-how (Zeekit), which has captured some market share (particularly within the trend house).

Walmart’s steady innovation and progress within the e-commerce house is obvious to all. A few of the milestones achieved embrace Walmart GoLocal, Walmart Luminate, Walmart Join, Walmart+, Spark Supply, Market, and Walmart Achievement Companies. General, the corporate has strengthened its aggressive edge by way of varied partnerships, investments and acquisitions to reinforce its aggressive benefit. One other power is its digital becoming room know-how (Zeekit), which has captured some market share (particularly within the trend house).

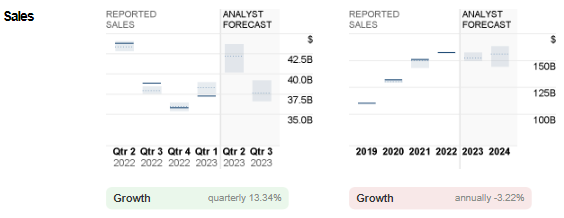

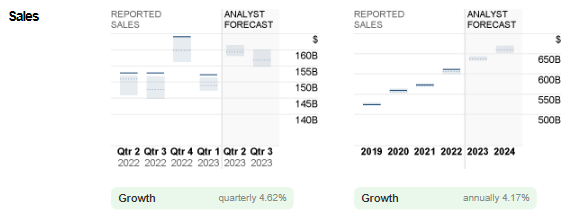

In its upcoming announcement, Walmart persistently expects gross sales to achieve $159.3 billion, up 4.6 per cent from the earlier quarter and greater than 4 per cent from the identical interval final yr.

In its upcoming announcement, Walmart persistently expects gross sales to achieve $159.3 billion, up 4.6 per cent from the earlier quarter and greater than 4 per cent from the identical interval final yr.

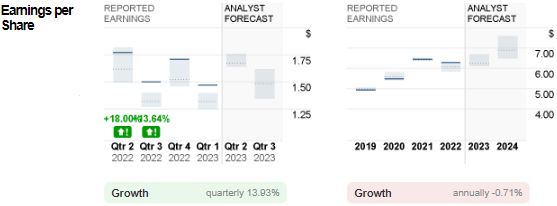

Earnings per share are anticipated to return in at $1.67, 20 cents increased than the earlier quarter. In the identical interval final yr the determine was $1.77.

Earnings per share are anticipated to return in at $1.67, 20 cents increased than the earlier quarter. In the identical interval final yr the determine was $1.77.

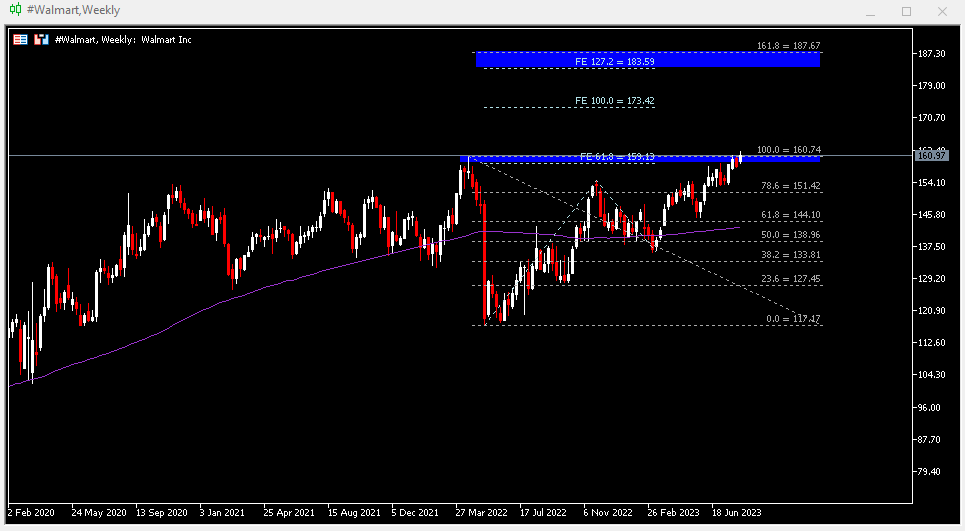

WALMART Technical Evaluation:

#Walmart created a brand new ATH final week at $162.09 (earlier value was $160.74 in April 2022) It’s at the moment testing a resistance zone of $159.10 – $160.70. If the bullish breakout is profitable, the corporate’s shares will go on to check $170, adopted by the Fibonacci enlargement forecast of $173.40. 151.40 (FR 78.6%) is the closest assist stage, adopted by $144.10, dynamic assist 100-week SMA and $139 (FR 50.0%).

Click on right here to entry our Financial Calendar

Larince Zhang

Market Analyst

Disclaimer: This materials is supplied as a common advertising communication for data functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication accommodates, or needs to be thought of as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All data supplied is gathered from respected sources and any data containing a sign of previous efficiency just isn’t a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive stage of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the knowledge supplied on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.