RHJ Supply: Personal Processing

Treasured metals royalty and streaming corporations characterize a really fascinating sub-industry of the dear metals mining {industry}. They supply some leverage to the rising metals costs, just like the everyday mining corporations; nonetheless, they’re much less dangerous compared to them. Their incomes are derived from royalty and streaming agreements. Beneath a steel streaming settlement, the streaming firm gives an upfront cost to amass the correct to future deliveries of a predefined proportion of steel manufacturing of a mining operation.

The streaming firm additionally pays some ongoing funds which might be normally nicely under the market value of the steel. They are often set as a hard and fast sum (e.g., $300/toz gold) or as a proportion (e.g., 20% of the prevailing gold value), or a mixture of each (e.g., the decrease of a) $300/toz gold and b) 20% of the prevailing gold value). The royalties normally apply to a small fraction of the mining challenge manufacturing (normally 1-3%), and they don’t seem to be related with ongoing funds. They will have varied kinds, however the commonest is a small proportion of the online smelter return (“NSR”). The NSR is calculated as revenues from the sale of the mined merchandise minus transportation and refining prices.

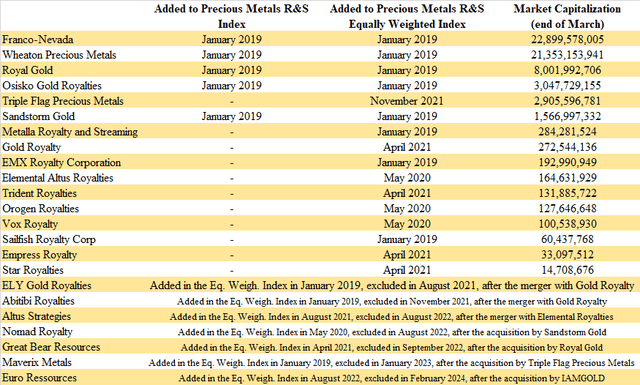

To higher observe the general efficiency of the entire sub-industry, I created a capitalization-weighted index (the Treasured Metals Royalty and Streaming Index) consisting of 11 corporations (in June 2020, expanded to fifteen). Later, primarily based on the inquiries of readers, I additionally launched an equal-weighted model of the index. Till March 2021, each indices included the identical corporations and had been calculated again to January 2019.

Nevertheless, some main modifications occurred in April 2021. As a result of increase of the royalty and streaming {industry} and the emergence of many new corporations, the indices skilled two main modifications. To begin with, the market capitalization-weighted index was modified to incorporate solely the 5 greatest corporations: Franco-Nevada (FNV), Wheaton Treasured Metals (WPM), Royal Gold (RGLD), Osisko Gold Royalties (OR), and Sandstorm Gold (SAND). The mixed weight of those 5 corporations on the previous index was round 95%, due to this fact, the small corporations had solely a negligible influence on their efficiency. The values of the index had been re-calculated again to January 2019, and between January 2019 and March 2021, the distinction within the general efficiency of the previous and the brand new index was solely 2.29 proportion factors. The second change is expounded to the equally weighted index that was expanded to twenty corporations.

The earlier editions of the month-to-month report will be discovered right here: Could 2019, June 2019, July 2019, August 2019, September 2019, October 2019, November 2019, December 2019, January 2020, February 2020, March 2020, April 2020, Could 2020, June 2020, July 2020, August 2020, September 2020, October 2020, November 2020, December 2020, January 2021, February 2021, March 2021, April 2021, Could 2021, June 2021, July 2021, August 2021, September 2021, October 2021, November 2021, December 2021, January 2022, February 2022, March 2022, April 2022, Could 2022, June 2022, July 2022, August 2022, September 2022, October 2022, November 2022, December 2022, January 2023, February 2023, March 2023, April 2023, Could 2023, June 2023, July 2023, August 2023, September 2023, October 2023, November 2023, December 2023, January 2024, February 2024.

Supply: Personal Processing

Franco-Nevada maintains its standing of the most important treasured metals R&S firm, with a market capitalization of almost $23 billion. The second-placed Wheaton Treasured Metals has a market capitalization of barely greater than $21 billion. On the backside of the record stays Star Royalties (OTCQX:STRFF) with a market capitalization of lower than $15 million. The one change within the rating in comparison with February occurred within the seventh and eighth place, the place Gold Royalty (GROY) and Metalla Royalty & Streaming (MTA) switched their locations.

Supply: Personal Processing

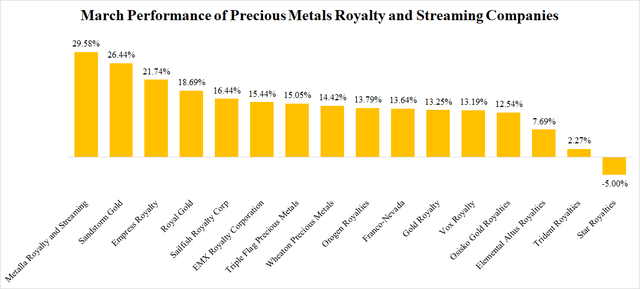

March was an amazing month for the dear metals R&S corporations. The gold market’s break-out to new file highs fuelled robust development on this inventory market section. Out of the 16 corporations, 15 resulted in inexperienced numbers. In 13 instances, the share value grew by greater than 12.5%. The largest beneficial properties had been recorded by Metalla. Its share value elevated by almost 30%. The expansion development began in late February when IAMGOLD (IAG) launched an up to date useful resource estimate for the Gosselin deposit which is part of the Cote gold challenge. The expansion was subsequently additional supported by the robust gold value development. Sandstorm Gold’s greater than 26% development was fuelled by the gold value motion too, nonetheless, additional help was supplied by some optimistic information associated to a number of of its belongings. The one firm that resulted in crimson numbers was Star Royalties. Its share value declined by 5%, though there was no company-specific information.

Supply: Personal Processing

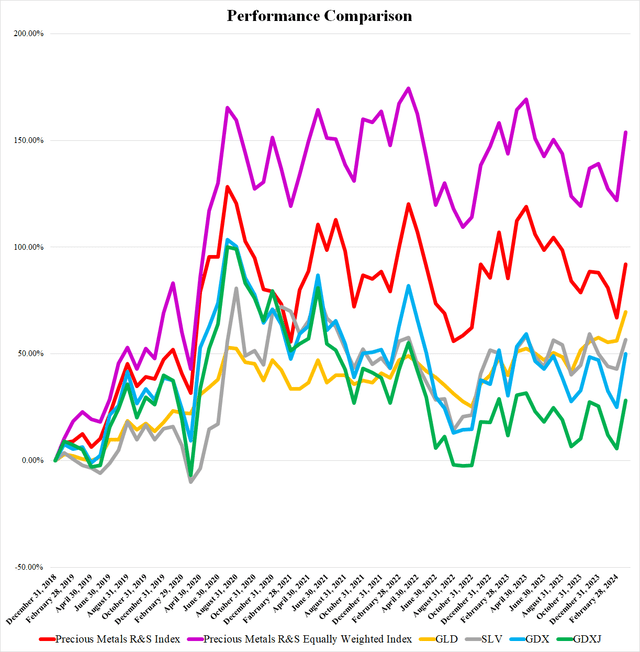

The share value of the SPDR Gold Belief ETF (GLD) grew by 8.58%, and the share value of the iShares Silver Belief ETF (SLV) even by 9.74%. This fueled steep development throughout the dear metals mining {industry}. Consequently, share costs of the VanEck Vectors Gold Miners ETF (GDX) and the VanEck Vectors Junior Gold Miners ETF (GDXJ) grew by 19.95% and 21.52% respectively. The dear metals R&S corporations did nicely too. The Treasured Metals R&S Index grew by 14.92%, and the Treasured Metals R&S Equally Weighted Index grew by 14.32%.

The March Information

The vast majority of information was associated to the This fall 2023 monetary outcomes. Some corporations supplied additionally portfolio updates. The largest information might be the Thacker Move lithium mine receiving a $2.26 billion mortgage from the U.S. Division of Power, which is superb information for Trident Royalties.

Franco-Nevada (FNV) launched its This fall monetary outcomes. The corporate offered 152,351 toz of gold equal, producing revenues of $303.3 million, which is consistent with the earlier quarter and barely lower than in This fall 2022. The working money movement amounted to $283.5 million, which is 20% greater than in Q3, however just one.5% greater than in This fall 2022. Franco-Nevada reported a web lack of $982.5 million, attributable to the $1.17 billion impairment cost associated to the Cobre Panama stream. The adjusted web revenue equals $172.9 million. Franco-Nevada ended This fall with money of $1.422 billion and debt-free. In 2024, Franco-Nevada expects gross sales of 480,000-540,000 toz of gold equal. By 2028, the gross sales ought to enhance to 540,000-600,000 toz of gold equal. In the course of the quarter, Franco-Nevada acquired an extra 1% NSR royalty on Skeena Assets’ (SKE) Eskay Creek gold challenge for $41.8 million, extra royalties on the Haynesville pure gasoline challenge for $125 million, and an extra 1% NSR royalty on Argonaut Gold’s (OTCPK:ARNGF) Magino gold challenge for $28 million.

Wheaton Treasured Metals (WPM) reported its This fall monetary outcomes too. The gold equal gross sales amounted to 162,360 toz. The revenues grew to $313.5 million, which is 40% greater than in Q3 and 33% greater than in This fall 2022. The working money movement jumped up too. It grew by greater than 40% to $242.4 million. The web revenue equaled $168.4 million, which is consistent with This fall 2022, however 45% greater than in Q3 2023. Wheaton ended This fall with money of $546.5 million, and a symbolical debt of $6.2 million. Throughout This fall, Wheaton acquired a 100% silver stream on Waterton Copper’s Mineral Park challenge for $115 million. It additionally agreed to pay as much as $530 million to amass a 62.5% gold stream and 5.25% platinum and palladium stream on Ivanhoe Mines’ (OTCQX:IVPAF) Platreef challenge, 6.875%-7.375% gold and silver stream on BMC Minerals’ Kudz Ze Kayah challenge, and three.05% gold stream on Dalradian Gold’s Curraghinalt gold challenge. Wheaton additionally paid $20 million for a royalty on Vista Gold’s (VGZ) Mt. Todd gold challenge. In February, Wheaton acquired a 1.5% NSR royalty on Integra Assets’ (ITRG) DeLamar challenge.

The corporate additionally adopted a progressive dividend coverage in accordance with which, as a lot as 30% of common money flows for the earlier 4 quarters ought to be distributed within the type of dividends. The Q1 2024 dividend was set at $0.155 per share which is 3.33% greater than in This fall. It will likely be paid on April 15, to shareholders of file as of April 2.

Sandstorm Gold (SAND) supplied an intensive portfolio replace. An important information is that Ivanhoe Mines (OTCQX:IVPAF) determined to speed up the Platreef Mine Part 2 improvement and likewise to extend the projected capability of the Platreef mine, the place Sandstorm holds a 37.5% gold stream. Part 1 manufacturing ought to begin in early 2025, an up to date feasibility examine for Part 2 is scheduled for H2 2024. Teck Assets (TECK) introduced that the Antamina mine life was prolonged till 2036. Sandstrom holds a 1.66% silver stream and 0.55% web revenue curiosity from Antamina. Value mentioning can also be Lundin Gold’s (OTCQX:LUGDF) choice to develop the Fruta del Norte mine throughput by 10% and recoveries by 3%. Sandstorm holds a 0.9% NSR royalty on Fruta del Norte. Much less optimistic is the data that following the mining catastrophe at its Turkish mine, SSR Mining (SSRM) retracted all its guidances concerning the Turkish belongings, the Hod Maden challenge included. Sandstorm expects that the challenge will likely be delayed by 1 yr.

The corporate additionally declared one other quarterly dividend. Sandstorm pays C$0.02 per share on April 26, to shareholders of file as of April 16.

Gold Royalty (GROY) introduced its This fall 2023 monetary outcomes. The corporate recorded revenues of $1 million, working money movement of -$1.7 million, and web lack of $19.4 million. The loss is attributable to a $19.76 million impairment cost associated primarily to the Jerritt Canyon, Beaufor, McKenzie Break, and Swanson royalties. As of the tip of This fall, Gold Royalty held money of $1.8 million and debt of $33.1 million. What’s necessary, in 2024, the corporate expects an roughly 100% development in attributable manufacturing, to five,000-5,600 toz of gold equal. The expansion is attributable primarily to the Cote, Odyssey, Cozamin, and Borborema royalties.

Metalla Royalty & Streaming (MTA) launched its This fall monetary outcomes. The corporate generated revenues of $1.4 million, which is consistent with the earlier quarter, and greater than 100% higher in comparison with the identical interval of final yr. The working money movement stays low, it declined from $300,000 in Q3 to -$800,000 in This fall. The web revenue amounted to -$1.9 million, which is just barely higher in comparison with Q3, nonetheless, there’s a notable enchancment in comparison with the $4.8 million loss recorded in This fall 2022. Metalla ended This fall with money of $14.1 million and the online debt amounted to $1.1 million.

EMX Royalty (EMX) launched its This fall monetary outcomes. The revenues amounted to $7.5 million, working money movement to $3.5 million, and web revenue to $1.4 million. All of the numbers are notably worse in comparison with Q3, because the Q3 outcomes had been inflated by the delayed funds associated to the Timok royalty. What’s optimistic, the numbers are notably higher in comparison with This fall 2022, as a result of Timok royalty that began producing common money flows following the decision of the dispute with Zijin Mining (OTCPK:ZIJMF), and as a result of rising Caserones royalty. As of the tip of This fall, EMX held money of $27.3 million and its web debt amounted to $5.4 million. In 2024, EMX expects gold equal gross sales of 11,000-14,000 toz of gold equal. That is lower than the 2023 gross sales of 15,784 toz of gold equal, nonetheless, the 2023 quantity consists of additionally the delayed Timok royalty funds gathered throughout 2021 and 2022.

Vox Royalty (VOXR) reported the This fall monetary outcomes. Its revenues declined from $3.5 million in Q3 to $3 million in This fall, nonetheless, in comparison with This fall 2022, they elevated by greater than 40%. The working money movement elevated notably, from $1.7 million in This fall 2022 and $1.4 million in Q3 2023, to $2.3 million in This fall 2023. Nevertheless, the online revenue became crimson numbers, as the corporate recorded a lack of $0.4 million. The loss is attributable to a $1 million impairment cost associated to Jaw, Phoebe, Cart, and Colossus royalties, because the operator of the tasks didn’t renew the mining claims. Nevertheless, primarily based on the take care of the operator, Vox ought to obtain 4 new royalties with a worth of a minimum of $1 million, due to this fact, the corporate expects the impairment to be reversed sooner or later. Vox ended This fall with money of $9.3 million and debt-free. In 2024, Vox expects royalty revenues of $11-13 million, which ought to be consistent with revenues of $12.3 million recorded in 2023. Vox additionally elevated the quarterly dividend by 9.1%. $0.012 per share will likely be paid on April 12, to shareholders of file as of March 29.

On March 18, Vox launched a dividend reinvestment plan below which, shareholders might obtain extra shares of the corporate at a 5% low cost, as an alternative of the money dividend. The corporate additionally introduced a $1.5 million share repurchase program.

The corporate additionally supplied an intensive portfolio replace. An important information is that De Gray Mining’s (OTCPK:DGMLF) acquisition of the Ashburton gold challenge (Vox holds a 1.75% GRR royalty) ought to velocity up its improvement. It’s also anticipated that Silver Mines (OTCPK:SLVMF) will launch an up to date feasibility examine for the Bowdens silver challenge (Vox holds a 0.85% GRR royalty) in H2 2024, and the ultimate funding choice ought to comply with quickly after. And Orla Mining (ORLA) expects to acquire the ultimate permits for the South Railroad challenge in 2025.

Trident Royalties (OTCQB:TDTRF) introduced that Lithium Americas (LAC) acquired a conditional dedication from the U.S. Division of Power for a $2.26 billion mortgage below the Superior Know-how Autos Manufacturing Mortgage Program for financing the development of the processing services at Thacker Move. It is a big step on the street to place the Thacker Move lithium mine into manufacturing. The challenge is supported not solely by Ford Motor Firm (F) but additionally by the U.S. authorities now. That is big information for Trident which holds an environment friendly 1.05% Gross Income Royalty on the challenge that ought to be producing 40,000 tonnes of battery-grade lithium carbonate per yr in Stage I, and 80,000 tonnes per yr after the Stage II growth.

Sailfish Royalty (OTCQX:SROYF) declared a Q1 dividend of $0.0125 per share, payable on April 15, to shareholders of file as of March 31. Sailfish additionally introduced that CMC Metals unilaterally terminated the choice settlement to amass Swordfish Silver Corp.

On March 27, Sailfish introduced that the allowing course of for Solidus Assets’ Spring Valley gold mine retains on progressing, with a Report of Determination anticipated within the winter of 2025. Sailfish holds a 0.5%-3% NSR royalty over the property (a greater a part of the proposed open pit is roofed by the three% NSR royalty).

Orogen Royalties (OTCQX:OGNRF) introduced preliminary This fall monetary outcomes. The revenues amounted to C$2.3 million ($1.69 million), which is sort of double the income recorded throughout the identical interval of the earlier yr. The expansion was fueled primarily by the Ermitano royalty. The web revenue amounted to C$350,000 ($257,000). The audited monetary outcomes ought to be launched earlier than the tip of April.

Elemental Altus Royalties (OTCQX:ELEMF) reported its preliminary This fall monetary outcomes too. The corporate offered roughly 2,800 toz of gold equal, producing revenues of $5.6 million. The general 2023 gross sales and revenues amounted to 9,070 toz of gold equal, and $17.8 million respectively.

The April Outlook

The earnings season is kind of over, and the information movement will in all probability be calmer in April. The early April days point out that April might be one other optimistic month for the dear metals R&S corporations. Nevertheless, it is going to be actually arduous to repeat the good March efficiency.

Editor’s Word: This text discusses a number of securities that don’t commerce on a serious U.S. trade. Please concentrate on the dangers related to these shares.