EUR/USD & GOLD PRICE FORECAST

- Gold costs and EUR/USD may acquire floor within the close to time period, however the broader development could hinge on incoming U.S. financial information

- Consideration shall be on the ISM companies PMI and the U.S. labor market report later this week

- This text appears at XAU/USD and EUR/USD’s key ranges to look at within the coming days

Commerce Smarter – Join the DailyFX E-newsletter

Obtain well timed and compelling market commentary from the DailyFX crew

Subscribe to E-newsletter

Most Learn: Fed Stays Put, Retains Mountaineering Bias; Gold & US Greenback Show Restricted Volatility

The Federal Reserve at this time concluded its penultimate assembly of 2023. As anticipated, the establishment led by Jerome Powell determined to take care of its benchmark rate of interest unchanged at its present vary of 5.25% to five.50%. When it comes to ahead steerage, the central financial institution caught to the script and saved the door open to additional coverage firming in case a extra restrictive stance is required afterward to curb inflation.

Regardless of the FOMC’s tightening bias, Powell did not steer market pricing towards one other hike, as he has finished up to now when financial situations warranted a extra aggressive stance. Though his press convention contained some hawkish parts, a robust conviction in the necessity to proceed elevating borrowing prices was absent, an indication that the normalization cycle could have already ended.

With policymakers seemingly extra cautious, maybe conscious that the total results of previous actions have but to be felt, the U.S. greenback may quickly be topping out. Nonetheless, to have faith on this evaluation, incoming information should verify that the outlook is starting to deteriorate quickly in response to more and more restrictive monetary situations.

Merchants could have an opportunity to gauge the well being of the general financial system later this week when the ISM companies PMI survey and October U.S. employment figures are launched. If each stories shock to the draw back by a large margin, because the ISM manufacturing indicator did, there may very well be scope for a big pullback within the broader U.S. greenback. This situation would enhance EUR/USD and gold costs (XAU/USD).

UPCOMING US ECONOMIC REPORTS

Supply: DailyFX Financial Calendar

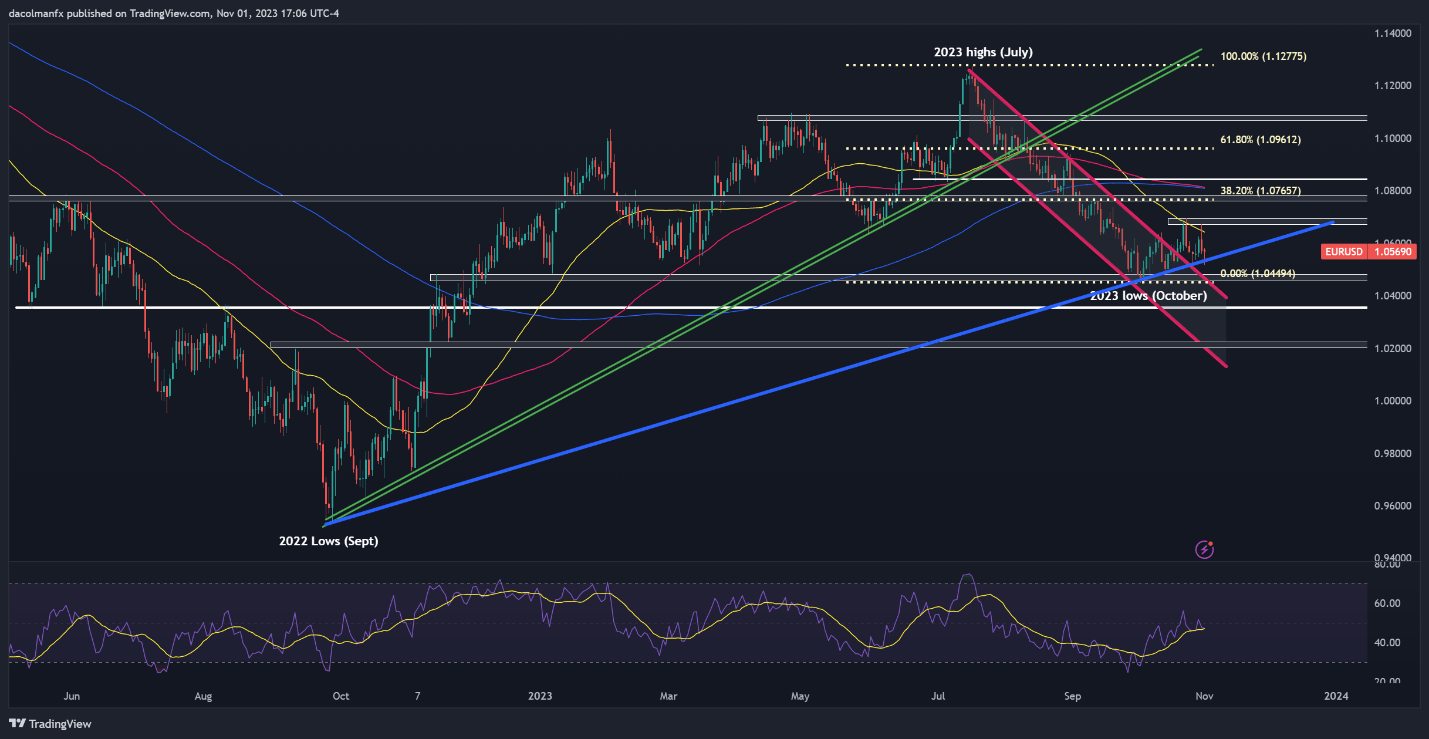

EUR/USD TECHNICAL ANALYSIS

EUR/USD was on track for a reasonable drop on Wednesday, however then reversed course after bouncing off medium-term trendline assist. Regardless of current value motion, the underlying bias stays bearish, however to be assured that the losses will speed up, the bears must push costs beneath 1.0535. Ought to this situation unfold, we may see a transfer in the direction of the 1.0500 deal with. On additional weak point, the main target shifts to 1.0355.

Conversely, if the bulls return in power and handle to drive the change price decisively increased, preliminary resistance lies between 1.0670 and 1.0695. Upside clearance of this technical ceiling may reignite upward impetus, paving the best way for a rally in the direction of 1.0765, the 38.2% Fibonacci retracement of the July/October descent.

Curious concerning the anticipated path for EUR/USD and the market catalysts that ought to be in your radar? Discover all the main points in our This autumn euro buying and selling forecast. Obtain it now!

Really helpful by Diego Colman

Get Your Free EUR Forecast

EUR/USD TECHNICAL CHART

EUR/USD Chart Created Utilizing TradingView

Questioning how retail positioning can form gold costs? Our sentiment information offers the solutions you’re in search of—do not miss out, seize a free copy at this time!

| Change in | Longs | Shorts | OI |

| Each day | -3% | -1% | -2% |

| Weekly | -1% | 0% | -1% |

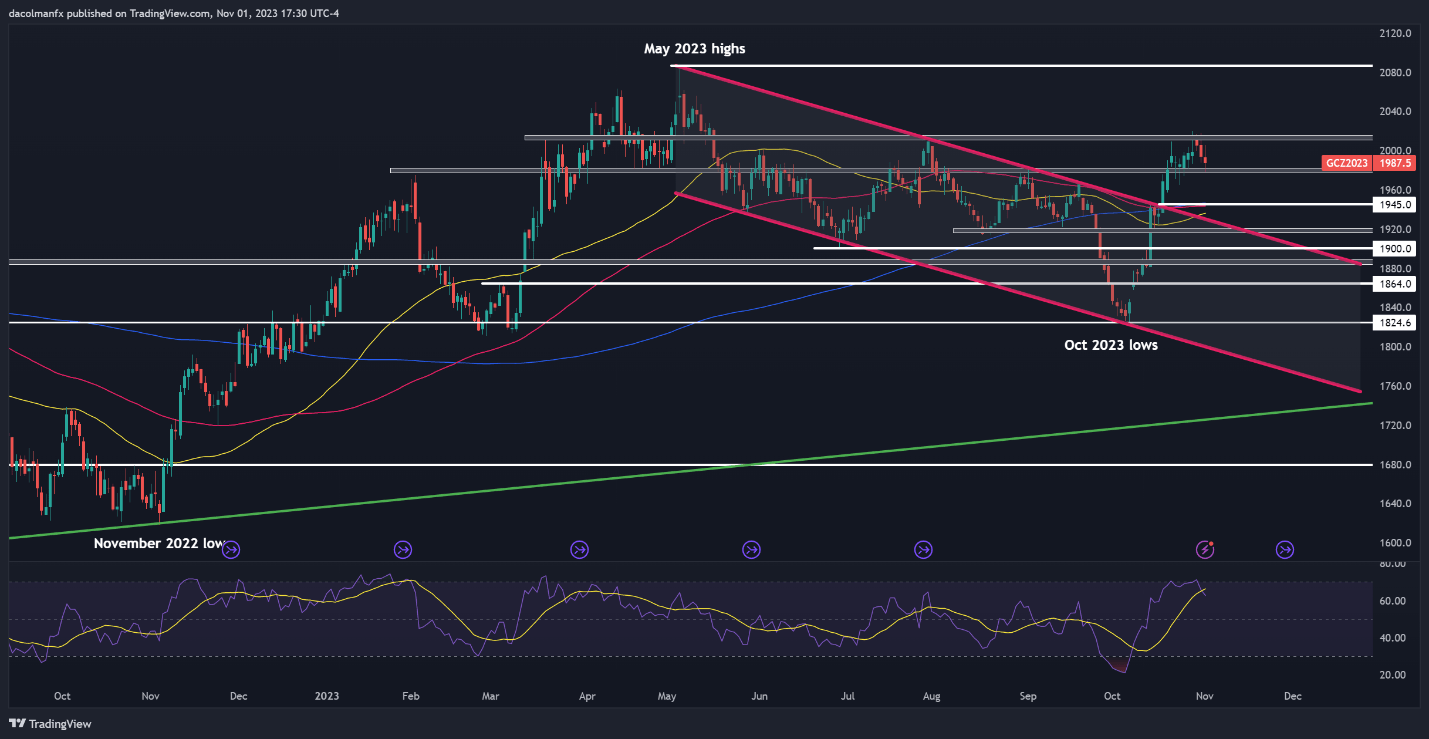

GOLD PRICE (XAU/USD)TECHNICAL ANALYSIS

Gold (front-month future contracts) has rallied sharply since its October lows, however has struggled to clear resistance within the $2,010/$2,015 vary. Makes an attempt to breach this space in current weeks have been met with downward rejections each single time, an indication that the bulls haven’t mustered the required energy to spark a breakout.

To achieve perception into XAU/USD’s outlook within the quick time period, it is important to observe how costs progress within the coming buying and selling classes, making an allowance for two potential situations.

State of affairs 1: If the yellow steel manages to take out the $2,010/$2,015 barrier, bullish momentum may collect tempo, creating the appropriate situations for a transfer in the direction of final 12 months’s excessive round $2,085.

State of affairs 2: If sellers engineer a robust comeback and push gold costs beneath assist at $1,980, losses may speed up, paving the best way for a attainable take a look at of the 200-day easy transferring common at $1,945. Under this threshold, consideration turns to $1,920.

GOLD PRICE CHART (FRONT-MONTH FUTURES)

Gold Futures Chart Created Utilizing TradingView