GBP/USD ANALYSIS

- Employment change (FEB) – ACT: 83K, EST: 5K

- Unemployment rate (MAR) – ACT: 3.7%, EST: 3.8%

CABLE ON THE UP!

Cable gained further traction after the employment change and unemployment releases beat estimates (see economic calendar below).

GBP/USD ECONOMIC CALENDAR

Source: DailyFX Economic Calendar

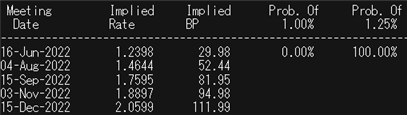

The data adds to the already tight labor market in the UK, giving the Bank of England (BoE) much to think about considering last week’s poor GDP figures. Later today, the focus shifts to Fed Chair Jerome Powell for any guidance from the Fed’s perspective while tomorrow’s UK inflation read may should give markets a short-term read on the BoE. We have already seen a marginal increase in money market rate hike pricing for 2022 (112bps) from last week (109bps).

BOE RATE HIKE PROBABILITIES

Source: Refinitiv

GBP/USDTECHNICAL ANALYSIS

GBP/USD DAILY CHART

Chart prepared by Warren Venketas, IG

Key resistance levels:

- 1.2494

- 20-day EMA (purple)

Key support levels:

BULLISH IG CLIENT SENTIMENT

IG Client Sentiment Data (IGCS) shows retail traders are currently LONG on GBP/USD, with 78% of traders currently holding long positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment however, due to recent changes in long and short positioning we arrive an upside bias.

Contact and follow Warren on Twitter: @WVenketas