The central financial institution’s job is rarely simpler, however within the present local weather, it’s unusually tough.

Along with the same old challenges that complicate real-time financial coverage choices, the should weigh the potential financial implications of a blizzard of edicts from the White Home. It’s unclear how President Trump’s plans have altered the Fed’s expectations, however non-public sector economists are weighing in on the outlook.

Torsten Sløk, Apollo’s chief economist, notes that whereas the incoming US financial information stays sturdy, “we’re beginning to fear concerning the draw back dangers to the financial system and markets from: 1) the impression of DOGE layoffs and contract cuts on jobless claims and a couple of) persistently elevated coverage uncertainty weighing on capex spending choices and hiring choices.”

Stephanie Roth, chief economist at Wolfe Analysis, is much less involved that the widespread terminations of federal workers that look like DOGE’s goal will take a severe chunk out of development.

“It’s not going to tip the financial system into recession by itself,” she advises.

In the meantime, President Trump yesterday reaffirmed that he plans to push forward with tariffs on Canada and Mexico subsequent week. “The tariffs are going ahead on time, on schedule.”

The potential for a tariff-related enhance in , if solely briefly, stays a risk. It’s open for debate how the Fed will reply, or if it is going to reply, however for the second the central financial institution is predicted to go away its goal charge unchanged on the subsequent FOMC assembly on Mar. 19, based mostly on Fed funds futures.

The policy-sensitive appears to agree that coverage is, for now, kind of applicable. This key charge, which is taken into account a benchmark for monitoring expectations of future Fed choices, fell to 4.18% yesterday (Feb. 24). The decline leaves the 2-year yield at its lowest shut since December.

The current slide within the 2-year yield additionally means the speed is once more buying and selling decisively beneath the median efficient Fed funds charge, which means the market is once more beginning to worth in a comparatively dovish outlook for Fed coverage.

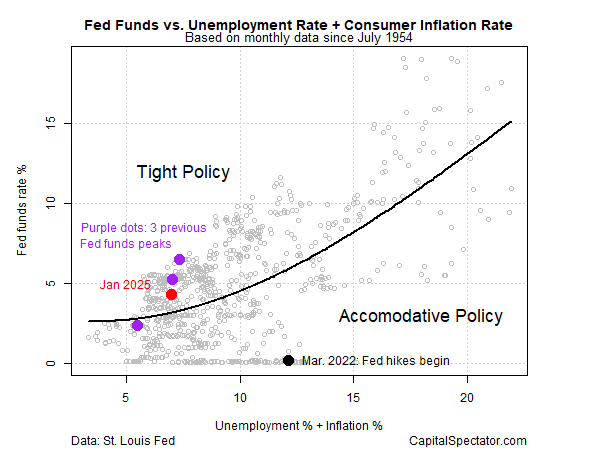

A easy mannequin to evaluate the present profile of Fed coverage, based mostly on client inflation and , suggests {that a} modestly tight stance prevails, as of January.

The query is whether or not the Fed believes its present coverage posture is acceptable going ahead. A actuality examine is due on Friday when the federal government publishes PCE inflation information for January. In distinction with final month’s “sticky” inflation report for CPI, economists anticipate a tamer spherical of numbers on Friday.

However January is already historic historical past at a time of fast-moving coverage shifts emanating from the White Home. The problem for the Fed is that the impression of tariffs and DOGE choices will begin to emerge inside a couple of months whereas financial coverage nonetheless works with lengthy and variable lags.