Panya Mingthaisong

Abstract

- In 2024, U.S. SMID cap development shares have been dominated by slim efficiency drivers—crowded AI trades and curiosity rate-sensitive sectors like housing and biotech—with the highest ten contributors accounting for greater than 1/3 of the Russell 2500 Development Index (the “Index”) return. This created a difficult setting for many worthwhile, high-quality firms and highlighted the market’s more and more short-term focus.

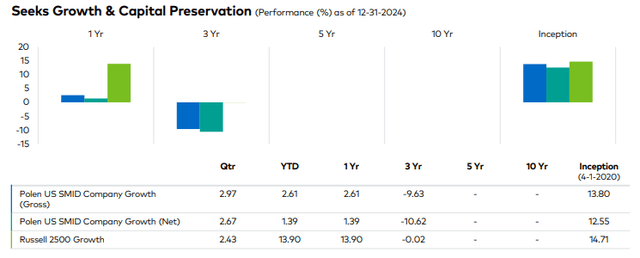

- The U.S. SMID Firm Development Composite Portfolio (the “Portfolio”) delivered 3.0% gross of charges and a pair of.7% web of charges for the quarter, barely outperforming the Index. This marked the top of an total disappointing yr by which the Portfolio returned 2.6% gross of charges and 1.4% web of charges, underperforming the Index’s 13.9% return.

- The highest contributors to the Portfolio’s relative and absolute efficiency within the fourth quarter have been Revolve Group (RVLV), Warby Parker (WRBY), and Goosehead Insurance coverage (GSHD).

- Essentially the most important detractors from relative efficiency have been Booz Allen Hamilton (BAH), TopBuild (BLD), and Hamilton Lane (HLNE). The numerous absolute detractors have been Booz Allen Hamilton, TopBuild, and Flooring & Décor (FND).

- Through the quarter, we initiated positions in seven new investments: Rambus (RMBS), Entegris (ENTG), Bentley Methods (BSY), Perception Enterprises (NSIT), Pure Storage (PSTG), Willscot Holdings (WSC), and Dutch Bros (BROS). We additionally added to a number of present positions.

- We eradicated six positions—Euronet Worldwide (EEFT), Aspen Know-how (AZPN), Fox Manufacturing unit Holding (FOXF), Tyler Applied sciences (TYL), Clearwater Analytics (CWAN), and Alarm.com (ALRM)—and trimmed a number of present positions.

- There are various examples of excessive beta, AI-adjacent development firms outperforming the broader investable universe. Whereas we didn’t personal these shares because of their low high quality, which harm our efficiency, we consider the Portfolio is well-positioned to learn from the GenAI-driven transformation—albeit in a extra sustainable, long-term-oriented method.

|

The efficiency knowledge quoted represents previous efficiency and doesn’t assure future outcomes. Present efficiency could also be decrease or greater. Intervals over one-year are annualized. Efficiency figures are introduced gross and web of charges and have been calculated after the deduction of all transaction prices and commissions, and embody the reinvestment of all revenue. Please reference the GIPS Report which accompanies this commentary. The commentary is just not supposed as a assure of worthwhile outcomes. Any forward-looking statements are based mostly on sure expectations and assumptions which can be inclined to modifications in circumstances. Opinions and views expressed represent the judgment of Polen Capital as of the date herein, might contain a lot of assumptions and estimates which aren’t assured, and are topic to vary. Contribution to relative return is a measure of a securities contribution to the relative return of a portfolio versus its benchmark index. The calculation might be approximated by the beneath formulation, making an allowance for purchases and gross sales of the safety over the measurement interval. Please observe this calculation doesn’t take into consideration transactional prices and dividends of the benchmark, because it does for the portfolio. Contribution to relative return of Inventory A = (Inventory A portfolio weight (%) – Inventory A benchmark weight (%)) x (Inventory A return (%) – Mixture benchmark return (%)). All company-specific info has been sourced from firm financials as of the related interval mentioned. |

Commentary

As measured by the Russell 2500 Development Index, U.S. SMID cap development shares have been up 2.4% within the fourth quarter and 13.9% for 2024. In one other risky quarter, SMID cap shares have been up over 10% after November’s U.S. Presidential election however relinquished nearly all these beneficial properties in December, with the U.S. Federal Reserve (Fed) setting the tone for a slower-than-expected rate of interest discount in 2025. Regardless of the volatility, our U.S. SMID Firm Development Portfolio returned 3.0% gross of charges and a pair of.7% web of charges, barely outperforming the Index. This marked the top of a disappointing yr by which the Portfolio returned 2.6% gross of charges and 1.4% web of charges, underperforming the 13.9% Index return.

Regardless of muted 2024 outcomes, we consider the basics of our Portfolio companies are sturdy and bettering. For a lot of the yr, the Russell 2500 Development efficiency was largely pushed by crowded AI trades and firms that stood most to learn from declining rates of interest (housing, biotech, unprofitable “moonshot” firms like house exploration, quantum computing, and so on). As proof of this narrowness, the highest 10 contributors to the 2024 Index efficiency accounted for greater than 1/3 of its return. That is decidedly not a conducive setting for many worthwhile, high-quality firms to outperform, and for us, it represented a significant relative efficiency headwind. For our present holdings, the market’s time horizon appeared to shrink considerably with a heightened concentrate on AI, excessively punishing companies that didn’t meet expectations for the quarter, far exceeding what their underlying fundamentals would justify. Final quarter, we highlighted Goosehead Insurance coverage as an illustration—down 40% at one level and later rebounding 60% as fundamentals proved stronger than anticipated. We witnessed a continuation of this development when firms reported earnings in October and November, which labored to our profit within the fourth quarter.

Quite a few lower-quality firms didn’t meet our Flywheel framework for high quality, weighing closely on relative efficiency. Essentially the most notable instance is Tremendous Micro Laptop, up practically 190% within the first half of the yr and driving a notable headwind. Notably irritating on this state of affairs—Tremendous Micro was reconstituted out of the index in late June and was down -62% within the second half of 2024. Many high-beta, AI-adjacent development firms outperformed the broader investable universe. Whereas we didn’t personal these shares because of their low high quality, negatively impacting our returns, we consider the Portfolio is well-positioned to learn from the GenAI-driven transformation in a extra sustainable and long-term method.

Whereas volatility and narrowly outlined, crowded trades within the Index have introduced short-term challenges for our high-quality, concentrated Portfolio, we consider these dynamics create a superb setting for inventory pickers like ourselves with a long-term, business-owner mindset. We stay dedicated to our collaborative, rigorous analysis course of to establish the very best long-term SMID cap compounders. We goal to generate returns by figuring out nice underappreciated companies all through their long-term compounding potential. In environments like this, many are additionally missed because of the market’s short-term focus and incapacity to see previous the following rate-cut determination. This has led to crowding in some securities and skittishness in others. We use our five-point Flywheel funding standards to see previous the noise and depend on our analysis course of to take a number of views and leverage our crew’s in depth expertise. We’re disciplined about paying the best worth to succeed in our mid-teens return goal and infrequently make the most of our library of vetted Flywheel firms to attend for the best alternative to purchase when volatility works in our favor. In consequence, we’re excited in regards to the prospects for our Portfolio even amid an unsure financial setting.

Portfolio Efficiency & Attribution

Through the fourth quarter, the U.S. SMID Firm Development Composite Portfolio returned 3.0% gross and a pair of.7% web of charges, respectively, in comparison with the Russell 2500 Development Index return of two.4%.

The highest contributors to the Portfolio’s relative and absolute efficiency within the fourth quarter have been Revolve Group, Warby Parker, and Goosehead Insurance coverage.

Revolve Group, a web based attire retailer focusing on primarily Millennial and Gen Z demographics, was the highest performer after demonstrating bettering fundamentals following a difficult interval, with the inventory’s complete return up over 100% for the yr. Whereas the patron setting stays below strain, we’re inspired by the corporate’s efforts to drive value efficiencies, cut back return charges, increase product strains, and proceed its worldwide push. We consider Revolve is well-positioned to develop earnings at an accelerating charge over the close to time period whereas the long-term outlook stays intact.

Warby Parker, a U.S.-based omnichannel retailer of eyewear merchandise with a novel vertically built-in direct-to-consumer enterprise mannequin, reported encouraging quarterly outcomes. The corporate skilled sturdy development in its glasses enterprise and continued momentum in touch lenses and optometry.

Funding in optometrists is yielding outcomes, driving improved gross margins by enhanced utilization. Warby Parker seems to be rising from a difficult interval the place it was adversely impacted by post-pandemic modifications in client conduct. Firm administration’s steps to cut back prices look like paying off. Extra just lately, we’ve seen fundamentals enhance, with advertising and marketing spend recovering now that margins have settled. We consider the corporate has the potential to reinforce its profitability as demand continues to get well and it completes and capitalizes on heavy investments in areas similar to optometry providers, which beforehand weighed on margins.

Goosehead Insurance coverage, a digitally enabled insurance coverage brokerage enterprise, was a prime contributor on the again of optimistic earnings outcomes together with a rising 2024 income steerage. The corporate continues to execute effectively amidst a difficult macro backdrop, driving strong expense administration, greater productiveness, and compelling agent headcount development.

Essentially the most important detractors from relative efficiency within the quarter have been Booz Allen Hamilton, TopBuild, and Hamilton Lane. The numerous absolute detractors have been Booz Allen Hamilton, TopBuild, and Flooring & Décor Holdings.

Booz Allen Hamilton confronted strain through the interval, not because of elementary enterprise weak point however moderately issues surrounding the Trump administration’s proposed Division of Authorities Effectivity (DOGE). Led by Elon Musk and former Republican presidential candidate Vivek Ramaswamy, DOGE has been mandated to curtail authorities spending, together with funds to authorities contractors like Booz Allen Hamilton, which derives practically 100% of its revenues from the U.S. authorities. Whereas we view these issues as extra noise than actuality, we’re monitoring developments carefully and can react accordingly.

TopBuild, a U.S. market chief in insulation distribution and set up providers within the residential development, industrial, and mechanical insulation markets, was weak over the quarter after posting tender quarterly outcomes. We consider the corporate presents publicity to secular tailwinds from years of underbuilding in new properties and a high-return enterprise mannequin that ought to show extra resilient than conventional homebuilders.

Hamilton Lane is a personal markets advisory and funds enterprise serving primarily institutional traders. A strong performer for the higher a part of 2024, the inventory got here below strain within the again half of the quarter, which coincided with rising charges in anticipation of the Fed pulling again on its 2025 charge reduce expectations. We preserve our perception that the corporate is well-positioned given the expansion in non-public markets throughout asset courses, in addition to Hamilton Lane’s extremely sturdy and recurring charge income and charge earnings.

Portfolio Exercise

Through the quarter, we initiated new positions in Rambus, Entegris, Bentley Methods, Perception Enterprises, Pure Storage, Willscot Holdings, and Dutch Bros. We additionally added to a number of present positions.

Rambus performs a foundational function in fueling innovation within the knowledge middle and server environments, serving massive reminiscence OEMs (Unique Tools Producers) and hyperscalers. With its fabless mannequin, Rambus generates strong free money move whereas sustaining a gentle R&D reinvestment to maintain its industry-leading reminiscence interface chips and silicon IP options. We estimate Rambus is well-positioned to compound earnings and free money move per share at a high-teens charge by the cycle.

Entegris is a number one provider of supplies and course of options centered totally on the semiconductor {industry}. The corporate has developed experience in varied chemical substances, gases, and filtration options that help probably the most superior semiconductor development manufacturing processes. The enterprise has just lately seen weaker-than-expected development in its mature nodes enterprise, which we count on to normalize into 2025 and 2026. General, we predict supplies, gasoline filtration, and dealing with—all Entegris core competencies—will probably be more and more essential in enabling semiconductor {industry} advances. We count on Entegris to ship sustainable high-teens EPS development on the again of double-digit income development and margin growth from working leverage.

Bentley Methods is a long-established chief in infrastructure engineering software program—particularly horizontal infrastructure networks similar to roads, bridges, rail and transit, water and wastewater, utility grids, and the assets sector. Over 40 years, Bentley has developed complete options for infrastructure engineering, masking all features of a venture lifecycle. The corporate is actively extending its moat by investing in new applied sciences like digital twins (digital fashions of a bodily object, course of, or system that makes use of real-time knowledge to simulate its conduct in the true world) and AI to reinforce its choices and deal with the rising demand for infrastructure and asset intelligence. Bentley solely went public in late 2020 however has an extended observe report as a traditional compounder, attaining a +8% CAGR (Compound Annual Development Price) in complete revenues over greater than 20 years. Bentley boasts excessive and increasing working and free money move margins, a resilient stability sheet, strong returns on capital, and a extremely recurring income mannequin. We consider we’re paying a good FCF (free money move) a number of for a mission-critical, steady enterprise benefitting from a number of secular tailwinds and guided by an aligned, long-term-oriented administration crew.

Perception Enterprises is a worldwide supplier of IT options to small- and medium-sized companies throughout varied finish markets. Perception has developed capabilities in {hardware} administration and software program and providers and has demonstrated a formidable long-term observe report of double-digit returns on invested capital and strong free money move era. The corporate has cemented itself as a crucial associate to its purchasers’ digital transformation initiatives. Our analysis suggests Perception will profit from a return to regular IT spending ranges within the coming years as firms prioritize {hardware} upgrades and proceed emigrate workloads to the cloud. We estimate Perception will compound earnings per share at 18% over the following 5 years, pushed by its deep buyer relationships and main cloud providers enterprise.

Pure Storage gives knowledge storage options primarily to enterprise prospects with non-public clouds and, extra just lately, hyperscalers. Pure stands out as a high-performance, all-flash storage supplier with no legacy laborious disk enterprise. Its aggressive benefit stems from its DirectFlash modules, the custom-built NAND flash chips managed by the corporate’s proprietary Purity software program. DirectFlash’s benefits embody greater storage capability, longer life span, and higher efficiency with decrease latency. This interprets to a premium, high-performance providing that generates excessive gross margins of ~70%, which we count on to develop over time. Though enterprise knowledge storage demand has been muted in comparison with computing or server demand, we consider storage demand will speed up, pushed by GenAI and total IT spending restoration. Traditionally, enterprise prospects have been keen to pay up for efficiency, whereas hyperscalers opted for low-cost, bulk storage options. This dynamic is shifting as Pure’s all-flash storage system permits for superior power financial savings in comparison with conventional laborious disc storage. In consequence, Pure has received its first hyperscaler contract, and we count on such success to proceed. The web result’s rising EPS and money move. We count on Pure’s earnings to develop at a 20% CAGR with growing returns on invested capital.

Willscot Holdings gives turnkey house and storage options with main market share in North America, serving prospects by 250 department areas. The corporate presents cell places of work, transportable storage containers, climate-controlled storage, clear-span buildings, and related providers, together with supply and set up. The enterprise mannequin is very predictable as property are leased with a median length of three years—this stability has enabled administration to allocate capital successfully. Development markets (industrial, non-residential, and residential) have been sluggish over the previous few years, and we anticipate an improved quantity backdrop forward. We count on this, mixed with continued pricing beneficial properties by greater connect charges of their Worth-Added Companies, to result in mid-teens EPS development over the following 5 years.

Dutch Bros, a drive-through espresso and beverage firm with practically 1,000 areas, reported compelling quarterly outcomes, elevating its full-year income and EBITDA (Earnings Earlier than Curiosity, Taxes, Depreciation, and Amortization) steerage. Strong same-store gross sales and regular unit development have pushed top-line development of +28% year-over-year. Earnings development seems poised to speed up as the corporate ramps up unit development in 2025, innovates its menu (into the untapped alternative to drive meals gross sales), and margins inflect greater with scale. We consider it’s nonetheless early days for Dutch Bros, which has a novel idea and is simply beginning to faucet into confirmed worth drivers like on-line ordering and meals. We consider Dutch Bros has the potential to be a considerably long-duration EPS (earnings per share) development enterprise.

We eradicated six positions—Euronet Worldwide, Aspen Know-how, Fox Manufacturing unit Holdings, Tyler Applied sciences, Clearwater Analytics, and Alarm.com—and trimmed a number of present positions.

We exited Euronet Worldwide given our warning in regards to the existential challenges going through its ATM enterprise because of the speedy shift towards a cashless society. We consider this limits the corporate’s appreciation potential even when the basics stay enticing. Whereas we nonetheless see Euronet as a high-quality enterprise, we recognized higher alternatives for our capital.

We exited our place in Aspen Know-how because of its introduced acquisition, which we predict limits its future return potential.

We bought our place in Fox Manufacturing unit Holdings, which has been an unsuccessful funding. Fox Manufacturing unit makes high-end shocks for bicycles and powered automobiles. The corporate was negatively impacted by pandemic disruptions within the bicycle provide chain.

Whereas these headwinds have abated, the corporate faces extra weak point in its powered automobiles section, which we count on to proceed because of rising seller inventories and a myriad of points on the auto OEMs. Given new inventory concepts, we consider Fox Manufacturing unit will climate this difficult interval, however we don’t see it as the very best alternative for our capital.

Over a number of quarters, we’ve used our funding in Tyler Applied sciences as a supply of funds and totally exited our place within the quarter. We see it as a high-quality, enticing enterprise centered on software program serving the general public sector, which has been a profitable funding in our view, attaining a $25B market cap. Nonetheless, we view the inventory’s return potential as much less compelling following its strong efficiency.

We moved on from Clearwater Analytics after substantial share worth appreciation led to valuation ranges that diminished its relative attractiveness within the portfolio.

Lastly, we exited our place in Alarm.com, the cloud, SaaS-based (Software program as a Service) software program platform for residential and industrial safety firms. Whereas we nonetheless view Alarm as a high-quality enterprise, the EPS development and return profile not evaluate favorably to newer concepts in our pipeline. In keeping with our greatest concepts and alternative cost-driven mindset, we bought out of the place.

Through the quarter, we added to and trimmed present holdings that largely replicate the chance value mindset famous above. We added to positions with higher risk-reward profiles and stronger Flywheels and trimmed positions based mostly on valuation to fund new positions and add to present holdings. We added to our positions in Booz Allen Hamilton, Paycom Software program (PAYC), Flooring & Décor, and Trex (TREX) and trimmed positions in Goosehead Insurance coverage, Houlihan Lokey (HLI), and Hamilton Lane.

Outlook

Seeking to 2025 and past, we’re optimistic about our Portfolio firms’ EPS development outlook and the comparatively low valuations for SMID cap shares. We predict enterprise fundamentals will doubtless proceed to enhance because of rising proof suggesting 2024 was the EPS backside for SMID caps broadly, and the M&A market might proceed to enhance on early beneficial properties in 2024. Underneath the Trump presidency, we consider decreased regulation and prioritized home companies might disproportionately profit SMID cap firms, which derive most of their income from the U.S.

We don’t count on persistent uncertainty to restrict our skill to realize our long-term return targets, as the basics of our Portfolio companies and potential for superior earnings development will finally drive the shares. Whereas we will’t predict how 2025 will unfold, we’re ready for continued volatility with financial uncertainty and shifting rate of interest expectations. We goal to put money into resilient companies that may self-fund their development. It is a key tenet of our Flywheel funding standards, which we uphold in good occasions and dangerous.

Thanks to your curiosity in Polen Capital and the U.S. SMID Firm Development Portfolio. Please contact us with any questions.

Sincerely,

Rayna Lesser Hannaway, CFA

Whitney Younger Crawford

|

Essential Disclosures & Definitions: Disclosure: This commentary may be very restricted in scope and is supposed to offer complete descriptions or discussions of the matters talked about herein. Furthermore, this commentary has been ready with out making an allowance for particular person goals, monetary conditions or wants. As such, this commentary is for informational dialogue functions solely and isn’t to be relied on as authorized, tax, enterprise, funding, accounting or every other recommendation. Recipients of this commentary ought to search their very own unbiased monetary recommendation. Investing includes inherent dangers, and any specific funding is just not appropriate for all traders; there’s at all times a threat of shedding half or all your invested capital. No assertion herein needs to be interpreted as a suggestion to promote or the solicitation of a suggestion to purchase any safety (together with, however not restricted to, any funding car or separate account managed by Polen Capital). Recipients acknowledge and agree that the data contained on this commentary is just not a advice to put money into any specific funding, and Polen Capital is just not hereby endeavor to offer any funding recommendation to any individual. This commentary is just not supposed for distribution to, or use by, any individual or entity in any jurisdiction or nation the place such distribution or use could be opposite to native regulation or regulation. Except in any other case said on this commentary, the statements herein are made as of the date of this commentary and the supply of this commentary at any time thereafter won’t create any implication that the statements are made as of any subsequent date. Sure info contained herein is derived from third events past Polen Capital’s management or verification and includes important parts of subjective judgment and evaluation. Whereas efforts have been made to make sure the standard and reliability of the data herein, there could also be limitations, inaccuracies, or new developments that would affect the accuracy of such info. Subsequently, this commentary is just not assured to be correct or well timed and doesn’t declare to be full. Polen Capital reserves the best to complement or amend these slides at any time, however has no obligation to offer the recipient with any supplemental, amended, substitute or extra info. Any statements made by Polen Capital concerning future occasions or expectations are forward-looking statements and are based mostly on present assumptions and expectations. Such statements contain inherent dangers and uncertainties and are usually not a dependable indicator of future efficiency. Precise outcomes might differ materially from these expressed or implied. The Russell 2500® Index is a market capitalization weighted index that measures the efficiency of the small to mid-cap development section of the U.S. fairness universe. It’s comprised of two,500 of the smallest securities within the Russell 3000® Index. The index is maintained by the FTSE Russell, a subsidiary of the London Inventory Alternate Group. It’s not possible to speculate instantly in an index. The efficiency of an index doesn’t replicate any transaction prices, administration charges, or taxes. Previous efficiency is just not indicative of future outcomes. Supply: All knowledge is sourced from Bloomberg except in any other case famous. All company-specific info has been sourced from firm financials as of the related interval mentioned. Definitions: Flywheel framework: Polen Capital’s framework to evaluate an organization’s high quality geared toward supporting sustainable development. It’s comprised of 5 self-reinforcing parts: 1) distinctive positioning, 2) repeatable gross sales course of, 3) strong enterprise mannequin, 4) efficient administration, and 5) value-creating reinvestment. Fabless: a enterprise mannequin by which an organization designs and markets semiconductors however outsources manufacturing to third-party foundries. This mannequin permits the corporate to concentrate on innovation whereas counting on companions to provide the chips. Mature nodes: an older semiconductor manufacturing course of with bigger function sizes that’s cost-effective and broadly used for functions like automotive and analog gadgets, the place modern efficiency is just not required. Unique Tools Producers (OEM): an organization that produces elements or merchandise which can be utilized in one other firm’s finish merchandise. OEMs would possibly manufacture {hardware} or components which can be built-in into gadgets bought below one other model’s title. Within the tech {industry}, it usually refers to producers supplying components like chips or software program to bigger system producers. Hyperscalers: massive know-how firms that construct and function in depth, scalable cloud infrastructure to help strong computing, storage, and networking capabilities. They supply cloud providers to companies and people, enabling speedy scaling of assets. EPS Development: the proportion enhance in an organization’s earnings per share over a particular interval, indicating its profitability development and skill to generate greater earnings for shareholders. Compound Annual Development Price (OTC:CAGR): annual charge of return that might be required for an funding to develop from its starting stability to its ending stability. Calculated by annualizing the speed of return over the measurement interval. Free money move a number of: a valuation metric evaluating an organization’s market cap to its free money move, indicating how a lot traders are keen to pay for every greenback of free money move the corporate generates. Headwind: an element or situation that may impede the efficiency or development of investments, sectors, or total economies. These obstacles could possibly be financial, political, or market-related and might negatively have an effect on funding returns. Tailwind: a good situation or issue that may propel asset costs or monetary markets upwards. These can embody financial development, technological developments, regulatory modifications, or different exterior influences that improve the efficiency of investments. Earnings Earlier than Curiosity, Taxes, Depreciation, and Amortization (EBITDA): a metric used to find out an organization’s monetary efficiency and gauge its profitability earlier than non-core bills and prices. It’s calculated by taking web revenue and including curiosity, taxes, depreciation, and amortization again to it. Contribution to relative return: a measure of a safety’s contribution to the relative return of a portfolio versus its benchmark index. The calculation might be approximated by the beneath formulation, making an allowance for purchases and gross sales of the safety over the measurement interval. Please observe this calculation doesn’t take into consideration transactional prices and dividends of the benchmark, because it does for the portfolio. Contribution to relative return of Inventory A = (Inventory A portfolio weight (%) – Inventory A benchmark weight (%)) x (Inventory A return (%) – Mixture benchmark return (%)). All company-specific info has been sourced from firm financials as of the related interval mentioned. |