AUD/USD ANALYSIS & TALKING POINTS

- Australian and Chinese language PMI’s disappoint leaving AUD on supply.

- FOMC minutes to come back later this night.

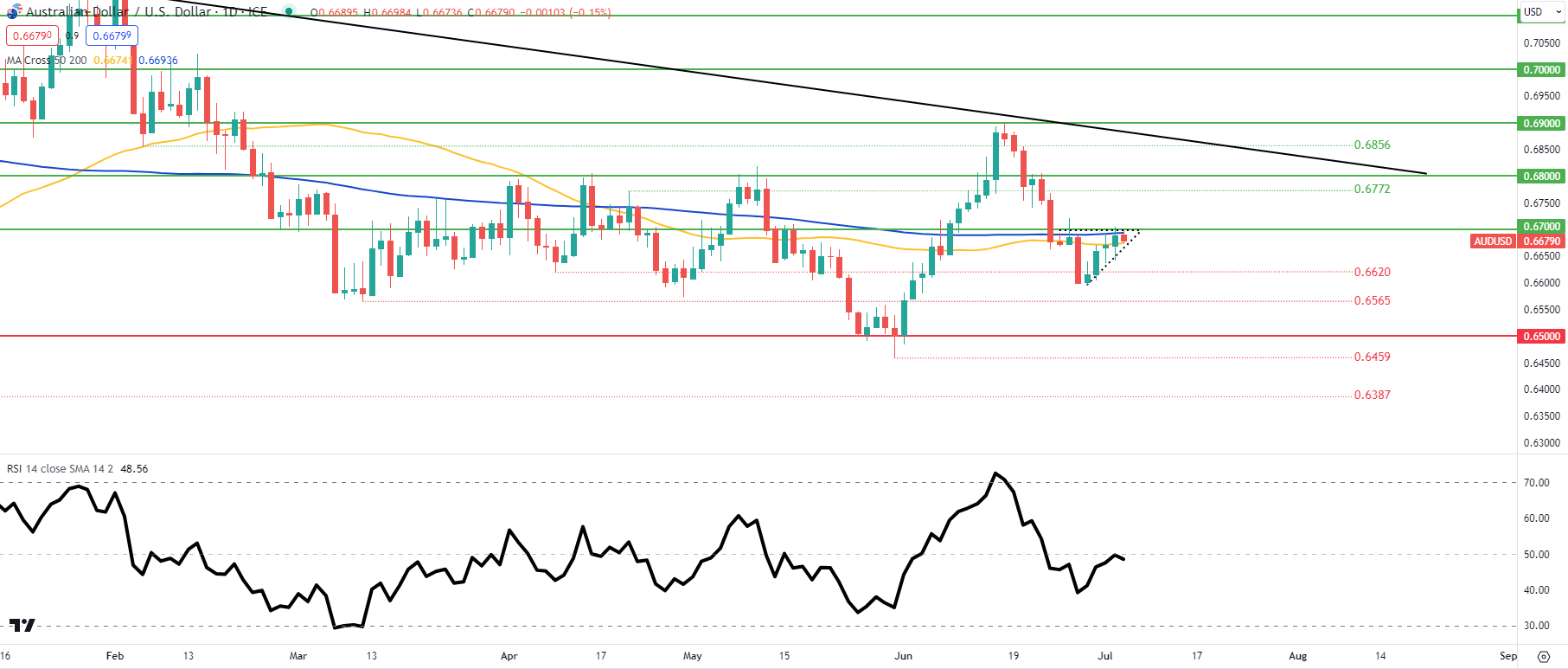

- Ascending triangle breakout looming as AUD/USD approached triangle apex.

Advisable by Warren Venketas

Get Your Free AUD Forecast

AUSTRALIAN DOLLAR FUNDAMENTAL BACKDROP

As we enter the second half of 2023, the Australian greenback is buying and selling at a key inflection level in opposition to the US greenback after yesterday’s Independence Day celebrations within the US. The morning kicked off in Asian commerce with two necessary financial releases together with each the Australian PMI and Chinese language Caixin PMI’s. Each missed estimates and highlighted the rising concern of world recessionary fears as tight financial coverage takes maintain. The Ai Group Trade Index measures adjustments in exercise for the economic sector and has pushed decrease revealing a deeper unfavourable contraction. China being such an in depth buying and selling companion with Australia, has added to the AUD selloff as a consequence of its ‘pro-growth’ nature and excessive optimistic correlation with the Chinese language economic system.

Main Australian commodity costs are beneath stress because the buck stays marginally bid alongside the weaker Chinese language backdrop. Later immediately, markets stay up for the FOMC minutes which ought to present some readability into the Fed’s mindset on the earlier assembly the place charges have been stored fixed. Additional corroboration in opposition to Fed Chair Powell’s most up-to-date hawkish feedback might be essential for short-term directional steerage.

Commerce Smarter – Join the DailyFX E-newsletter

Obtain well timed and compelling market commentary from the DailyFX group

Subscribe to E-newsletter

AUD/USD ECONOMIC CALENDAR (GMT +02:00)

Supply: DailyFX financial calendar

TECHNICAL ANALYSIS

AUD/USD DAILY CHART

Chart ready by Warren Venketas, IG

Day by day AUD/USD value motion now trades inside and ascending triangle formation (dashed black line) the place the higher resistance sure is respective of the 0.6700 psychological degree. The convergence by each the 50-day and 200-day transferring averages respectively, make for an space of confluence that would present breakout potential. A break under triangle help might invalidate the sample and prolong the medium-term downtrend whereas a break above resistance will seemingly open up subsequent resistance zones.

Key resistance ranges:

- 0.6800

- 0.6772

- 0.6700/Triangle resistance

- 200-day MA (blue)

Key help ranges:

- 50- day MA (yellow)

- Triangle help

- 0.6620

IG CLIENT SENTIMENT DATA: MIXED

IGCS reveals retail merchants are presently internet LONG on AUD/USD, with 64% of merchants presently holding lengthy positions. At DailyFX we usually take a contrarian view to crowd sentiment however as a consequence of latest adjustments in lengthy and quick positioning we arrive at a short-term cautious disposition.

Contact and followWarrenon Twitter:@WVenketas