Bitcoin critic Peter Schiff has acknowledged what he described because the “first actual use case” for Bitcoin. Recognized for supporting gold over digital property, Peter Schiff has repeatedly mentioned that Bitcoin has no utility.

Nonetheless, in a latest put up on X, he pointed to a scenario involving funding supervisor Jim Chanos for instance the place Bitcoin could serve a sensible position.

Peter Schiff Critiques Michael Saylor Bitcoin Shopping for Technique

In line with an X put up, Bitcoin critic Peter Schiff remarked that Bitcoin may lastly have a use — although not the one Bitcoin advocates promote. He referred to investor Jim Chanos, who lately disclosed that he bought Bitcoin to hedge in opposition to his quick place in MicroStrategy inventory (MSTR).

Technique, led by Government Chairman Michael Saylor, has continued to extend its Bitcoin holdings. The corporate now owns almost 570,000 BTC. This has led some market watchers to view MSTR as a proxy for Bitcoin with added company threat. Schiff mocked this technique, stating that Saylor has “by accident created an actual use case for Bitcoin,” the place traders use BTC to guard themselves from the dangers tied to Saylor’s personal agency.

Funding supervisor Chanos is thought for shorting shares of corporations he considers to be overvalued or structurally weak. Like Peter Schiff, he reportedly sees MSTR as overleveraged as a result of its Bitcoin technique. By proudly owning Bitcoin whereas shorting MSTR, Chanos goals to restrict his losses in case Bitcoin costs surge.

Chanos Bets In opposition to MicroStrategy Valuation

In an X put up, Chanos defined that traders are paying an excessive amount of for every greenback of Bitcoin publicity by means of Technique. In line with his assertion, MSTR inventory is buying and selling at a premium that far exceeds the precise worth of its Bitcoin holdings. He argued,

“Buyers are paying $3 of inventory value to achieve $1 of Bitcoin publicity.”

Peter Schiff used this situation to argue that Bitcoin’s solely sensible position has grow to be a monetary hedge — not as a forex or retailer of worth. Chanos’s hedge technique implies that whereas MSTR’s inventory could fall as a result of overvaluation, the Bitcoin he holds may cushion these losses.

Technique has additionally confronted criticism for borrowing funds to purchase Bitcoin. The corporate lately added 13,390 BTC for about $1.34 billion. Critics warn that such aggressive buying may expose the agency to threat if Bitcoin’s value declines. Bitcoin critic Peter Schiff has echoed these considerations, saying that giant BTC value drops may flip paper income into actual monetary stress for MicroStrategy.

Regardless of this backlash, Professional-XRP lawyer John Deaton additionally added to the dialogue, evaluating Michael Saylor’s long-term Bitcoin technique to that of Warren Buffett’s funding method with Berkshire Hathaway. He acknowledged that Saylor could also be aiming to manage as much as 5% of the entire Bitcoin provide in circulation regardless of the mockery.

MicroStrategy (MSTR) Inventory Efficiency

MicroStrategy (MSTR) inventory has gained almost 40% in 2025, reflecting Bitcoin’s upward development. Nonetheless, Peter Schiff argues that this development is tied extra to Bitcoin value motion than to the corporate’s core enterprise efficiency. This has led to considerations about sustainability if Bitcoin enters a correction part.

Nonetheless, the latest buys by corporations like Metaplanet and Tether-backed firm Twenty One Shares have boosted the optimism for Bitcoin value to breach the resistance to a brand new all-time excessive.

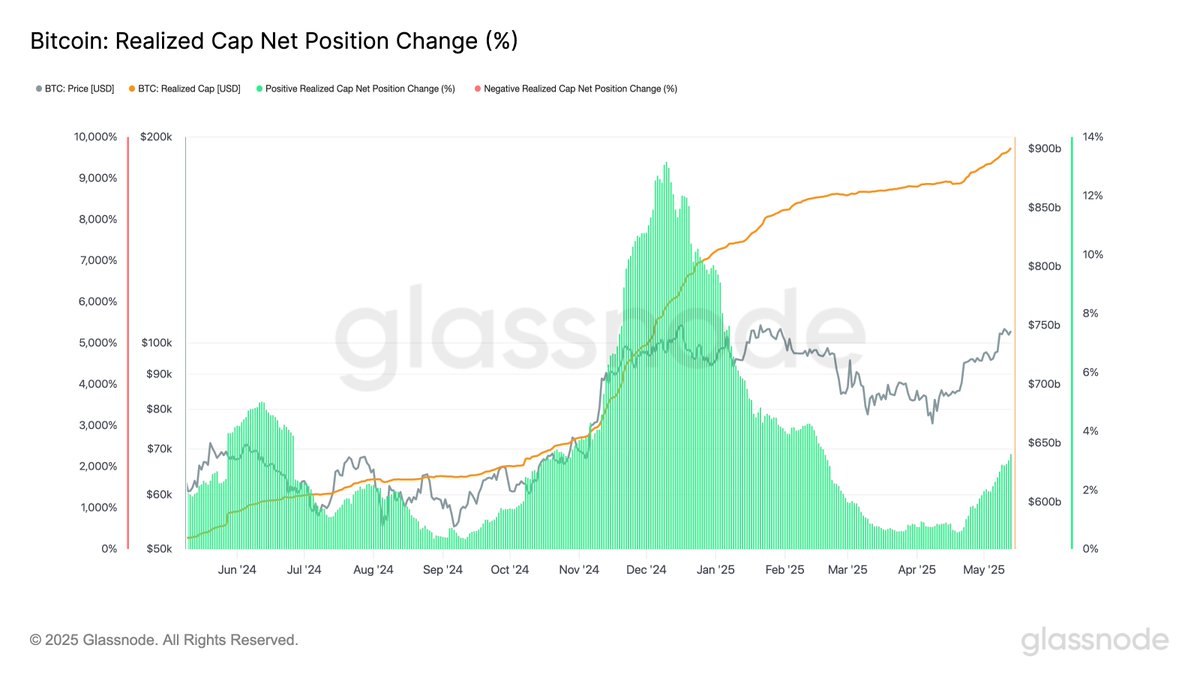

The broader Bitcoin market is at present in a value consolidation vary between $100,678 and $105,700. Analysts forecast a possible breakout if the BTC value holds above key ranges. Glassnode knowledge reveals Bitcoin’s realized cap has elevated by $30 billion since April 20, suggesting new capital is coming into the market which is a precursor to a bullish breakout.

Disclaimer: The offered content material could embody the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability on your private monetary loss.

✓ Share: