naphtalina/iStock by way of Getty Photographs

Funding thesis

My preliminary bullish thesis about Perion Community (NASDAQ:PERI) didn’t age properly over the past quarter because the inventory value declined by virtually 30%, a lot deeper than the broader market. Right this moment, I would love to replace my evaluation to reveal that Stick has grow to be an much more engaging funding alternative after the current weak spot within the inventory value. Fundamentals stay robust as the corporate continues demonstrating stellar income progress and profitability metrics growth. My valuation evaluation means that the inventory is greater than twice undervalued, and the corporate’s steadiness sheet is a fortress. All in all, I improve PERI’s ranking to “Sturdy Purchase”.

Latest developments

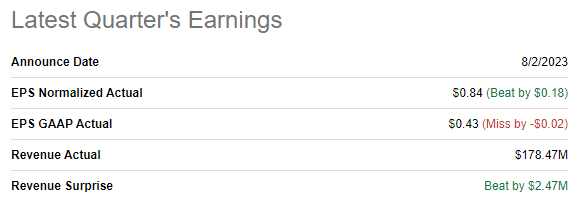

The most recent quarterly earnings had been launched on August 2, when the corporate topped consensus estimates. Income momentum demonstrated resilience because the YoY progress accelerated to 21.7%. The energy in income allowed the working margin to increase considerably from 14.9% to 19.3%. Because of the expanded working margin and improved working capital administration, the corporate’s free money movement [FCF] for the quarter virtually tripled on a YoY foundation.

Searching for Alpha

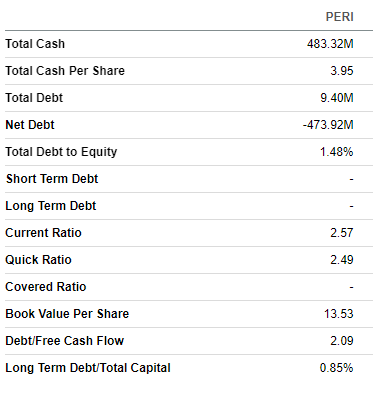

The most recent quarter’s monetary efficiency enabled the corporate to strengthen its monetary place additional. Close to-term liquidity is in glorious form, with virtually no excellent debt. The corporate is in a powerful, virtually half-billion-dollar internet money place, which makes it well-positioned to finance additional progress organically or by way of acquisitions.

Searching for Alpha

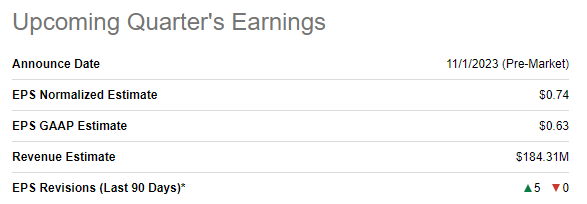

Sturdy income progress momentum is predicted to be sustained. The upcoming quarter’s earnings launch is scheduled for November 1, and the highest line is projected by consensus to reveal a 16% YoY progress. The profitability is poised to observe because the adjusted EPS is predicted to increase from $0.53 to $0.74.

Searching for Alpha

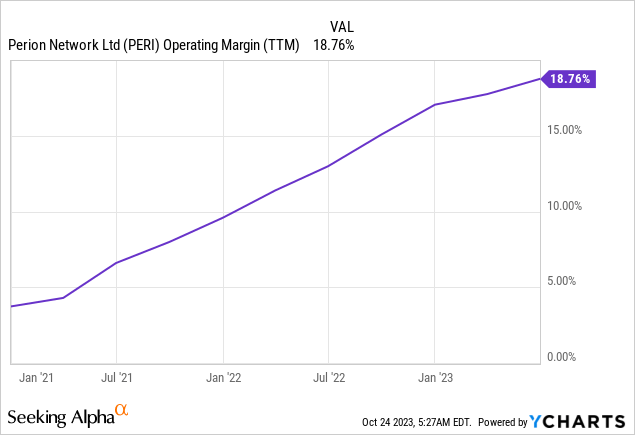

Total, the corporate has demonstrated spectacular progress momentum for 12 straight quarters of double-digit YoY progress. Profitability metrics are additionally increasing at a speedy tempo, and 5 upward EPS revisions over the last 90 days counsel that the momentum remains to be robust. The TTM working margin chart seems to be like a straight line demonstrating spectacular progress.

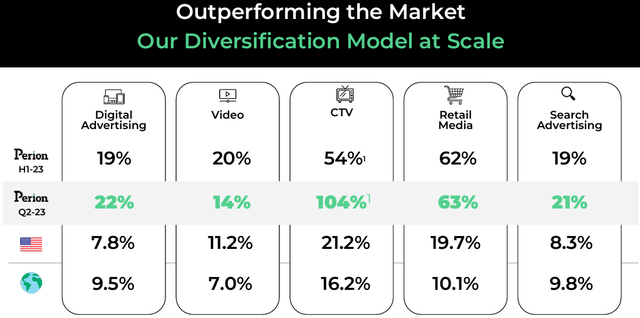

The energy in profitability is primarily fueled by spectacular income progress. It is usually necessary to remember that we’re at the moment navigating a really difficult setting of chopping promoting budgets and tight financial coverage. However Perion’s topline progress demonstrates robust resilience and a number of instances outperforms the home and worldwide markets.

Perion’s newest earnings presentation

The corporate’s capacity to outperform the digital promoting trade throughout a number of segments is a crucial bullish signal. It signifies Perion’s aggressive energy and talent to seize market share whereas sustaining rising profitability metrics. I additionally like the corporate’s strategically diversified enterprise mannequin, which permits flexibility within the present unsure setting. The truth that the administration acknowledges the necessity to innovate can be a superb signal for potential traders. The deal with retail media as a necessary progress driver allows the corporate to leverage information and AI to ship customized advert experiences, which creates extra worth for Perion’s prospects.

Final however not least, the truth that in the course of the newest earnings name, the administration raised its full-year steerage, with a projected 16% YoY progress in income on the midpoint and a 26% YoY progress in adjusted EBITDA, is a transparent expression of confidence in future efficiency.

Valuation replace

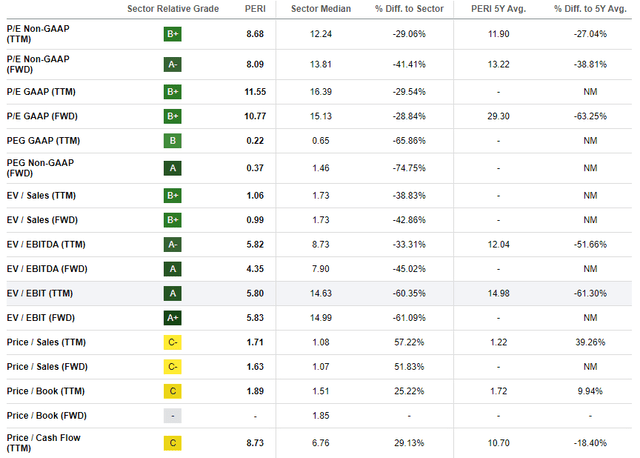

This yr, the inventory considerably underperforms the broader U.S. market with a lower than one p.c value improve. Searching for Alpha Quant assigns the inventory a good “B” valuation grade as a result of many of the ratios are considerably decrease than the sector median and historic averages.

Searching for Alpha

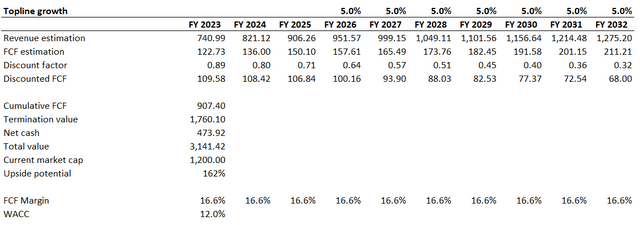

PERI is an aggressive progress firm, so the discounted money movement [DCF] simulation is the choice to proceed with. Given the newest Fed’s hawkish rhetoric, I exploit an elevated 12% WACC for discounting. I exploit the flat 16.6% TTM FCF margin for the entire subsequent decade. I’ve income consensus estimates obtainable for the upcoming three full fiscal years and undertaking a 5% CAGR for the years past.

Writer’s calculations

Based on my DCF simulation, the enterprise’s truthful worth is roughly $3.1 billion, greater than twice the present market cap. The inventory is considerably undervalued, and my goal value is about $65 per share.

Dangers replace

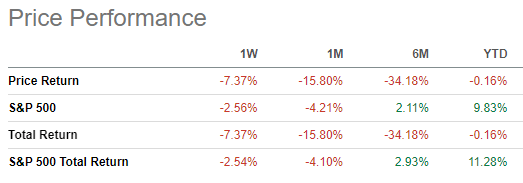

The inventory experiences weak momentum, softly talking. In comparison with the S&P 500 index, PERI underperforms throughout all short-term horizons, and there’s little certainty relating to the timing of the sentiment pivot towards the inventory.

Searching for Alpha

I’ve agency conviction relating to the enterprise’s prime quality and substantial inventory undervaluation, however it’s the inventory market that strikes the value. It’d take a number of quarters earlier than traders acknowledge the worth of the inventory, and the demand for it can go up, spurring up the value. That stated, potential Perion traders needs to be prepared to carry the inventory for the long run and able to abdomen substantial volatility and near-term underperformance in comparison with the broader market.

As a progress firm, Perion’s inventory additionally faces a considerable danger of huge sell-offs in case of underperforming in comparison with consensus estimates. Valuation considerably is dependent upon future money flows, and if there’s a little trace that future earnings are in danger, it’d result in investor panic even when the weak spot is momentary and never secular.

The current developments within the Gaza Stripe, which resulted in a army battle between Israel and Hamas, are additionally a considerable danger for Perion, which is headquartered in Israel. Though the army capabilities of the 2 sides might seem unequal, with Israel possessing one of many world’s most technologically superior armies, the potential for a army battle poses dangers, each when it comes to bodily safety and financial stability, for all people and entities positioned in shut proximity to the battle’s epicenter.

Backside line

To conclude, Perion is a “Sturdy Purchase” at this inventory value degree. My valuation evaluation means that the inventory is greater than two instances undervalued, even underneath pretty conservative assumptions. The corporate’s monetary efficiency demonstrates robust momentum because the income demonstrates double-digit YoY progress in 12 quarters in a row, and the TTM working margin chart seems to be like a straight line directed up. The steadiness sheet is a fortress, that means the corporate has sufficient assets to gas additional progress.