HeliRy

Observe:

I’ve lined Efficiency Transport (NASDAQ:PSHG) beforehand, so buyers ought to view this as an replace to my earlier articles on the corporate.

Final 12 months, small Greece-based tanker operator Efficiency Transport joined peer Imperial Petroleum (IMPP, IMPPP) and sister firm OceanPal (OP) in relentlessly diluting widespread shareholders at a tiny fraction of internet asset worth (“NAV”) for the only function of rising their respective fleets.

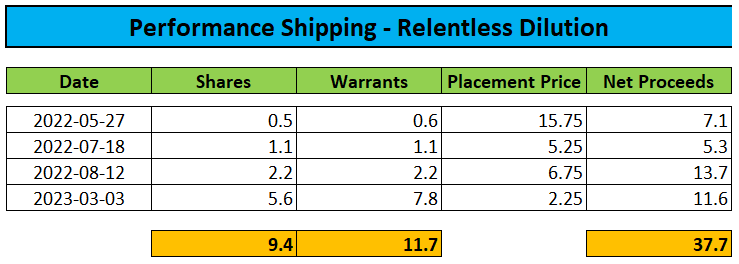

Over the previous 18 months, Efficiency Transport has raised roughly $37.7 million in internet proceeds from a collection of fairness choices together with warrant sweeteners:

Regulatory Filings

Please notice that widespread shareholders suffered further dilution (albeit to a lesser extent) from share gross sales executed beneath two current at-the-market choices.

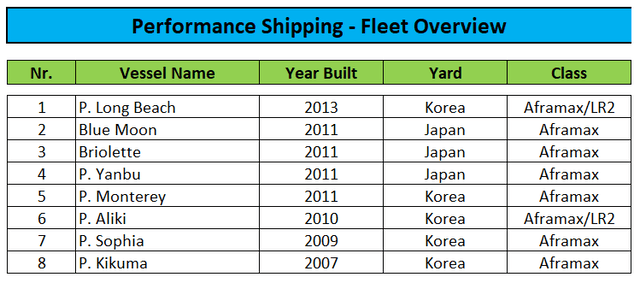

The corporate has used the funds to broaden its tanker fleet to eight vessels with an estimated market worth of roughly $350 million:

Firm Presentation

In addition, Efficiency Transport has ordered a newbuild Aframax/LR2 tanker for a purchase order worth of $62.2 million with supply anticipated in This fall/2025. In April, the corporate paid the primary installment of $9.5 million.

Like different tanker corporations with a concentrate on the spot- and short-term time constitution markets, Efficiency Transport has benefited closely from elevated constitution charges attributable to current geopolitical occasions.

In H1/2023, the corporate generated a whopping $40.8 million in money from working actions.

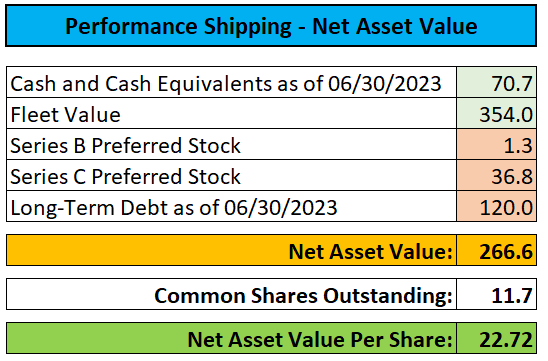

Regardless of the favorable market atmosphere, Efficiency Transport continues to commerce at an attention grabbing 90% low cost to internet asset worth (“NAV”) as buyers stay cautious of the corporate’s tainted previous:

Regulatory Filings

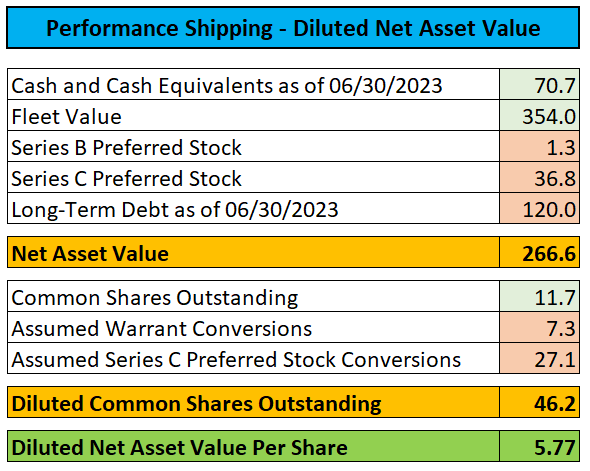

Sadly, this quantity stays topic to materials dilution from potential warrant workout routines and Sequence C Convertible Most popular Inventory conversions with fully-diluted NAV per share estimated to be under $6:

Regulatory Filings

Nonetheless, even after the current rally within the shares, the low cost to fully-diluted NAV nonetheless calculates to greater than 60%.

Over the previous couple of months, infamous Greek delivery magnate George Economou has amassed near 10% of the corporate’s widespread shares in a collection of open market purchases and said his intention to interact in a proxy combat.

On Wednesday, Mr. Economou surprisingly launched a young supply to amass all of Efficiency Transport’s excellent shares for $3.00 in money per share thus inflicting the inventory worth to leap by virtually 30%.

Traders ought to notice that the supply is topic to a lot of situations with the bulk being solely throughout the management of the corporate and its Board of Administrators.

Amongst different issues, the supply is conditional upon:

- Mr. Economou being provided the vast majority of all issued and excellent widespread shares on a fully-diluted foundation.

- The corporate eradicating its poison tablet.

- Cancellation of the corporate’s Sequence C Convertible Most popular Inventory which is managed by Chairwoman Aliki Paliou and her partner, CEO Andreas Michalopoulos.

- Mr. Economou being handed over management of the Board of Administrators.

However with Ms. Paliou and Mr. Michalopoulos commanding roughly 90% of the voting rights, there’s mainly no means for Mr. Economou’s hostile supply to succeed.

Not surprisingly, Efficiency Transport is defending vigorously towards Mr. Economou’s calls for (emphasis added by creator):

(…)

Efficiency Transport recurrently engages with buyers and is open minded with respect to worth creation alternatives. In that mild, we’re deeply involved by the actions taken by Sphinx and its principal George Economou.

During the last a number of weeks, Sphinx stealthily took a big place in our inventory and has proceeded with more and more aggressive actions in the direction of the Firm, together with demanding to one way or the other remove the rights of a broadly-held class of shares, looking for to vary our company construction, nominating a director candidate to our Board, proposing to take away different administrators and demanding a overview of our books and information. Up to now, we’ve responded promptly, noting our disagreement with Sphinx’s baseless allegations.

Sphinx has finished all of this with out stating their intentions. We’re open to participating with Sphinx and Mr. Economou as we might with any shareholder. Nonetheless, given they’ve taken these steps with out being clear about their targets and whereas hiding behind their attorneys, we are able to solely assume the worst.

Mr. Economou’s file of destroying shareholder worth and enriching himself by way of self-dealing and poor company governance speaks for itself. We notice that the nominee proposed by Sphinx, John Liveris, has aided Mr. Economou in a few of his most egregious transactions, together with at Ocean Rig and OceanFreight.

Nonetheless, we stand by to interact constructively with Sphinx to higher perceive their intentions and our Board will overview their proposals and nominees by way of our regular company practices and requirements. Assuming the related authorized necessities are happy, our shareholders could have the chance to vote on Sphinx’s nomination and proposals at our 2024 annual assembly of shareholders.

It is very important perceive that Efficiency Transport is constructing a robust firm with vital development and worth creation alternatives. Our Board of Administrators includes extremely certified administrators, the vast majority of whom are unbiased and all of whom are dedicated to exercising their enterprise judgment and performing in accordance with their fiduciary duties to the advantage of the Firm and all shareholders.

In mild of our comparatively small market capitalization and to make sure shareholders have the chance to understand the complete upside potential of their investments in our Firm, we established our company construction with a categorised Board to guard towards the varieties of coercive and hostile actions we’re seeing from Sphinx. (…)

At this level, I simply do not see a viable path for George Economou to achieve management of Efficiency Transport with out the consent of the corporate and its controlling shareholders.

With Mr. Economou’s supply representing an virtually 50% low cost to fully-diluted NAV, there’s merely no foundation for Efficiency Transport’s controlling shareholders to think about a deal. On the flip facet, there is not any sense in buying the corporate at a worth near NAV so I don’t anticipate Mr. Economou to lift his supply materially.

Not less than for my part, the one means for George Economou to probably get his arms on Efficiency Transport could be to problem the corporate’s possession construction in court docket which might doubtless end in a protracted battle with restricted prospects of success.

Backside Line

Issues proceed to escalate at Efficiency Transport with George Economou surprisingly launching a hostile tender supply to amass the entire firm’s excellent widespread inventory for $3.00 per share in money.

Please notice that the supply is conditional upon the corporate eradicating all obstacles to the proposed acquisition which at the very least for my part shouldn’t be going to occur.

Given this problem, buyers should not wager on the share worth approaching the proposed takeover worth anytime quickly.

Shareholders contemplating to simply accept Mr. Economou’s supply ought to contact their dealer in an effort to guarantee that the November 8 deadline can be met.

With little prospects of George Economou succeeding in his battle for management of Efficiency Transport and the inventory worth up by virtually 200% since my “Speculative Purchase” suggestion in late June, I’m downgrading the corporate’s shares from “Speculative Purchase” to “Maintain“.

Traders ought to notice that George Economou has additionally amassed a sizeable stake in OceanPal, one other Palios family-controlled delivery firm that was spun off by Diana Transport (DSX) final 12 months and trades at an analogous low cost to NAV. Nonetheless, in distinction to Efficiency Transport, Mr. Economou has but to state his intentions concerning OceanPal.

Threat Components

Apart from a possible deterioration in tanker market situations, key dangers for Efficiency Transport’s shareholders are additional dilution and notably George Economou abandoning his present efforts to take management of the corporate.

Editor’s Observe: This text covers a number of microcap shares. Please pay attention to the dangers related to these shares.