Fotoatelie

PepsiCo (NASDAQ:PEP) is an American multinational company headquartered in Buy, New York. It is likely one of the world’s largest meals and beverage firms with its largest competitor being Coca-Cola Firm (KO).

Listed below are a few of PepsiCo’s most well-known merchandise:

- Pepsi

- Frito-Lay

- Quaker Oats

- Gatorade

- Tropicana

- SodaStream

The corporate was based in 1965 by way of the merger of Pepsi-Cola and Frito-Lay. The corporate has since expanded by way of a sequence of acquisitions, together with the acquisition of Quaker Oats in 2001 and Tropicana Merchandise in 1998.

PEP operates in additional than 200 international locations and territories. The corporate’s merchandise are bought in grocery shops, comfort shops, merchandising machines, and eating places. PepsiCo additionally has various meals service companies, together with Frito-Lay Foodservice and Quaker Oats Foodservice.

PepsiCo is a vertically built-in firm, which implies that it owns and operates all the steps within the meals and beverage manufacturing course of. This provides PepsiCo a substantial amount of management over its merchandise and permits it to maintain prices down.

On condition that the US economic system looks as if it’s headed for a recession, an organization like PepsiCo, being that it’s a main participant within the world meals and beverage trade, might be an amazing inventory to carry. The corporate’s merchandise are loved by shoppers all around the world and administration has gotten sensible with product sizes as properly, which enchantment to a higher viewers. PepsiCo is dedicated to innovation and to offering its prospects with high-quality merchandise.

The notice of well being and curiosity in consuming and consuming wholesome has risen within the US through the years, as US shoppers search for more healthy choices with regards to what they drink and meals they devour. PepsiCo has various modern merchandise within the pipeline, together with a brand new line of wholesome snacks and a brand new sort of soda that’s made with pure substances, which ought to entice these kinds of prospects.

A Dividend King With A lot Of Fizz

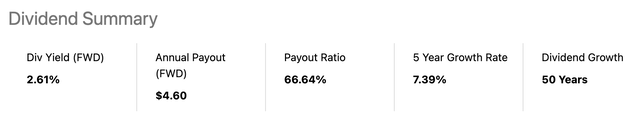

PepsiCo is an organization that undoubtedly focuses on returning cash to shareholders. They’ve proven this by way of share buybacks and rising dividends. The truth is, PepsiCo is likely one of the latest additions to the celebrated Dividend Kings listing for having hiked the dividend for 50 consecutive years now and counting.

PEP at present pays an annual dividend of $4.60, which equates to a dividend yield of two.6%. The corporate’s payout ratio is 66% and over the previous 5 years, the corporate has hiked the dividend a median of seven.4% per 12 months, which is in step with the latest hike.

PEP remains to be climbing its dividend at an honest price, one which usually outpaces inflation, they usually have an okay payout ratio, which tells me if the corporate continues to carry out on the present tempo, the dividend ought to proceed to climb within the coming years.

In search of Alpha

Latest Monetary Efficiency

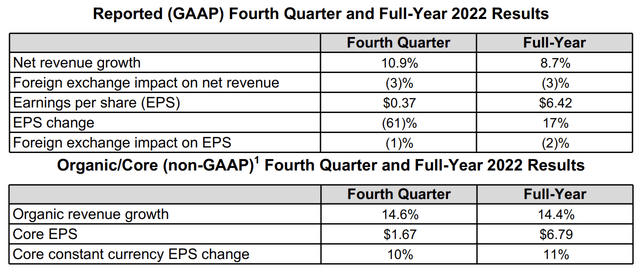

In February, PepsiCo launched their This autumn and full 12 months 2022 earnings. The corporate noticed revenues climb 10.9% to roughly $28 billion in This autumn and revenues grew 8.7% over all the 12 months. Natural income development grew 14.6% in This autumn, which was largely in-line with the complete 12 months in 2022.

PEP This autumn Press Launch

Given the affect of inflation, PepsiCo was pressured to hike their costs in 2022, which is one cause we noticed strong outcomes. This autumn outcomes had been larger than analysts’ expectations throughout the quarter, beating on each the highest and backside strains.

Right here is the This autumn outcomes in comparison with analyst expectations:

- Earnings per share: $1.67 adjusted vs. $1.65 anticipated

- Income: $28 billion vs. $26.84 billion anticipated

Both the corporate does a wonderful job outperforming expectations or analysts are poor at producing estimates as a result of PEP revenues has topped expectations in 28 out of the previous 32 quarters. In the meantime, EPS has overwhelmed to the upper aspect in 34 of the previous 36 quarters. Each are very spectacular in their very own proper.

Looking forward to 2023, administration is asking for the next:

- 6% enhance in natural income

- 8% enhance in core fixed forex EPS

- A core annual efficient tax price of 20%

- Complete money returns to shareholders of roughly $7.7 billion, comprised of dividends of $6.7 billion and share repurchases of $1.0 billion.

Is PEP A Purchase, Promote, or Maintain?

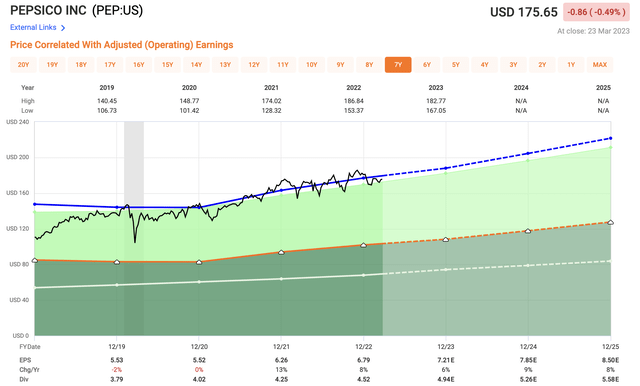

Analysts are searching for PEP to generate adjusted EPS of $7.21 in 2023, which is barely beneath the 8% enhance administration is anticipating. On condition that, shares of PEP are at present buying and selling at a ahead earnings a number of of 24.4x. Over the previous 5 years, shares of PEP have traded nearer to 26x.

This implies shares are barely undervalued, nonetheless, as we transfer the timeline out to the previous decade, shares of PEP have traded nearer to 23.1x. Immediately’s financial coverage is drastically totally different from a budget situations we noticed within the markets, thus the 23.1x common a number of appears extra reasonable.

On condition that, I’d personally price shares of PEP a HOLD on the present second.

Quick Graphs

Investor Takeaway

As we have now seen, PepsiCo is a pacesetter within the beverage and snack trade. They battle it out with KO within the beverage area, however add just a little extra to the desk provided that they’ve the snack element of the enterprise.

Whatever the financial backdrop, US and even world shoppers wish to devour snacks. Most of PepsiCo’s merchandise are low in greenback worth, which may nonetheless enchantment to prospects as cash will get tighter if we fall right into a recession.

PepsiCo’s administration staff does an amazing job prioritizing returning capital to shareholders, evidenced by each the 50 consecutive years of dividend development and by the $7.7 billion they anticipate to return to shareholders in 2023 alone.

Nonetheless, there are lots of nice firms out there, however valuation issues and proper now, though the inventory doesn’t look extraordinarily overvalued, the valuation just isn’t all that compelling in the mean time. It is a inventory I plan to maintain on my watchlist within the occasion we get a pullback.

Disclosure: This text is meant to supply info to events. I’ve no data of your particular person objectives as an investor, and I ask that you just full your personal due diligence earlier than buying any shares talked about or advisable.