Most Learn: U.S. Greenback Outlook & Market Sentiment: USD/JPY, USD/CAD, USD/CHF

The U.S. greenback, as measured by the DXY index, strengthened this previous week, closing at its greatest degree since mid-February on Friday. Regardless of preliminary losses following the Fed’s dismissal of renewed inflation dangers and indications that it was nonetheless on monitor for 75 foundation factors of easing this yr, the buck reversed larger within the subsequent two days amid a world shift in rate of interest expectations.

US DOLLAR INDEX WEEKLY CHART

Supply: TradingView

The Financial institution of England’s dovish posture throughout its March assembly, coupled with the Swiss Nationwide Financial institution’s surprising price minimize, fueled hypothesis that different key central banks would possibly calm down their insurance policies sooner than the FOMC, given the extra fragile state of their respective economies. The European Central Financial institution, for instance, could possibly be considered one of them.

Keen to find what the long run holds for the U.S. greenback? Delve into our quarterly forecast for skilled insights. Get your complimentary copy now!

Beneficial by Diego Colman

Get Your Free USD Forecast

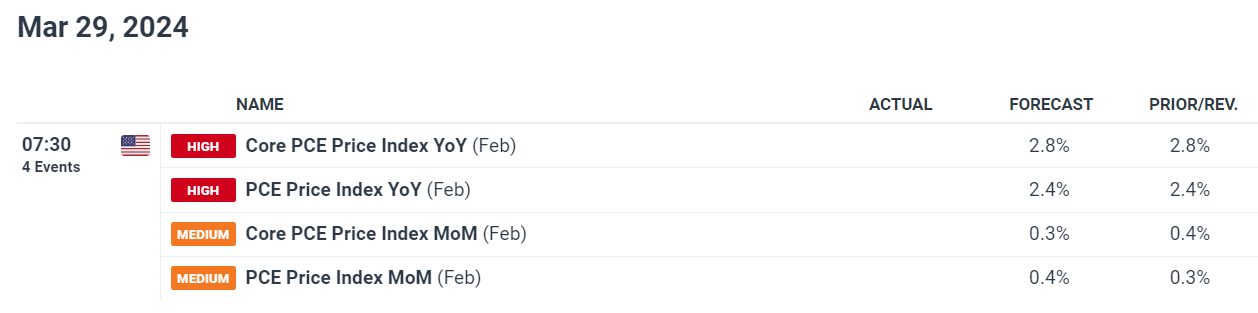

Waiting for potential catalysts, subsequent week’s spotlight on the U.S. financial calendar would be the launch of the core PCE deflator, the Fed’s favourite inflation gauge. With many worldwide markets shuttered for Good Friday, the true response to the information may not be fully evident till Monday. Regardless of this, volatility may nonetheless make an look resulting from thinner liquidity situations.

Specializing in the upcoming PCE report, the core worth index indicator is forecast to have risen 0.3% m-o-m in February, leaving the 12-month studying unchanged at 2.8%. Any consequence above this estimate needs to be bullish for the greenback, because it may drive the U.S. policymakers to attend a bit longer earlier than pivoting to a looser stance.

UPCOMING US PCE DATA

Supply: DailyFX Financial Calendar

Wish to know the place EUR/USD might headed over the approaching months? Discover all of the insights out there in our quarterly forecast. Request your complimentary information as we speak!

Beneficial by Diego Colman

Get Your Free EUR Forecast

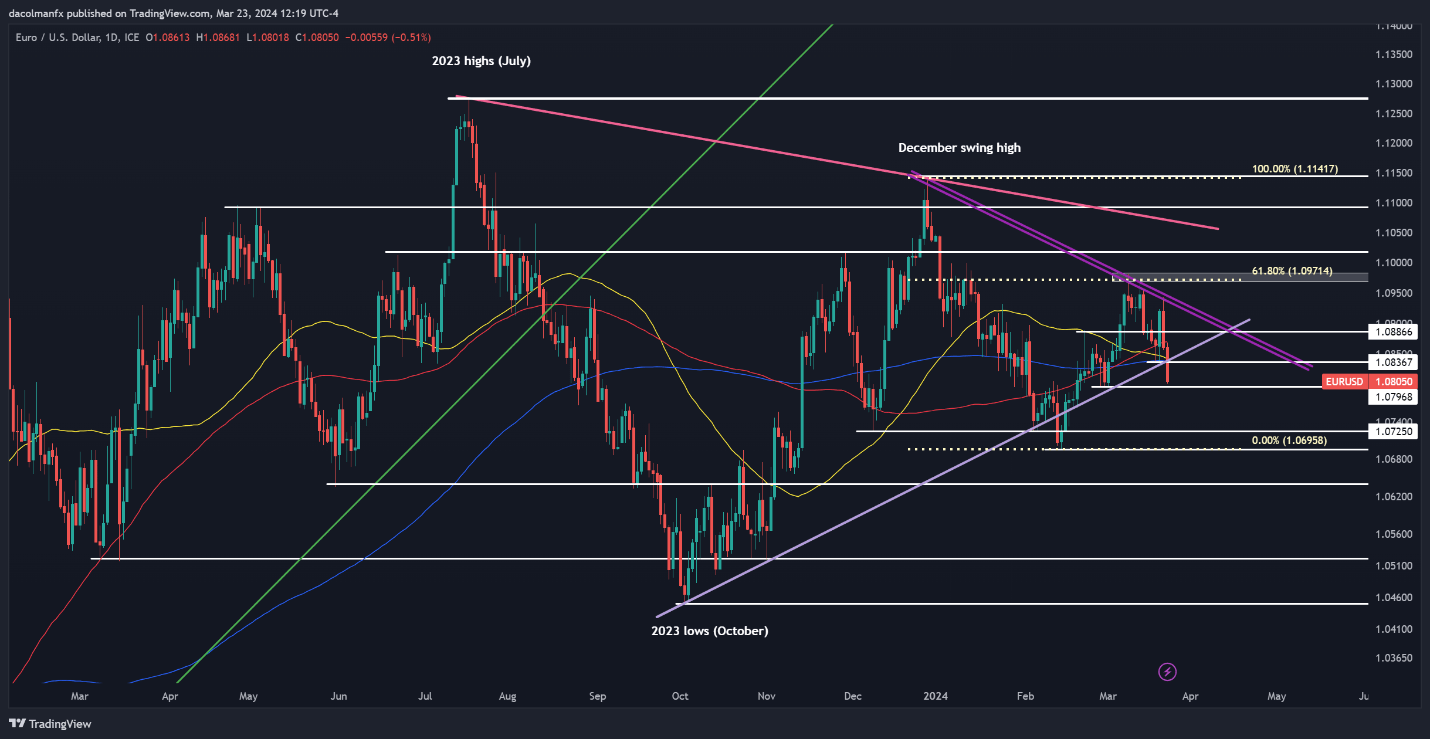

EUR/USD FORECAST – TECHNICAL ANALYSIS

EUR/USD has fallen sharply in latest days, breaching each trendline help and the 200-day easy transferring common at 1.0835, signaling a bearish shift. If losses speed up within the coming week, a key technical flooring to observe emerges at 1.0800. Under this space, the main focus will probably be on 1.0725.

Alternatively, if bulls mount a comeback and spark a rebound, resistance might be recognized within the 1.0835-1.0850 band. Within the occasion of a bullish push previous this vary, consideration will probably be directed in the direction of the 100-day easy transferring common, adopted by 1.0890 and 1.0925 in case of sustained power.

EUR/USD PRICE ACTION CHART

EUR/USD Chart Created Utilizing TradingView

Interested in what lies forward for USD/JPY? Discover complete solutions in our quarterly buying and selling forecast. Declare your free copy now!

Beneficial by Diego Colman

Get Your Free JPY Forecast

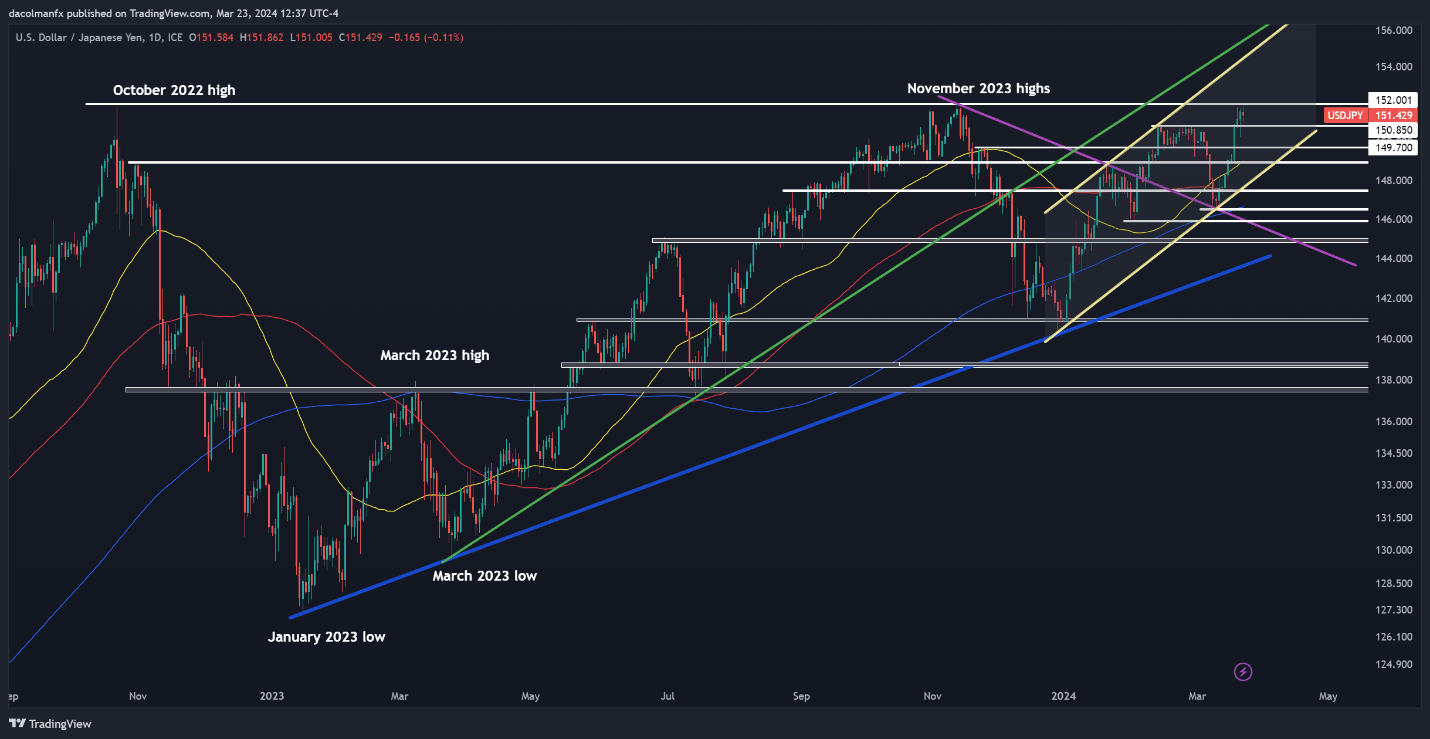

USD/JPY FORECAST – TECHNICAL ANALYSIS

USD/JPY jumped this week, coming inside putting distance from retesting its 2023 peak close to 152.00. A breach of this resistance may immediate Japanese authorities to step in to help the yen, so beneficial properties will not be sustained. With out FX intervention, nevertheless, a breakout may usher in a transfer in the direction of 154.40.

On the flip facet, if sellers return and handle to drive costs decrease, technical help looms at 150.90 and 149.75 thereafter. The pair may stabilize round these ranges throughout a pullback, however within the occasion of a breakout, a drop in the direction of the 50-day easy transferring common at 148.90 can’t be dominated out.

USD/JPY PRICE ACTION CHART

USD/JPY Chart Created Utilizing TradingView

Keen on studying how retail positioning can supply clues about GBP/USD’s directional bias? Our sentiment information comprises useful insights into market psychology as a development indicator. Obtain it now!

| Change in | Longs | Shorts | OI |

| Day by day | 8% | -9% | 1% |

| Weekly | 25% | -28% | 0% |

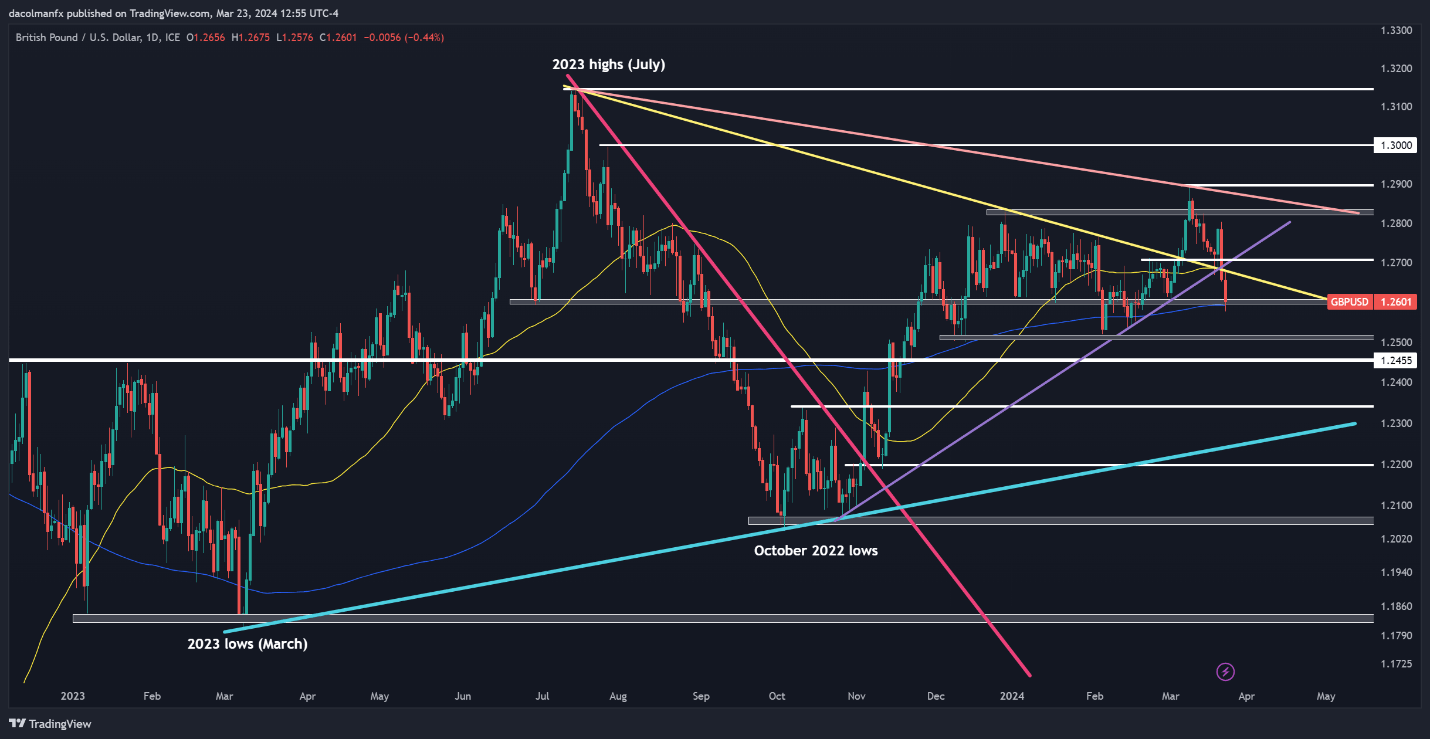

GBP/USD FORECAST – TECHNICAL ANALYSIS

GBP/USD plunged this week, breaching main ranges within the course of, together with 1.2700, the 50-day easy transferring common and a key trendline at 1.2675. Ought to losses proceed within the close to time period, explicit focus needs to be positioned on the 200-day SMA at 1.2600, as a break beneath it might set off a drop in the direction of 1.2520.

Conversely, in a situation the place sentiment brightens and cable phases a reversal, resistance thresholds might be pinpointed at 1.2675 and 1.2700 thereafter. Bulls might have a tough time taking out these boundaries, but in the event that they handle to invalidate them, there can be little standing in the way in which of reclaiming the 1.2800 mark.

GBP/USD PRICE ACTION CHART

GBP/USD Chart Created Utilizing TradingView