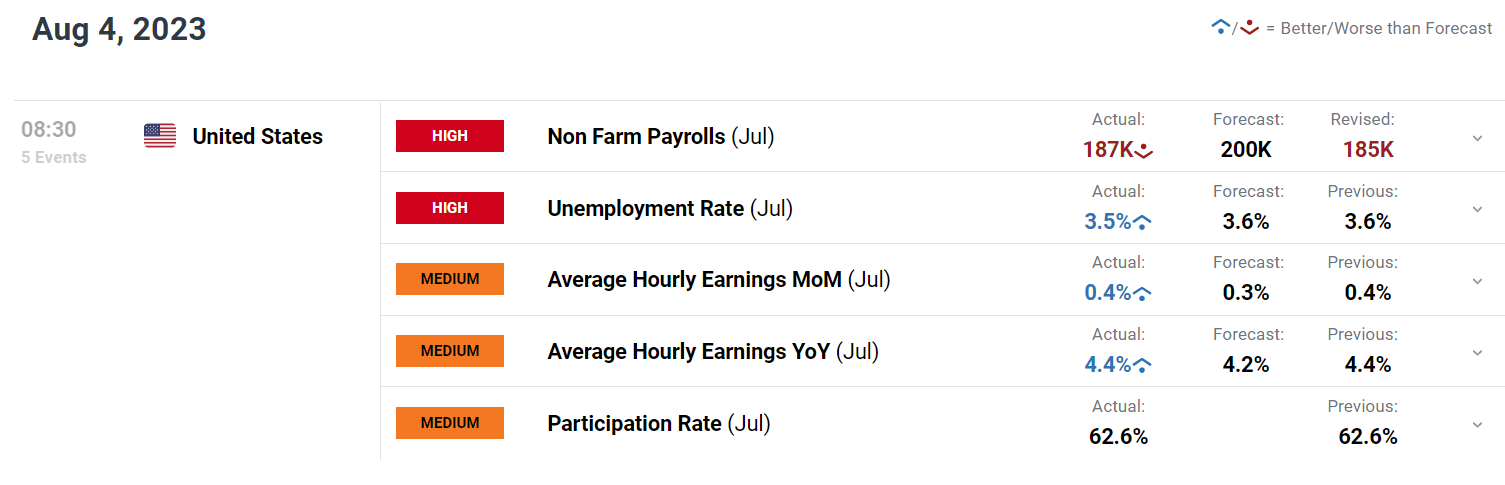

JULY LABOR MARKET REPORT

- July U.S. nonfarm payrolls at 187,000 versus 200,000 anticipated

- Unemployment charge ticks down to three.5%, one-tenth of a % beneath consensus estimates

- Gold rises whereas the U.S. greenback slides following the discharge of the employment report

Beneficial by Diego Colman

Get Your Free USD Forecast

Most Learn: Euro Worth Outlook – EURUSD on Breakout Watch, EURGBP Vary Continues

U.S. employers continued so as to add to their ranks at a wholesome tempo firstly of the third quarter for an financial system within the superior stage of the enterprise cycle, however hiring slowed reasonably from earlier within the 12 months, an indication that corporations are beginning to develop into extra cautious about increasing headcount as sticky inflation and the Fed’s aggressive tightening marketing campaign solid a shadow over the financial outlook.

Based on the Bureau of Labor Statistics, the U.S. financial system added 187,000 jobs in July, beneath the 200,000 anticipated, following a downwardly revised 185,000 acquire in June. In the meantime, the jobless charge edged down to three.5% versus 3.6% anticipated, indicating excessive labor market tightness, however elevating hopes client spending will stay secure within the close to time period.

UNEMPLOYMENT RATE AND NONFARM PAYROLLS

Supply: BLS

Elsewhere within the nonfarm payrolls survey, common hourly earnings, a strong inflation gauge intently tracked by the Fed, rose by 0.4% month-to-month, with the annual charge holding regular at 4.4%. Analysts polled by Bloomberg information have been on the lookout for nominal compensation to extend 0.3% on a seasonally adjusted foundation and 4.2% within the final twelve months.

Beneficial by Diego Colman

Get Your Free Gold Forecast

LABOR MARKET DATA AT A GLANCE

Supply: DailyFX Financial Calendar

Slower hiring brings optimistic information for the Fed, because it indicators that worth stability could also be restored with out sacrificing the financial system to the altar of a 2% inflation goal. Nonetheless, merchants ought to control wages as elevated pay development poses upside inflation dangers. In any case, the Goldilocks report presents policymakers with the chance to engineer a delicate touchdown, one thing that has traditionally been difficult to attain when aggressive tightening measures have been obligatory.

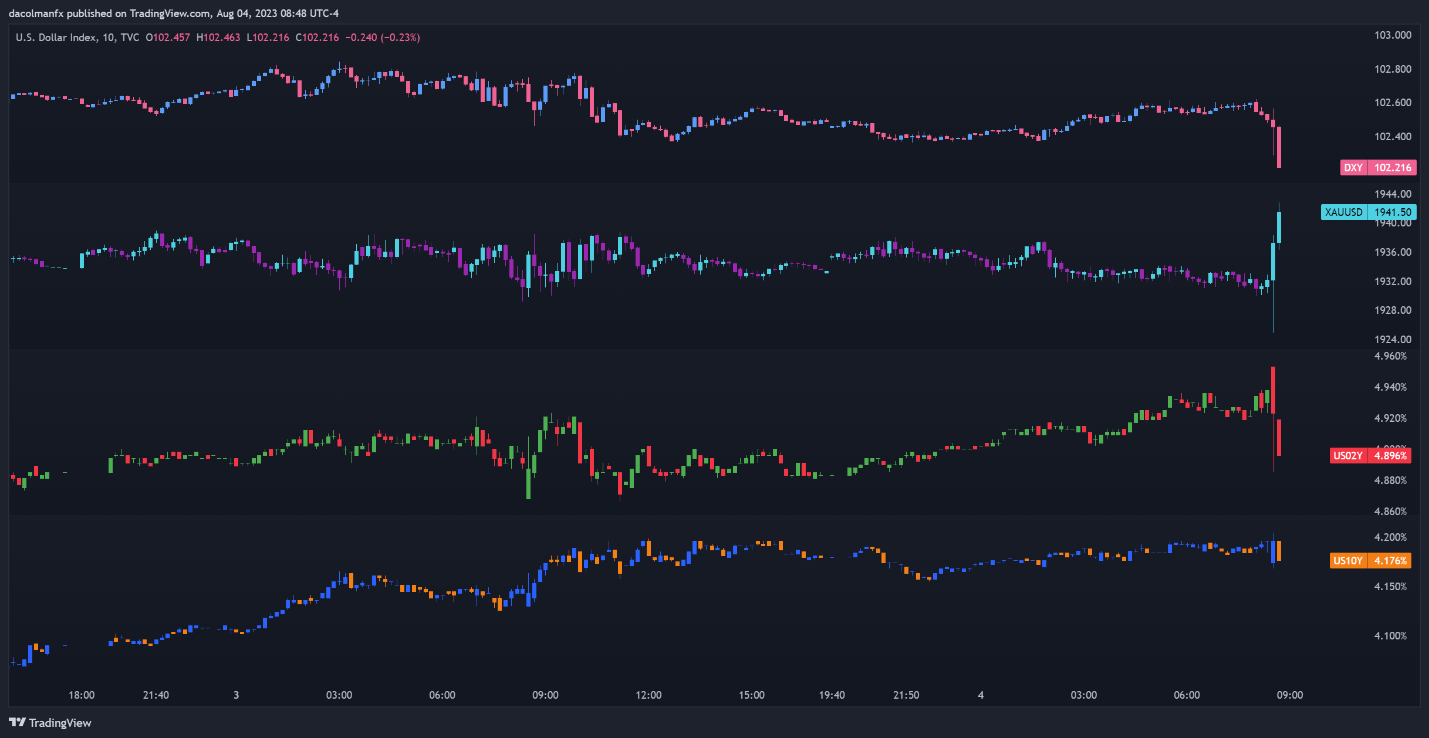

Instantly following the discharge of the employment survey, the U.S. greenback, as measured by the DXY index, took a flip to the draw back, sliding into damaging territory, weighed by retreating Treasury yields. In the meantime, gold costs perked up, rising to $1,940, boosted by the strikes within the fixed-income area.

Beneficial by Diego Colman

Get Your Free Prime Buying and selling Alternatives Forecast

US DOLLAR, GOLD, US YIELDS CHART

Supply: TradingView

With the U.S. financial system holding up properly however cooling, rate of interest expectations may quickly head in a extra dovish path, pushing merchants to cost out additional tightening completely for 2023. In opposition to this backdrop, the U.S. greenback may battle to increase its restoration, making a optimistic surroundings for gold costs.