SHansche/iStock through Getty Pictures

Co-authored by Treading Softly.

One reality that I realized as I turned a dad or mum is you could by no means resolve what is going on to be high quality time. All that you are able to do is put money into amount time with your loved ones, and know that a few of it will be high quality. High quality time seems by itself, naturally amongst the amount of time that you simply present. Many life experiences might be ruled the identical method. It’s a must to expose your self to totally different experiences in life for a few of these experiences to be the standard that’s price telling tales to your grandchildren.

Relating to the market, you are going to have a plethora of various experiences, particularly if you happen to’ve been an investor for any size of time. You’ll expertise good instances available in the market the place it appears to solely be climbing and each choice you make appears to show that you are a genius, and you are going to expertise bear markets the place all the things appears to be falling aside and it doesn’t matter what you do, you are apprehensive that you will lose all of it. In between these intervals, you are going to expertise lulls when there’s nothing loopy occurring, and also you’re simply diligently working away at constructing the proper portfolio to satisfy your wants.

In the present day, I need to take a look at a chance that gives life experiences to others and also can give you life experiences whereas offering you with sturdy revenue alongside the way in which.

Let’s dive in!

Get Some Experiences

EPR Properties (NYSE:EPR), yielding 6.8%, is an actual property funding belief, or REIT, that’s targeted on proudly owning what administration phrases “experiential” actual property. This makes it probably the most entertaining REIT to do “due diligence” by visiting its properties. Positive, you possibly can go try Walgreens location #122, owned by Realty Revenue (O), and see that it’s one other pharmacy on one other busy nook, or you can go try Valcartier Village Vacances in Quebec, Canada. Supply.

EPR Properties Presentation

I have never been there but, however I’ve loved myself totally at a variety of EPR-owned places. Whether or not having fun with snowboarding at considered one of EPR‘s Vail places, enjoyable at The Springs in Pagosa Springs, Colorado, spending a day at Six Flags, catching the most recent blockbuster at AMC, driving the sky tram in Gatlinburg, Tennessee, or laughing with your folks about how horrible your golf swing is at a Prime Golf, you’ll have a variety of enjoyable at EPR’s properties. How do I do know? These are all issues that I’ve accomplished at EPR properties. For the retirees touring the continent of their RVs, I will say you can have a worse concept than making an attempt to go to each location EPR owns!

I do should say that, as a lot enjoyable as EPR properties are to go to, it’s much more entertaining when you possibly can pay for the entire journey with EPR dividends!

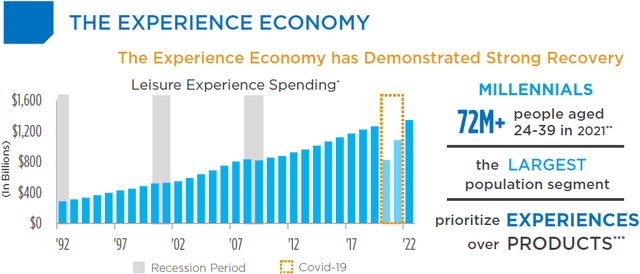

COVID had a novel influence on EPR and the experiential economic system. Whereas leisure spending is theoretically expendable and, in concept, one thing that folks would think about reducing throughout a recession, in observe, it is not. Folks like to “deal with” themselves, and whereas saving for a trip is perhaps tougher, the proof means that spending on leisure is fairly sturdy, even throughout recessions. COVID is the exception which precipitated a considerable crash in leisure spending:

EPR Properties Presentation

Whereas EPR’s actual property covers all kinds of leisure choices, the one factor all of them have in frequent is that they contain locations the place teams of individuals mingle in public.

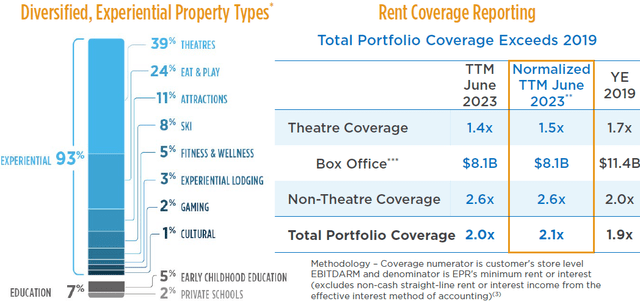

EPR remains to be recovering from this influence however is getting again on observe. Tenants have been paying again lease that EPR deferred throughout COVID, and lease protection is above 2019 ranges for EPR tenants, though theaters are nonetheless trailing.

EPR Properties Presentation

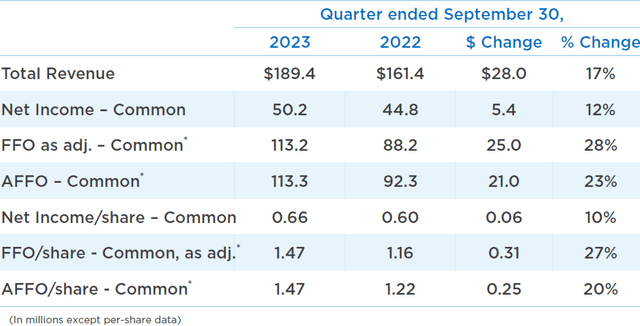

EPR just lately confronted a significant tenant chapter with Regal Cinemas. With the corporate rising from chapter, Regal has resumed paying lease. Regardless of the distraction of the Regal chapter, EPR managed to develop the underside line year-over-year:

EPR Properties Presentation

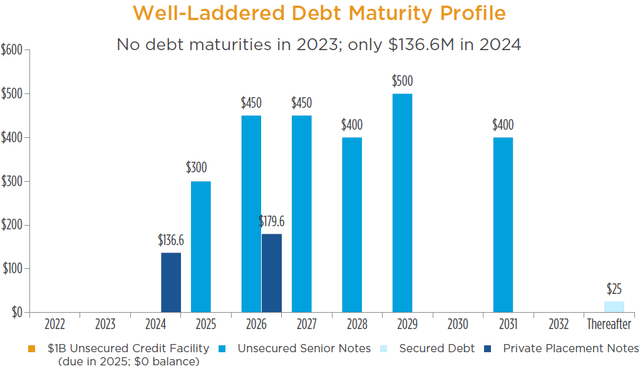

EPR is in a main place to increase with debt/EBITDA at solely 4.4x, a $1 billion revolver that’s fully open, and $173 million in money available. EPR has just one maturity for 2024, and so they have sufficient money available to pay it off fully in the event that they need to.

EPR Properties Presentation

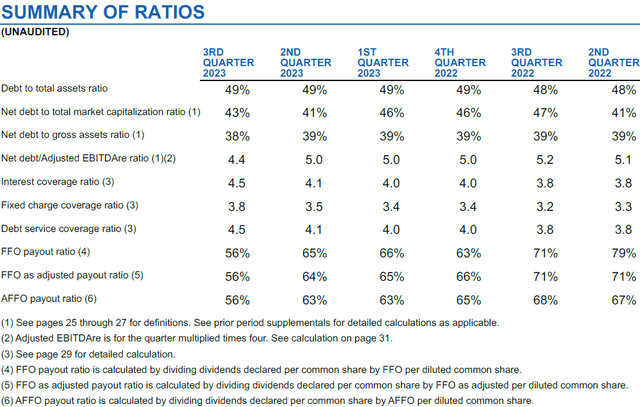

EPR has room to leverage up safely, because the shopping for alternatives enable for it. The perfect half is that EPR’s adjusted funds from operations, or AFFO, payout ratio is just 56%. Supply.

EPR Properties Q3 Complement

This gives us with a variety of confidence that EPR will likely be elevating the dividend early subsequent yr to get the payout ratio again to 65-70%. In 2023, administration selected to be conservative, given the uncertainty of what would occur through the Regal chapter.

If EPR leverages again as much as its regular vary of 5-5.5x, we may see above-average dividend development for the following few years.

Throughout COVID, EPR noticed a staggering discount in money stream. As just about all of its tenants had been forcefully shut down by the federal government, EPR was in a position to work out lease deferral agreements. It’s tough for any firm to see a large lower in money flows. Nonetheless, EPR managed to navigate COVID with out issuing new fairness – in reality, EPR truly purchased again shares, decreasing its share rely. EPR did not take out extra debt. It emerged from COVID with a steadiness sheet that’s stronger immediately than it was earlier than COVID. EPR administration managed to keep away from the actions that may trigger everlasting and irreversible harm to shareholders.

Over the following few years, we are able to count on EPR to redeploy its capital, leverage again up, and see earnings return to pre-COVID ranges and go even greater. That will likely be a constructive catalyst for dividend development to pre-COVID ranges and past.

Conclusion

With EPR, we are able to put money into experiential properties that guests look ahead to visiting. Good experiences drive repeat enterprise, which retains the lease checks flowing into EPR and retains the dividend {dollars} following into your account. EPR’s administration staff proved expert and succesful in dealing with the COVID shutdowns and slowdowns, having EPR emerge stronger and leaner than earlier than. Now, traders are primed for an excellent alternative to take pleasure in excessive ranges of revenue and capital positive aspects as EPR resumes its development.

Relating to your retirement, I incessantly focus on how I need your retirement inquiries to be targeted on easy methods to spend your time with family members, buddies, and your hobbies. EPR gives loads of choices on locations to go to and have fulfilling experiences; it is even higher when it pays for them too! Retirement needs to be a time to expertise new issues, or retread the outdated nostalgic floor. It is not a time that needs to be marked by need or battle, financially talking. Unlock new ranges of revenue and see the way it can revolutionize your outlook.

That is the fantastic thing about my Revenue Methodology. That is the fantastic thing about revenue investing.