In the US, solely 27% of personal sector staff have entry to paid household depart, leaving tens of millions of latest mother and father to decide on between monetary stability and time with their new child youngsters. Present options fall brief, with state applications excluding many households and conventional short-term incapacity insurance coverage providing restricted protection that primarily advantages solely birthing mother and father. Parento addresses this crucial hole by offering the first-ever insurance coverage product particularly designed for paid parental depart, providing corporations a three-in-one resolution that mixes custom-made insurance coverage protection, streamlined depart administration, and personalised mother or father teaching. The platform serves each birthing and non-birthing mother and father, attaining a exceptional 95% return-to-work price in comparison with the trade normal of 60%. With its complete method, Parento helps employers management bills whereas supporting staff by one among life’s most important transitions, concentrating on the $43B whole addressable marketplace for parental depart options.

AlleyWatch sat down with Parento CEO and Founder Dirk Doebler to be taught extra in regards to the enterprise, its future plans, latest funding spherical, and far, far more…

Who have been your traders and the way a lot did you elevate?

Parento raised $5.9M in a Seed II spherical led by ResilienceVC, with participation from Kapor Capital, Bread & Butter Ventures, Operator Stack, Coyote Ventures, ffVC, Human Ventures, Springbank, Precursor, Cross Impression, Ok Road, Evidenced, and Avesta. Parento’s whole funding to this point is $10.3M.

Inform us in regards to the services or products that Parento provides.

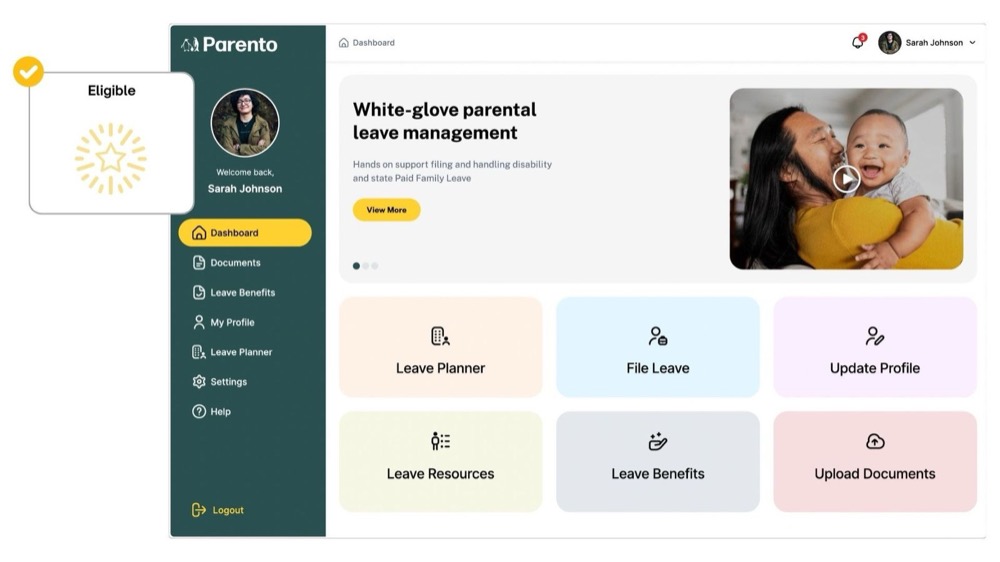

Parento offers a three-in-one paid parental depart resolution that mixes insurance coverage, streamlined parental depart administration, and personalised mother or father teaching. This method helps employers management bills, ease HR burdens, and help staff. Parento drives outcomes like a 95% return-to-work price, surpassing the trade normal of 60% with robust participation from each moms and dads.

What impressed the beginning of Parento?

I based Parento in 2019. Beforehand serving as a CFO of a consumer-packaged items model with a big base of girls and new mother and father, I noticed firsthand how insufficient present parental depart options have been. On the time, the one obtainable choices have been state-paid household depart applications and short-term incapacity insurance coverage. Each choices excluded many households, failed to offer ample day without work, and provided restricted monetary help. Non-public alternate options, corresponding to self-funding depart, have been costly and unsustainable for many employers. Recognizing the pressing want for a extra inclusive and efficient resolution, Parento was based to shut these gaps inside paid parental depart.

How is Parento completely different?

Parento stands aside as a result of we pioneered the first-ever insurance coverage product for paid parental depart, giving corporations a method to anticipate beginning charges, handle threat, and switch unpredictable prices into predictable ones. Not like consultants or coverage advisors, Parento delivers a complete three-in-one resolution:

- Monetary help by custom-made PPL insurance coverage insurance policies tailor-made to every firm’s worker demographics; very similar to automobile insurance coverage is constructed round a driver’s profile.

- Administrative help that streamlines the complexities of depart administration for HR groups.

- Worker engagement and training that enhances the mother or father expertise, boosts psychological well being, and drives retention.

Whereas short-term incapacity insurance policies have lengthy been used as a stopgap for maternity depart, Parento’s protection is deliberately inclusive, designed for each birthing and non-birthing mother and father. This mixture of innovation, customization, and inclusivity makes Parento essentially completely different and a strong stand-alone from anybody else within the house.

What market does Parento goal and the way massive is it?

Parento targets small and mid-sized companies throughout various sectors (together with nonprofits and manufacturing/warehousing) and is increasing by way of partnerships and unions such because the Worldwide Union of Working Engineers (IUOE). Our major imaginative and prescient is to offer paid parental depart to all people in want of insurance coverage.

- We goal corporations with a minimum of 10 full-time staff

- All industries are welcome however we see fast adoption in consulting {and professional} companies, public entities, and people with staff throughout a number of states, each with and with out entry to paid parental depart .

TAM is roughly $43B.

What’s your corporation mannequin?

Parento offers paid parental depart insurance coverage to employers instantly, with limitless professional help to working mother and father, particularly after they’re welcoming a brand new child. Combining these companies, even when optionally obtainable, allows us to offer such hands-on help to even the smallest of corporations.

How are you getting ready for a possible financial slowdown?

We’re specializing in sectors that keep resilient early in any slowdown, guaranteeing we develop whereas supporting purchasers by uncertainty.

What was the funding course of like?

The funding course of was each intense and humbling. It was an expertise marked by lengthy hours, excessive stress, and loads of ups and downs. After securing an preliminary time period sheet, I assumed the remainder of the spherical would come collectively rapidly, however in actuality it took one other two months to deliver extra traders on board. The method was extra complicated than anticipated, requiring persistence, endurance, and fixed engagement to see it by.

What are the most important challenges that you just confronted whereas elevating capital?

The stress of not realizing when, or even when, the spherical will come collectively and shut, or if it would crumble. The strain solely intensifies the longer the method takes, particularly as extra funds reject you.

What components about your corporation led your traders to write down the verify?

Now we have loads of alignment between the social affect we’re having in getting extra money into common People’ pockets. Our traders are searching for social returns along with monetary ones, and that alignment is refreshing.

What are the milestones you intend to attain within the subsequent six months?

Parento plans to scale the workforce, launch new automations, launch with new distribution companions, and increase income by 3-4x.

What recommendation are you able to provide corporations in New York that wouldn’t have a recent injection of capital within the financial institution?

Practically each founder goes by it, and even some that elevate can run uncomfortably low on capital. Attain out to the opposite founders in your community recurrently and commiserate with them as a result of the lows of founding an organization are actually low, and actually solely different founders will recognize how powerful it’s to have little or no money.

The place do you see the corporate going now over the close to time period?

We will probably be launching quite a few new merchandise whereas investing in additional model consciousness, so count on to see our identify on the market far more usually.

What’s your favourite fall vacation spot in and across the metropolis?

Undoubtedly the Rivertowns. Our favourite cafe that has my favourite croissants is over in Hastings-on-Hudson. The altering leaves with the Palisades and Hudson within the background are good.