MicroStockHub/iStock by way of Getty Photographs

Written by Nick Ackerman. This text was initially revealed to members of Money Builder Alternatives on February eleventh, 2023.

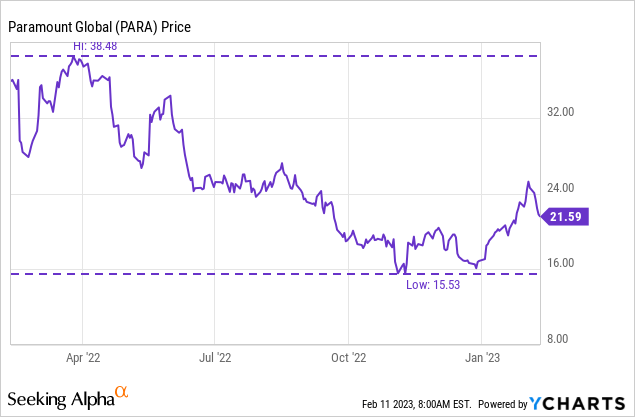

Paramount International (NASDAQ:PARA) has continued to be a risky inventory. It was surging with the remainder of the market initially of the yr. During the last yr, it has collapsed by virtually 40% regardless of that sturdy transfer, however shares are nicely off their lows we noticed a few months in the past. Much more not too long ago, we have seen Paramount International shares come down after topping the $25 stage.

YCharts

With that stated, we had our written places expire nugatory with PARA on the $16 strike. That locked in our choice premium with the passing of the newest weekly choices expiration.

This newest commerce was entered into on January sixth, 2023. We collected $0.32 on the time. That labored out to a possible annualized return of 20.86% if we might make an identical commerce over the course of a yr. With PARA, that is fairly potential and is not so far-fetched. We have often been in a position to get these kind of PAR outcomes.

Nevertheless, this newest commerce was truly thought-about a roll as a result of it was strung with closing a earlier commerce. Truly, not only one earlier roll commerce however two. That is the place it could possibly get a bit tough to comply with, so I am going to hold it concise. This string of trades truly goes all the best way again to October.

- October fifth, 2022, we promote PARA places at a $16 strike to gather $0.32.

- November 4th, 2022, shares are sliding and going beneath our $16 strike. We roll, and shutting the place prices $0.58. We roll right down to $15 and out to the January twentieth, 2023 expiration gathering $1.23. Web assortment on this commerce was $0.65, however we additionally collected $0.32 beforehand for a complete premium of $0.97.

- January sixth, 2023, received us the place we’re, expiring nugatory right this moment. Nevertheless, it got here by closing the January twentieth, 2023 commerce for $0.05. Primarily which means the premium acquired grew to become $0.92 with the $0.32 for the newest commerce or a internet premium of $1.24.

Ultimately, to place all of it collectively, this sequence of trades would have introduced in $1.24 in premium over 130 days if adopted alongside for each. Utilizing the $16 strike worth, that was the place we initially began, which means that the PAR arrived at 21.76%.

That is merely an finish to that earlier sequence of trades and the place we’re right this moment.

Earlier PARA Trades

PARA, being fairly a risky inventory, is one we have been taking part in with for some time now. That is how we beforehand ended up with an extended place by means of promoting places. They’ve weekly choices, and most strikes nearer the cash are liquid.

To make it much more sophisticated and go over extra historical past of our trades, we have taken a batch of shares beforehand that we wrote calls on not too long ago. That introduced in one other $0.32 in choices premium. On the $25 strike worth, the shares truly surged above that stage – however that commerce does not expire till March third, 2023. That means that it’s nonetheless an excellent commerce.

Nevertheless, there at the moment are 7 whole trades rolled or expired that concerned promoting places or calls on PARA. It brings out the whole premium collected to $3.26. The preliminary commerce goes again to June twenty eighth, 2022. Throughout that point, PARA paid two dividends of $0.24 or $0.48. We even acquired the This fall dividend with our lengthy shares.

That in the end implies that we have generated round 6.8x what we might have from the dividend throughout this similar interval. Whereas I would not essentially advocate an investor do that with their total portfolio, it helps spotlight why I really feel it may be worthwhile to put in writing choices in a minimum of a few of your portfolio.

Even higher lately now as a result of if you’re sitting in money, most brokerages are paying one thing lately. If yours is not, transfer to a distinct dealer. As of penning this, Constancy is paying 4.18% on the money that’s put aside for writing cash-secured places. In order that money itself earns a good return earlier than we are able to redeploy it in one other commerce or ultimately get assigned.

I do not thoughts holding PARA shares for what it is value, both. On that entrance, they’re additionally producing a dividend yield of 4.45%. Nevertheless, the security of that dividend is questionable. Typically, you promote places solely on a place you would not thoughts ultimately going lengthy on. That does not imply you’ll be able to’t roll perpetually, probably by no means taking project.

Why Is Paramount International Struggling Anyway?

Paramount International earnings are arising on February sixteenth, so I will not spend an excessive amount of time on the basics with contemporary quarterly knowledge coming so quickly.

That being stated, to the touch on it frivolously, PARA’s massive push is into streaming because it competes with Netflix (NFLX) and Disney (DIS). These two opponents have some deep pockets that make it more durable to compete with them. That is one of many massive issues working towards PARA, as they’re spending billions on content material whereas the legacy advert enterprise deteriorates.

Traders are anticipating a continued slowdown of commercial, with a recession looming. It is one space the place firms can reduce prices and see comparatively restricted harm. PepsiCo (PEP) and Coca-Cola (KO) not promoting on TV networks for a few quarters is not going to make shoppers immediately neglect their manufacturers and cease shopping for them.

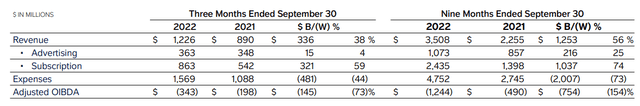

Here is a have a look at their Direct-to-Shopper division throughout Q3, which incorporates their streaming companies. Paramount+ is the core pillar of that entrance. Showtime goes to be merged with Paramount+, so it can turn into even bigger.

PARA DTC Outcomes Q3 (Paramount International)

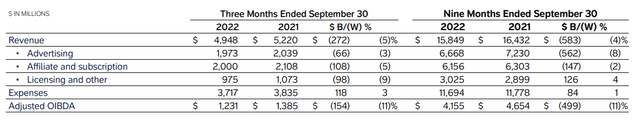

Now, here’s a fast have a look at the Q3 TV Media outcomes. Not like streaming, it’s worthwhile however shrinking.

PARA TV Media Outcomes Q3 (Paramount International)

Merely put, we now have a worthwhile a part of their enterprise shrinking whereas a section of hopes and desires (streaming) is costing them billions and is unprofitable up to now. Whereas streaming actually is the long run, it’s an unsure one. There was large income progress, however when it turns into worthwhile is to be decided. They need to proceed spending billions to deliver on new content material, or subscribers go away.

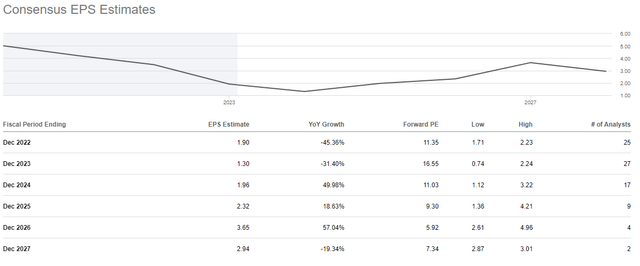

Analysts anticipate for the following two years that EPS will proceed to deteriorate earlier than rising once more. At this level, it might recommend that analysts consider that both streaming begins to generate a revenue in these years or they cease spending as a lot as they’re now.

PARA EPS Estimates (Searching for Alpha)

Nevertheless, these EPS estimates proceed to shrink often. In December, once we final seemed, fiscal 2022 was anticipated to be $1.98. For fiscal 2023, they anticipated $1.38 in earnings, and monetary 2024 was put at $2.10. So we see one other discount within the coming years of expectations.

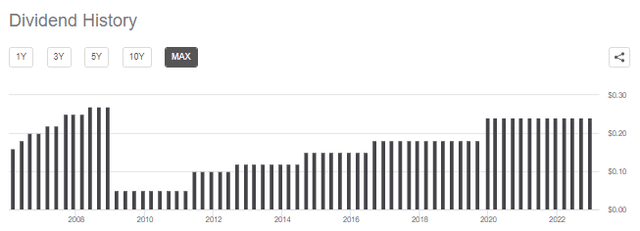

With diminishing earnings, the Paramount International’s $0.96 annual dividend comes into query. They might reduce it to unencumber additional cash to throw at streaming. They are not an organization that’s as dedicated to their dividend as some others. In reality, it hardly will get introduced up of their quarterly earnings calls.

PARA Dividend Historical past (Searching for Alpha)

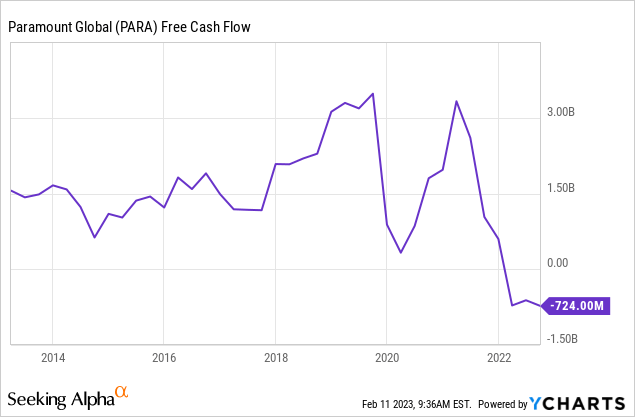

With damaging free money stream, the image turns into even grimmer. So a reduce would not be one thing that may shock me. Since I maintain this in my speculative portfolio, it is not the top of the world for me, and it would not make me promote.

YCharts

What’s Subsequent?

With these places expiring nugatory, we now have some additional cash for cash-secured put writing. PARA is on the checklist of names I would not thoughts including to my place and even decreasing my value foundation. In hindsight, taking project at $16 would not have been a nasty thought contemplating the place we at the moment are. Nevertheless, on the time, the momentum to the draw back was fairly excessive too. Thus, if it had come to it, taking shares at $15 would have been higher once we rolled down.

Anyway, that is historical past. Listed here are a few concepts that may very well be value contemplating. The primary warning right here is with earnings arising. We’re getting juiced-up premiums for promoting places because of that as a result of the expectation for potential project is bigger. If we see poor outcomes, shares might plunge. Then again, good earnings might see the shares pop.

Moreover, we all know how liquid choices are for PARA, so it could possibly typically simply be rolled if one desires.

- March seventeenth, 2023 expiration, going aggressive at a $20 strike might internet an investor $0.87. For going daring, that may put the PAR at practically 47%.

- March seventeenth, 2023 expiration, going extra conservative at $17.50 might end in a premium of $0.34 and a PAR of 20.86%.

- On the nearer-dated weekly expirations, you may get much more aggressive. If one is assured in PARA or does not thoughts taking shares at $21.5 with the March tenth, 2023 expiration, one might acquire $1.20 for this at-the-money commerce. In fact, that premium acquired would cut back your breakeven to $20.30, offering some draw back cushion alone. In that case, your PAR explodes on this YOLO-style commerce to 75.45%. The possibilities of having the ability to replicate that very same commerce over a yr aren’t very practical, although.