Juan Jose Napuri

We’re over midway by means of the Q3 Earnings Season for the valuable metals sector and whereas the outcomes have been first rate total, Pan American Silver’s (NYSE:PAAS) outcomes have been on the disappointing aspect. It’s because not solely did we see one other quarter of comparatively weak margins regardless of the addition of the Yamana belongings, however La Colorada and El Penon carried out under plan, leading to Pan American now guiding towards the decrease finish of its annual steering. In the meantime, though Escobal remaining offline is already priced into the inventory, progress right here has moved at a snail’s tempo with the ILO 169 session persevering with to pull on, which hasn’t allowed for any optimistic change in sentiment associated to this asset. On this replace we’ll dig into the Q3 outcomes, the up to date FY2023 outlook, and whether or not the inventory is buying and selling in a low-risk purchase zone after its current miss.

Jacobina Mine – Yamana Web site

Q3 Manufacturing & Gross sales

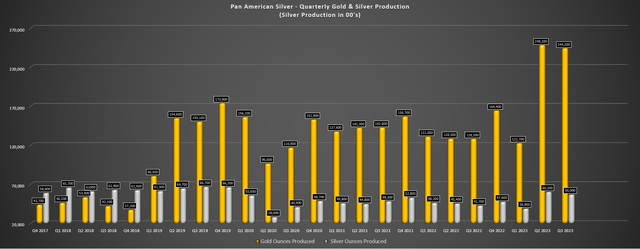

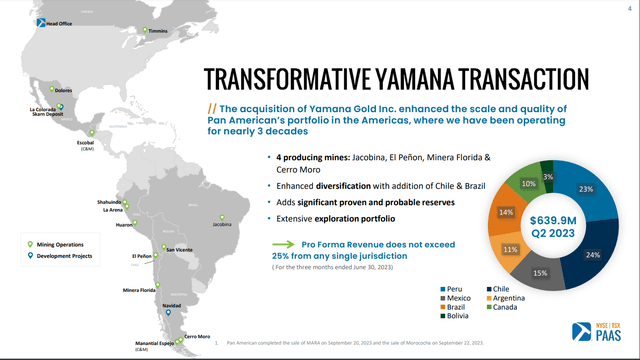

Pan American Silver launched its Q3 outcomes this week, reporting quarterly manufacturing of ~5.69 million ounces of silver and ~244,200 ounces of gold, translating to a 25% and 90% improve year-over-year, respectively. The rise in silver manufacturing was associated to the brand new contribution from El Penon (~1.01 million ounces), Minera Florida (~89,000 ounces), and Cerro Moro (~1.27 million ounces) from the Yamana acquisition, offset by one other weak quarter at La Colorada (decrease throughput and grades) and Manantial Espejo transferring into care and upkeep (~857,000 ounce headwind). As for the gold enterprise, Jacobina (~48,300 ounces), Cerro Moro (~27,000 ounces), Minera Florida (~24,200 ounces), and El Penon (~29,100 ounces) offered a cloth increase to output, however this was sadly offset by decrease output at Shahuindo and Dolores, with decrease gold grades and throughput on the Mexican mine (0.57 grams per tonne of gold vs. 0.69 grams per tonne of gold) as a consequence of mine sequencing.

Pan American Silver – Quarterly Gold & Silver Manufacturing – Firm Filings, Writer’s Chart

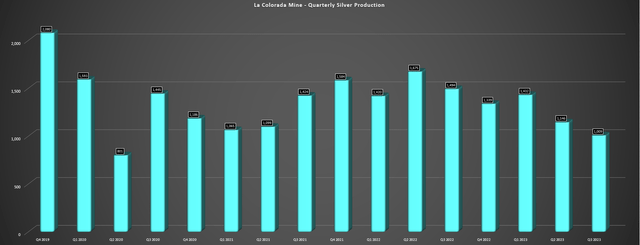

Wanting on the outcomes slightly nearer within the above chart, this was nonetheless a really stable quarter for gold manufacturing with Pan American seeing annualized manufacturing simply shy of ~1.0 million ounces of gold, however silver manufacturing has continued to disappoint, with it really down on a four-year foundation (~5.69 million ounces vs. ~6.67 million ounces) regardless of the acquisition of two belongings with significant silver manufacturing (Cerro Moro and El Penon), with the sale of Morococha, Manantial Espejo in care & upkeep, and far decrease grades at La Colorada and Dolores (plus decrease throughput at La Colorada). That mentioned, the underwhelming manufacturing outcomes from La Colorada (~1.01 million ounces) in Q3 have been associated to continued ventilation-related constraints which have impeded entry to the high-grade and deeper portion Japanese Calendaria space of the mine. This wasn’t helped by an armed theft on the mine within the quarter, which led to a quick shutdown with decrease throughput year-over-year.

La Colorada – Quarterly Manufacturing – Firm Filings, Writer’s Chart

Along with the decrease output throughout all metals at La Colorada that considerably affected its unit prices ($30.30/ouncesall-in sustaining prices vs. $18.50/ouncesin Q3 2022), we additionally acquired unfavourable information out of the newly acquired El Penon Mine. Sadly, Q3 manufacturing fell sharply sequentially, with grades of 98 grams per tonne of silver and a pair of.70 grams per tonne of gold (Q2 2022: 110 grams per tonne of silver and three.23 grams per tonne of gold) and have been under plan in response to the corporate. Pan American said it has begun a evaluate of the mining sequence to permit for extra steady manufacturing based mostly on current reconciliation knowledge, with unfavourable grade variability in Q3. Pan American famous restricted drilling (“drilled wider than it might have preferred to see”) was accomplished in these high-grade areas that it had developed for mining and that it will work on rising drill density sooner or later within the higher-grade areas of the deposit. Total, this is not an enormous deal, because it’s the primary point out of grade shortfalls, however it definitely did not assist what have been already mediocre Q3 outcomes. Not surprisingly, this affected unit prices, with AISC at El Penon hovering to $1,372/oz.

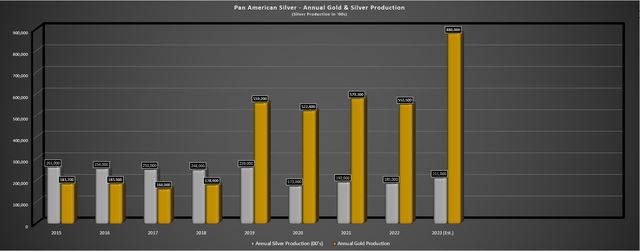

Pan American – Annual Silver & Gold Manufacturing + FY2023 Estimates – Firm Filings & Writer’s Chart

Given the weaker than deliberate manufacturing at these two mines, Pan American famous that it now expects to ship into the decrease finish of its steering of 21.0 to 23.0 million ounces of silver and 870,000 to 970,000 ounces of gold, with this proven within the chart above. And based mostly on year-to-date manufacturing of ~15.6 million ounces of silver and ~615,100 ounces of gold, we’re more likely to see annual manufacturing are available in under 21.5 million ounces of silver and under 900,000 ounces of gold, a disappointing improvement. Plus, this decrease output will have an effect on its deliberate all-in sustaining prices, with silver section all-in sustaining prices [AISC] now anticipated to come back in above the highest finish of its steering ($14.00 – $16.00/oz). The silver lining is that that is largely La Colorada associated, and with vent shaft at ~520 meters and the set up of two exhaust followers anticipated to be accomplished by mid-2024, we are going to see a significant restoration in manufacturing beginning in Q3 at this key asset (entry to increased grades at East Candelaria).

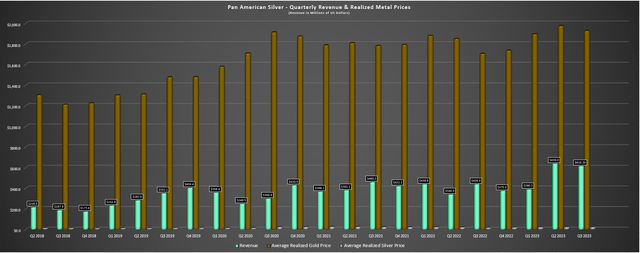

Pan American – Income & Realized Metals Costs – Firm Filings, Writer’s Chart

Lastly, taking a look at PAAS’ monetary outcomes, income soared to $616.3 million on the again of latest mines that have been acquired earlier this yr and better realized metals costs ($1,927/ouncesgold and $23.11/ouncessilver). In the meantime, working money move was additionally up materially to $114.6 million (Q3 2022: $54.4 million), and the corporate paid down a web ~$295 million in debt within the quarter, with additional proceeds (~$45 million) from the closing of its sale of Agua de la Felda in early November. The results of current divestments and its diminished debt load is that Pan American can anticipate to see ~$90 million in annual financial savings from decrease care & upkeep prices, with additional beneficial properties anticipated from as much as $60 million in annual synergies from the deal. Plus, Pan American might have a look at further asset gross sales to additional strengthen its stability sheet, which ought to finally assist to assist main capex for La Colorada Skarn if authorized) and probably opportunistic share buybacks if the share value stays at depressed ranges.

Prices & Margins

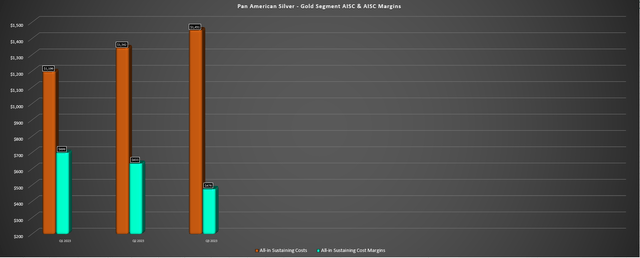

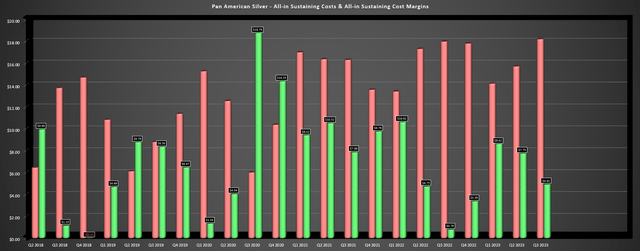

Transferring over to prices and margins, it wasn’t an excellent quarter right here both, with silver section all-in sustaining prices coming in at $18.19/oz, translating to AISC margins of $4.92/ouncesor barely ~21%. That mentioned, this was largely due to the disappointing efficiency at La Colorada and better sustaining capital at Huaron/San Vicente, which had prices nearer to ~$17.00/ouncesover the previous two years. Fortuitously, gold section AISC was higher however nonetheless got here in slightly under my expectations, with AISC bettering to $1,451/oz (Q3 2022: $1,614/oz) largely due to being up towards straightforward year-over-year comparisons associated to NRV changes at Dolores final yr. And whereas margins additionally improved materially to $476/oz (Q3 2022: $91/oz), they have been nonetheless under the business common. That mentioned, we must always see improved gold section AISC subsequent yr with a full yr from the earlier Yamana operations, assuming El Penon can get again on monitor.

Pan American – Gold Section AISC & AISC Margins – Firm Filings, Writer’s Chart Pan American Silver Section AISC – Firm Filings, Writer’s Chart

Total, the margin efficiency in Q3 was weaker than I anticipated, however Pan American was bailed out by increased metals costs and it was an unusually weak quarter for 2 of its most efficient belongings. On a optimistic word, the corporate is sitting on ~$390 million in money and simply over $300 million in web debt and is positioned to have the ability to spend money on progress and asset optimization its belongings after a really stable begin to portfolio rationalization simply six months after the Yamana deal closed. So, whereas the current outcomes weren’t something to put in writing house about, the corporate is making the fitting strikes to place itself for the longer term and I might anticipate a a lot better Q3 subsequent yr with La Colorada mining increased grades and hopefully nearer to 10,000 tonne per day processing charges at Jacobina.

Valuation

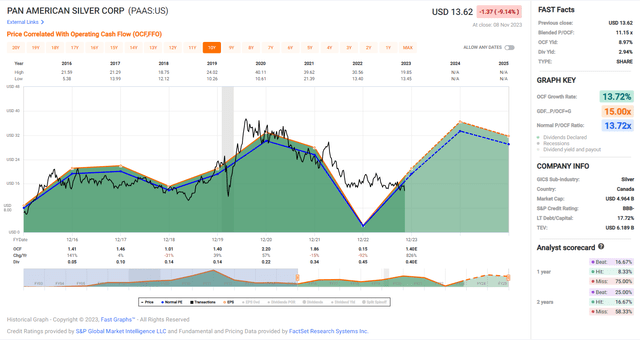

Based mostly on ~365 million shares and a share value of US$13.80, Pan American trades at a market cap of ~$5.04 billion, down from a peak market cap of ~$8.4 billion at its 2021 highs. That is though Pan American has a a lot stronger portfolio in the present day with a number of stronger belongings, in addition to a a lot better improvement pipeline with La Colorada Skarn, La Area II (extra more likely to be bought), Escobal, the potential for Jacobina Section 4 and presumably Jacobina Norte long-term, and different lower-capex alternatives like potential expansions at Minera Florida and Cerro Moro. And moreover buying and selling at a a lot decrease market cap, PAAS additionally trades at a major low cost to its historic a number of with it at the moment sitting at simply ~7.0x extra conservative estimates for FY2024 working money move ($1.95) vs. a 10-year common a number of of ~13.7. In the meantime, the inventory has gone from buying and selling at a premium to web asset worth to a reduction (~$5.04 billion vs. estimated web asset worth of ~$5.8 billion) which is kind of uncommon among the many silver producer house.

Pan American Silver Historic A number of – FASTGraphs.com

So, what provides the present disconnect?

For starters, whereas Pan American has undoubtedly added some distinctive belongings after scooping up all of Yamana’s producing and superior development-stage belongings (ex-Malartic and Wasamac), margins have declined materially for its legacy belongings due to inflationary pressures. The truth is, year-to-date prices are materially increased than they have been in FY2020 when the inventory peaked (~$16.00/ouncesvs. ~$11.40/ouncesfor silver / ~$1,350/ouncesvs. ~$1,010/ouncesfor gold) regardless of the addition of lower-cost Yamana belongings. And whereas we must always see prices enhance subsequent yr with a full yr of contribution from the Yamana portfolio and a greater yr out of La Colorada, the fact is that margins have made little progress regardless of increased metals costs. Second, whereas the added diversification is a optimistic (extra mines and fewer focus jurisdictionally), Pan American has changed into extra of a gold producer vs. a silver producer and this could have a unfavourable affect typically as a premium is usually assigned to silver producers.

Pan American Portfolio – Firm Presentation

Lastly, whereas there is not any query that Pan American is a stronger firm in the present day following the Yamana deal and acquired a really affordable value for the Yamana belongings in its tag-team cope with Agnico Eagle (AEM), now we have seen extreme a number of compression sector-wide. That is evidenced by a few of the largest gold producers buying and selling at multi-year lows on a P/CF foundation regardless of the gold value inside 10% of all-time highs. Therefore, I might argue {that a} extra conservative a number of for PAAS is 11.0x money move vs. its historic a number of of ~13.7. And whereas it beforehand regarded like we might see PAAS get pleasure from a significant improve in FY2024 money move, La Colorada continues to endure from air flow constraints (anticipated to have an effect on H1-24 manufacturing as effectively) and inflation has remained stickier than I beforehand anticipated, suggesting {that a} extra conservative FY2024 money move estimate is ~$720 million or ~$1.98 per share. If we multiply this determine by a good a number of of 11.0, this interprets to a good worth for the inventory of US$21.80.

Though this represents a 60% upside from present ranges, I’m on the lookout for a minimal 40% low cost to honest worth to make sure a margin of security for mid-cap shares, and particularly these which can be unstable like PAAS. Therefore, whereas there is not any query that PAAS is without doubt one of the extra undervalued names within the sector in the present day, I stay on the sidelines after taking earnings at a mean value of US$16.65 year-to-date provided that the inventory has been struggling to carry on to beneficial properties regardless of its undervaluation. That mentioned, if the inventory have been to say no under US$13.10 the place it might transfer again right into a low-risk purchase zone, I might strongly take into account re-buying my place. For now, I proceed to see extra enticing bets elsewhere, and it is powerful to be overly bullish about This autumn with increased metals costs partially being offset by what might be one other underwhelming quarter at La Colorada and the same quarter for gold-equivalent ounce [GEO] manufacturing implied by the revision to the low finish of steering vs. year-to-date output.

Abstract

Pan American Silver has finished a stable job optimizing its portfolio and de-leveraging because the closing of the Yamana acquisition, and whereas the Q3 outcomes have been disappointing with the disappointing grades at El Penon and the continued ventilation-related constraints plus a quick suspension at La Colorada (armed theft of two trailers of focus). The silver lining is that these seem like short-term points and we must always see a lot better grades in H2-2024 at La Colorada and a return to extra normalized grades at El Penon. On a unfavourable word, FY2024 manufacturing might be softer than I anticipated and we’re nonetheless ready for the completion of the ILO 69 session at Escobal in Guatemala with issues transferring slowly with regard to probably reinstating the mining license. To summarize, whereas PAAS is affordable, there is not any speedy catalyst for a re-rating outdoors of upper metals costs. So, whereas I see PAAS as a top-5 approach to get silver publicity sector-wide, I am not in a rush to leap again within the inventory simply but.