da-kuk

Palantir Applied sciences Inc. (NYSE:PLTR) has skilled exceptional development, surpassing expectations and lifting the inventory from its earlier low valuation. Nonetheless, it is essential to completely analyze the dangers and alternatives inherent within the present elevated value ranges. This text delves into a possible buying and selling alternative, analyzing attainable outcomes whereas sustaining a balanced perspective on danger. It advocates for energetic danger administration, contemplating components such because the trade panorama and broader fairness market circumstances.

A Macro Perspective

Over the past 12 months, the know-how sector within the US has showcased spectacular development, serving as a pivotal driver of financial enlargement and driving the fairness market to new historic highs. Notably, industries akin to semiconductors, laptop {hardware}, software program infrastructure, and utility software program emerged as standout performers. This exceptional development owes a lot to the event and proliferation of Synthetic Intelligence (AI) and Machine Studying (ML) applied sciences, cutting-edge software program functions, that are more and more built-in in lots of features of our lives. These applied sciences have revolutionized information analytics and decision-making processes, bolstering the effectivity and effectiveness of assorted industries. Moreover, the growing integration of the Web of Issues (IoT) and efforts in the direction of complete community connectivity and digitalization have considerably propelled these sectors in the direction of sustained profitability.

Nonetheless, as I noticed on this article centered on a basic market outlook, this exuberant rally might remind the passion within the fairness market witnessed through the dotcom bubble, as particularly the S&P 500 (SP500), is held up by a small variety of mega-caps, which signify just one.6% of the full shares within the index. At this level, it’s cheap to query the sustainability of the previous speedy enlargement, whereas some industries have just lately given some indicators of weak spot.

finviz finviz

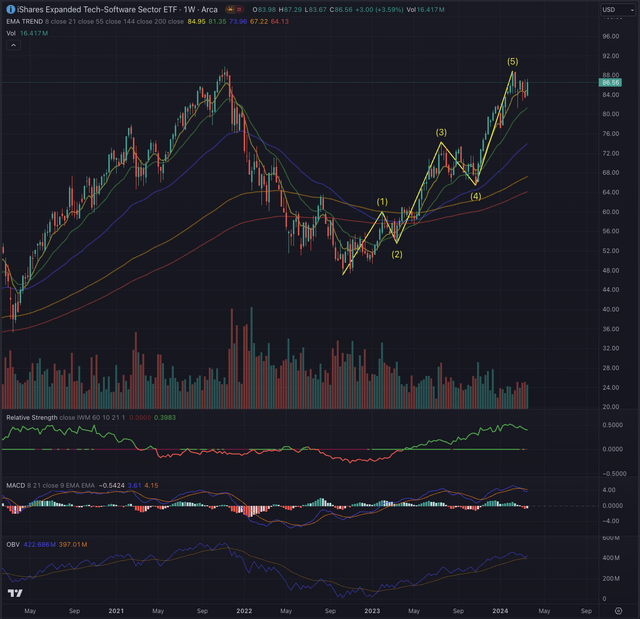

The iShares Expanded Tech-Software program Sector ETF (IGV) is presently within the remaining part of a five-wave impulse sequence, a sample confirmed by its wave construction, which has propelled the benchmark near its All-Time-Excessive (ATH) at $89.76. Following a big downturn after reaching its peak in November 2021, spurred by a speedy post-pandemic restoration rally, the trade reference skilled substantial losses.

Nonetheless, latest developments recommend indicators of exhaustion in IGV’s momentum. Relative energy in comparison with the broader fairness market, as represented by the iShares Russell 2000 ETF (IWM), has peaked, and the prolonged Transferring Common Convergence Divergence (MACD) momentum indicator has skilled a bearish crossdown. It stays to be seen whether or not the present rally possesses enough momentum to propel IGV past its ATH or if a considerable correction is critical for traders to digest the previous bull run. Moreover, the latest surge lacks sturdy shopping for stress, as evidenced by the peaking On Stability Quantity (OBV), which could invert and break down from its shifting common, a scenario not noticed because the peak in 2021, which led to a 47% decline.

Writer, utilizing TradingView

The place are we now?

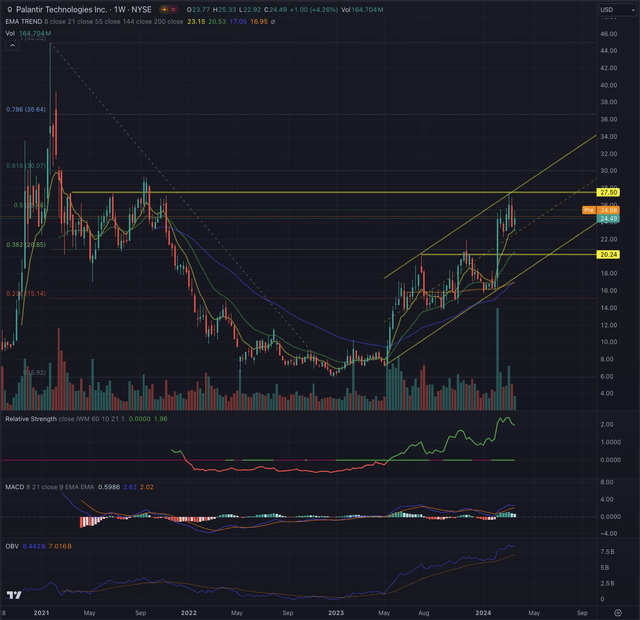

Upon analyzing the weekly chart, it is obvious that PLTR has conformed to a basic cup formation sample and could also be forming the deal with part. The inventory’s momentum has been fueled by sturdy shopping for curiosity, which is clear within the stable weekly shopping for quantity and a constant improve within the OBV. This upward trajectory has delineated an up-trending channel, with PLTR reaching the channel’s higher boundary for the second time, significantly on days marked by substantial accumulation.

Moreover, the short-term Exponential Transferring Averages (EMAs) spanning 8 and 21 days have persistently offered help, reinforcing the energy of the uptrend. Nonetheless, it is price noting their deviation from the longer-term EMA144, suggesting a necessity for warning concerning the pattern’s sustainability.

Writer, utilizing TradingView

Certainly, regardless of demonstrating vital relative energy, the present analysis of PLTR suggests a possible overextension, highlighted by notable expansions in its MACD and a latest peak in relative energy in comparison with the broader inventory market. Whereas these observations have been made based mostly on PLTR’s weekly chart, it’s crucial to zoom in and validate them utilizing the day by day chart. This shorter timeframe provides a clearer perception into the construction of the latest rally, which could should be extra evident on the weekly chart. Via a meticulous examination of the day by day chart, I can higher discern the dynamics at play and decide whether or not the present trajectory of the inventory is sustainable or if a corrective part is on the horizon.

What’s coming subsequent?

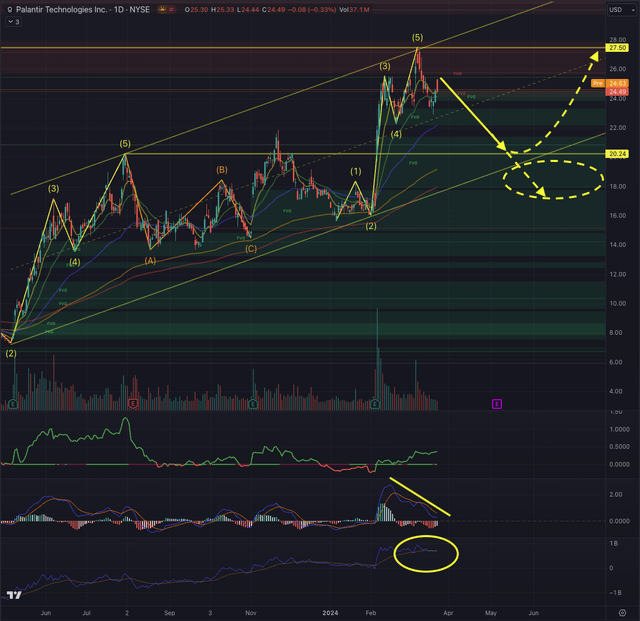

A better examination of PLTR’s day by day chart reveals the distinct five-wave patterns the inventory has fashioned in its trending channel, main as much as the robust overhead resistance, which might signify the breakout stage from the cup-formation. The value has consolidated from its latest peak, hinting at a attainable corrective wave formation.

Writer, utilizing TradingView

Whereas the prospect of PLTR overcoming overhead resistance stays unsure, my major situation leans in the direction of a better chance of the inventory retracing and testing its prior breakout stage. Notably, PLTR has left a notable hole between $19.75 and $17.90, indicative of areas needing pricing balancing, as noticed with Truthful Worth Gaps (FVG). This habits aligns with typical patterns seen throughout sturdy actions.

Supporting this situation is a pronounced divergence within the MACD, a possible peak within the OBV, and a return of day by day quantity to extra reasonable ranges following a big surge in February. Preliminary value targets for the retracement are set at $20.24, progressing in the direction of $17.90. Whereas this retracement situation seems most definitely, PLTR might discover help and resume its ascent, significantly in the direction of the preliminary value goal, confirming the breakout and fostering elevated shopping for curiosity.

Alternatively, PLTR could consolidate inside its present ranges, forming a good vary and quick deal with earlier than breaking out from overhead resistance. This situation might result in value targets between $30-31.50 initially, with additional targets round $36.70. Such a situation would necessitate a considerable surge in shopping for stress catalyzed by a extremely constructive occasion, presumably through the subsequent earnings launch.

In mild of those observations and recognizing that each PLTR and the trade benchmark have achieved vital targets and are prolonged, suggesting a probable retracement, it is prudent to think about profit-taking measures. Regardless of acknowledging PLTR’s potential inside secular development traits, the present inventory value displays an excessively optimistic sentiment. From a technical perspective, the dangers outweigh the alternatives, prompting to charge PLTR as a promote place.

The underside line

Technical evaluation is a beneficial software for traders, enhancing their prospects of success by navigating the complexities of listed securities. Like consulting a map or utilizing GPS for an unfamiliar journey, incorporating technical evaluation into funding selections offers a strategic information. I combine methods grounded within the Elliott Wave Concept and leverage Fibonacci’s rules to guage possible outcomes based mostly on possibilities. This methodology aids in validating or difficult potential entry factors, contemplating components akin to sector efficiency, trade traits, and value motion. My technical evaluation goals to comprehensively assess an asset’s scenario and derive possible outcomes knowledgeable by these theories.

Over the previous 12 months, the US know-how sector has seen vital development, pushed by improvements like AI and ML. Nonetheless, issues about market sustainability have emerged, significantly with the dominance of some massive firms. Given these observations and the prolonged nature of PLTR and the broader market, it is prudent for traders to think about taking profit-taking measures. Whereas PLTR holds promise in long-term development traits, its present valuation seems overly optimistic from a technical and short-term perspective, warranting a cautious method and resulting in score PLTR as a promote place.