Shares completed largely decrease, with the equal-weight Invesco S&P 500® Equal Weight ETF (NYSE:) down about 60 bps, whereas the market-cap-weighted index closed flat. In the present day kicked off what needs to be an eventful week, however to date, there’s not a lot to speak about.

The Treasury introduced it plans to rebuild the TGA to $850 billion by the top of each September and December, signaling that Bessent & Co. isn’t trying to shake issues up—for now.

The Treasury additionally expects to borrow simply over $1 trillion this quarter—$453 billion greater than projected in April. Subsequent quarter, it plans to borrow a further $590 billion, nonetheless focusing on a TGA steadiness of $850 billion. On Wednesday morning, we’ll find out how they intend to finance all this borrowing, with most anticipating the majority to come back by way of T-Invoice issuance.

Charges had been largely unmoved. Even the 30-year yield rose modestly, up 3.5 foundation factors to 4.96%.

However extra importantly, this may permit the TGA to be replenished, which ought to finally lead to decrease reserve balances held on the Fed and decrease liquidity ranges.

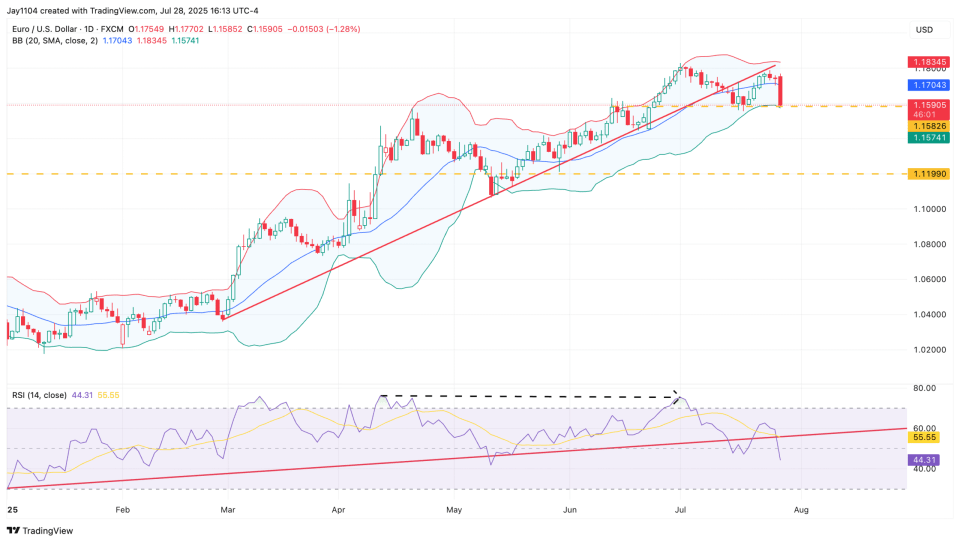

The largest transfer in the present day got here in FX, with the greenback strengthening—significantly in opposition to the euro—after the commerce deal announcement, which appeared to closely favor the U.S. Whether or not the EU chooses to simply accept the settlement is one other matter, because it nonetheless requires approval by member states.

is teetering on the sting of a breakdown, sitting simply above key assist at 1.159. The uptrend has already failed, and momentum, as measured by the Relative Power Index, has additionally rolled over. A break of assist possible opens the door for a transfer decrease, doubtlessly right down to 1.119.

A stronger greenback will even work to cut back liquidity available in the market, since most measures of “world liquidity” are simply greenback proxies.

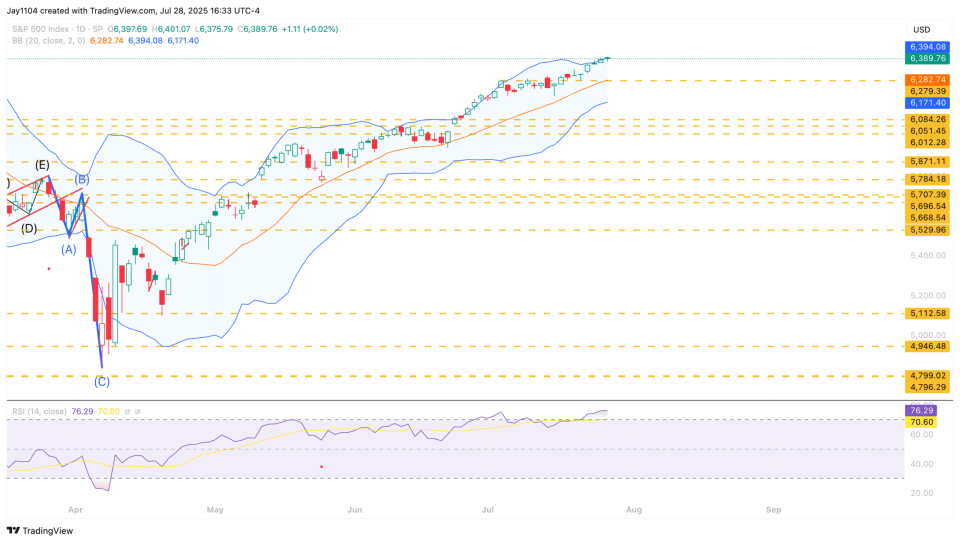

Within the meantime, shares simply churned with little actual motion. The stays overbought, with an RSI above 70 and the index buying and selling above its higher Bollinger Band. Whereas it’s potential for the index to remain overbought for an prolonged interval, a number of elements—reminiscent of low realized volatility, tightening liquidity situations, and a stronger greenback—counsel these situations could not persist for much longer.

Within the meantime, shares simply churned with little actual motion. The stays overbought, with an RSI above 70 and the index buying and selling above its higher Bollinger Band. Whereas it’s potential for the index to remain overbought for an prolonged interval, a number of elements—reminiscent of low realized volatility, tightening liquidity situations, and a stronger greenback—counsel these situations could not persist for much longer.

Authentic Put up

Authentic Put up