Canadian Greenback – Speaking Factors

- USDCAD sinks to key help on continued USD weak point

- BoC Gov Macklem opens door to smaller charge hikes

- Canadian inflation information on deck subsequent week

Really helpful by Brendan Fagan

Get Your Free High Buying and selling Alternatives Forecast

Canadian Greenback Outlook: Impartial

The Canadian Greenback’s efficiency was fairly blended final week regardless of appreciable weak point within the US Greenback. Whereas USDCAD punched decrease, different Loonie pairs struggled. The blended efficiency of the Canadian Greenback final week got here as oil costs surged increased on the again of reopening information out of China. Regardless of the sturdy hyperlink between oil and the Loonie, some CAD crosses fell sufferer to broader international tendencies.

Trying to subsequent week, the financial calendar is comparatively quiet for Canada. Wednesday will see the discharge of October inflation information, which is able to probably weigh closely on the Loonie. The Financial institution of Canada elected to gradual its tempo of charge hikes after a massively frontloaded charge cycle, as financial information in Canada continues to chill. Subsequent week’s inflation print might result in vital volatility in CAD pairs ought to there be a large repricing of BoC expectations.

Canadian Financial Calendar

Courtesy of the DailyFX Financial Calendar

In feedback made final week in Toronto, BoC Governor Tiff Macklem indicated that the central financial institution was open to smaller charge hikes shifting ahead. Whereas saying that charges nonetheless “have additional to go,” Macklem revealed that there “might be one other bigger-than-normal step or it might be reverting to extra regular 25-basis-point steps, we’ll see.” Macklem’s feedback come at an important time, as broader financial information exhibits indicators of slowing however inflation information stays sizzling. That is the dilemma that central bankers globally face; how far do you push with the intention to reign in inflation?

In further feedback made final week, Governor Macklem touched on the character of Canada’s tight labor market. Macklem said that labor markets should soften with the intention to decrease inflation, because the financial system stays in a interval of “extra demand.”

The Financial institution of Canada is combating appreciable wage pressures, as vacancies stay elevated and wage development stays broad. The Canadian financial system added over 100k jobs in October, whereas the unemployment charge remained at 5.2%. Macklem went on to state that growing labor provide is “not an alternative choice to utilizing financial coverage to average demand and produce demand and provide into steadiness.”

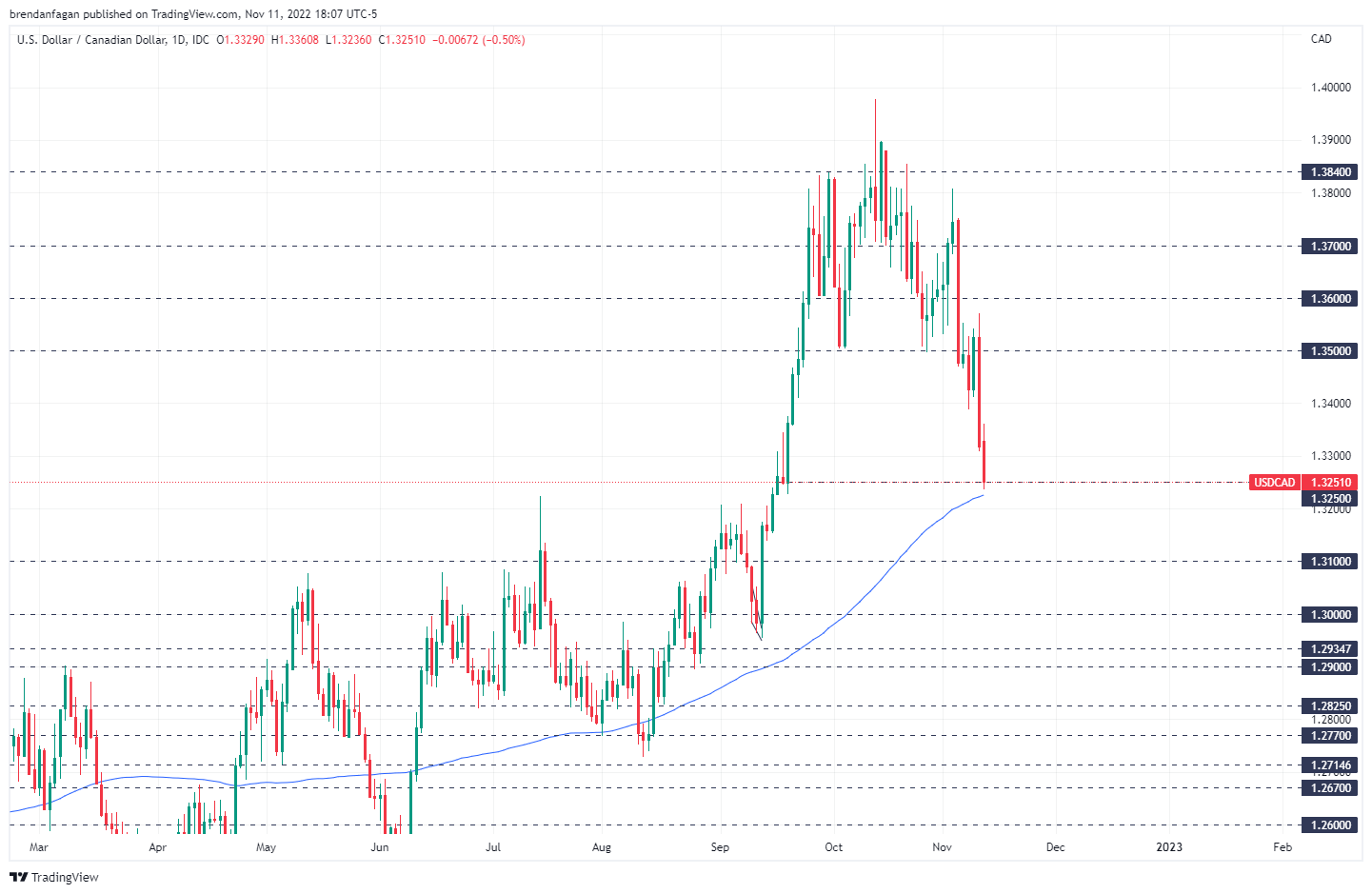

Following final week’s US CPI print, a robust repricing of Federal Reserve charge hike expectations noticed a large transfer within the USD advanced. Consequently, USDCAD was in a position to make the clear break under 1.3500 earlier than discovering help into the Friday fixing. As extra merchants look to push the US Greenback decrease, USDCAD might stand to learn significantly. USDCAD bears had been unable to tag or shut under the 100-day shifting common at 1.3225. Value did finally discover help at September’s 1.3250 stage, and this confluent space might supply bears a problem of their quest for decrease costs. The story right here continues to be pushed by the Federal Reserve, however subsequent week’s inflation report in Canada might have its say in whether or not these key ranges under are damaged.

General, bears seem firmly in management and it could simply be a matter of time earlier than 1.3100 trades. Whereas a countertrend rally could be painful, it can’t be dominated out given how far USDCAD has fallen in such a brief period of time. A retracement again to prior help at 1.3400 might simply materialize earlier than the subsequent leg decrease to the 1.3000 space can start.

USDCAD Each day Chart

Chart created with TradingView

Commerce Smarter – Join the DailyFX E-newsletter

Obtain well timed and compelling market commentary from the DailyFX group

Subscribe to E-newsletter

RESOURCES FOR FOREX TRADERS

Whether or not you’re a new or skilled dealer, we’ve a number of assets obtainable that will help you; indicator for monitoring dealer sentiment, quarterly buying and selling forecasts, analytical and academic webinars held each day, buying and selling guides that will help you enhance buying and selling efficiency, and one particularly for many who are new to foreign exchange.

— Written by Brendan Fagan

To contact Brendan, use the feedback part under or @BrendanFaganFX on Twitter