Claude Laprise

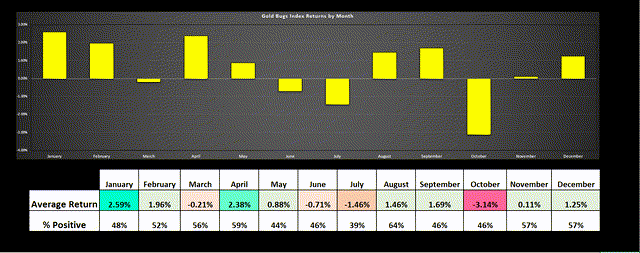

Whereas the S&P 500 (SPY) has added to its This fall features, the Gold Miners Index (GDX) has given up the majority of them, down ~11% year-to-date in what’s sometimes its greatest month of the 12 months from a seasonality standpoint. This may be attributed to underwhelming steerage from some firms and mediocre manufacturing outcomes and a ~6% correction within the gold value that has contributed to sector-wide promoting strain. Whereas this correction is actually disappointing for these holding underperforming producers on a year-to-date foundation like Evolution Mining (OTCPK:CAHPF), Fortuna (FSM) and First Majestic Silver (AG), Osisko Gold Royalties (NYSE:OR) has been a sanctuary within the storm, considerably outperforming GDX year-to-date.

Gold Bugs Index Seasonality – Creator’s Knowledge & Chart

This relative power is regardless of Osisko Gold Royalties’ FY2023 outcomes coming in a bit softer than hoped (albeit out of the firm’s management because it does not function these mines and the gold silver/ratio can have an effect on GEO calculations). The outperformance could also be attributed to its spectacular development profile searching to 2027 mixed with its much less unstable margins, benefiting from a vastly superior enterprise/mannequin in comparison with producers. On this replace we’ll dig into the This fall/FY2023 outcomes, current developments, and why Osisko Gold Royalties (“Osisko”) continues to be one of many sector’s higher buy-the-dip candidates.

All figures are in United States {Dollars} at a CAD/USD 0.78/1.0 change fee except they’ve a C$ in entrance of the determine.

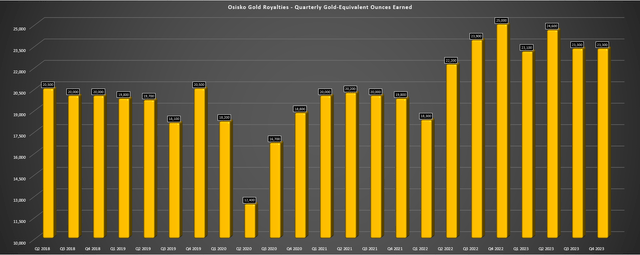

This fall & FY2023 Manufacturing

Osisko launched its This fall outcomes earlier this month, reporting that it earned ~23,300 gold-equivalent ounces [GEOs], a ~7% decline from the year-ago interval. The decrease output could be attributed to a decrease contribution from the Renard Mine (diamond stream) which briefly suspended operations on the finish of October, putting itself underneath the safety of the Firms’ Collectors Association Act [CCAA] in a interval of decrease diamond costs. Moreover, Island Gold was up in opposition to troublesome comps within the year-ago interval with elevated grades final 12 months, with manufacturing sharply in This fall 2023 vs. This fall 2022. Sadly, this offset contribution from the CSA Mine in Australia with this silver stream now closed (copper stream will kick in subsequent 12 months), and what’s sometimes one of many strongest quarters of the 12 months for a lot of of its companions.

Osisko Gold Royalties Quarterly GEOs Earned – Firm Filings, Creator’s Chart

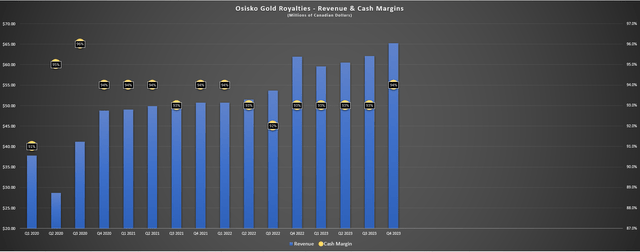

On a constructive word, the upper gold value offset a few of this weak spot, with Osisko reporting quarterly income from royalties/streams of C$65.2 million [US$50.9 million] at a report quarterly money margin of 94%. This translated to money margins of C$61.2 million [US$47.7 million], and helped to push annual income to a report C$247.3 million [US$192.9 million] with a report money margin of C$230.7 million [US$179.9 million]. Not solely was this a major beat vs. FY2022 ranges on money margin (+14% year-over-year) due to a median realized gold value of $1,971/oz in This fall and $1,944/oz for the 12 months, but it surely was achieved manufacturing being beneath plan for its companions with a a lot slower than deliberate ramp up at Mantos Blancos, a weaker 12 months at Renard, decrease grades at Island Gold, and a disruption to operations at Eagle. Plus, this was achieved with comparatively low silver costs ($23.35/oz), affecting its silver income at bigger property like CSA and Mantos Blancos.

Osisko Gold Royalties – Quarterly Income & Money Margins – Firm Filings, Creator’s Chart

On a constructive word, Osisko ought to have a greater 2024 on deck. It is because the corporate might have a headwind from the Renard diamond stream, however it could actually sit up for a full 12 months of silver stream contribution from the CSA Mine (~430,000 payable ounces), copper deliveries starting in H2 from the CSA Mine (3% on ~46,000 tonnes of copper at a price of simply 4% of spot or ~$5 million in income for H2), and what’s hopefully a greater 12 months for Capstone Copper (OTCPK:CSCCF) which has struggled to keep up the deliberate 20,000 tonne per day throughput fee at Mantos Blancos the place Osisko has a big silver stream. Lastly, Osisko will profit from preliminary contributions from Tocantinzinho, the place business manufacturing is predicted in H2, elevated manufacturing at Island Gold, the next silver stream fee at Gibraltar, and what ought to be a stronger 12 months at Eagle with ~190,000 ounces of gold on this large 5% royalty.

To summarize, whereas GEOs earned might have are available beneath expectations, that is largely out of Osisko’s management (weaker silver/gold ratio, companions working property, Renard detrimental shock), however this was nonetheless a report 12 months with additional information on deck in 2024 and 2025.

Current Developments

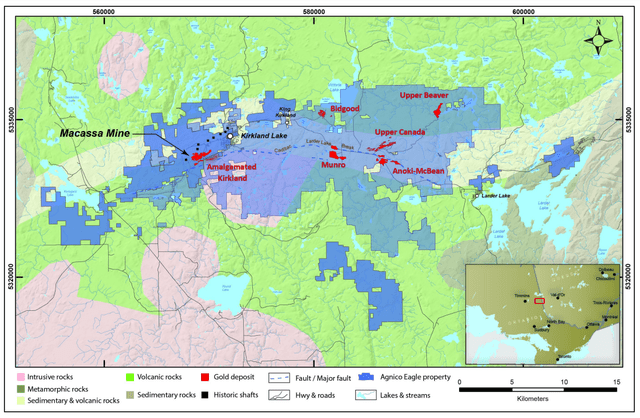

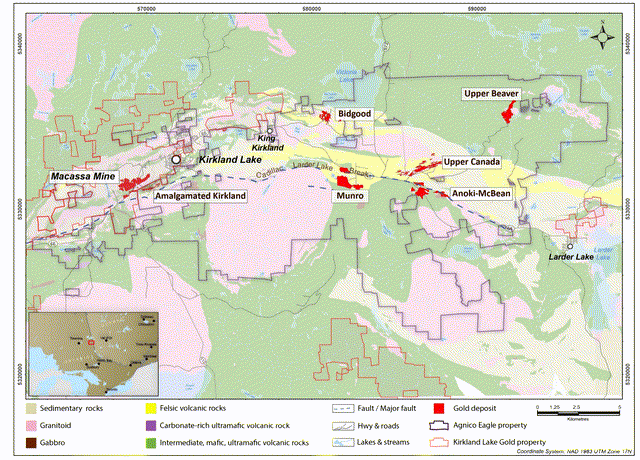

Transferring over to current developments, it will likely be a busy 12 months for Osisko’s portfolio and the corporate ought to be capable of anticipate even increased drilled meters. It is because Agnico Eagle (AEM) now has full possession of Canadian Malartic and continues to drill aggressively right here to show up new ounces to fill the mill post-2027, the corporate is prone to proceed average ranges of drilling at Higher Beaver/Higher Canada/Amalgamated Kirkland (Kirkland Lake Camp with Osisko having a 2% royalty on most of land bundle) if this could possibly be a future feed supply for its Abitibi Camp mills. In the meantime, Alamos Gold (AGI) is stepping up drilling at Island Gold after continued exploration success each regionally and near-mine. Lastly, Osisko Gold Royalties’ traders will hopefully get higher visibility into what Higher Beaver might in the end seem like from a manufacturing date and contribution standpoint with a much-awaited inner examine anticipated in H1-2024 to stipulate how Wasamac/Higher Beaver can benefit from extra capability on the Malartic Mill later this decade.

Kirkland Lake Camp & Osisko Gold Royalties (ex-Macassa Fundamental) – Agnico Eagle Presentation Kirkland Lake Camp (Agnico/Kirkland Property Boundary with Osisko Gold Royalties on Agnico Floor) – Agnico Presentation

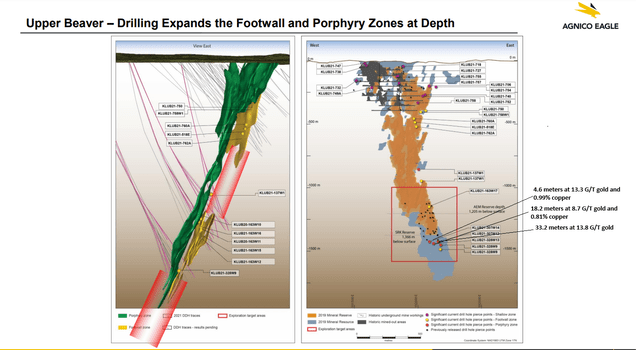

For these unfamiliar with Higher Beaver, that is a formidable asset whose exploration success hasn’t been mentioned as a lot solely as a result of it is within the portfolio of a large like Agnico and never but in operation. Nonetheless, that is a formidable undertaking with a comparatively high-grade reserve of ~1.4 million ounces of gold at 5.43 grams per tonne of gold (plus ~20,000 tonnes of copper), with a further inferred useful resource of ~1.4 million ounces of gold at 5.07 grams per tonne of gold (plus indicated useful resource of ~0.4 million ounces at 3.45 grams per tonne of gold), and 22,000+ tonnes of copper. Spotlight intercepts from this asset in This fall 2021 delivered a number of above-average grade hits like 14.3 meters at 15.5 grams per tonne of gold and 0.16% copper (West Porphyry), and 18.2 meters at 8.7 grams per tonne of gold and 0.81% copper within the deep conversion program, and Agnico said in 2022 that the 2022 drill marketing campaign succeeded in its plans to fill in gaps within the Footwall Zone and convert inferred ounces within the Porphyry/Footwall zones all the way down to 1,600 meters, with this “anticipated to have a constructive influence on the technical analysis/up to date mineral reserve/useful resource estimate in 2023 (now pushed to 2024).”

Higher Beaver Drilling – Agnico Web site

As for the potential right here, Agnico Eagle has famous in previous updates that it’s taking a look at transporting ~5,000 tonnes per day to the Canadian Malartic Mill by 2030. This could translate to manufacturing ranges upwards of 200,000 ounces per 12 months even utilizing conservative assumptions on grade and recoveries (Agnico Eagle has said 150,000 to 200,000 ounces of gold per 12 months however tends to be conservative), with extra upside from copper. Therefore, I’d anticipate this to translate to upwards of 4,000 GEOs per 12 months as soon as in manufacturing for Osisko or ~$8.0 million in annual income, and the corporate would profit from a further ~$600,000 in income from Higher Beaver alone because it’s in a position to double-dip on the per tonne royalty of US$0.31 from any ore coming exterior of Malartic to the mill (as much as a 65,000 tonne per day restrict). Notably, Agnico has additionally said that it might have a look at additionally processing ore (hauled by rail) from different properties within the area (Higher Canada and Anoki-Mcbean), with a mixed useful resource of ~3.3 million ounces grading upwards of three.5 grams per tonne of gold on common at these two property within the Kirkland Lake Camp.

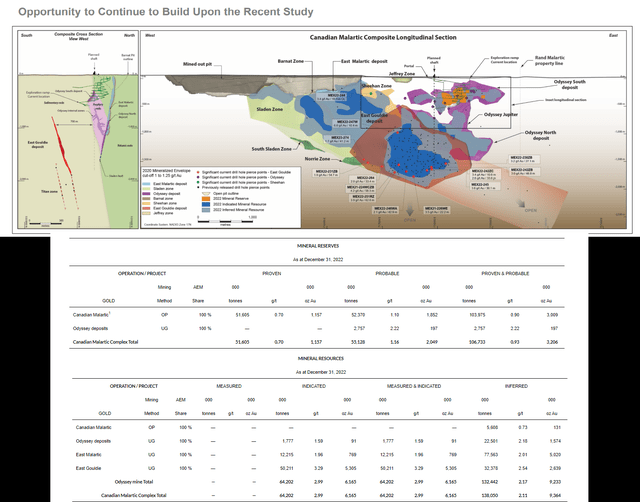

Canadian Malartic Useful resource & Lengthy Part – Firm Web site

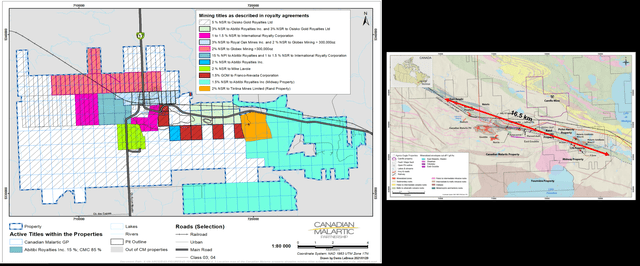

As for Canadian Malartic which is a top-2 asset for Agnico Eagle by scale now that it has been consolidated, the useful resource at Odyssey Underground (Osisko holds a 3-5% NSR on Odyssey, and 5% on Malartic Floor), it stays open at depth, and there appears to be like to be extra upside onto 5% royalty floor with the East Gouldie Extension, suggesting that this mine life possible extends properly into the 2050s with exploration upside. Nonetheless, the extra alternative is that Osisko holds a royalty on a lot of the land at Canadian Malartic and there will probably be over 40,000 tonnes per day of extra capability post-2027, and nonetheless ~30,000 tonnes per day even when Wasamac/Higher Beaver can contribute a mixed 10,000 tonnes. Therefore, with this being a ~900,000 ounce operation utilizing solely half of its mill capability and Agnico’s high precedence is discovering gold on Malartic floor or at Camflo to fill its mill post-2027 vs. organising toll-milling offers or doubtlessly buying neighbors in shut proximity to its mill, there appears to be like to be 1.0 million ounce potential right here post-2031 and Osisko has a 5% royalty on a lot of the floor proper subsequent to the mill, suggesting additional upside on high of Higher Beaver, a probable future feed supply.

Osisko Gold Royalties Protection at Malartic + Malartic Property Targets – Malartic TR, Agnico Web site

Lastly, it is value noting that even when Agnico Eagle chooses to go for ounces off of 5% floor at Canadian Malartic or cannot discover enough feed in direct proximity to the mill, Osisko will profit from a constant ~$1.1 million in income on its per tonne royalty for all materials sourced off Canadian Malartic floor. And in a best-case situation with a full mill at ~61,000 tonnes per day vs. ~19,000 tonnes per day underground, this is able to equal a further ~$4.7 million per 12 months on high of the ~$50 million in income from Odyssey and ~$8 million in income from Higher Beaver (if green-lighted). And I’d argue that this income deserves a premium valuation provided that it is coming from what will probably be a top-10 mine by scale globally in a top-ranked jurisdiction owned by the sector’s most aggressive driller in Agnico Eagle.

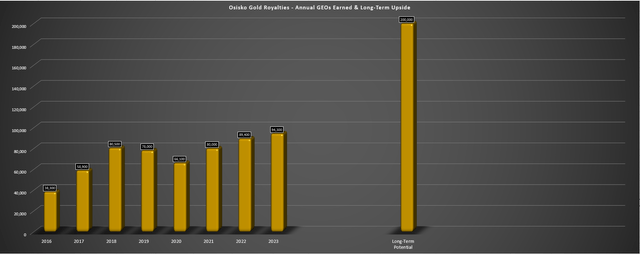

As for the larger alternative exterior of those two property, I in the end see the potential for Osisko to develop right into a 180,000+ GEO every year producer in 2030 if key property can get throughout the end line, and upwards of 200,000 GEOs if the corporate can add at the very least 5,000 GEOs every year in future contribution alongside the best way which actually appears to be like doable given the present atmosphere and Osisko’s robust and rising liquidity place (~$480 million with accordion choice). A number of property that can contribute to Osisko’s development embrace full manufacturing from CSA, Corvette, Windfall, Cariboo, Higher Beaver, Namdini, WKP, Island Gold Growth, Mantos Blancos Growth, and several other base metals property of various scale like Cascabel, On line casino, White Pine/Copperwood, Pine Level, Hermosa, Antakori, Marimaca and Costa Fuego.

Osisko Gold Royalties – Annual GEOs Earned & Lengthy-Time period Upside – Firm Filings, Creator’s Chart & Estimates

The final improvement value noting is that Osisko offered its stake in Osisko Mining (OTCPK:OBNNF) for proceeds of $103 million which it used to pay down extra of its debt, ending Q3 with simply ~$97 million in web debt vs. ~$186 million to complete Q3. I believe this was a wonderful transfer because the market has not given Osisko any worth for its fairness investments, but it surely gives speedy financial savings from an curiosity expense standpoint and will increase its liquidity place to benefit from any offers that may come throughout the plate. Plus, Osisko already has large upside to Osisko Mining via its 2.0% – 3.0% NSR on the longer term 300,000+ ounce mine and discovery optionality regionally, so I do not see any have to have extra publicity with a big fairness stake particularly when the choice is assured financial savings by placing these proceeds in direction of debt compensation.

Valuation

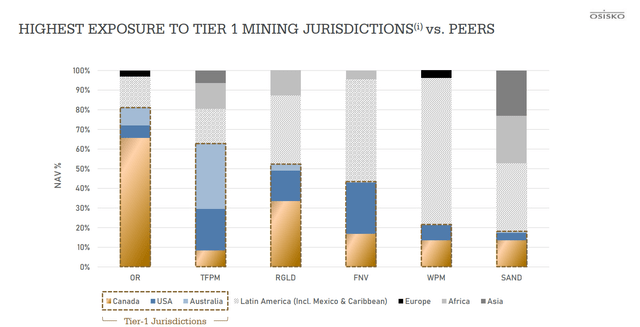

Based mostly on ~185 million shares and a share value of US$14.00, Osisko trades at a market cap of ~$2.59 billion and an enterprise worth of ~$2.69 billion. This makes it one of many top-5 names by capitalization within the royalty/streaming area, however the inventory continues to commerce at a fraction of the common market cap of ~$16.0 billion among the many large three. And whereas that is largely tied to its a lot smaller manufacturing profile (~100,000 GEOs every year), Osisko has essentially the most spectacular portfolio exterior of the large three, with actual potential to get to 200,000 GEOs every year by 2030 with development that is purchased and paid for plus new offers given the favorable atmosphere for buying new royalties. A portfolio of this scale based mostly in Tier-1 ranked jurisdictions with long-life uncapped royalties might simply command a valuation of 1.70x – 1.80x P/NAV. Therefore, with OR buying and selling at simply 1.03x P/NAV based mostly on an estimated web asset worth of ~$2.53 billion, I see important near-term (conservative honest a number of: 1.30x or US$17.80 right this moment), and long-term upside within the inventory, particularly if it could actually proceed to develop its NAV in a disciplined method because it has since 2020.

Osisko Gold Royalties Tier-1 Jurisdiction Publicity vs. Friends – Firm Web site

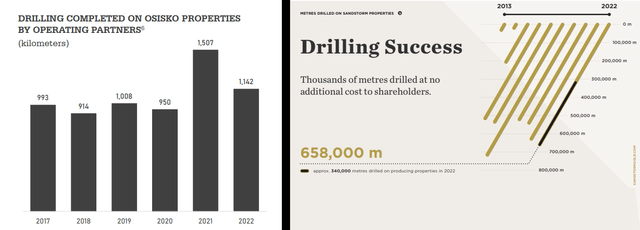

The ultimate level value noting is that whereas all royalty/streaming firms might have the identical good thing about appreciable meters being drilled on their properties every year, Osisko is exclusive as a result of it has a number of royalties held by probably the most aggressive drillers sector-wide with Agnico Eagle on the Canadian Malartic Advanced, Kirkland Lake Camp (together with Higher Beaver), Hammond Reef, Akasaba West, and some different non-core royalties. This contributes to important drilling throughout its portfolio relative to friends, with a median of ~1.15 million meters drilled in 2021 and 2022 on Osisko properties by its working companions vs. different similar-sized firm with simply over half the drilling at ~630,000 meters.

Drilling Accomplished on Osisko/Sandstorm Properties by Companions – Firm Displays

And whereas not each meter drilled is equal (not all land is as potential), this rising variety of meters drilled provides appreciable optionality to make new discoveries on high of the commodity value upside that every one firms profit from. Nonetheless, with no price to Osisko or different royalty/streamers, investing in these firms is very fascinating, as we noticed for the royalty holder on Timok. In reality, Timok has turned out to be a monster that Zijin Mining (OTCPK:ZIJMF) plans to spend as much as $4.0 billion on for an growth, and this can be a royalty that can generate $100+ million in cumulative money move even after being chopped down vs. a value paid for the royalty of simply $160,000. Therefore, for traders in search of double-sided optionality (commodity value/discovery) without charge to them (vs. producers that should spend to drill these meters), Osisko and royalty/streamers as a complete provide unimaginable reward/danger if purchased throughout sector-wide corrections, with occasional surprises like Corvette (*).

Osisko’s Corvette royalty is an asset that did not get any air-time beforehand with restricted drilling, however an enormous lithium discovery has been made since that appears prefer it might contribute ~$20 million in money move every year for Osisko beginning in 2030, and doubtlessly extra if a serious swoops in and builds a bigger undertaking on the onset.

Pierre Lassonde says it greatest on optionality and the facility of royalties vs. streams:

“Right here’s the factor — why the Franco enterprise mannequin is so extremely highly effective and only a few folks perceive this. None of our rivals do. They don’t perceive what we’ve got after we create a royalty. I’m not speaking a couple of stream; I’m speaking a couple of royalty — just like the Goldstrike royalty or the Detour royalty. We get a free perpetual choice on the discoveries made on the land by the operators, and we get a free perpetual choice on the value of gold. Take into consideration this: if somebody fingers you a free perpetual choice on 6 million acres of land, and also you don’t must put up a penny, don’t you suppose that in some unspecified time in the future, you’re going to get fortunate? That’s what it’s. Now we have put collectively a land bundle by buying and creating royalties the place we find yourself with a free perpetual choice. It’s the optionality worth of the land, the worth of the operator spending cash on our land, and the optionality to increased gold costs. And that’s value a lot cash.”

– Pierre Lassonde

Abstract

Osisko Gold Royalties had one other report 12 months in Q3 and whereas steerage got here up shy of estimates, we must always important development in annual GEOs over the following few years. It is because Alamos is working to greater than double its manufacturing profile at Island Gold, Mantos Blancos continues to work in direction of its 20k TPD Growth, the CSA Mine will present a full 12 months of contribution in 2024, and we must always see a number of new property come on-line within the subsequent 6-30 months, together with Namdini (~3,600 GEOs), Windfall (~6,500 GEOs), and Tocantinzinho (~1,300 GEOs). In the meantime, a number of property stay within the wings and are prone to begin manufacturing by 2028 like Cariboo, Costa Fuego, and doubtlessly Hermosa. And when mixed with ~$500 million in liquidity and an atmosphere that favors promoting royalties/streams vs. fairness for builders/producers due to decrease share costs, Osisko ought to be capable of decide up a number of new royalties to additional complement its portfolio, boosting its NAV per share.

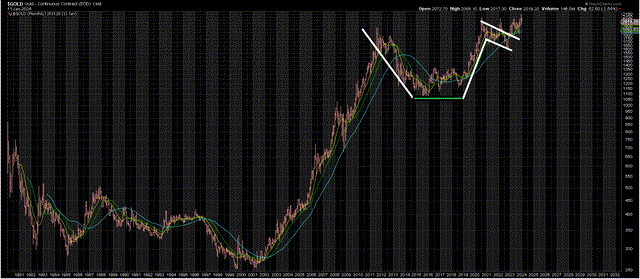

Gold Yearly Chart – StockCharts.com

In the meantime, the outlook for gold value upside has not often been higher, with gold engaged on one of many largest breakouts amongst any asset courses in years, and breakouts of this magnitude (if confirmed), which usually gasoline multi-year uptrends. In reality, the final main cup-style breakout in gold occurred from 1996 to 2005, with gold marching increased for one more six years and greater than doubling within the interval. And whereas this does not imply we’ve got to see a repeat, the enticing technical setup actually suggests some allocation mining firms is sensible, with Osisko offering a car to profit from this upside and a resurgence in drilling exercise amongst smaller producers sector-wide with the safety from a margin standpoint if the metallic continues to tread water. In abstract, I proceed to see OR as a top-10 option to get publicity to the gold value, and I’d view any sharp pullbacks as shopping for alternatives.