Justin Sullivan/Getty Photos Information

Funding thesis

My preliminary bullish thesis about Oracle (NYSE:ORCL) didn’t age nicely because the inventory moved roughly consistent with the broader U.S. market. I believe that the cautious general market sentiment was the principle purpose why the inventory value stagnated over the past quarter. From the elemental perspective, the corporate delivered a robust quarter and continues investing closely in development and innovation. Income continues to develop even within the present unsure setting, and ORCL demonstrates strong working leverage even regardless of challenges associated to Cerner integration. Regardless of substantial indebtedness, I take into account the corporate’s steadiness sheet as very robust, positioning ORCL nicely to gas development and innovation, however not on the expense of buyers, which is essential. My valuation evaluation suggests the inventory is considerably undervalued. Due to this fact, I reiterate my “Sturdy Purchase” ranking for ORCL.

Latest developments

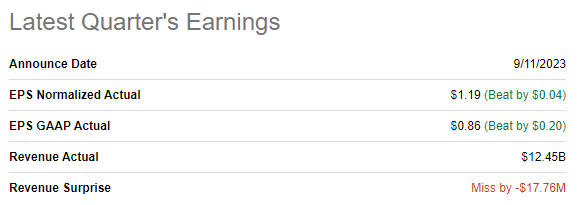

The newest quarterly earnings have been launched on September 11, when the corporate barely missed income consensus estimates however delivered a constructive bottom-line shock.

Writer’s calculations

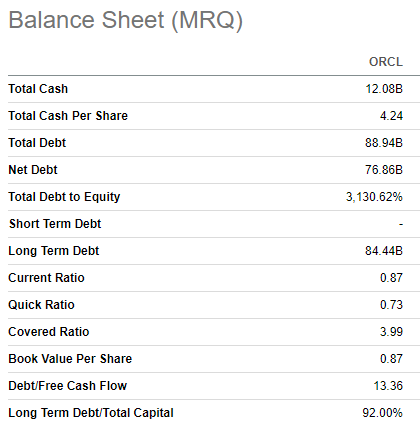

Income grew by a powerful 8.8% YoY; the top-line power was largely pushed by the Cloud enterprise. Complete Cloud Income, SaaS, and IaaS mixed grew YoY by a powerful 29% in fixed forex. The highest-line power allowed ORCL to broaden the working margin by greater than three proportion factors, which is strong. Sturdy working leverage enabled ORCL to generate $6 billion in levered free money move [FCF]. Having substantial FCF permits ORCL to steadiness between investing in innovation, bettering the steadiness sheet and returning funds to shareholders with dividend payouts and buybacks. The corporate’s substantial leverage shouldn’t mislead readers as solely $4.5 billion is payable inside a yr, which is nearly thrice decrease than the excellent money quantity. ORCL delivered nearly 15% dividend CAGR over the past 5 years, and I believe that its huge FCF margin, along with its wholesome steadiness sheet, positions the corporate nicely to proceed demonstrating stellar dividend development.

Searching for Alpha

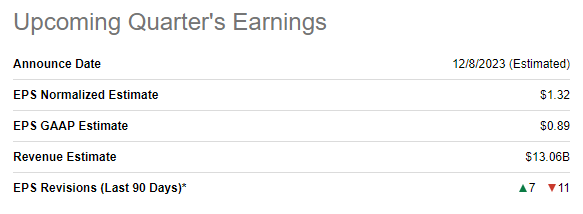

The earnings for the upcoming quarter are scheduled for launch on December 8. Consensus estimates forecast quarterly income at $13.06 billion, which signifies a strong 6.3% YoY development. The adjusted EPS is predicted to observe the highest line and broaden from $1.21 to $1.32.

Searching for Alpha

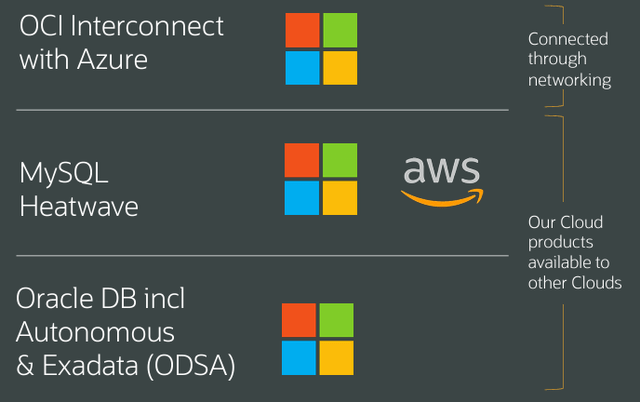

I’m optimistic concerning the upcoming quarter’s earnings launch as a result of the corporate’s largest star, the Cloud enterprise, demonstrates strong acceleration as the corporate efficiently rides the wave of enterprise cloud digitalization. Because the enterprise cloud business is predicted to compound at a staggering 20% yearly as much as 2030, this favorable secular development is predicted to maintain robust momentum over a number of years. Oracle’s stellar Cloud enterprise development means that the administration demonstrated distinctive execution lately. Nevertheless, current developments recommend that they’re unwilling to cease and try to enhance ORCL’s place on this extremely aggressive market. The introduced deeper collaboration with Microsoft’s (MSFT) Azure cloud service signifies a dedication to staying aggressive within the cloud infrastructure market. In response to Brent Bracelin from Piper Sandler, the collaboration with Microsoft positions Oracle on the forefront of cloud innovation as Azure is gaining robust momentum.

Oracle.com

The expanded strategic AI partnership with Nvidia (NVDA) additionally underlines the administration’s robust deal with synthetic intelligence [AI] capabilities. Oracle has built-in the Nvidia AI Enterprise and DGX Cloud AI supercomputing platform into the Oracle Cloud Market, which reinforces Oracle Cloud Infrastructure’s [OCI] capabilities by providing clients accelerated, safe, and scalable options for AI growth and deployment. Nvidia’s current stellar earnings launch signifies that the demand for AI and machine studying [ML] is accelerating. That mentioned, Oracle’s strategic transfer to develop a partnership with Nvidia is a robust one, which underlines the administration’s dedication to innovation.

I anticipate these current developments to positively have an effect on the near-term monetary efficiency and construct long-term worth for shareholders. The inventory is favored by many dividend buyers on account of its stellar dividend development monitor file, and the administration does every part to maintain this development of a shareholder-friendly capital allocation strategy.

Valuation replace

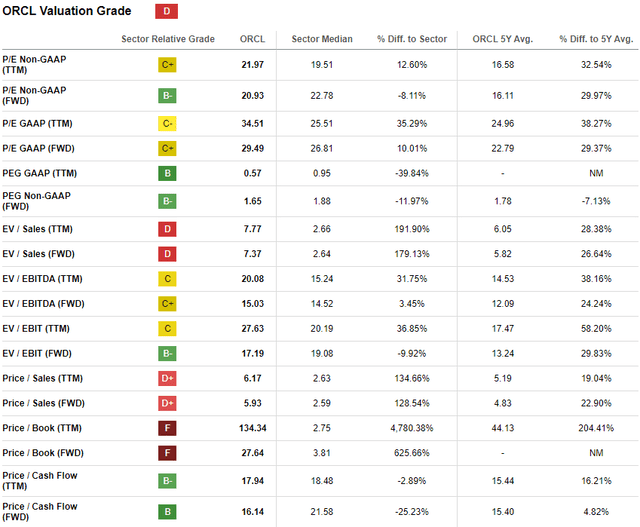

ORCL rallied by 39% year-to-date, considerably outperforming the broader U.S. inventory market. Searching for Alpha Quant assigns the inventory a low “D” valuation grade as a result of valuation ratios are largely larger than the sector median. One other signal which may point out overvaluation is the truth that ORCL’s present multiples are larger than historic averages throughout the board.

Searching for Alpha

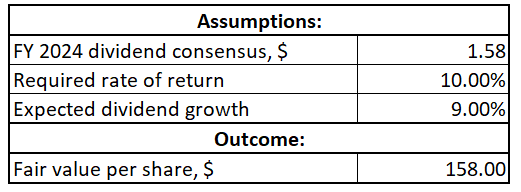

To get extra proof, I need to simulate a dividend low cost mannequin [DDM]. I exploit a ten% WACC as a required charge of return. Consensus dividend estimates mission an FY 2024 dividend payout of $1.58. ORCL has a stellar dividend development historical past, and the payout ratio is barely 29%, which suggests my 9% dividend CAGR is pretty conservative.

Writer’s calculations

In response to my DDM simulation, the inventory’s honest value is $158. That is about 36% larger than the present value ranges, which means the inventory has substantial upside potential. That mentioned, the inventory could be very attractively valued.

Dangers replace

The corporate’s iconic founder, Larry Ellison, performs a pivotal position in Oracle’s company tradition and innovation. Nevertheless, as Mr. Ellison, the corporate’s CTO, approaches his eightieth anniversary in 2024, issues over management succession are growing. Regardless of Larry Ellison having already stepped down as the corporate’s CEO about ten years in the past, there are obvious uncertainties concerning Oracle’s potential to maintain its distinctive tradition with out Mr. Ellison’s direct involvement.

Whereas Oracle’s acquisition of Cerner will doubtless unlock new alternatives and synergies for the corporate, there are additionally obvious dangers. Merging numerous enterprise operations, programs, and cultures might undermine the effectivity and efficiency of the mixed entity. The Cerner acquisition, specifically, has compressed consolidated margins, and if the combination doesn’t proceed easily, it could fail to ship the anticipated returns.

Backside line

To conclude, Oracle remains to be a “Sturdy Purchase”. I take into account profitability headwinds associated to the Cerner acquisition to be regular since integrating two massive companies isn’t a simple in a single day course of. It’s essential that ORCL continues delivering robust income development, particularly within the Cloud enterprise, the corporate’s largest guess. The steadiness sheet is powerful sufficient to proceed investing aggressively in innovation whereas guaranteeing robust dividend development. My valuation evaluation suggests the inventory is considerably undervalued with a 36% upside potential, which makes ORCL a compelling funding alternative.