manassanant pamai

By Sonal Desai, Ph.D., Chief Funding Officer, Franklin Templeton Mounted Earnings

The Federal Reserve has fueled market conviction that the nice previous days of extraordinarily low rates of interest and plentiful liquidity are quickly to return.

Our Franklin Templeton Mounted Earnings CIO Sonal Desai sees this response as an extra of dovish enthusiasm that units the stage for extra volatility. She shares her newest insights on the coverage outlook and the implications for traders.

This guarantees to be fairly a difficult yr for traders. I feel macro uncertainty is particularly excessive, and it may be sensible to method 2024 with even better mental humility than normal.

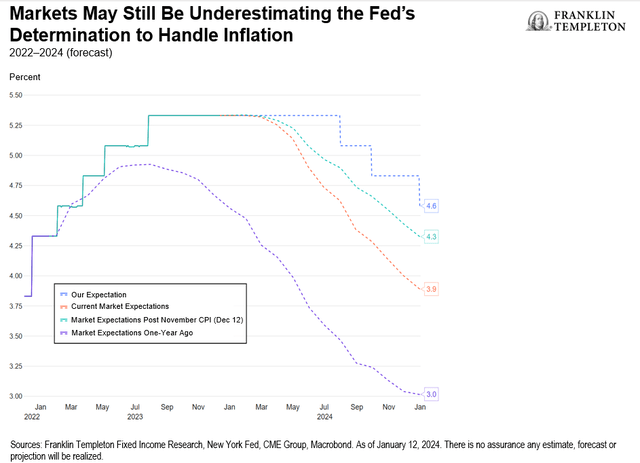

Early in 2023, with the federal funds fee at 4.25%-4.50%, markets anticipated that earlier than the tip of the yr the Federal Reserve (Fed) would have reversed course and lower charges by 50 foundation factors (bps).

I felt very strongly that traders have been underestimating the inflation downside and the Fed’s willpower to take care of it. The Fed didn’t lower charges, and the fed funds fee right this moment is a full share level greater than a yr in the past.

As the brand new yr kicks off, I really feel much less out of sync with market consensus, however I imagine many traders have once more gotten carried away by dovish enthusiasm.

The 75 bps in fee cuts the Fed has signaled for this yr seem life like given the progress in inflation, however markets started in some unspecified time in the future pricing in near 150 bps and see the cuts starting as early as March, which to me appears approach too quickly.

The markets have already completed plenty of easing for the Fed, bringing monetary circumstances again to the extent prevailing when the fed funds fee was simply 1.75%.

With the economic system nonetheless sturdy, there needs to be no hurry for the Fed to chop, although it’s onerous to foresee if and the way the election calendar would possibly have an effect on the rate-cuts calendar.

If a yr in the past I used to be struck by how badly markets gave the impression to be misreading the Fed, right this moment I’m struck by the Fed’s newfound lack of prudence. In December, Fed Chairman Jerome Powell took a victory lap.

That is maybe comprehensible, as a result of we now have seen a considerable decline in inflation with virtually no harm to the economic system.

However the marked change in Fed rhetoric has predictably fueled market conviction that we’re about to return to the completely satisfied days of extraordinarily low rates of interest and plentiful liquidity – a conviction bolstered by the Fed’s signaling that it intends to finish quantitative tightening with a a lot bigger steadiness sheet than beforehand thought, in order to keep up “greater than ample liquidity.”

Whether or not advertently or inadvertently, the Fed has fueled a brand new surge in irrational exuberance in markets, which I feel contributes to retaining inflation dangers alive and makes investing in 2024 much more difficult.

Don’t get me unsuitable, I don’t imply to downplay the Fed’s success in bringing inflation underneath management. Decisive financial tightening, mixed with fading provide shocks, has considerably slowed worth dynamics and helped restrain inflation expectations.

However there are nonetheless two sorts of inflation dangers that traders must be conscious of: first, that the “final mile” again to 2% would possibly show too gradual for consolation; and second, that an ill-timed new shock would possibly ship inflation again up.

December Shopper Worth Index (CPI) knowledge have simply confirmed that inflation stays sticky properly above goal.

Core CPI got here in at 3.9% year-over-year (y/y), barely under November’s 4.0%; “supercore,” which excludes shelter in addition to meals and power, additionally held at 3.9% y/y; headline CPI rose to a higher-than-expected 3.4% y/y (from November’s 3.1%).

More moderen annualized shifting averages are solely a little bit decrease: 3.3% for core CPI during the last three months, exhibiting no enchancment over the previous six months.

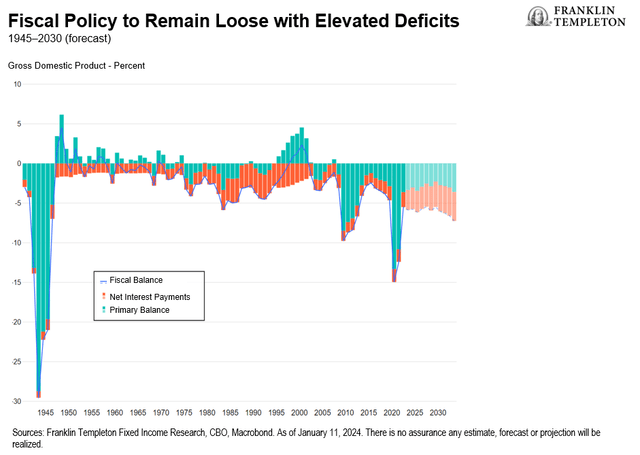

Fiscal coverage is the elephant within the room – it stays extraordinarily free, and as we’re getting into an election yr, I see little or no probability of a near-term correction.

This not solely contributes to inflation dangers, but additionally bolsters the chance of fiscal dominance; it will get more and more onerous for the Fed to disregard the persistently massive authorities financing wants, and the heavier impression that curiosity expenditures have on the funds itself.

Lengthy-term concerns can even affect the funding surroundings in 2024, on condition that we’re exiting the inflation emergency interval and beginning to converge to a brand new equilibrium.

I nonetheless imagine that the brand new regular will likely be loads just like the previous regular, the pre-global-financial-crisis (GFC) regular. In different phrases, I don’t imagine we are going to return to extraordinarily low rates of interest and very plentiful liquidity.

It appears more and more clear, in my view, that the impartial fee of curiosity is greater than markets assume and than the Fed retains indicating. It’s onerous in any other case to know how the US economic system has remained so robust even with the fed funds fee above 5% since final Could.

I feel the pure fee, in nominal phrases, is probably going 4% or a bit greater, quite than the two.5% within the Federal Open Market Committee’s long-term projections.

The Fed’s signaled intention to maintain the steadiness sheet extraordinarily massive additionally issues me considerably. I see many individuals arguing that the extent of reserves on the central financial institution has nothing to do with financial institution lending.

I feel there’s a main confusion right here. It’s true that an enlargement within the Fed steadiness sheet doesn’t routinely power banks to lend extra, however it’s equally true that a big inventory of reserves, which corresponds to a big Fed’s steadiness sheet, creates ample room for extra lending and borrowing ought to banks select to take action.

It is usually true that a big steadiness sheet by means of its impression on liquidity contributes to free monetary circumstances. This, in spite of everything, is precisely why the Fed had launched quantitative easing within the first place.

There may be a number of causes for the Fed to favor a bigger steadiness sheet (fiscal dominance and monetary repression being doable contributors), however I feel it’s a dangerous transfer.

By leaving ample room for lending and borrowing, it opens one other channel for extra risky changes within the financial and monetary system – and it reinforces the market’s view that the post-GFC circumstances of ample liquidity will reestablish themselves.

As I have a look at a US economic system which enters 2024 on a robust footing, supported by robust fairness markets, free fiscal coverage and a sturdy labor market with wage development nonetheless properly in extra of the inflation goal, my conclusion is that this by no means warrants a return to the very free financial coverage that markets nonetheless want for.

All this makes for a really difficult funding surroundings, as a result of markets have run properly forward of the Fed, they’ve already pre-empted greater than all of the financial coverage motion that we are able to realistically anticipate this yr.

So I anticipate extra volatility within the coming quarters, with the 10-year Treasury yield probably going again towards 4.50%. Within the coming quarters, extending period will begin wanting extra engaging.

For my part, fastened revenue will extra firmly reestablish its position as a portfolio diversifier, finally benefiting from lowered volatility as soon as the Fed’s response perform turns into much less of a spotlight for markets.

What are the dangers?

All investments contain dangers, together with doable lack of principal.

Fairness securities are topic to cost fluctuation and doable lack of principal.

Mounted revenue securities contain rate of interest, credit score, inflation and reinvestment dangers, and doable lack of principal. As rates of interest rise, the worth of fastened revenue securities falls. Low-rated, high-yield bonds are topic to better worth volatility, illiquidity and chance of default.

Unique Publish

Editor’s Observe: The abstract bullets for this text have been chosen by Looking for Alpha editors.