JARAMA

Omega Healthcare Traders, Inc. (NYSE:OHI) displayed a combined monetary efficiency in Q3 2023, marked by a slight lower in web revenue, attributed to elevated bills and diminished revenue from unconsolidated joint ventures. The corporate’s Nareit Funds From Operations (FFO) and Funds Accessible for Distribution (FAD) confirmed a marginal enhance, signaling a steady working efficiency. This text analyzes Omega Healthcare’s monetary outcomes from Q3 2023 earnings alongside a technical evaluation of inventory value to find out future value tendencies and potential funding alternatives. It’s famous that the inventory shows strong bullish value actions, indicating potential for upward momentum.

Omega Healthcare’s Q3 2023 Earnings

The corporate reported a web revenue of $93.9 million, or $0.37 per widespread share, a slight lower from $105 million, or $0.43 per widespread share, in Q3 2022. This decline in web revenue is attributed primarily to elevated bills and a lower in revenue from unconsolidated joint ventures, regardless of an increase in different revenue and complete income.

The corporate’s Nareit FFO stood at $161 million or $0.63 per widespread share, in comparison with $159 million, or $0.65 per widespread share, in Q3 2022. Regardless of the next share depend, the marginal enhance in Nareit FFO suggests a steady working efficiency. Equally, FAD barely elevated to $174 million, or $0.68 per widespread share, in comparison with $173 million, or $0.71 per widespread share, in Q3 2022. This progress in FAD signifies the corporate’s potential to generate money circulation, though the elevated share depend impacted the per-share figures.

Through the quarter, Omega Healthcare Traders made important new investments totaling $106 million, together with actual property acquisitions, loans, and capital tasks. The sale of 15 services for $99 million and the reimbursement of a $105 million vendor be aware, leading to a $44 million achieve, highlights the corporate’s strategic asset administration. Moreover, promoting 29 services leased to LaVie for $305.2 million post-quarter finish underscores the lively portfolio administration technique.

The corporate strengthened its stability sheet by coming into right into a $429 million unsecured time period mortgage and issuing 4 million widespread shares for $126 million in gross proceeds. This monetary maneuvering, together with over $600 million in money and $1.4 billion accessible beneath its line of credit score, positions Omega Healthcare effectively for future investments and debt obligations.

Nevertheless, CEO Taylor Pickett famous potential headwinds, together with smaller restructurings, many tenants nonetheless on a money foundation, and depleting safety deposits, which could impression FAD in This fall 2023 and early 2024. Regardless of these challenges, Pickett stays optimistic about long-term alternatives within the expert nursing business, buoyed by enhancing working situations and demographic tailwinds.

Furthermore, Omega Healthcare demonstrated lively administration of its portfolio, navigating challenges and capitalizing on alternatives. The divestment of LaVie services for a considerable quantity showcased a strategic shift, balancing quick money inflow with mortgage pay-offs. Nevertheless, Omega Healthcare confronted lease cost points with Maplewood and Guardian, prompting using safety deposits to mitigate income shortfalls. These challenges had been partly offset by new investments, together with the acquisition of care houses within the U.Ok. and a talented nursing facility in Virginia, in addition to important new investments within the fourth quarter. These acquisitions, alongside strategic actual property loans, spotlight Omega’s dedication to progress and diversification. The various yields and escalators connected to those investments replicate a nuanced strategy to portfolio administration, aiming to safe long-term profitability amidst a dynamic healthcare actual property panorama.

General, Omega Healthcare Traders has demonstrated a resilient and strategic strategy to navigating the complexities of the healthcare actual property market. Whereas dealing with headwinds resembling tenant cost points and potential future challenges, the corporate has successfully balanced threat and alternative, as evidenced by its lively portfolio administration and strategic investments. These actions, mixed with a strengthened stability sheet and a concentrate on long-term progress prospects within the expert nursing sector, place Omega Healthcare effectively to navigate the evolving panorama and capitalize on demographic and market tendencies.

Decoding Historic Technical Traits

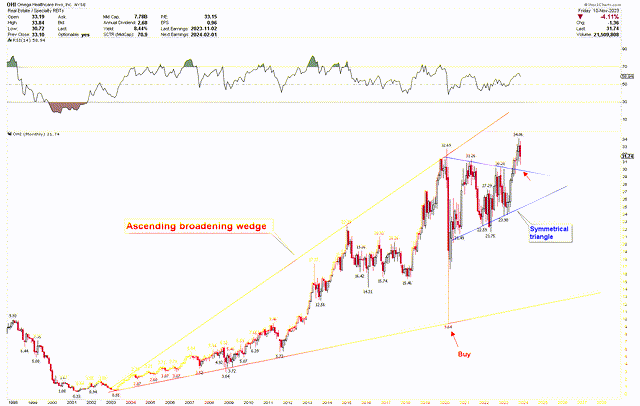

The technical evaluation of Omega Healthcare over the long run, as evident from the month-to-month chart beneath, presents a robustly bullish development. This chart reveals a gentle upward trajectory within the inventory’s worth, starting from its 2001 low level of $0.33.

This upward trajectory was primarily as a consequence of its robust place within the long-term healthcare sector, significantly in expert nursing and assisted residing services. This sector noticed strong progress pushed by an growing older inhabitants in the US, growing the demand for long-term care companies. Omega, as a REIT specializing in these kinds of properties, benefited from this demographic development. The corporate’s strategic acquisitions and efficient administration of its property portfolio additional strengthened its monetary efficiency, resulting in a constant enhance in dividends, which attracted income-focused traders. Moreover, the low-interest-rate setting for a lot of this era made Omega Healthcare extra enticing for its larger yields, thereby driving up inventory costs. This mix of favorable demographics, strategic progress, and a conducive financial setting underpinned Omega Healthcare’s inventory value appreciation till 2019.

OHI Month-to-month Chart (stockcharts.com)

Nevertheless, Omega Healthcare Traders skilled a major drop in its inventory value, primarily because of the outbreak of the COVID-19 pandemic. The pandemic posed unprecedented challenges to the healthcare sector, particularly services like these Omega Healthcare invests in, resembling expert nursing and assisted residing services. Traders had been involved about elevated operational prices, potential disruptions in lease collections, and the broader impression of the pandemic on the healthcare system. These fears had been mirrored in a pointy decline in Omega Healthcare’s inventory value. Nevertheless, the inventory shortly reversed to larger ranges as the corporate demonstrated resilience. Omega Healthcare’s centered enterprise mannequin, which incorporates long-term leases, a diversified tenant base, and governmental assist measures for healthcare services, helped stabilize its monetary place. Moreover, the roll-out of COVID-19 vaccines and an elevated concentrate on healthcare infrastructure contributed to investor confidence within the sector’s restoration, aiding within the inventory value rebound.

After hitting a low in 2020, the market recovered strongly, growing an ascending broadening wedge sample, highlighting important volatility. Furthermore, the market uncertainty throughout 2021 and 2022 resulted within the growth of a symmetrical triangle. This triangle was conclusively damaged on the upside in July 2023, triggering a surge of optimistic momentum available in the market. Presently, costs are settling at larger ranges, suggesting the opportunity of continued upward tendencies.

Key Motion for Traders

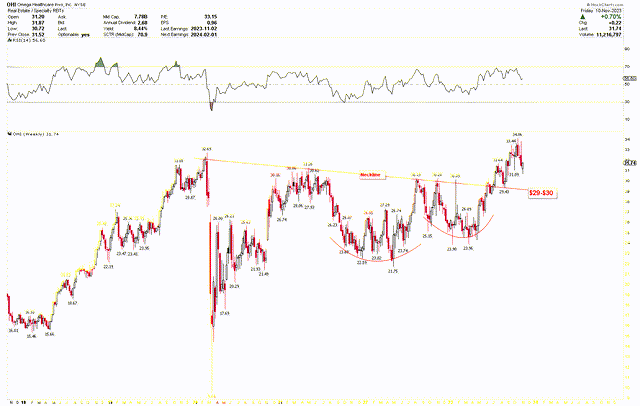

To realize a deeper perception into the market tendencies following 2020, the weekly chart depicted beneath illustrates the distinctly bullish value actions. This strong value resurgence post-COVID-19 is characterised by rounding backside patterns, with a neckline round $29-$30. The worth has notably surpassed this threshold, indicating an upward trajectory. The market correction noticed in October 2023 is in keeping with this bullish development and represents a compelling funding prospect.

OHI Weekly Chart (stockcharts.com)

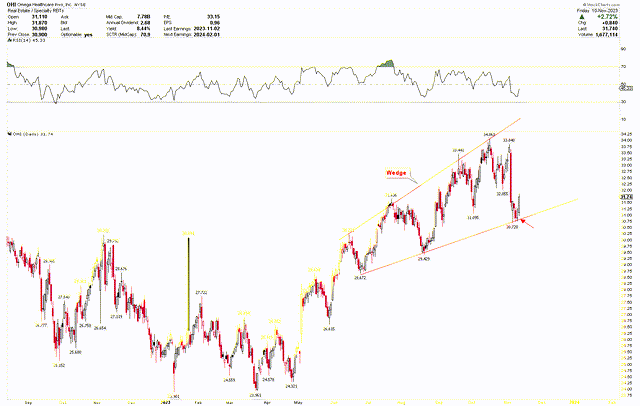

The short-term day by day chart additionally showcases a wedge formation, underscoring the numerous market volatility. The worth’s sharp restoration from a low of $30.72 on the fringe of this broadening wedge is a testomony to the robust market momentum.

OHI Every day Chart (stockcharts.com)

From the above dialogue, it is evident that Omega Healthcare’s long-term outlook is decidedly optimistic. The worth adjustment skilled in October 2023 presents a lovely entry level for long-term traders anticipating future value will increase. Traders might think about shopping for the inventory at its current worth if it trades over the $22 mark.

Dangers

The rise in bills and diminished revenue from unconsolidated joint ventures point out operational challenges. These elements might sign inefficiencies or issues in three way partnership partnerships, which may proceed to impression profitability. Furthermore, persistent bills relative to revenue can pressure the corporate’s monetary well being, doubtlessly affecting its funding capabilities and dividend payouts. Moreover, Omega Healthcare is delicate to rate of interest modifications. Rising rates of interest can enhance borrowing prices and negatively impression valuation. The healthcare sector is topic to regulatory modifications, shifts in healthcare coverage, and technological disruptions, all of which may impression Omega Healthcare’s operations and profitability.

From a technical perspective, notable volatility results in potential short-term value swings. That is significantly related for traders with a shorter funding horizon. Ought to the inventory shut beneath $22 in a month, it may signify a continued downward development earlier than any potential upswing.

Backside Line

In conclusion, Omega Healthcare Traders exhibited a fancy monetary image in Q3 2023, characterised by a modest decline in web revenue as a consequence of elevated bills and diminished returns from unconsolidated joint ventures. Nevertheless, the corporate’s Nareit FFO and FAD confirmed slight enhancements, indicating a steady operational efficiency amidst difficult situations. Furthermore, the corporate’s proactive portfolio administration, demonstrated by important new investments and strategic divestments, displays a robust dedication to progress and flexibility within the dynamic healthcare actual property market. Regardless of dealing with tenant cost challenges and potential short-term headwinds, Omega Healthcare’s long-term outlook stays optimistic, supported by demographic tendencies and a concentrate on the expert nursing sector.

From a technical evaluation standpoint, Omega Healthcare’s inventory has proven a robust bullish development over the long run. The current breakout from a symmetrical triangle sample in July 2023 and the following value stabilization recommend a possible continuation of this upward trajectory. The short-term value adjustment in October 2023 has pushed the worth right down to the strong assist degree indicated by the month-to-month, weekly, and day by day charts. This consolidation of the worth at this assist degree suggests underlying energy within the value. Traders might think about buying Omega Healthcare on the present costs and growing holdings if the worth declines additional, supplied it stays above $22.