Oil (WTI, Brent Crude) Evaluation

- WTI oil finds help round important long-term degree, hinting at a reversal

- Brent crude oil turns simply wanting bridging the worth hole created by OPEC’s shock provide minimize

- IG retail consumer sentiment turns ‘combined’ as longs surge and shorts decline

- The evaluation on this article makes use of chart patterns and key help and resistance ranges. For extra data go to our complete training library

Really useful by Richard Snow

Get Your Free Oil Forecast

WTI Oil Finds Help Earlier than Closing the Worth Hole

Oil markets have mounted considerably of a problem to the newest selloff across the long-term degree of $77.40. The indicators of bearish fatigue forward of the $75.75 degree seems simply wanting technically finishing a full retracement of the latest hole greater.

Subsequent candles exhibiting a reluctance to commerce decrease (by way of the decrease candle wicks) means that bears could also be operating out of momentum or require an extra catalyst to bridge the hole. The newest spherical of OPEC cuts come into power in Might and markets are doubtlessly extra evenly balancing dangers of a development slowdown and decreased oil provide, balancing the marketplace for now.

With $77.40 performing as instant help, the following degree of consideration within the occasion of a bearish continuation is $77.40. Then again, resistance seems across the $79.10 degree adopted by the $82.50 zone of resistance.

Oil (WTI) Day by day Chart

Supply: TradingView, ready by Richard Snow

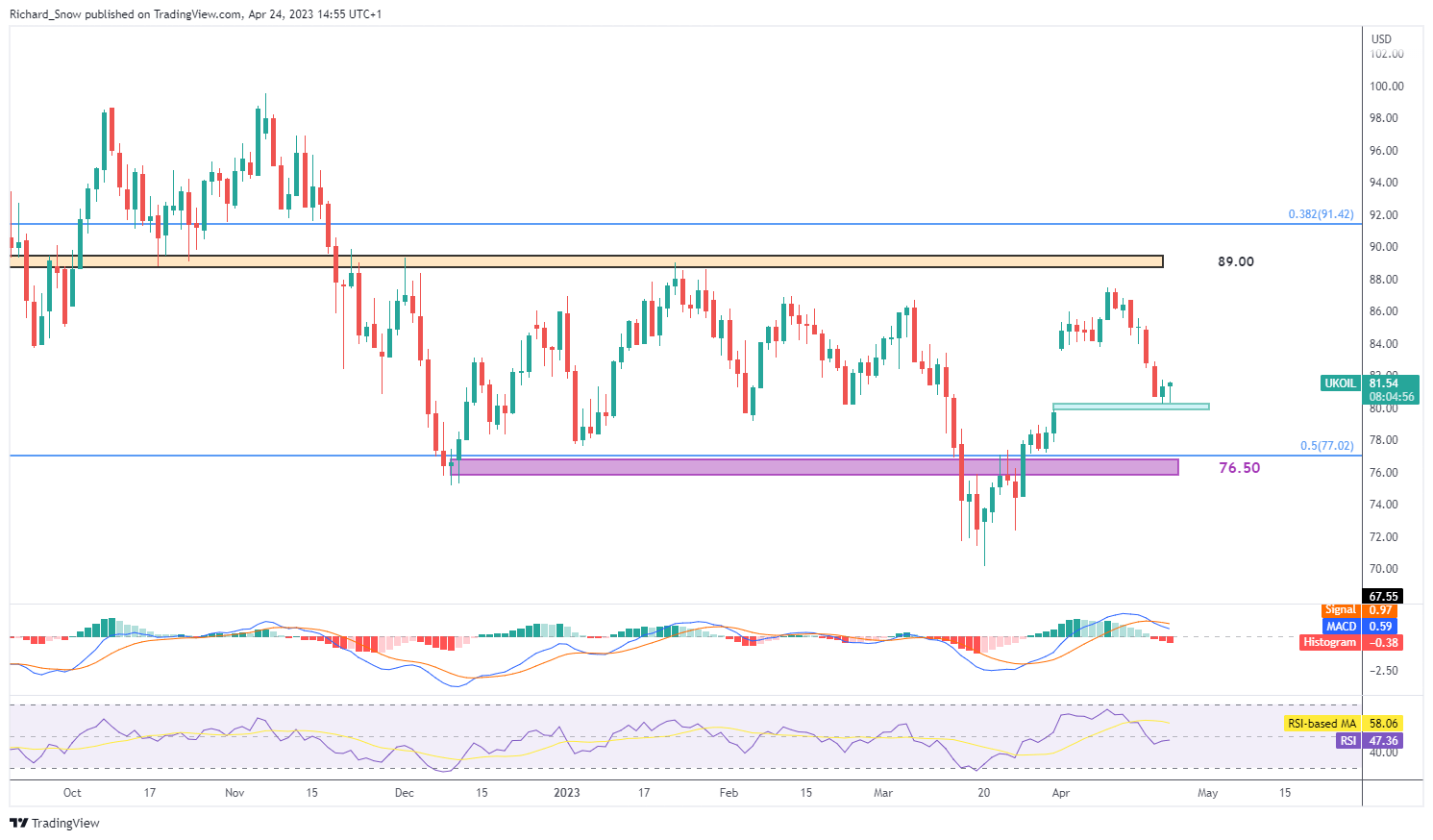

Brent crude oil has mounted a slight pullback after coming inside a couple of ticks of attaining a full retracement of the worth hole. The potential for a pullback is constructing after yesterday’s beneficial properties adopted by a continued transfer in early US buying and selling. Help seems across the zone of help at $79.89 after which the 50% retracement of the 2020-2022 main transfer at $77. Resistance stays all the way in which at $89 which seems a good distance away.

Brent crude oil day by day chart

Supply: TradingView, ready by Richard Snow

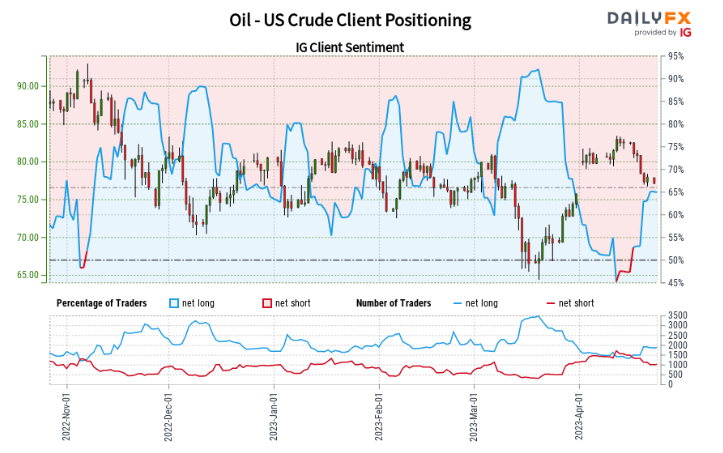

Oil (WTI) Retail Sentiment Offers a Blended Outlook as Lengthy Positioning Surges

Oil– US Crude:Retail dealer knowledge exhibits 64.72% of merchants are net-long with the ratio of merchants lengthy to brief at 1.83 to 1.

We sometimes take a contrarian view to crowd sentiment, and the very fact merchants are net-long suggestsOil– US Crude costs could proceed to fall.

The variety of merchants net-long is 3.42% greater than yesterday and 33.82% greater from final week, whereas the variety of merchants net-short is 3.94% greater than yesterday and 30.59% decrease from final week.

Positioning is much less net-long than yesterday however extra net-long from final week. The mix of present sentiment and up to date modifications offers us an extra combined Oil – US Crude outlook.

Commerce Smarter – Join the DailyFX Publication

Keep updated with the newest market transferring developments

Subscribe to Publication

— Written by Richard Snow for DailyFX.com

Contact and observe Richard on Twitter: @RichardSnowFX