Final week, commodity indexes skilled notable declines primarily as a consequence of a pointy drop in oil costs. Moreover, hawkish statements from the Federal Reserve ruling out a March price minimize contributed to the downward strain, strengthening the US Greenback within the course of.

Regardless of gold initially reaching near-record highs, it later retreated following a sturdy US jobs report. Oil costs, each Brent and WTI, witnessed important slumps as US officers emphasised efforts to stop additional escalation of regional conflicts. This correction additionally displays lowered considerations concerning broader provide disruptions.

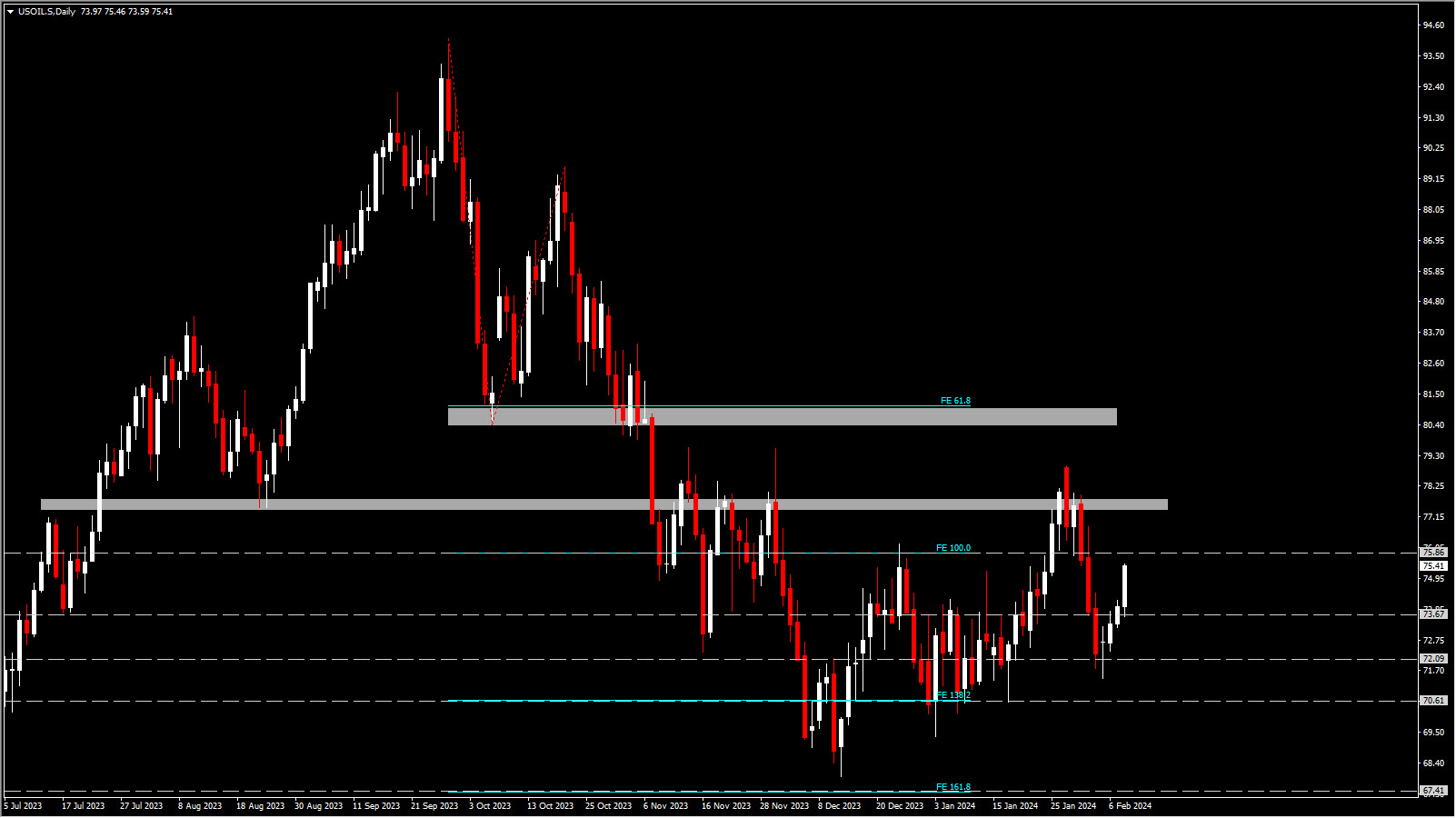

Nonetheless this week, the current indications of sluggish progress in China and the Fed’s hawkish stance have tempered demand expectations. Oil costs have continued to climb, with USOIL rising greater than 1% to $75.30, whereas UKOIL is buying and selling at $80.60 per barrel. Though costs have seen a 4-session uptick, they continue to be beneath ranges seen earlier than the Fed signaled the unlikelihood of a March price minimize final week.

Market consideration stays on potential provide disruptions and international progress prospects as central financial institution insurance policies and Center Japanese developments are assessed. Israel’s Prime Minister Benjamin Netanyahu rejected a ceasefire supply from Hamas, though US Secretary of State Antony Blinken indicated room for additional negotiations. Furthermore, official knowledge revealed a larger-than-expected 3.15 million barrel decline in US gasoline inventories final week.

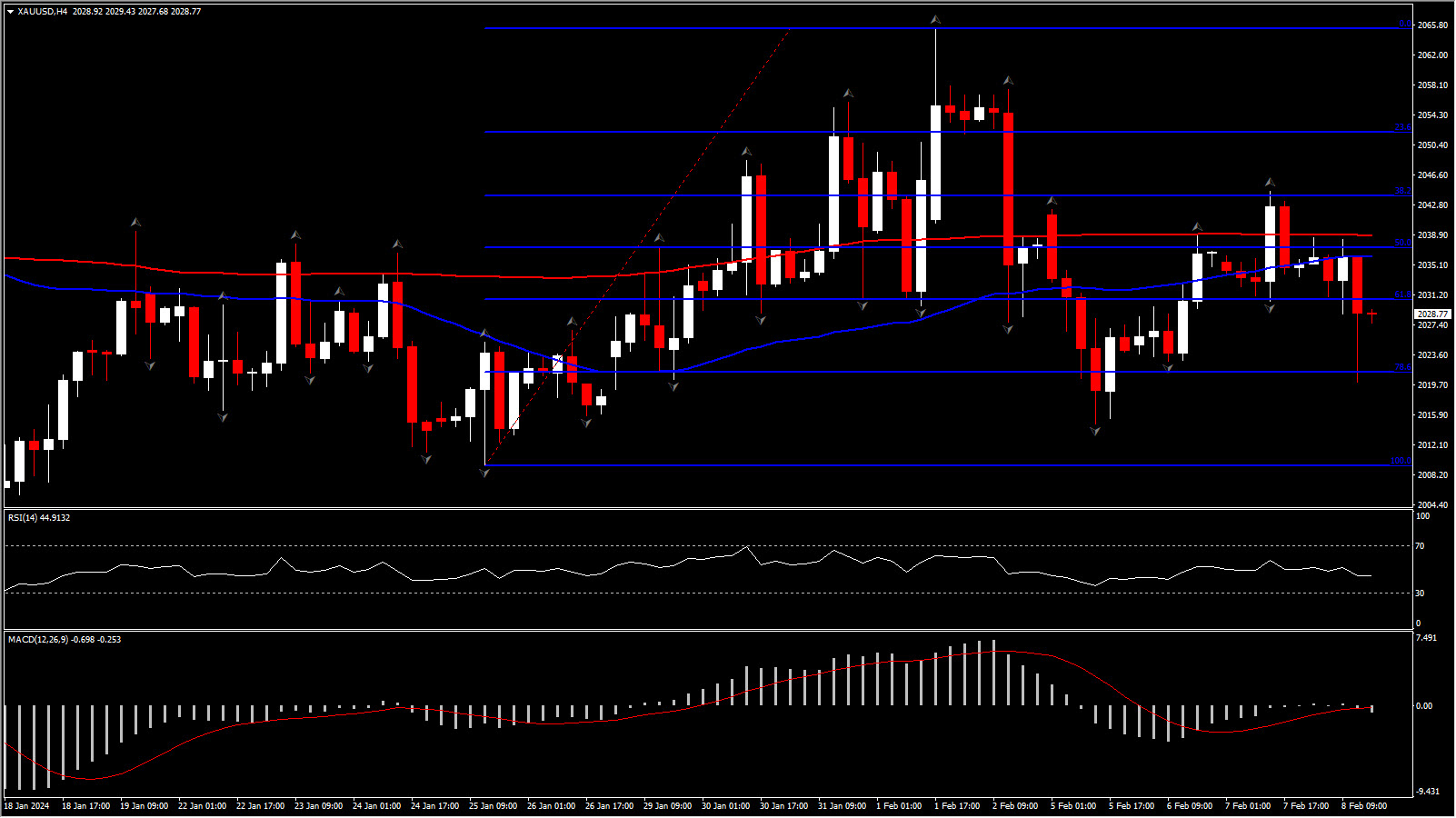

In metallic markets, Gold costs peaked at $2,065.48 per ounce earlier than plummeting following the better-than-expected US jobs report and Powell’s subsequent feedback. The general demand for gold remained resilient amidst geopolitical and financial uncertainties, as highlighted by the World Gold Council’s current report.

The Gold value has retreated from final week’s highs however stays elevated at $2030 per ounce awaiting US CPI subsequent week and any additional indications concerning the timing of the Fed’s potential rate of interest minimize this yr. Presently, the Fed officers are hesitant to decrease rates of interest till they’re extra assured that inflation will attain the two% goal. They offered varied causes for not feeling rushed to provoke coverage easing or to behave swiftly as soon as they do. Therefore, excessive rates of interest amplify the chance value of holding gold.

In the meantime, Palladium costs declined to a recent 5-year low amid persistent considerations about demand. Palladium has declined by 2% to $858 per ounce, reaching its lowest stage since August 2018.

Copper futures suffered as a consequence of apprehensions about Chinese language demand, aggravated by stories indicating a continued decline in manufacturing exercise. In the meantime, the dampening prospects of early price cuts within the US and Europe have weighed on demand. Moreover, stories of a considerable copper deposit discovery in Zambia contribute to long-term provide expectations.

Lithium costs stay depressed, attributed to the downturn in electrical car gross sales throughout China. Regardless of short-term fluctuations, elements akin to geopolitical tensions, commerce uncertainties, and ongoing elections worldwide are anticipated to maintain investor curiosity in gold as a safe-haven asset all through 2024, in response to Louise Avenue, Senior Markets Analyst on the World Gold Council.

Click on right here to entry our Financial Calendar

Andria Pichidi

Market Analyst

Disclaimer: This materials is offered as a common advertising communication for data functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication accommodates, or needs to be thought-about as containing, an funding recommendation or an funding suggestion or a solicitation for the aim of shopping for or promoting of any monetary instrument. All data offered is gathered from respected sources and any data containing a sign of previous efficiency is just not a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive stage of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the data offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.