Crude Oil Price Talking Points

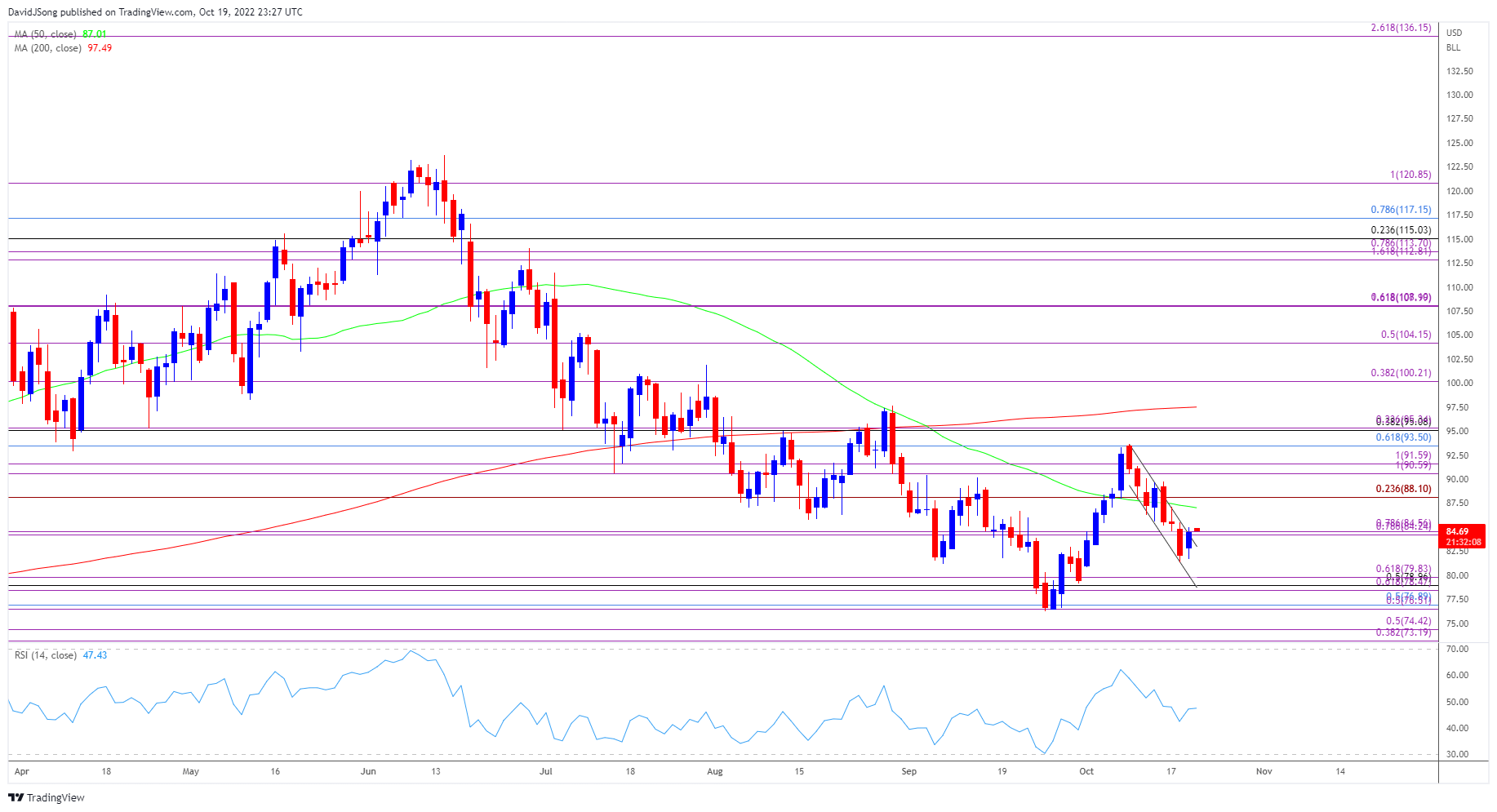

The price of oil trades in a narrow range despite an unexpected decline in US inventories, but a bull-flag formation may unfold over the coming days as crude appears to be reversing a head of the monthly low ($80.87).

Oil Price Reverses Ahead of Monthly Low to Keep Bull Flag Formation Intact

The recent series of lower highs and lows in the price of oil unravels as it hold above the weekly low ($81.30), and the crude may attempts to break out of a descending channel with the Organization of Petroleum Exporting Countries (OPEC) on track to “adjust downward the overall production by 2 mb/d” starting in November.

It seems as though the shift in OPEC’s production schedule will have a greater influence on the price of oil even as the Biden Administration plans to release “15 million barrels from the Strategic Petroleum Reserve (SPR) to be delivered in December” as a key reversal appears to be taking shape following the Ministerial Meeting from earlier this month.

In turn, the price of oil may longer respond to the negative slope in the 50-Day SMA ($87.01) as OPEC’s most recent Monthly Oil Market Report (MOMR) warns of slowing demand, and it remains to be seen if the organization will react to the developments coming out of the US as fresh figures from the Energy Information Administration (EIA) point to robust demand.

The update from the EIA shows crude stockpiles narrowing 1.725M in the week ending October 14 versus forecasts for a 1.38M rise, and a further decline in crude inventories may keep the price of oil afloat as market participants brace for a slowdown in OPEC supply.

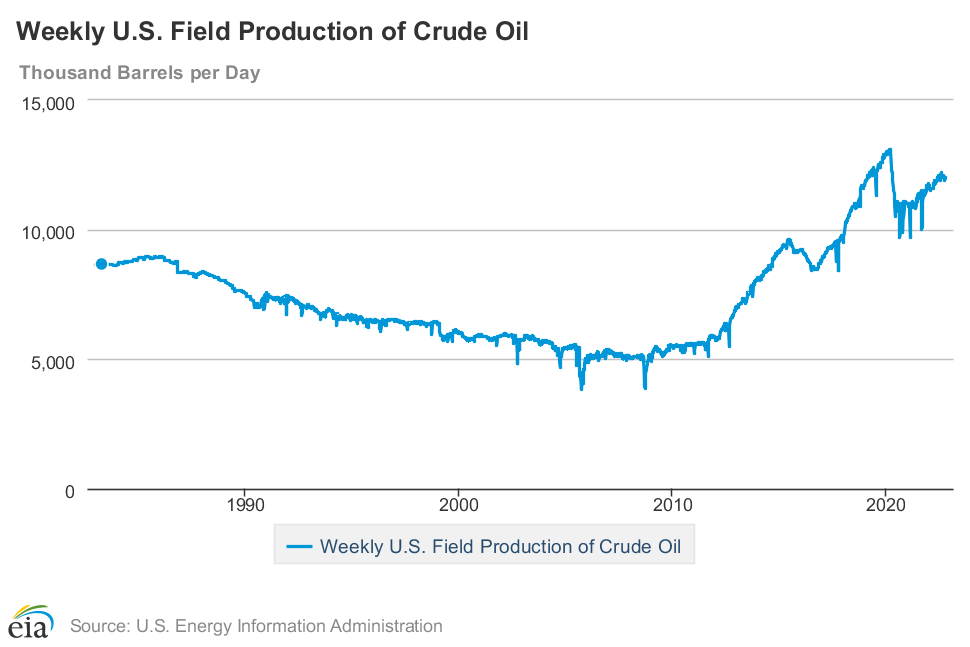

Nevertheless, a deeper look at the figures from the EIA show weekly field production increasing for the first time since August, with the figure climbing to 12,000K from 11,000K in the week ending October 7, and the development may provide OPEC with greater scope to further adjust its production schedule at the next Ministerial Meeting on December 4 as rising interest rates across advanced economies curbs the outlook for oil consumption.

With that said, the advance from the September low ($76.25) may turn out to be a key reversal in the price of oil as it defends the January low ($74.27), and a bull-flag formation may unfold over the coming days as crude appears to be reversing a head of the monthly low ($80.87).

Crude Oil Price Daily Chart

Source: Trading View

- A bull-flag formation may unfold in the price of oil as it appears to be reversing ahead of the monthly low ($80.87), with the move back above the $84.20 (78.6% expansion) to $84.60 (78.6% expansion) raising the scope for a further advance in crude as it appears to be breaking out of a descending channel.

- A move above the 50-Day SMA ($87.15) bring $88.10 (23.6% expansion) on the radar, with a break/close above the 90.60 (100% expansion) to $91.60 (100% expansion) region opening up the monthly high ($93.64).

- However, failure to defend the monthly low ($80.87) would negate the bull-flag formation, with a move below the $78.50 (61.8% expansion) to $79.80 (61.8% expansion) region bringing the $76.50 (50% expansion) to $76.90 (50% retracement) area back on the radar.

Trading Strategies and Risk Management

Becoming a Better Trader

Recommended by David Song

— Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong