- rally goes into overdrive after OPEC provides no reduction

- Euro underneath stress, may worsen when ECB meets subsequent week

- Powell doesn’t say a lot however shares like that, peace talks resume

Commodity markets panic

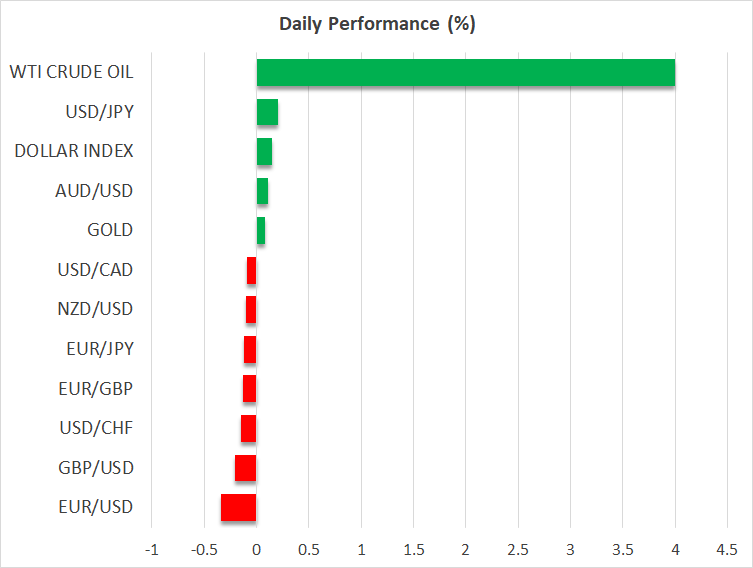

The storm in commodity markets is popping right into a hurricane. What began out as an vitality shock due to the suffocating sanctions on Russia has began to broaden out, lighting a hearth underneath meals costs and metals.

Oil costs have been on the tip of the spear all through this commodity rally, charging larger to succeed in ranges final seen in 2008. There are widespread studies that merchants and corporations around the globe are refusing to the touch Russian oil regardless that there haven’t been any express sanctions imposed on it, which is creating a way of shortage.

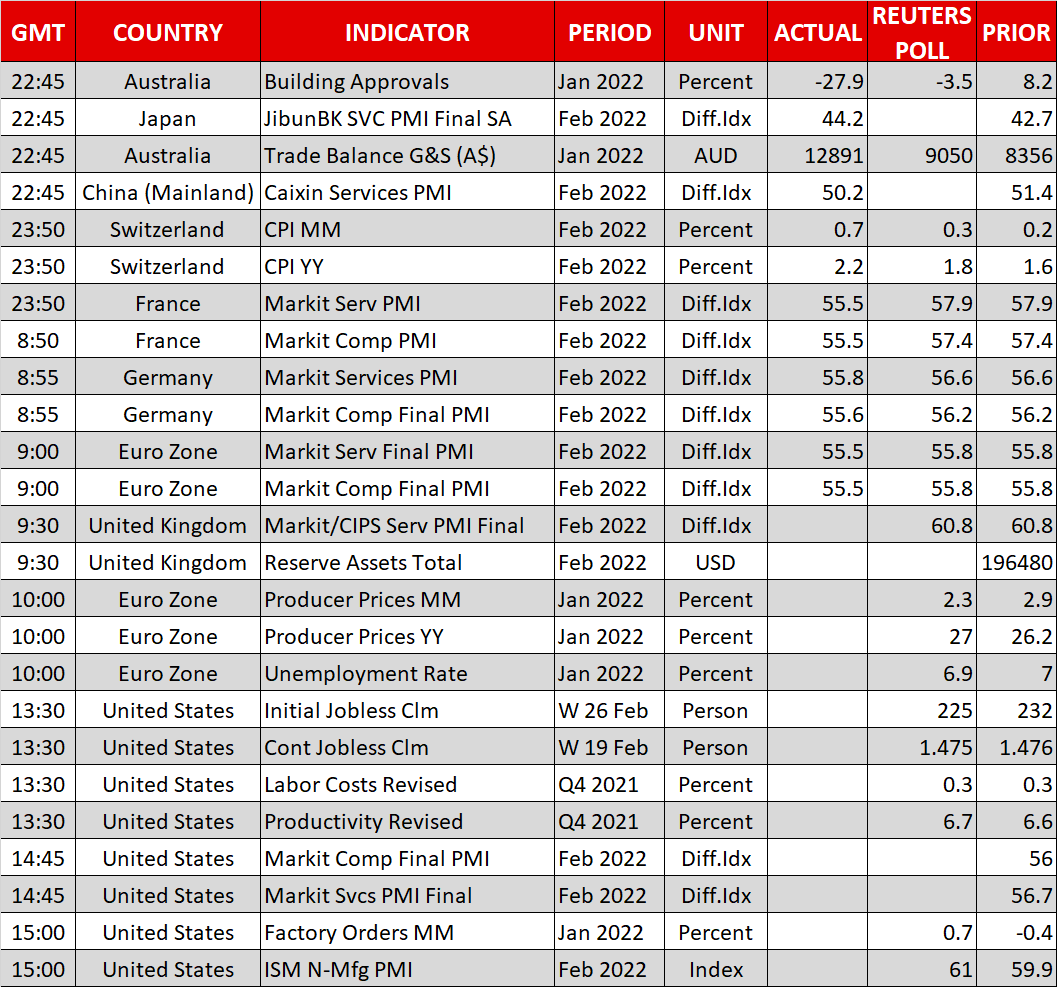

Futures markets inform the entire story as most commodities have reached file ranges of ‘backwardation’, which basically means traders are keen to pay a wealthy premium for securing provide instantly. OPEC didn’t assist alleviate this scarcity in any respect yesterday, sticking to its plan so as to add provide very step by step regardless of the mayhem within the markets.

Actually unhealthy information for the euro

With meals costs now becoming a member of vitality costs of their march larger, merchants are betting inflationary pressures gained’t go away anytime quickly. Market-based inflation expectations metrics have skyrocketed these days, making a headache for central banks, particularly the European one.

The ECB will meet subsequent week and it faces an not possible dilemma. European progress will most likely take a critical hit as shoppers get squeezed by hovering meals and vitality prices. The banking sector may even exacerbate any slowdown given its publicity to Russian belongings. Alternatively, inflation is prone to warmth up even additional.

Subsequently, the ECB must select – prioritize progress and settle for a interval of upper inflation, or forge forward with larger charges and threat crashing the financial system? For the euro, each selections are damaging. Both the central financial institution will pause its normalization plans or it’s going to threat one other coverage mistake.

In distinction, the US financial system faces solely an inflationary shock. America is vitality unbiased and its banks have virtually no publicity to Russian cash, so that is unlikely to hamstring financial progress. In brief, current developments argue for extra ache in euro/greenback and the technical image tells an identical story.

Equities cheer Powell testimony

The temper in inventory markets improved yesterday after the Fed chief performed down the prospect of a 50 foundation factors price improve throughout his Congressional testimony. Treasury yields moved larger as effectively, though that gave the impression to be pushed by the leap in vitality costs, not something Powell stated.

It’s fairly putting that inflation expectations have risen rather more than nominal yields these days, retaining actual yields suppressed. That’s one other means of claiming inflation will spike however central banks gained’t take a sledgehammer to strike it down, which paints a positive image for gold costs.

Elsewhere, the Financial institution of Canada raised rates of interest as anticipated. The choice did not have a right away influence on the , however with the central financial institution uncertainty out of the best way, the foreign money managed to realign itself with oil costs within the aftermath.

As for right this moment, Powell will testify once more, this time earlier than the Senate. On the information entrance, the ISM providers PMI could possibly be essential forward of tomorrow’s US employment report. The minutes of the most recent ECB assembly will even be launched however are most likely outdated given current occasions.

Maybe most significantly, the second spherical of peace talks between Ukraine and Russia is anticipated to kick off. Merchants might be hanging on each phrase. Any indicators of de-escalation may spark enormous reversals in monetary markets, particularly as a result of that appears unlikely with the preventing intensifying these days.