Marje

Funding thesis

I do not normally wish to personal cyclical companies and attempt to look for individuals who carry out nicely in as many financial environments as potential. I’m making the exception with NVR, Inc. (NYSE:NVR) due to its excessive returns on capital, rising margins, and spectacular enterprise mannequin.

As I’ll present on this article, NVR just isn’t a classical home builder with a leveraged steadiness and excessive dangers associated to land and housing stock.

NVR’s distinctive enterprise mannequin permits the corporate to profit from the upside of an inflationary surroundings whereas it will get safety on a downturn, as we noticed within the 2007-2009 monetary disaster when it had one of the best efficiency in comparison with its friends.

The corporate is having fun with some tailwinds from a scarcity within the housing market within the U.S., and it operates in a number of the greatest states of the nation.

The housing enterprise just isn’t more likely to be disrupted by any new know-how or synthetic intelligence, which gives an additional margin of security over the long run.

Firm background

NVR is among the largest U.S. homebuilders (primarily single-family indifferent properties) and enhances its enterprise with a mortgage banking division to totally serve its clients.

The corporate was fashioned in 1980 in Virginia, it at present operates in fifteen states within the japanese a part of the U.S. and Washington DC, and operates underneath three enterprise names, Ryan Properties, which is marketed primarily to first-time consumers at extra inexpensive costs, NVHomes, and Heartland Properties, its dearer and luxurious segments.

The corporate has advanced its enterprise mannequin and it isn’t the standard homebuilder. In 1992, NVR filed for chapter due to reducing demand for brand new housing in an over-built market and unhealthy danger administration, because it had an overloaded steadiness of stock ($600MM at the start of 1990 for $30MM web revenue in 1989).

The corporate discovered its lesson, and as we’ll see within the subsequent sections, it has allowed it to cut back danger, carry out higher than its rivals, and deploy its capital in a extra environment friendly means.

Within the upcoming years, the corporate concentrated its enterprise on fewer states and made some small acquisitions to enter surrounding markets and enhance effectivity. In 1997, it acquired Fox Ridge Properties for $20MM, getting into the Nashville market, in 2005 it purchased Marc Homebuilders, which operated within the Columbia South Carolina market, and in 2012 it acquired Heartland Properties for $17MM, the second-largest homebuilder in Pittsburgh.

Enterprise mannequin

What makes NVR’s enterprise mannequin specific is that as a substitute of buying the land straight, they management it by means of choices, which generally vary as much as 10% of the acquisition worth of completed heaps. To get management over the land, they signal land buy agreements (LPA) with land builders and provides a deposit within the type of money or letters of credit score (normally money), which permits the corporate to keep away from the monetary necessities and limits its danger in a market downturn since they will stroll away and never train the choice.

Utilizing this buy mannequin, NVR will get safety on the draw back, whereas profiting in an inflationary surroundings with rising land costs.

As soon as they’ve organized with the ultimate dwelling consumers the supply of the homes and received the preliminary deposits, they train the LPA and begin the development, which is normally delivered in lower than 90 days to its clients.

NVR leases seven manufacturing amenities the place they inventory a number of the constructing supplies and pre-assemble them earlier than delivering them to the constructing website to cut back supply instances and enhance stock rotation.

The corporate presents a restricted variety of home fashions that may be personalized, which requires much less materials stock and design prices. As talked about earlier, NVR operates on the East Coast with a better geographical focus when in comparison with its rivals, which permits the corporate to be extra environment friendly and develop sturdy relations with land builders.

On high of the development section, which represents over 97% of whole revenues and 92% of web revenue (2Q 2023), NVR additionally has a mortgage banking division that gives mortgages to 86% of its dwelling consumers. To keep away from carrying the liquidity danger, the corporate sells all its mortgages to buyers within the secondary markets, normally inside 30 days from the mortgage closing.

The corporate employs roughly 6,550 full-time staff, of whom 5,500 are working within the homebuilding section and 1,050 within the mortgage banking operations. Critiques from staff are in keeping with its rivals (3.7 out of 5 at Glassdoor).

Because the firm operates on the East Coast, I consider NVR has fewer dangers in a market downturn in comparison with its rivals, since these are states with a better share of public staff, like Washington D.C., Delaware, Virginia, New Jersey, or Maryland.

Relating to seasonality, NVR usually has greater new orders within the first half of the yr and better dwelling settlements and web revenue within the second half.

This conservative enterprise mannequin in a cyclical trade paid off in the course of the 2007-2009 nice monetary disaster when NVR’s inventory fell by 65% from its peak on the finish of 2005 to its backside in March 2009, whereas different homebuilders like Lennar Company (LEN) fell 95%, PulteGroup, Inc. (PHM) 93%, and D.R. Horton, Inc. (DHI) 91%.

Financials

One of many points that caught my consideration about NVR’s enterprise mannequin is its spectacular financials since I do not normally personal shares that function in cyclical industries.

I consider it is very important consider NVR’s efficiency by means of the entire cycle, and never just some years the place the corporate carried out higher than common prefer it has performed in the newest years because of a scarcity of housing, as we’ll see later, and a low-interest surroundings.

Since NVR does not personal the land till it begins constructing, it has a lightweight steadiness, the place virtually half of the property are money. Within the 2Q 2023, the corporate had $2.6B in money for a complete asset steadiness of $6.2B. It had $1.8B of heaps and housing models lined underneath gross sales agreements with clients and $438MM in mortgages held on the market. Constructing supplies are simply $22.41MM (2Q 2023), which reduces the chance on a draw back but additionally limits the upside in an inflationary surroundings since they can not profit from the rising price of constructing supplies held in inventory.

On the fairness and legal responsibility aspect, $4.1B is fairness and $900MM are its Senior Notes due 2030 at a 3.00% rate of interest.

This asset-light steadiness with excessive stock turnover permits NVR to realize superior returns on capital, which might be reinvested within the enterprise and returned to shareholders by means of share buybacks.

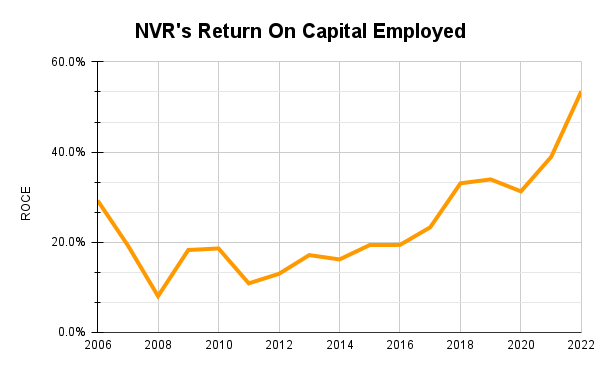

Creator (Knowledge from NVR’s Annual Experiences)

When reviewing NVR’s return on capital employed by means of the entire cycle, from the heights of the housing market in 2006 to 2022, the typical ROCE is at 24%.

It would not be truthful to guage NVR’s efficiency with the newest outcomes, for the reason that firm had gross margins of 26.7% in 2022 and 23.6% in 2021, means above its common gross margins of 19% (2006-2022) due to rising inflation, low-interest charges and the pandemic impact have been many households have been searching for transferring into greater homes, and I anticipate margins to cut back within the upcoming years.

The information that I consider is consultant, aside from the rising ROCE, is that the corporate has been in a position to enhance its web revenue margins due to its working leverage and the discount of its promoting and administrative bills in comparison with revenues.

In 2006, with a 22.1% gross revenue margin, NVR’s web revenue margins have been at 9.6%, whereas in 2019 and 2020, with gross revenue margins at 20.2% and 20.8% respectively, web revenue margins have been at 11.8% and 11.9%.

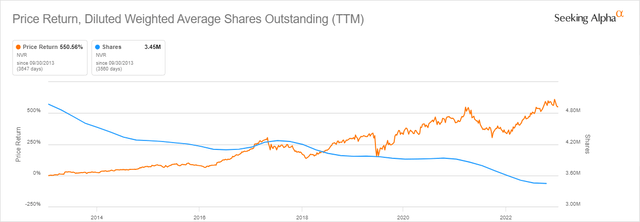

NVR has low Capex because it leases its workplaces and manufacturing amenities and it has restricted capability to reinvest its free money movement into the enterprise. Over the last 10 years, it has reinvested a median of twenty-two.4% of its money from operations into the enterprise and has spent $7.3B on share repurchases (101% of its money from operations). The entire diluted shares excellent have diminished from 4.86MM in 2013 to the present 3.46MM within the 2Q of 2023, eliminating virtually 29% of its excellent shares, which has boosted its share worth.

Searching for Alpha

For my part, it is a high capital allocation, the place administration deploys the capital into the enterprise with out forcing an excessive amount of geographical enlargement to keep up its aggressive benefit and main market place whereas returning the remaining free money movement by means of share buybacks, a extra environment friendly means in comparison with dividends when searching for to compound.

Housing market scarcity

To research the present state of the housing market within the U.S., we want to try the speed of family formation and the availability of latest properties.

Within the U.S., there are at present 130.2MM households (August 2023, Yardeni Analysis, Inc.) rising at a median price of 1.3% yearly, which might correspond to 1.69MM new households per yr.

This knowledge is just like the 1.62MM new models wanted per yr calculated on a Freddie Mac research in regards to the housing provide, which incorporates 1.1MM for brand new family formation, 0.3MM to exchange depreciated current properties, 0.1MM for second properties, and 0.1MM for emptiness.

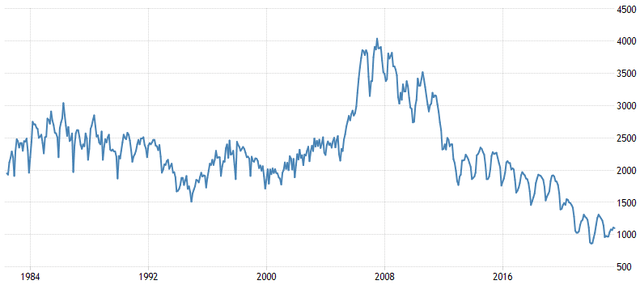

If we have a look from an extended timeframe perspective, since 1959 till the nice monetary disaster, there have been solely two years of housing begins beneath 1MM models, and since then there have been six. The market has been balancing the over-supply in the course of the 1998-2007 upcycle, however the principle query to reply can be, is there a scarcity within the U.S. housing market?

Through the 1998-2007 interval, the variety of family formations totaled 14.99MM, whereas the availability of latest homes was 17.18MM, giving us an over-supply of two.19MM properties.

From 2008 to 2022, the variety of new properties averaged 1.06MM properties delivered per yr, means beneath the typical of 1.6MM of latest properties wanted, with a deficit of 0.44MM properties per yr. The over-supply of two.16MM properties had been already lined within the subsequent 5 years, and from 2014 till 2022, we accrued an under-supply that totaled roughly 3.5MM properties and the housing stock has fallen to an unprecedented low stage.

Tradingeconomics.com (Knowledge from the Nationwide Affiliation of Realtors)

In the newest report from the U.S. Division of Housing and City Growth for August 2023 constructing permits have been at 1.54MM, assembly the present long-term common demand for brand new housing.

The present scenario would require dwelling builders to ship a better variety of new properties per yr to cowl the under-supply, in any other case, dwelling costs would enhance considerably, as now we have not too long ago seen.

From 2001 till 2Q of 2023, dwelling costs have been rising at a median of two.8% CAGR, however costs elevated considerably quicker from 2019 at a 6.8% price. Even when inflationary pressures performed their position, I consider the present state of the housing market may gain advantage homebuilders over the upcoming years.

From a short-term perspective, greater rates of interest would intuitively be seen as detrimental for homebuilders due to decrease demand from new consumers, however this additionally limits present owners from promoting their properties that have been purchased at decrease rates of interest.

If we take note of that present owners will not be incentivized to promote their properties, and new households are fashioned yearly, the most definitely consequence can be greater costs, even in a recession.

As quickly as rates of interest go down, new dwelling provide ought to enhance to satisfy the under-supply accrued over the last years. Present expectations from the Federal Reserve are that charges will keep at present ranges for a while, declining to 4% in 2025 and a pair of.9% in 2026, however this will change rapidly primarily based on the financial system’s efficiency, which for now appears to be sturdy.

Anticipated progress

I do not anticipate new properties delivered to develop quick within the quick time period since 30-year mounted loans are at present at over 7%, however I additionally anticipate the costs to maintain at present ranges or develop for the following years.

That is the development now we have seen the final quarter, with settlements reducing by 13% when in comparison with the 2Q of 2022, however costs on the similar ranges. The excellent news is new orders elevated by 27% and the cancelation price was 11%, in comparison with 14% a yr in the past.

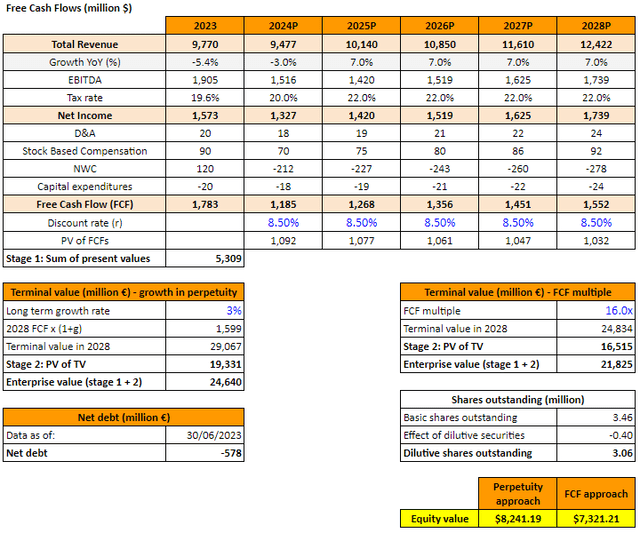

Because the second half of the yr used to have greater revenues and new orders are rising, I agree with present estimates of income at $9.7B for 2023, a 5.4% lower from 2022. For 2024, I anticipate revenues to lower by 3% at $9.4B, which is extra pessimistic in comparison with analyst expectations of $10.37B. I anticipate working margins to lower from 19.5% in 2023 to 14% margin from 2025 onwards and web revenue margins at 13% due to decrease administrative bills as the corporate turns into bigger, persevering with with final decade’s development.

From 2025, I anticipate revenues to develop at 7%, above its historic common primarily based on the present under-supply that must be lined. I used an 8.5% low cost price, given its 3% price of debt, a ten% price of fairness, a 22% tax price, and 20-80 weight for debt and fairness. The long-term progress price I anticipate is at 3%, decrease than the typical historic inflation price and assuming there is not new family formation, which I consider is a extremely conservative situation.

In my base case situation, I already included all exercisable shares from administration and I assume the corporate is lowering the 4% yearly, which already consists of the dilutive impact from administration inventory choices.

Creator

From a terminal worth perspective, my truthful worth can be $8,241, whereas from an FCF a number of perspective at 16x LTM FCF, it might be $7,321. The typical truthful worth is $7,781, presenting a 30% upside from present costs.

When making use of the identical mannequin however with a ten% web revenue margin, which I consider can be the low finish of a recessive cycle, the truthful worth can be at $5,715, limiting the draw back at present costs and simply overpaying by 5%. In that situation, web revenue can be at $0.95B in 2024 and $1.01B in 2025.

Valuation

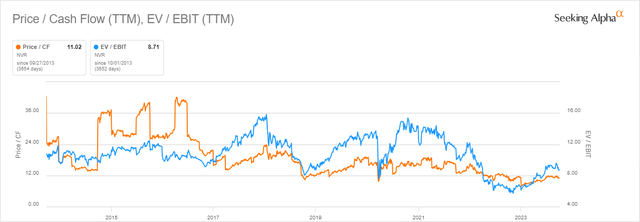

NVR is at present buying and selling at 11x LTM FCF/EV and eight.7x EBIT/EV, however I consider this isn’t consultant since 2022 was an irregular yr from a margin and FCF perspective.

Searching for Alpha

For my part, it might be extra correct to evaluate the present valuation with the following twelve months free money movement, and it might be at present buying and selling at about 12x-15x, relying on utilizing my estimates offered on the mannequin or consensus estimates, which I consider are just a little optimistic. NVR is buying and selling beneath its subsequent twelve months FCF/EV common of 16.8x for the final 10 years.

Dangers

The primary danger I see from NVR can be a powerful financial disaster with a quick enhance in unemployment whereas rates of interest don’t come down due to excessive inflation.

This situation might be brought on by power worth will increase or a scarcity of products that limits NVR’s capability to ship new properties.

This may additionally go away NVR with some mortgages pending on the market that would lower in worth, the corporate at present owns $438MM in mortgages on the market. These mortgages might trigger losses if rates of interest proceed to extend for the reason that firm couldn’t have the ability to match the rates of interest dedicated with its clients at origination with rates of interest paid by third events that purchase these loans from NVR.

If rates of interest come down throughout a recession, a number of the ache from greater unemployment might be compensated by rising new orders coming from the under-supply accrued over the last years.

Conclusion

Despite the fact that there are some dangers if a tough touchdown is to come back, and NVR is working on a cyclical enterprise, I consider the standard of the corporate, its managed danger construction, and the present low cost greater than compensate for these short-term dangers.

I see a risk-reward asymmetry given the present scarcity within the housing market within the U.S. and I consider present costs are already considering a lower in revenues and margins.

In a base case situation, my truthful worth is at present at $7,781, representing a 30% upside and that’s the reason I price NVR inventory as a purchase.