- As we strategy the tip of 2023, traders are gearing up for 2024, specializing in potential high-growth shares.

- On this piece, nevertheless, we’ll analyze the high-flyers of 2023 and whether or not their bullish momentum can carry into 2024.

- We are going to check out the highest three performers of the S&P 500, which incorporates the likes of Nvidia and Meta Platforms.

- Seeking to beat the market in 2024? Let our AI-powered ProPicks do the leg be just right for you, and by no means miss one other bull market once more. Be taught Extra »

As we strategy the tip of 2023, traders are proactively fine-tuning their portfolios for the upcoming 12 months, 2024.

Whereas it is crucial to pinpoint new shares poised for explosive development within the coming 12 months, a eager eye can be being saved on the sturdy performers of 2023, evaluating the potential for his or her bullish momentum to increase into 2024.

Inside the , three standout performers have dominated this 12 months. Within the following evaluation, we’ll delve into every of those shares individually, assessing whether or not their exceptional momentum could be sustained within the upcoming 12 months.

Nvidia

In 2023, chipmaker Nvidia Company (NASDAQ:), which made the a lot of the synthetic intelligence tailwind, managed to extend its market dominance within the manufacturing of AI processors as much as 90% with its proactive strategy to the sector.

This breakthrough, which opened an enormous hole with its closest rivals, was priced extraordinarily positively by traders Nvidia’s inventory has risen 237% for the reason that starting of 2023, making it probably the most appreciated inventory within the S&P 500.

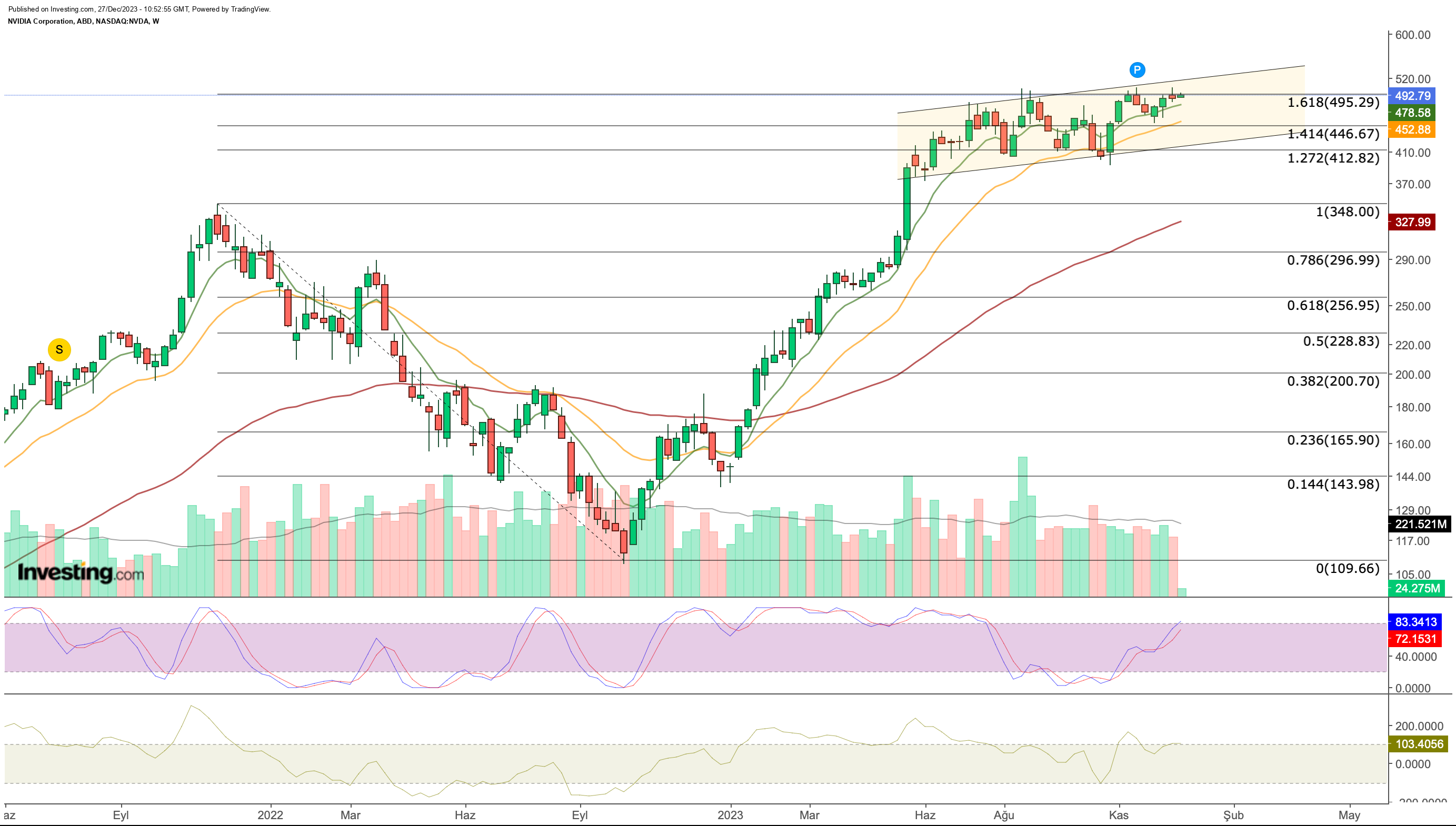

Supply: InvestingPro

The corporate’s sturdy monetary efficiency continues to positively affect its share worth. Notably, it has constantly exceeded expectations by way of revenue per share and income development over the previous 12 months.

Though Nvidia’s share skilled vital momentum within the first half of the 12 months, there was a slight slowdown within the second half. Nonetheless, the general outlook stays bullish.

Analyzing the 2024 forecasts for Nvidia on InvestingPro, it’s evident that analysts broadly anticipate sustained income and revenue development.

Thirty-six analysts venture a development fee exceeding 10% for each income and revenue, particularly within the first quarter of the upcoming 12 months.

Consultants assert that there’s appreciable room for development within the synthetic intelligence sector, and Nvidia, a key producer of high-performance chips for this sector, is predicted to hold the constructive development noticed in 2023 into the following 12 months.

In keeping with InvestingPro’s honest worth evaluation, the present honest worth for NVDA is calculated at $510 primarily based on current valuations. Analyst estimates recommend that the inventory may doubtlessly rise to a mean of $650 in 2024.

Technically talking, NVDA’s continuation of its barely upward trending channel motion within the second half of the 12 months is the primary hanging view.

On this path, a mean of $490 (Fib 1,618) has shaped a resistance.

If the $500 band is caught with weekly closes, technically we are able to see that NVDA can transfer to the following goal zone within the $700 band. Within the decrease zone, round $410 appears to be an necessary help to maintain the development intact.

Meta Platforms

Meta Platforms (NASDAQ:) has achieved the second-highest return amongst S&P 500 shares this 12 months with an almost 195% enhance in worth.

Though the corporate has made vital investments within the Metaverse and digital actuality lately, it has not been capable of obtain the specified momentum on this discipline because of the lower-than-expected development of the sector and a few authorized obstacles.

Nonetheless, Meta’s agency foothold within the social media trade continues to make a major contribution to the corporate’s returns.

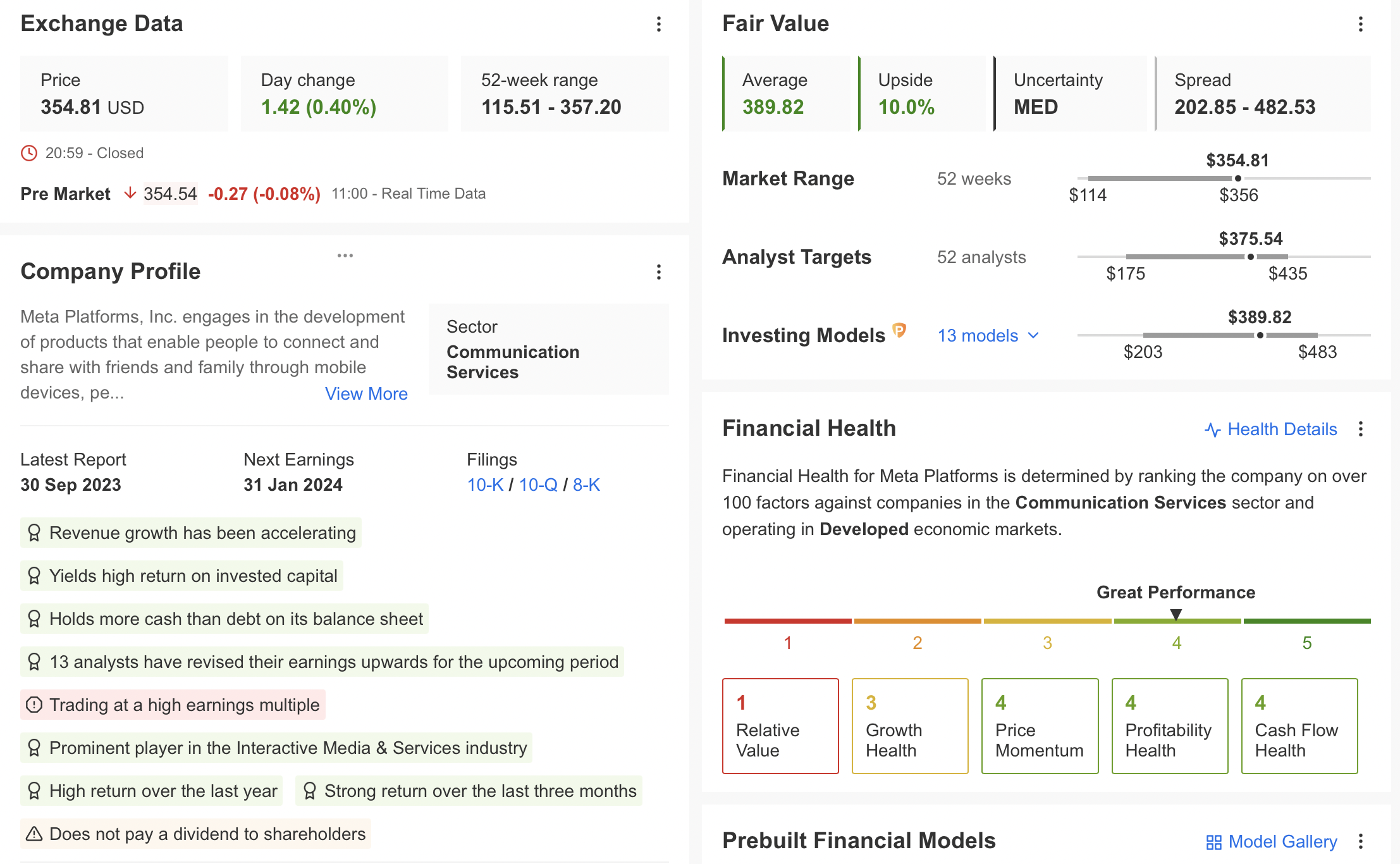

Supply: InvestingPro

This 12 months, Meta expanded its social media footprint with Threads, a posting app much like X after Fb, Instagram, and WhatsApp.

Along with the continued rise of Meta inventory all year long, the corporate continued to exceed expectations because it introduced sturdy monetary outcomes all year long.

All through 2024, if income development continues to exceed expectations, META’s share is prone to keep its development within the new 12 months.

Whereas META moved in a downtrend within the one 12 months till the tip of 2022, it largely compensated for its losses within the earlier 12 months with this 12 months’s positive aspects.

The resistance level 320 {dollars} (Fib 0.786), which the share worth had problem with, particularly within the July – November interval, could be interpreted as an necessary transfer.

Technically, the following resistance for META appears to be the 2021 peak of $381. If this worth is exceeded with weekly closures, we are able to see that the inventory can transfer in direction of the vary of $460 – $560 in 2024.

Royal Caribbean Cruises

Shares of Royal Caribbean Cruises (NYSE:), one of many main firms within the cruise trade, entered the highest 3 within the S&P 500 with a 160% enhance in worth for the reason that starting of the 12 months and managed to exceed its worth within the pre-Covid interval.

With the acceleration of trip spending within the post-pandemic interval, the cruise firm working worldwide has additionally managed to extend its income by 66% within the final 12 months.

Though the corporate has gained vital development momentum this 12 months, it’s doable to see some issues when its financials.

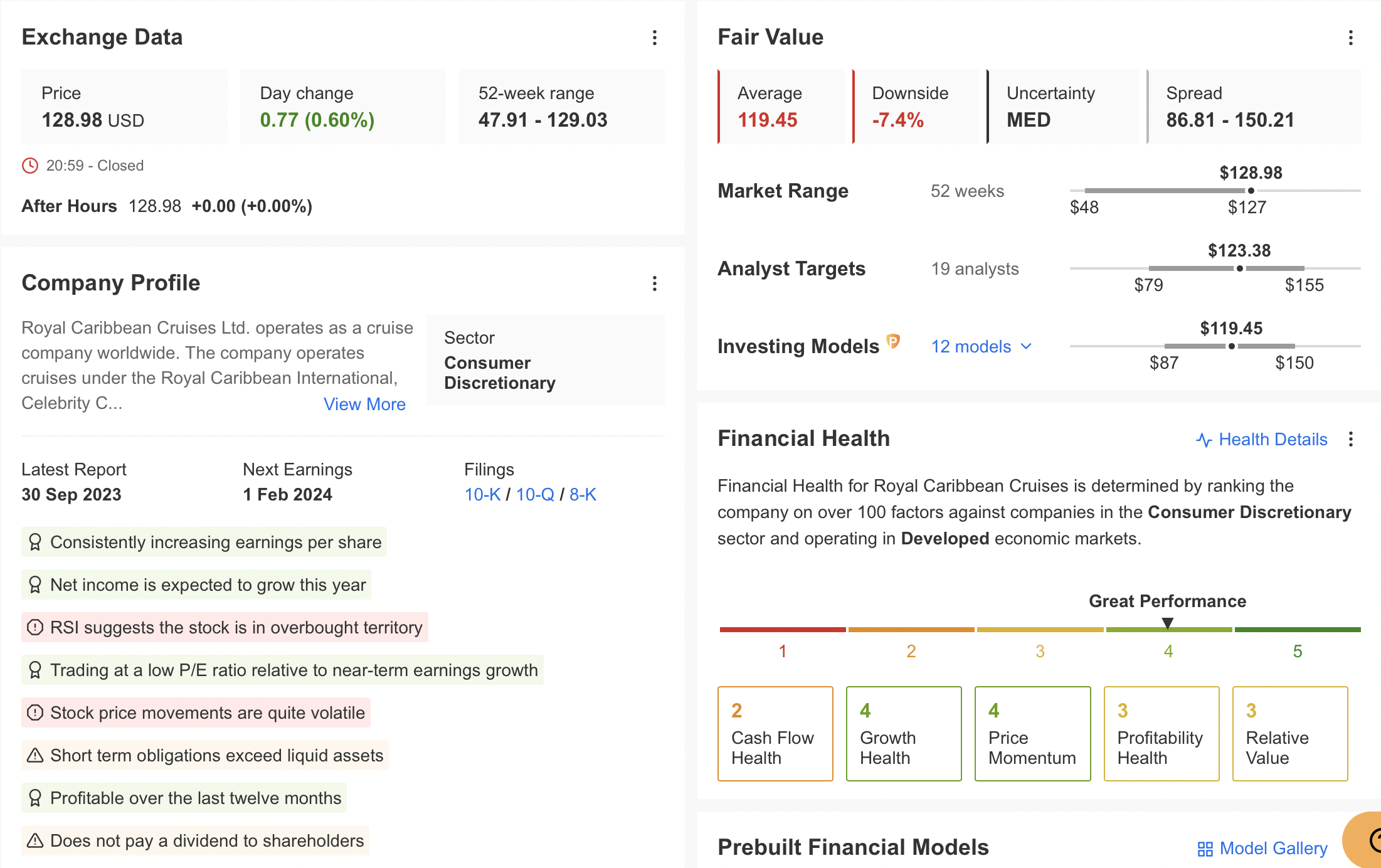

If we have a look at Royal Caribbean’s monetary abstract through InvestingPro; we are able to see that it has an issue equivalent to short-term debt obligations being above liquid belongings.

Supply: InvestingPro

That is because of the firm’s excessive quantity of debt to outlive resulting from its falling income in the course of the pandemic. The corporate has survived this troubled interval however has additionally seen a weakening in its steadiness sheet after the robust interval in 2020 occasions.

Nonetheless, the corporate, which has generated vital money move this 12 months, has managed to stay steady whereas having no issues with debt compensation.

The volatility of the share worth and the truth that the corporate doesn’t distribute dividends give the impression that it’s not very favorable for long-term funding in the intervening time, contemplating its excessive indebtedness.

If we have a look at the constructive elements of RCL; we are able to depend the regular enhance in EPS this 12 months, the continued development in internet revenue, and the low P/E ratio accordingly.

In 2024, demand for cruises may have a direct influence on RCL’s efficiency.

After we have a look at RCL from a technical viewpoint, the primary hanging element is that the inventory maintains its development and strikes alongside the rising channel.

On this approach, if the share, which managed to go the $ 100 – $ 115 resistance space, can proceed to extend its money move recurrently, the inventory can transfer in direction of the $ 160 band in the identical path.

Within the decrease area, $115 stands as the primary help worth, whereas under this worth, a correction might come as much as the $ 80 band under $100 in weekly closures.

InvestingPro honest worth evaluation, alternatively, sees the inventory barely overvalued in keeping with the most recent monetary outcomes and predicts a decline to $ 119.

***

In 2024, let onerous choices grow to be straightforward with our AI-powered stock-picking instrument.

Have you ever ever discovered your self confronted with the query: which inventory ought to I purchase subsequent?

Fortunately, this sense is lengthy gone for ProPicks customers. Utilizing state-of-the-art AI know-how, ProPicks supplies six market-beating stock-picking methods, together with the flagship “Tech Titans,” which outperformed the market by 670% over the past decade.

Be a part of now for as much as 50% off on our Professional and Professional+ subscription plans and by no means miss one other bull market by not understanding which shares to purchase!

Declare Your Low cost At the moment!

Disclaimer: The creator doesn’t personal any of those shares. This content material, which is ready for purely academic functions, can’t be thought-about as funding recommendation.