- US-China chip commerce sees short-term pause, easing restrictions, boosting Nvidia’s cross-border operations.

- China’s antitrust probe on the corporate could price 1–10% of income, affecting inventory sentiment.

- Its document $26 billion revenue helps sturdy fundamentals, doubtlessly driving shares above $184.

- In search of actionable commerce concepts to navigate the present market volatility? Subscribe right here to unlock entry to InvestingPro’s AI-selected inventory winners.

The continued commerce battle primarily entails the US and China, focusing closely on laptop chips. There’s a brief pause on this battle till at the very least November 10. Throughout this time, each international locations have relaxed some restrictions: the US is permitting extra superior chip gross sales, and China has resumed exporting essential uncooked supplies utilized in electronics and vehicles. , a serious chip firm, is caught within the center and is affected extra by political selections than financial ones.

China Fortifies Its Bargaining Place

Antitrust violation proceedings have began, doubtless tied to the continuing financial talks in Madrid between the US and China, presumably as a strategic transfer in negotiations. Beijing accuses US firm Nvidia of breaking the principles concerning its 2020 buy of Israeli firm Mellanox Applied sciences. Nvidia was allowed to make this buy on the situation that it could pretty distribute merchandise in China, however that is now being questioned. If discovered responsible, NVIDIA would possibly face fines between 1% and 10% of its annual income.

Since China’s market makes up 13% of Nvidia’s complete income, shedding gross sales there would considerably affect the corporate, presumably reducing its inventory worth. Nvidia’s CEO, Jensen Huang, warned that if the US restricts its enterprise with China, rivals like Huawei may step in, serving to China turn into extra self-sufficient on this space. Traders are intently watching the negotiations, as their outcomes would possibly affect Nvidia greater than the corporate’s .

Nvidia’s Elementary Energy

Nvidia’s newest monetary report reveals that its web revenue is constant to develop quickly, reaching a brand new document excessive of over $26 billion.

Supply: InvestingPro

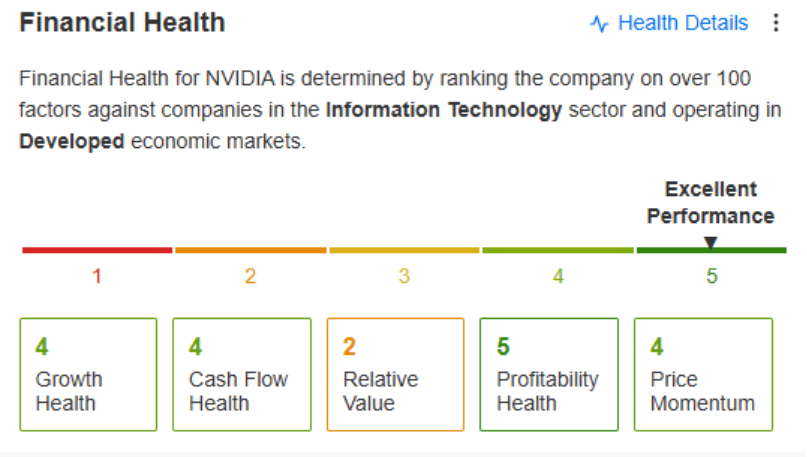

This spectacular revenue contributes to Nvidia receiving the best score on the monetary well being index, signaling a really sturdy basis for the corporate’s future progress.

Supply: InvestingPro

So, if geopolitical points and the outcomes of commerce negotiations don’t turn into main obstacles, Nvidia’s inventory worth may preserve rising.

Nvidia’s Share Decline Pauses

In late August and early September, Nvidia’s inventory worth stopped its decline at round $164 per share, successfully resulting in sideways motion. The present worth is close to its historic excessive of round $184 per share. The most certainly state of affairs is that the inventory will break by this excessive and proceed to rise, particularly because the information about attainable antitrust violations hasn’t prompted a major drop in worth.

For individuals who are optimistic about Nvidia’s inventory (the bull camp), a adverse sign can be if the value drops under the help degree of $164 per share. If this occurs, it may result in additional declines, doubtlessly bringing the value all the way down to round $144 per share.

InvestingPro offers a complete suite of instruments designed to assist buyers make knowledgeable selections in any market atmosphere. These embrace:

- AI-managed inventory market methods re-evaluated month-to-month.

- 10 years of historic monetary knowledge for 1000’s of worldwide shares.

- A database of investor, billionaire, and hedge fund positions.

- And plenty of different instruments that assist tens of 1000’s of buyers outperform the market day by day!

Not a Professional member but? Try our plans right here.

Disclaimer: This text is written for informational functions solely. It’s not meant to encourage the acquisition of property in any means, nor does it represent a solicitation, supply, suggestion or suggestion to speculate. I want to remind you that every one property are evaluated from a number of views and are extremely dangerous, so any funding resolution and the related threat belongs to the investor. We additionally don’t present any funding advisory providers.