- Q2 2023 Efficiency: Normalized EPS: $2.70, GAAP EPS: $2.48, Income: $13.51 billion

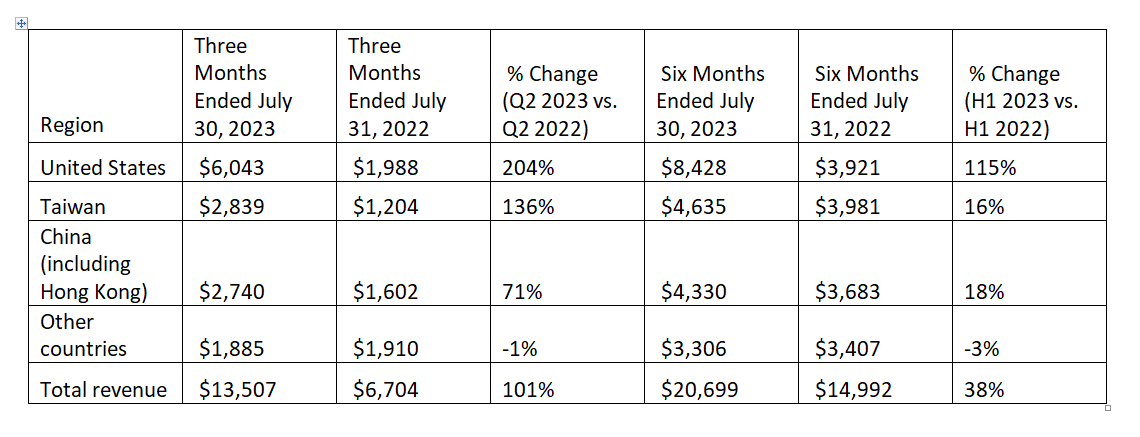

- International Attain: Sturdy income development within the US (204% improve in Q2 2023), with constant development in Taiwan and China (together with Hong Kong), showcasing NVIDIA’s international attain and flexibility.

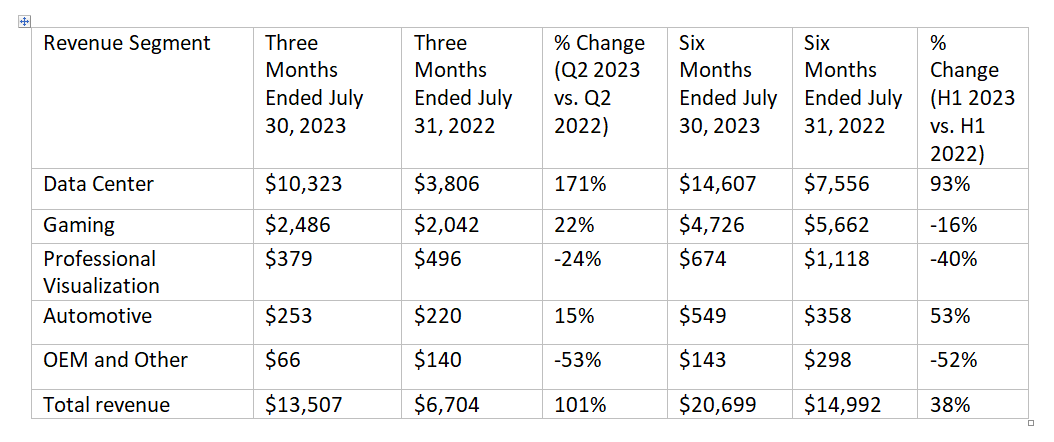

- Development Driver: Information Middle phase is the first income driver, with a 171% improve in Q2 2023 and a 93% improve in H1 2023.

NVIDIA Company (NASDAQ:) has exhibited distinctive monetary efficiency and strategic developments, positioning itself as a frontrunner within the tech business. The corporate’s newest earnings report confirmed excellent outcomes, surpassing market expectations by way of earnings per share (EPS) and income. With a strong basis, NVIDIA is poised for continued development and success.

Distinctive Q2 2023 Efficiency

Within the second quarter of 2023, NVIDIA reported a normalized EPS of $2.70, exceeding the consensus estimate by a formidable $0.63, whereas the GAAP EPS stood at $2.48, $0.75 greater than anticipated. The corporate’s income for the quarter reached $13.51 billion, surpassing expectations by a considerable $2.42 billion. This distinctive monetary efficiency highlights NVIDIA’s capacity to exceed market expectations, making it a sexy funding alternative.

Upcoming Quarter Outlook

Looking forward to the upcoming quarter, the consensus estimate for normalized EPS is $3.35, with projected GAAP EPS at $2.97. Income is anticipated to achieve a median estimate of $16.07 billion. NVIDIA’s sturdy monetary efficiency and the market’s optimistic outlook reveal the corporate’s potential for continued development.

Strategic Developments and Information Middle Dominance

NVIDIA’s strategic bulletins and enterprise highlights additional help its development trajectory. The corporate has made important developments throughout its numerous segments, together with information middle innovation, gaming developments, skilled visualization initiatives, and automotive milestones. NVIDIA’s give attention to innovation and rising applied sciences positions it as a market chief in these sectors. The Information Middle phase stays NVIDIA’s major income driver, with a 171% improve in Q2 2023 and a major 93% improve in H1 2023. The corporate’s management in AI, HPC, and graphics, coupled with rising demand for AI adoption and data-center scale innovation, contribute to its success on this phase.

Gaming Sector Restoration and Challenges

Within the gaming sector, NVIDIA’s GeForce platform boasts a robust place in PC gaming, serving 200 million players globally. With a 22% development in Q2 2023, the gaming phase is exhibiting indicators of restoration, and the introduction of the NVIDIA Avatar Cloud Engine (ACE) for Video games goals to remodel gaming experiences additional. NVIDIA’s Skilled Visualization phase, which holds a 90% market share in workstation graphics, skilled a decline of 24% in Q2 2023. To counter this decline, NVIDIA launched three new desktop workstation RTX GPUs and a significant launch of the NVIDIA Omniverse platform, enhancing AI, graphics, and real-time rendering capabilities.

Automotive Developments

The Automotive phase witnessed a 15% improve in Q2 2023, highlighting NVIDIA’s dominant place in autonomous driving. Partnerships with firms like MediaTek reveal NVIDIA’s dedication to advancing automotive AI and graphics.

International Attain and Market Adaptability

Geographically, NVIDIA’s US income surged by 204% in Q2 2023, affirming sturdy home demand. Taiwan and China (together with Hong Kong) additionally confirmed constant development, emphasizing NVIDIA’s international attain and market adaptability.

Conclusion

Regardless of sure challenges and uncertainties, corresponding to provide chain complexity, product transitions, and international commerce dynamics, NVIDIA stays well-positioned for future success. The corporate’s capacity to innovate, strategic partnerships, and market enlargement alternatives, coupled with its capacity to exceed market expectations, make it a extremely engaging funding possibility. As NVIDIA continues to drive innovation and capitalize on its market benefits, it’s well- positioned for long-term development and success within the tech business. The corporate’s sturdy financials, coupled with its give attention to rising applied sciences and market enlargement alternatives, warrant us to proceed to purchase with a long-term goal within the vary of $620-630.

Disclosure: We don’t maintain any place within the inventory.

Unique Put up