Svetlana Repnitskaya/Second by way of Getty Photographs

Funding Thesis

Northern Oil and Gasoline (NYSE:NOG) offers within the upstream vitality enterprise. The agency has reported stable monetary leads to the final three years and began paying excessive dividends to its shareholders. I will probably be inspecting the financials of the corporate and the demand and costs of the corporate’s merchandise. It has considerably elevated its manufacturing ranges and expanded its footprint via acquisitions which will help it to seize current stable demand and maintain development.

About NOG

NOG is an vitality agency primarily based in america that carries out the acquisition, improvement, exploration, and manufacturing of oil and pure fuel properties primarily within the Permian, Appalachian, and Williston Basins. Later it expanded its presence within the Permian area and in addition accelerated its diversification via massive acquisitions within the basins of Appalachian. The corporate offers in oil and pure fuel manufacturing and exploration by participating on a proportionate foundation together with third-party pursuits in wells which might be drilled and accomplished in spacing items that comprise its acreage. The corporate had roughly 272 thousand internet acres and about 9800 gross wells on the finish of the third quarter. It elevated an extra 18,800 acres to its Permian footprints because the starting of the fiscal yr.

Financials

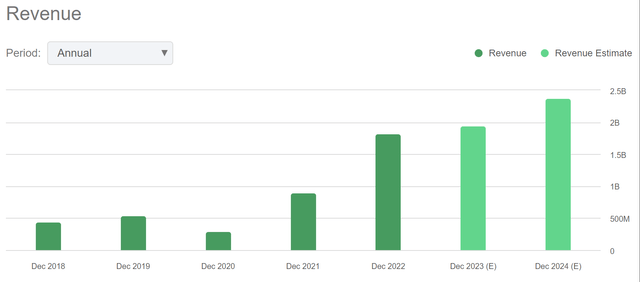

Income Traits of NOG (Searching for Alpha)

NOG has achieved large development within the final three years. The corporate’s oil & fuel income was $975.1 million in FY2021 which is a humongous rise of 200.9% YoY from $324.1 million in FY2020. Within the succeeding yr, the corporate’s oil & fuel income grew to $1.99 billion which is a rise of 103.65% YoY. The elevated manufacturing and costs of oil & pure fuel have helped the corporate to realize this stable development within the final three years.

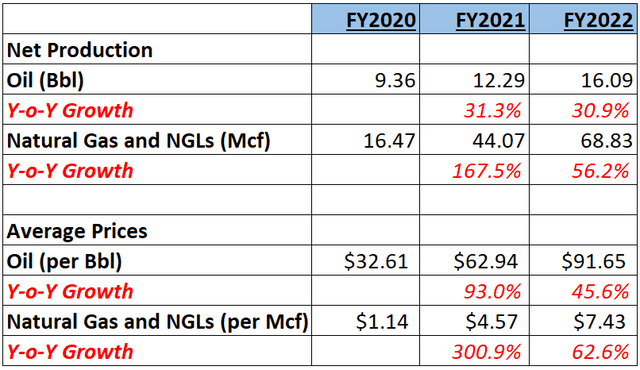

Manufacturing and Promoting Value Historical past of NOG (Worth Quest)

The oil & fuel business is very risky and uncovered to the chance of market fluctuations. It has been impacted prior to now three years resulting from elevated rates of interest, rising materials prices, and geopolitical conflicts. The geopolitical conflicts have resulted in disrupted provide and demand and excessive costs of oil & pure fuel. The elevated income has resulted in vital development of the online earnings.

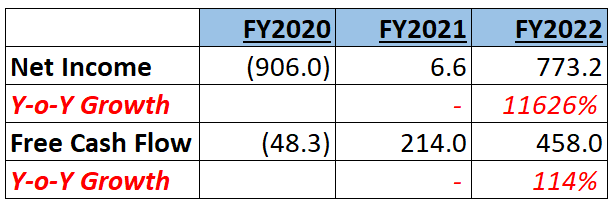

Web Earnings and FCF Historical past (Worth Quest)

In FY2021, the corporate’s internet earnings was $6.6 million which is equal to 0.68% of oil & fuel income and big development in comparison with internet lack of $906 million in FY2020. Its internet earnings skyrocketed in FY2022. The corporate reported internet earnings of $773.2 million in FY2022 which is 38.85% of oil & fuel income. The first driver of this development is favorable product costs and income development outpacing the working bills development.

Even in 2023, the business has proven constructive indicators. The worldwide demand has surged by 2.2 mbpd and has additionally gone past the 100 mbpd level for the primary time in historical past. This development is especially fueled due stable demand from China. Just lately, it was famous that the U.S. is without doubt one of the main exporters and is understood for exporting massive portions that are nearly near the full manufacturing of Russia or Saudi Arabia.

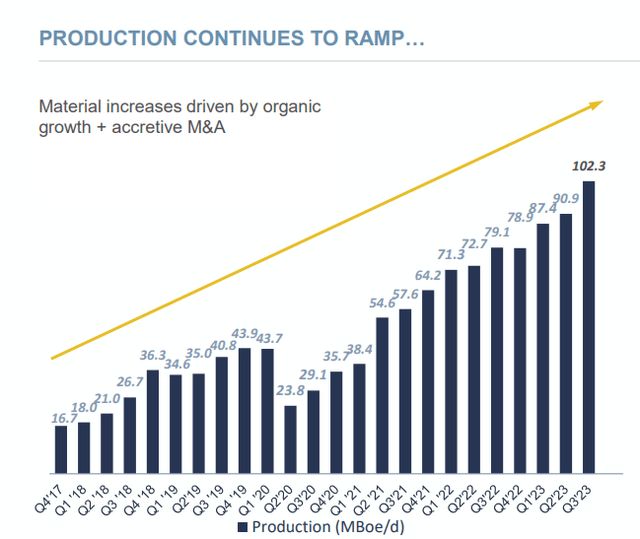

Manufacturing of NOG (Investor Presentation: Slide No: 10)

The corporate has reported its quarterly outcomes. It reported a income of $313.97 million, down 60.33% in comparison with $791.64 million in Q322. This decline was primarily fueled by loss on commodity derivatives and a discount in common gross sales worth. Web earnings declined by 95.50% YoY from $580.85 million to $26.11 million. It reported a diluted EPS of $0.28. This primarily resulted from a rise in manufacturing bills and noncash expenditures. Oil and Gasoline represented about 62% and 38% respectively of the corporate’s manufacturing portfolio. NOG reported $879 million in liquidity and adjusted EBITDA stood at $385.50 million. The corporate has elevated its manufacturing in Q3 by 13% QoQ to 102,327 Boe per day in comparison with the second quarter. This upside was achieved resulting from a 42% rise within the manufacturing ranges within the Permian Basin on a sequential foundation.

The corporate carried out properly within the third quarter although the macroeconomic tensions had been overpowering and I consider it may well broaden its revenue margins sooner or later because it has considerably accelerated its manufacturing ranges in comparison with the earlier yr which will help it to handle the market demand and enhance its buyer base. The administration additionally has a constructive outlook to realize development within the upcoming quarters.

Nick O’Grady, NOG’s Chief Government Officer, commented that NOG had skilled a extremely profitable third quarter characterised by ongoing operational energy, document natural development, and achievement in acquisition. He famous that the corporate had shifted into harvest mode, leading to elevated free money stream, whereas nonetheless actively pursuing accretive acquisitions. He highlighted the sturdy state of the steadiness sheet and the increasing scale of NOG, positioning it properly to additional improve development prospects for 2024 and past as they navigate via numerous funding alternatives.

NOG has not too long ago introduced Bolt-on acquisitions which can embody core non-operated working curiosity properties within the Appalachian Basins and North Delaware for 107,657 shares of frequent inventory and an preliminary mixed buy worth of $170 million. It acquired about 0.8 internet producing wells and 1.7 internet wells-in-process in Jefferson, Belmont, Ohio, and Monroe Counties. It has additionally expanded its presence within the Northern Delaware Basin by buying non-operated pursuits in Lea and Eddy Counties and New Mexico throughout 3000 internet acres with round 1.0 internet wells in course of and 13.0 internet producing wells. The mixed common manufacturing for 2024 is anticipated to be 6500 Boe per day. After the closing of the transaction, the corporate can have 40,000 internet acres of Permian land and might turn into its largest basin when it comes to manufacturing in addition to exercise. On the Appalachian entrance, the agency can have its presence within the core of Utica which additionally has a excessive potential for enlargement in the long run. As well as, it’s anticipating a capital expenditure of $33 to $38 million. The money stream from operations for the acquisitions is predicted between $57.5 to $62.5 million, indicating a purchase order worth a number of of two.8- 3.0x. I consider these acquisitions extremely align with the corporate’s trajectory of manufacturing development and might profit the agency in accelerating its manufacturing ranges on a notable stage.

The macroeconomic variables equivalent to rising rates of interest may proceed to have an effect on business in FY2024 as inflation continues to be considerably excessive. In response to IEA, the worldwide demand for oil can lower roughly to 180,000 bpd in 2024 resulting from EV penetration and full restoration after the pandemic. I feel the oil costs may lower considerably in FY2024 as IEA expects that the worldwide oil provide development can outpace the demand development. Even when the provision development surpasses the demand development the costs may nonetheless be larger than costs in FY2022 as 2024 is simply the beginning of upper provide development. The corporate’s elevated manufacturing will help the corporate to seize the present demand out there. That’s the reason, I consider it’s cheap to imagine that the corporate can surpass EPS of FY2022 in FY2024. I’m assuming a development charge of two.2% in FY2024 from an EPS estimate of $6.75 in FY2023 (3.4% development in comparison with EPS of FY2022) as the worldwide manufacturing and worth may lower in FY2024 in comparison with FY2023. Due to this fact, I’m predicting the corporate’s EPS for FY2024 to be $6.90.

Dividend Yield

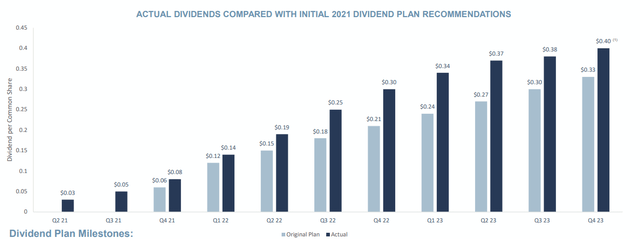

The corporate has began paying dividend since FY2021. It has managed to keep up glorious money positions which was primarily fueled resulting from its elevated operations. In FY2023, NOG distributed dividends of $0.34, $0.37, $0.38, and $0.40 in Q1, Q2, Q3, and This autumn, respectively, which makes the annual dividend $1.49. The FY2023’s annual dividend represents a dividend yield of 4.43% in comparison with the present share worth of $33.56. The corporate’s dividend yield is 13.29% larger than the sector median dividend yield of three.91%. NOG’s FCF payout ratio in FY2021 was 9% and in FY2022 it was 17%. The administration is projecting a document free money stream era in Q4FY2023. Due to this fact, I’m assuming that the corporate may enhance the dividend distribution in FY2024 and will pay $0.42 quarterly dividend which is an annual dividend of $1.68. If we evaluate the annual dividend of $1.68 with present share worth, we are going to get a dividend yield of 5.01%. The enterprise is increasing its manufacturing ranges and buying new companies which help dividend fee will increase. This interesting dividend yield makes the corporate a gorgeous inventory, particularly for risk-averse and retired traders.

Precise vs Preliminary Dividend Plan of NOG (Investor Presentation: Slide No: 10)

What’s the Predominant Danger Confronted by NOG?

The corporate extremely relies on third events to market its oil and pure fuel. These operations depend on numerous elements: proximity and capability of pipeline techniques, processing amenities, rail transportation property, and oil trucking fleets owned by third events. If these providers by exterior sources get disrupted resulting from causes equivalent to bodily injury or different authorized challenges, it may well negatively impression the corporate’s operations and might additional scale back its profitability by decreasing its gross sales ranges.

Valuation

The oil & fuel business is rising quickly which is mirrored in its constructive demand dynamics. I feel the agency is positioned properly to cater to the rising demand because it has expanded its manufacturing ranges which will help it to extend its market share and profitability by promoting extra volumes from its elevated manufacturing ranges. After contemplating all these elements, I’m estimating an EPS of $6.90 for FY2024 which provides the ahead P/E ratio of 4.86x. The comparability of ahead P/E ratio of 4.86x with the sector median of 9.76x signifies that the corporate is undervalued. I feel the agency can probably develop within the subsequent yr on account of stable current demand within the business and NOG’s rising manufacturing ranges which will help it to commerce above its present P/E ratio. I estimate that the corporate may commerce at a P/E ratio of 6.5x in FY2024, giving the goal worth of $44.85, which is a 33.64% upside in comparison with the present share worth of $33.56.

Conclusion

The corporate has reported its monetary outcomes and skilled resistance within the development ranges nonetheless it carried out properly regardless of the macroeconomic pressures. I consider that the agency can broaden its revenue margins sooner or later quarters because it has not too long ago elevated its manufacturing ranges and in addition carried out numerous acquisition plans to develop its productions which will help it to reply to the stable current business demand. Nevertheless, the worldwide oil demand is slowing down. The worldwide provide development can surpass the demand development within the coming interval. In FY2024, the product costs may proceed to stay larger because the demand continues to be considerably larger than the provision. It additionally pays a gorgeous dividend which I consider can enhance sooner or later because the money stream will increase resulting from its expanded operations. The inventory is at present undervalued and I feel it may well develop by 33% from the present worth ranges on account of its enlargement actions and enhancing demand out there. After analyzing all of the above eventualities, I assign a purchase score to NOG.