Written by Axel Rudolph, Senior Market Analyst at IG

Beneficial by IG

Get Your Free Equities Forecast

Nikkei 225 stabilizes as September attracts to an finish

The Nikkei 225 stabilizes into month-end regardless of Japan shopper morale falling to a six-month low as better-than-expected preliminary industrial manufacturing and a constructive shut on Wall Road aided Asian inventory markets to stem their September falls.

The Nikkei 225 thus managed to remain above its Thursday low at 31,665.4 which was made near the 25 August low at 31,563.2. Have been this degree to present approach in October, the August low at 31,251.2 can be in focus.

Instant resistance to deal with is the 22 September low at 32,167.9, adopted by the mid-September low and the 55-day easy shifting common (SMA) at 32,396.5 to 32,464.9. Whereas under this space, bearish strain retains the higher hand.

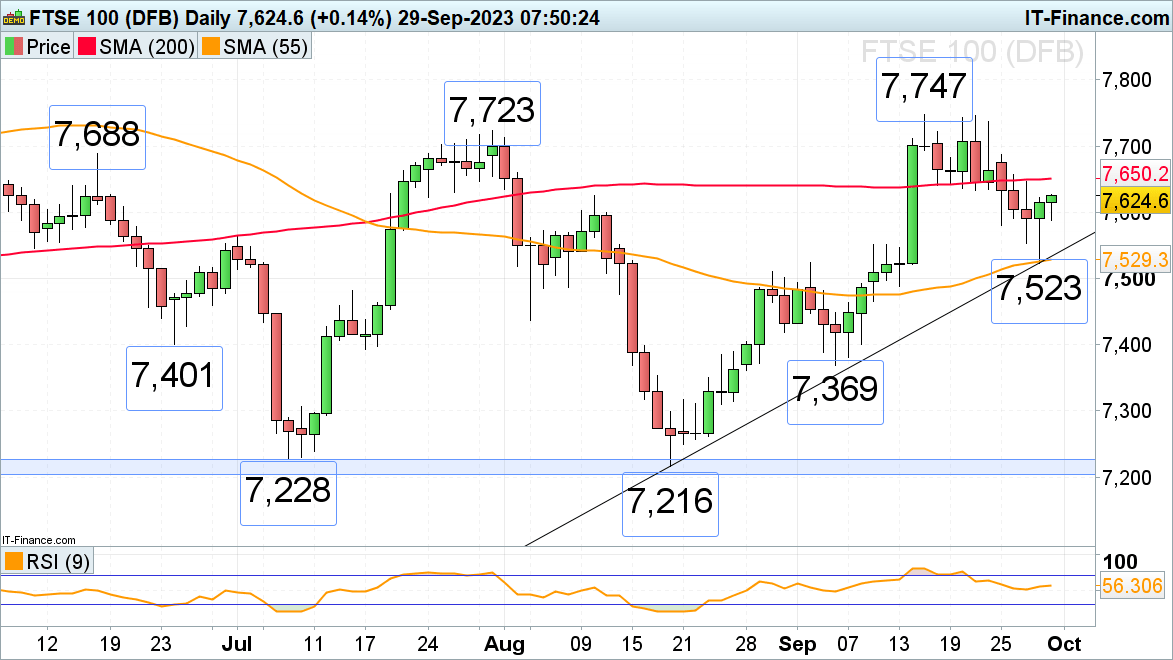

FTSE 100 bounces off assist into month finish

The FTSE 100 is making an attempt to construct on Thursday’s Wall Road led features following dovish feedback by Federal Reserve (Fed) members Goolsbee and Barkin and better-than-expected UK revised enterprise funding numbers.

The 200-day easy shifting common (SMA) at 7,650 is thus again in sight. Potential obstacles above it may be seen on the 7,688 June excessive and in addition between the 7,723 July peak and the present September excessive at 7,747. These highs will have to be bettered for the psychological 7,800 mark and the 8 Could excessive at 7,817 to be again in play.

Minor assist sits at Wednesday’s low at 7,553.

A fall by this week’s low at 7,523 would open the door to the psychological 7,500 area.

Commerce Smarter – Join the DailyFX Publication

Obtain well timed and compelling market commentary from the DailyFX staff

Subscribe to Publication

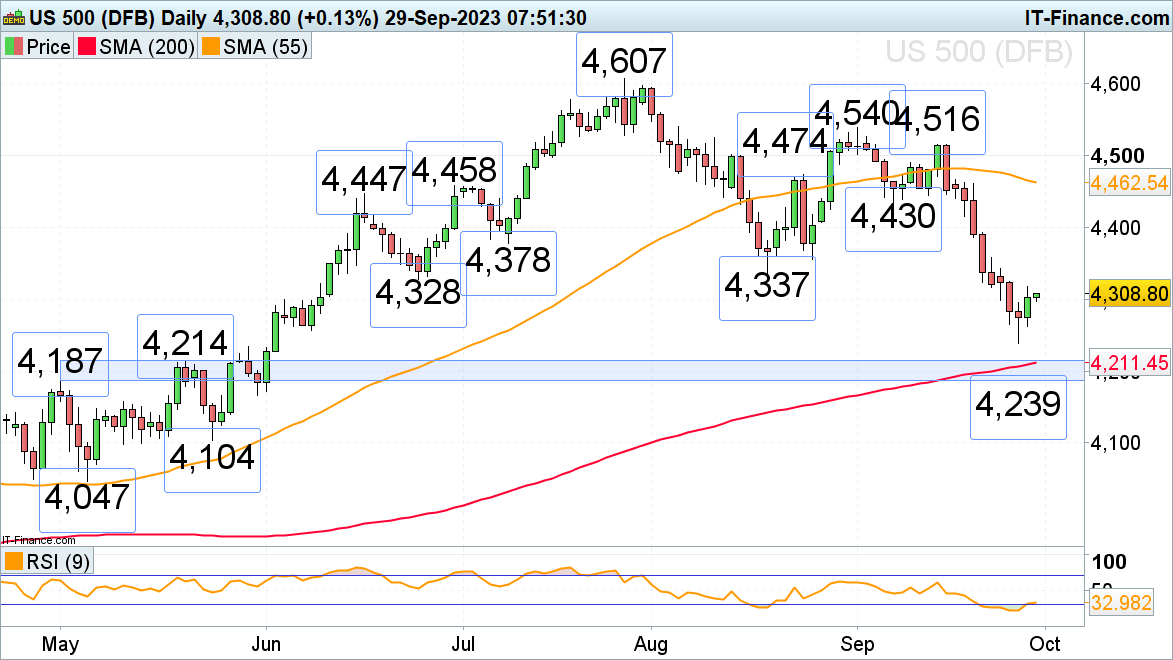

S&P 500 ends 9 straight day fall

A retreat within the oil value, dollar and US yields amid dovish Fed discuss and sharply decrease revised shopper spending have helped the S&P 500 stem its 9 straight day fall to 4,239 and led to a small constructive shut on Thursday.

Whereas this week’s low underpins, the late June to August lows at 4,328 to 4,337 can be eyed. First, although, Thursday’s excessive at 4,318 will have to be exceeded.

Under the September low at 4,239 lies the foremost 4,214 to 4,187 assist space which consists of the early and late Could highs and the 200-day easy shifting common (SMA).