NFT lending has had its strongest month, with $444 million in month-to-month quantity all through January.

A brand new report from NFTGators famous the “important surge in NFT exercise” as Polygon NFTs once more surpassed Ethereum in quantity. The rise in NFT lending is partly liable for the rise in exercise. BendDAO had probably the most important quantity in January at $36 million.

NFT exercise will increase

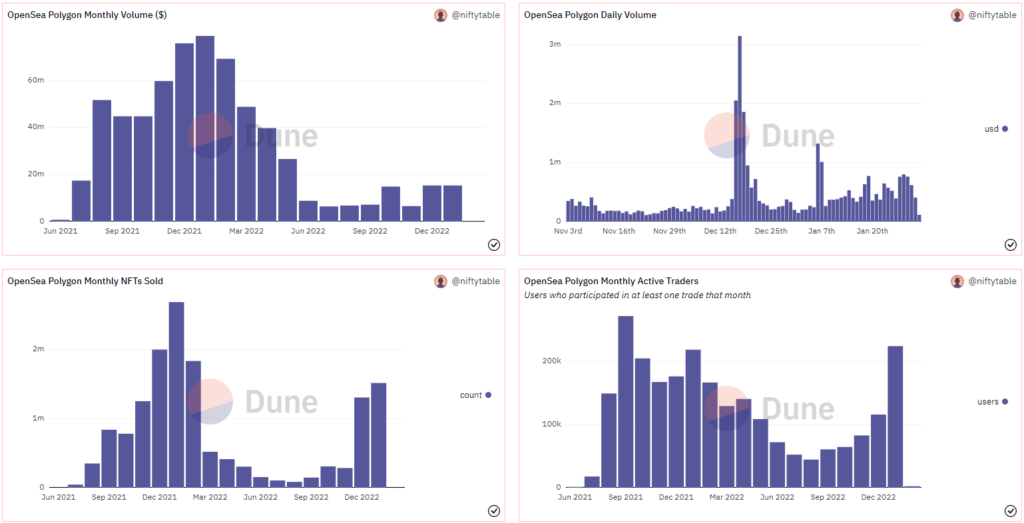

The rise in NFT lending is part of a wider NFT resurgence. OpenSea exercise elevated as 319,641 Ethereum customers offered 1,132,681 NFTs, whereas 224,719 Polygon customers traded 1,514,895 NFTs in January.

In consequence, the common NFT on Ethereum traded for $1390, shopping for a median of three.54 NFTs. However, the sale worth on Polygon was simply $69, with a median of seven NFTs per consumer. Due to this fact, Ethereum merchants spent a median of $4,920, and Polygon merchants invested $483.

The beneath charts visualize the information and the uptick in Polygon NFT exercise.

The surge in NFT Lending

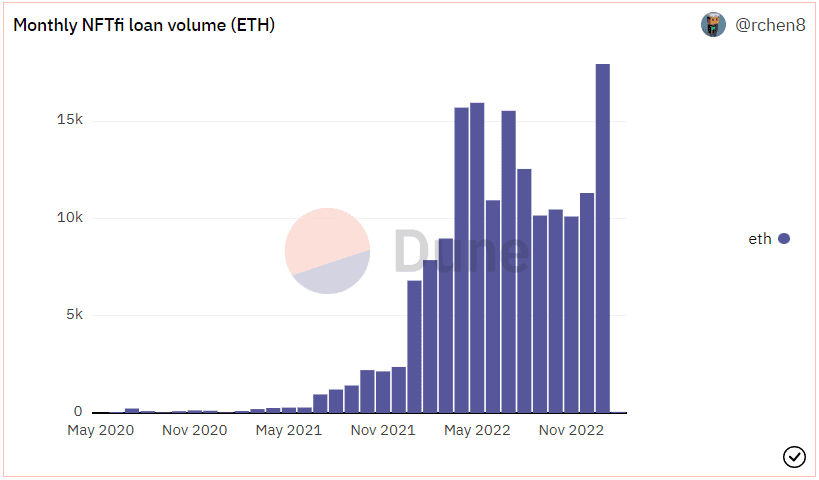

The report disclosed that 17,900 ETH was distributed by 4,399 loans. The common mortgage worth was 4 ETH per mortgage, 29 ETH per borrower, and 61.5 ETH per lender.

The elevated exercise has additionally diminished the price of NFT loans, as lenders pay a median of $90 per mortgage in curiosity funds.

Exterior of the market chief, BendDAO, different platforms akin to NFTfi, X2Y2, and Arcade made up a further $44.8 million.

Mortgage quantity was beneath 1,000 ETH per 30 days in the course of the NFT bull run of 2021, and it beforehand peaked shortly earlier than the Terra Luna crash in Might 2022.