Shares rebounded yesterday forward of at present’s job report, with for 185,000 new jobs to have been created, down from 216,000 final month.

In the meantime, the is predicted to tick larger to round 3.8% from 3.7% final month, whereas is predicted to drop to 0.3% in January from 0.4% in December and at 4.1% y/y.

Bear in mind, final yr, we bought that shock January job report that was significantly better than anticipated.

We noticed the rebound yesterday and managed to stall at 4900; it was the spot the place the index opened yesterday.

Given the outcomes from Meta (NASDAQ:) and its huge transfer larger, it appears we may fill that hole at present, so long as the roles report is available in okay and has no surprises.

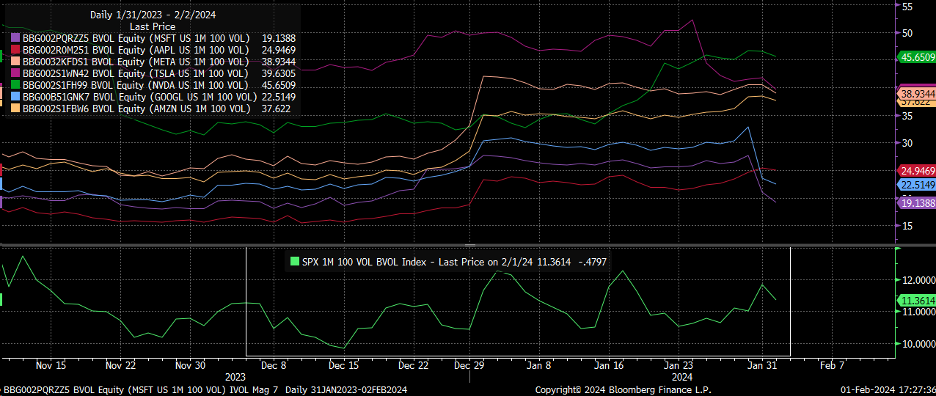

I remained targeted on the Implied Volatility ranges for the Mag7 names and the S&P 500 and see how this performs out.

I’m undecided how the motion in Meta will play into this as a result of the shares are up loads after it introduced a dividend and added on its share buyback program.

Meta launched outcomes that have been significantly better than anticipated, which I’d name shock-and-awe on the income beat and even the steerage for income subsequent quarter.

The brand new dividend was a shock, so the inventory is up 14% after hours. A few of this may increasingly have been performed to overshadow the upper capex and higher-than-expected bills.

The corporate sees a capex of $30 to $37 billion in 2024 versus estimates of $33.4 billion.

The corporate additionally sees whole bills at $94 to $99 billion versus estimates of $96.4 billion. The transfer up looks as if loads to me, so it is going to be attention-grabbing to see if all of the features maintain.

Amazon (NASDAQ:) is buying and selling up 7.5% after hours, which additionally looks as if loads, contemplating AWS missed income estimates, coming in at $24.204 billion versus estimates of $24.221 billion.

That is fractionally, however contemplating the dimensions of the beat by Azure, the AWS numbers don’t appear to check as properly.

The corporate additionally guided first-quarter income of $138 to $143.5 billion versus estimates of $142 billion.

It’s simply shocking I suppose to have seen Microsoft (NASDAQ:) go down after it was reported and to see these Amazon AWS numbers for Amazon to go up.

I get that working earnings was higher, however nonetheless. I personal each Microsoft and Amazon.

In fact, Apple (NASDAQ:) reported good numbers on the highest and backside however had horrible numbers out of China, which was an enormous concern of mine.

The corporate reported China income of $20.8 billion versus estimates of $23.5 billion and an 11.4% miss. Providers income for Apple additionally missed coming in at $23.1 billion versus estimates of $23.3. billion.

Apple does give numbers for steerage, however mentioned it anticipated income to be flat to final yr for the fiscal second quarter, versus expectation for 1% development. The inventory is down about 3.5% after hours.

So total, it was only a unusual day, and I may think about at present getting stranger with the job report nonetheless on the market.

Authentic Publish