NZD/USD, New Zealand Greenback, US Greenback – Outlook:

- NZD tumbled after RBNZ hiked charges as anticipated.

- RBNZ signalled it could be completed with tightening.

- What does it imply for NZD/USD?

Advisable by Manish Jaradi

Foreign exchange for Freshmen

The New Zealand greenback tumbled after the Reserve Financial institution of New Zealand (RBNZ) raised its benchmark price by 25 foundation factors, in step with expectations, however signalled it could be completed with tightening.

The New Zealand central financial institution was extensively anticipated to hike the money price by 25 foundation factors to five.5%, albeit a smaller hike than the 50 bps transfer in April on persistent value pressures. The tempo of the tightening has slowed because the earlier hikes spill over on to the economic system – macro knowledge has underwhelmed in current months and consensus NZ financial progress expectations for this yr have been downgraded sharply since April.

NZD/USD 5-minute Chart

Chart Created Utilizing TradingView

Some available in the market had anticipated charges to peak at 5.75% within the cycle as inflation has moderated from a three-decade excessive of seven.3% to six.7% however remains to be approach above RBNZ’s 1%-3% goal band simply because the job market, together with wage progress, stays sturdy.Nonetheless, RBNZ’s acknowledgement that charges are at peak has weighed on NZD.

In the meantime, threat sentiment has taken a again seat given restricted progress in Washington to lift the US authorities’s debt ceiling, and the scaling again in expectations of a Fed price reduce this yr after hawkish remarks from a number of Fed officers. Cash markets anticipate the Fed to maintain charges on maintain at its subsequent assembly in June however have pushed again price the primary price reduce to the tip of the yr from mid-2023.

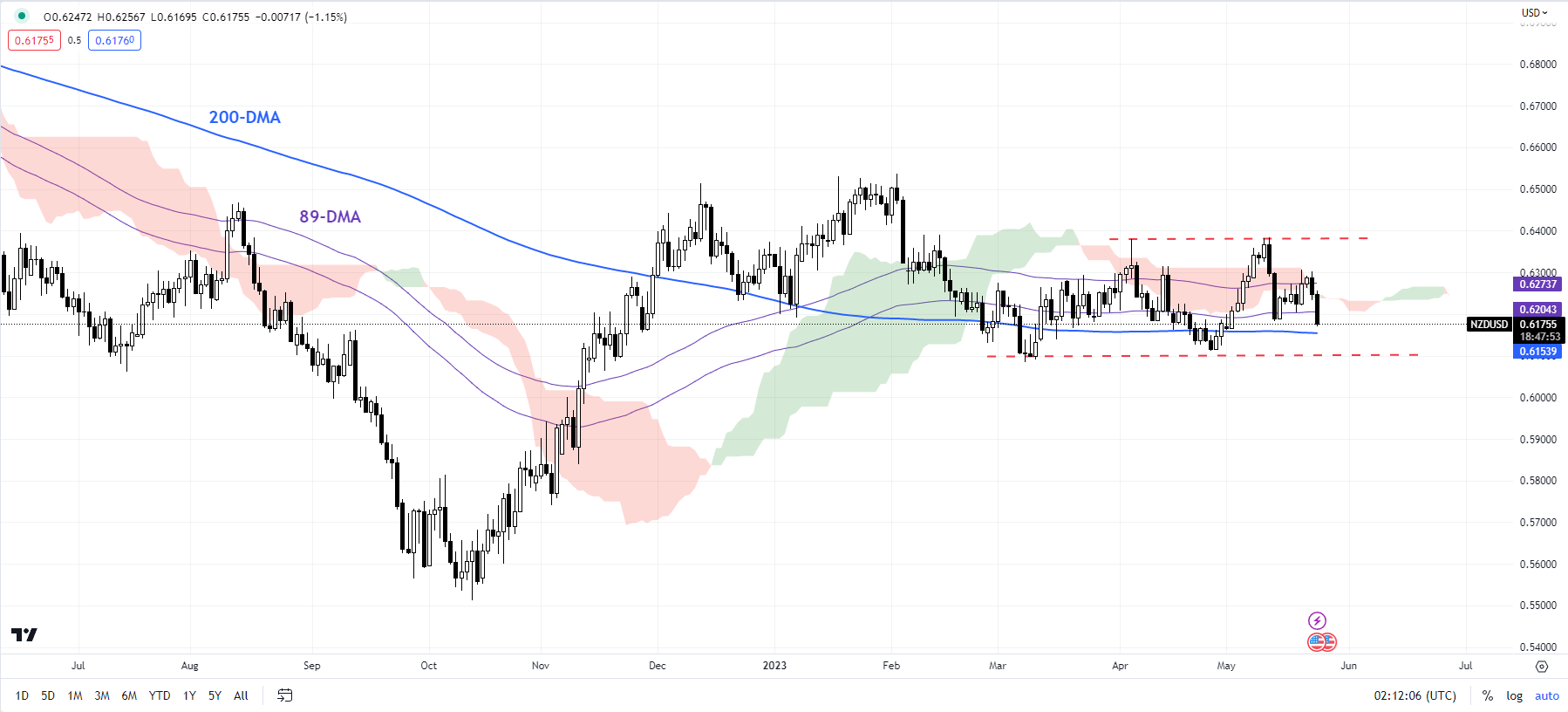

NZD/USD Each day Chart

Chart Created Utilizing TradingView

The chance-sensitive NZD/USD has pulled again in consequence inside its well-established vary since March, pushing again bullish prospects highlighted within the earlier replace. See “Is the New Zealand Greenback Turning Corners? Worth Setup in NZD/USD, AUD/NZD, GBP/NZD”, revealed Could 12. Any break beneath the essential assist on the March low of 0.6085 would negate the optimistic outlook.

On technical charts, NZD/USD has been boxed in a 0.6085-0.6385 vary since early March. Any breakout from the vary may open the door for a 300-pip transfer – the worth goal based mostly on the width of the sample.

Commerce Smarter – Join the DailyFX Publication

Obtain well timed and compelling market commentary from the DailyFX workforce

Subscribe to Publication

— Written by Manish Jaradi, Strategist for DailyFX.com

— Contact and observe Jaradi on Twitter: @JaradiManish