Since mid-2022, Netflix (NASDAQ:) inventory has been on a gentle upward path, with periodic pullbacks. The strongest good points have come round earnings season, as the corporate constantly beats Wall Avenue’s expectations for income and web earnings.

With Netflix now not reporting subscriber numbers, traders have shifted their consideration to different key metrics—comparable to margins, web earnings, and income from each subscriptions and promoting.

A lot of Netflix’s latest success could be traced again to 2 main strikes in 2022: introducing a lower-cost ad-supported tier and cracking down on password sharing. These choices helped reignite progress, main to 6 consecutive quarters of double-digit income will increase.

Because the first of these studies in January 2024, Netflix shares have surged 129%, far outpacing the 28% achieve. The important thing query now could be whether or not Netflix can prolong that momentum with one other robust Q2 efficiency.

Netflix’s Core Strengths Behind Its World Success

Netflix posted a file web revenue of $2.89 billion —its highest ever. This robust end result displays its world subscriber base, which may select from varied plans starting from $7.99 to $24.99.

Promoting is turning into a significant a part of Netflix’s enterprise, with 94 million customers now on ad-supported plans. To strengthen this space, Netflix has launched its personal advert tech platform. With a projected $8 billion in free money movement for 2025, the corporate has the monetary backing to proceed investing on this platform.

Netflix goals to double its advert income this yr to $3 billion. Nevertheless, one attainable problem is the influence of President Donald Trump’s proposed tariffs. If utilized to the movie trade, these tariffs may increase the price of producing content material outdoors the US.

Excessive Optimism Forward of Netflix’s Outcomes

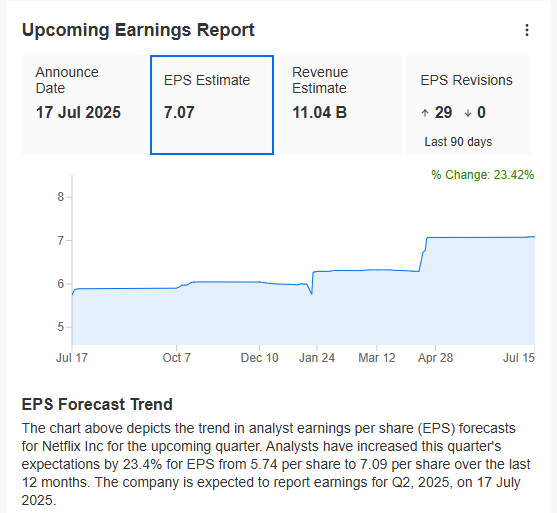

Over the previous three quarters, traders have responded very positively to Netflix’s monetary outcomes, displaying robust confidence within the firm proper after every earnings launch.

Market sentiment round Netflix stays extremely optimistic, with many analysts elevating their estimates and no downward revisions in sight. If the corporate meets expectations, each its income and earnings per share will hit new all-time highs.

Is Netflix’s Correction a Purchase Sign for the Subsequent Leg Up?

After hitting new all-time highs, Netflix’s inventory is now going via a correction and is approaching a key assist degree round $1,230 per share.

It’s seemingly that Netflix’s inventory will keep across the present assist degree throughout right this moment’s session. The subsequent transfer will depend upon the quarterly outcomes set to be launched afterward. If the outcomes are robust, the inventory may resume its uptrend and attain new all-time highs. Nevertheless, if the assist degree is damaged, the correction may deepen and take the worth under $1,200 per share.

****

Make sure to try InvestingPro to remain in sync with the market pattern and what it means on your buying and selling. Leveraging InvestingPro can unlock a world of funding alternatives whereas minimizing dangers amid the difficult market backdrop.

Subscribe now for as much as 50% off amid the summer season sale and immediately unlock entry to a number of market-beating options, together with:

- ProPicks AI: AI-selected inventory winners with confirmed observe file.

- InvestingPro Honest Worth: Immediately discover out if a inventory is underpriced or overvalued.

- Superior Inventory Screener: Seek for the very best shares primarily based on lots of of chosen filters, and standards.

- Prime Concepts: See what shares billionaire traders comparable to Warren Buffett, Michael Burry, and George Soros are shopping for.

Disclaimer: This text is written for informational functions solely. It’s not supposed to encourage the acquisition of belongings in any means, nor does it represent a solicitation, supply, suggestion or suggestion to take a position. I wish to remind you that each one belongings are evaluated from a number of views and are extremely dangerous, so any funding choice and the related danger is on the investor’s personal danger. We additionally don’t present any funding advisory companies.