Netflix (NASDAQ:) inventory has been driving a wave of progress, with the value climbing steadily for over two years. This momentum has been fueled by a surge in new subscriptions and a powerful push into promoting income.

Since launching its $6.99 ad-supported tier in 2022, the streaming big has seen a noticeable enhance in income. With in the present day’s Q3 2024 earnings report looming, buyers are wanting to see if the worldwide streaming big can keep its upward trajectory.

The corporate is predicted to publish file income, supported by a flurry of upward revisions. Nonetheless, the inventory has lately pulled again, hovering across the vital $700 assist degree.

Netflix’s Technique: Increasing Content material and Monetizing Adverts

As competitors within the streaming area intensifies, Netflix has leaned into sports activities broadcasting and dwell occasions, together with NFL video games, to broaden its content material choices.

The extremely anticipated second season of Squid Sport can be set to attract in viewers. However the true story for buyers is Netflix’s push into promoting.

In Q2, ad-supported subscriptions jumped 34% year-over-year, underscoring the corporate’s capacity to faucet into a brand new income stream.

The upcoming elimination of the $6.99 plan will additional nudge subscribers towards the $15.99 ad-supported tier, boosting margins.

Investor Focus: Will It Pay Off?

Wall Road expects Netflix to indicate sturdy income and earnings progress, mirrored in 30 upward revisions forward of in the present day’s report.

Supply: InvestingPro

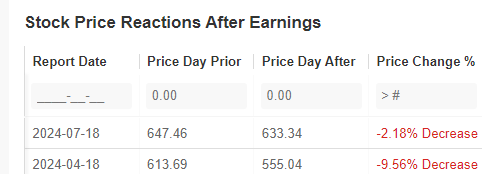

However current historical past means that even beating estimates could not assure a inventory value surge, as previous earnings surprises have generally led to sell-offs.

Supply: InvestingPro

Traders shall be paying shut consideration to ahead steerage and subscriber progress, with analysts anticipating a 4.5 million enhance in new customers.

Technical Outlook: Key Help at $700 Forward of Outcomes

Netflix’s inventory has rebounded over the previous week, testing the $700 assist degree. A break under this might set off additional draw back towards September’s lows.

Nonetheless, a optimistic earnings report might reignite the uptrend, with $750 and $800 as the following targets for bulls.

***

Disclaimer: This text is written for informational functions solely; it doesn’t represent a solicitation, provide, recommendation, counsel or suggestion to take a position as such it isn’t supposed to incentivize the acquisition of property in any method. I want to remind you that any kind of asset, is evaluated from a number of views and is extremely dangerous and due to this fact, any funding choice and the related danger stays with the investor.