Tariff disruption is fertile floor for innovation

Final week, we had Liberation Day, ushering in a interval of intense upheaval. The US imposed tariffs on markets and sectors internationally, earlier than quickly reversing some, whereas doubling down on others, significantly with China.

It doesn’t matter what your information or expertise, there’s nonetheless confusion about what’s subsequent. I mentioned this with a number of analysts and senior Consultants at Mintel, and after some preliminary shocked – one thing companies in all places possible skilled – we regrouped. We reminded ourselves that serving to companies navigate uncertainty is what we do finest at Mintel, particularly after 15 years of back-to-back market disruptions.

Every of those crises has been very totally different. However from the monetary crash to COVID-19, Mintel has gained helpful insights from every interval of disruption. Our collective information and expertise, together with datasets that date again a long time, implies that we’re geared up to understanding what’s subsequent. That is what defines Mintel.

So, what have we discovered? Nicely, over the previous 15 years, we’ve seen a fair proportion of financial and political earthquakes: the tremors of the monetary crash, the unprecedented influence of COVID-19, the drawn-out saga of Brexit, and the continuing cost-of-living disaster. Every occasion has been a lesson in adaptation, resilience, and has supplied a masterclass find alternative amidst the chaos. By means of all of it, one precept has remained steadfast: consistency. In instances of uncertainty, manufacturers want to indicate a trusted voice and be guided by a gradual hand on the tiller.

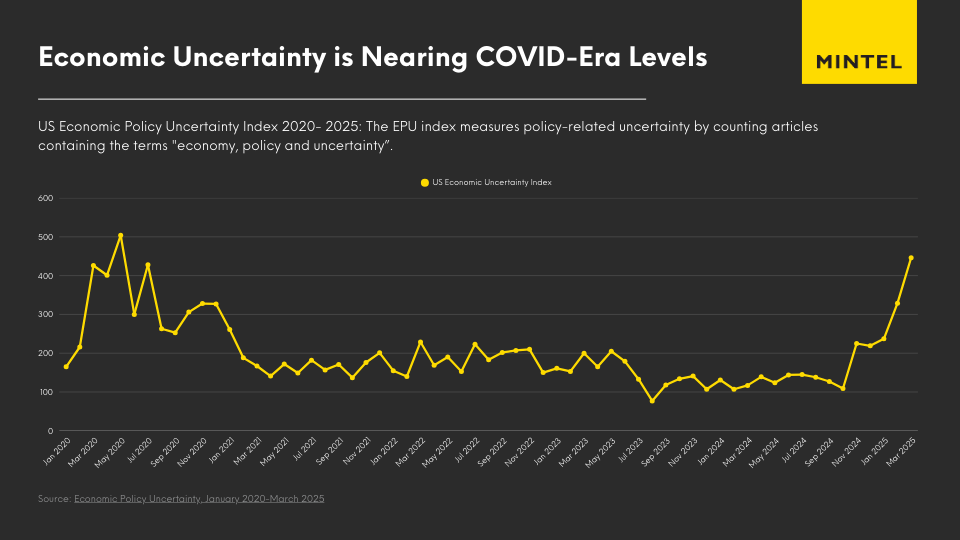

The problem now goes past the speedy influence of the tariffs. They amplify much more uncertainty to an already unpredictable international state of affairs. And uncertainty has an inevitable influence on how each companies and customers behave.

That is significantly difficult, on condition that client confidence remains to be fragile. Solely a minority of individuals say their funds are wholesome, whereas many behaviours adopted in the course of the cost-of-living disaster are nonetheless in full impact. Manufacturers should adapt to this actuality with readability and function.

40% of UK customers say they’re reducing again on luxuries, and 34% say they’re switching to lower-cost retailers.

Are manufacturers really doing sufficient to bolster their worth proposition, to remind customers why they’re value that little further, particularly when budgets are tighter than ever? Or are some merely hoping to journey out the storm, heads down, maybe assuming customers gained’t even discover their silence? That, in itself, is a chance. As a result of in instances of uncertainty, inaction might be simply as deafening as a misstep. However right here’s the thrilling half: this very disruption, this sense of being ‘caught,’ is fertile floor for innovation.

Historical past doesn’t repeat itself – nevertheless it usually rhymes

At Mintel, we’ve received an immense useful resource of institutional information that we will draw on. We’ve been monitoring markets, customers and types for over 50 years. We’ve guided our shoppers via uncertainty earlier than, offering a transparent, actionable path ahead when it issues most.

And whereas every time, the trigger and form of the disaster has been totally different, while you observe again via Mintel’s analysis and information, there are widespread themes.

The larger the extent of uncertainty within the broader market, the extra that companies and customers attempt to take again management by reassessing their spending.

Usually, that includes lowering spend. When uncertainty hits, it makes rational sense to attempt to create a margin of security. (“The paradox of thrift”: financial exercise drops, simply as an financial system wants essentially the most help.)

However specializing in spending additionally performs into our underlying want for management. None of us has any management over Donald Trump’s commerce insurance policies (or, in earlier crises, over vitality costs, or COVID-19, or international monetary stability), however we do have management over our personal spending.

5 ways in which client behaviour modifications throughout instances of financial uncertainty…

Whereas particular modifications differ by market and particular person, sure constant patterns are inclined to emerge.

- Concentrate on worth and efficacy

When each penny counts, each buy issues. We noticed this clearly within the family care sector in the course of the cost-of-living disaster. COVID-19 had already pushed efficacy up the agenda, however the cost-of-living disaster added one other layer. Shoppers needed to make sure that the purchases they made weren’t solely efficient for well being causes, but in addition provided true worth for cash. - Buying and selling down…

Lots of the commentary on client behaviour throughout powerful instances revolves round methods individuals are attempting to save cash. Some individuals are pressured to commerce down, whereas others achieve this by selection. In classes they’re not super-engaged in, or the place there’s a technique to reduce spend with out lowering high quality, they’ll swap to lower-cost options. - … And buying and selling up

However customers’ behaviour is far more refined than simply reducing again throughout the board. They’re additionally ready to spend extra in the event that they suppose that’ll give them a greater return on their funding.The monetary disaster, for instance, considerably accelerated the expansion of the UK’s premium prepared meal market. Retailers noticed a chance to capitalise on customers who have been reducing again on eating out, and repositioned the prepared meal from a handy however uninspiring fallback to an indulgent however inexpensive luxurious.

This sample occurs throughout classes. Magnificence manufacturers know all in regards to the “lipstick impact”: individuals treating themselves to luxurious merchandise as a way to elevate their temper. Mintel’s expertise reveals that almost each class may have its personal equal of this pattern, whether or not that’s premium prepared meals, luxurious fragrances, or inexpensive upgrades to trip packages.

- Market polarisation

The mix of selective buying and selling down and buying and selling up means classes change into extra polarised. The center floor turns into a troublesome place to be. It’s neither inexpensive sufficient to be a discount, nor indulgent sufficient to be a deal with.Branded merchandise are significantly weak to this impact, given the continued enchancment in non-public label options, each on the higher and decrease finish of the market.

- Flight to security

Manufacturers can thrive by specializing in the tendency for customers to change into extra risk-averse. For those who can’t afford to waste cash, experimenting with new merchandise is dangerous. You would possibly save a bit of cash by switching to a less expensive various, but when your youngsters don’t like that various, then the cash is wasted altogether.

…And why manufacturers can’t afford to take a seat again and look ahead to circumstances to enhance

It’s not simply client behaviour that modifications. In earlier financial slowdowns, our International New Merchandise Database (GNPD) has highlighted the best way innovation tendencies shift. We now have seen a decline in brand-led innovation, with non-public labels taking a larger share of innovation.

Simply as with customers’ altering emphasis on lowering prices, it’s a logical response to market uncertainty. Innovation is pricey and dangerous.

Nevertheless, inaction can also be dangerous, particularly given the menace posed by non-public label. When customers are underneath stress, their habits change. This creates alternatives in addition to challenges. It means they’re now not buying on autopilot, and that current loyalties are up for grabs. If manufacturers abandon the innovation battleground to non-public label, they threat completely shedding market share.

What’s subsequent?

Mintel has already revealed a number of articles inspecting the influence of the tariffs on client behaviour throughout a number of classes and markets, together with one on what it could imply for European food and drinks markets (client-access solely), alongside perception items on how UK, US and Southeast Asian customers are prone to react.

Nevertheless, the implications gained’t solely differ throughout totally different classes and areas. They’ll even be dramatically totally different throughout manufacturers working in precisely the identical market. That’s the place our Mintel Consulting group might help. We are able to draw on Mintel’s heritage and our collective genius to create successful methods tailor-made to your particular person goals.

We did this all through COVID-19 and the cost-of-living disaster, and we’ll do it once more. For instance, we’re already speaking to an iconic American model to assist them perceive whether or not current occasions will have an effect on the best way international customers relate to their merchandise.

For those who’re trying to perceive how these modifications have an effect on your individual model, your clients, and your innovation technique, then get in contact with Mintel Consulting to study extra about how we will use our strategies to assist drive your development methods.

We might help you establish what’s already taking place in your sector, predict what’s coming subsequent, and perceive what it means for your corporation’s technique.

Contact a Advisor