MarsYu

By Samuel Rines

The U.S. economic system has slowed. However “slowed” requires a little bit of context. There is no such thing as a scarcity of the way to parse the financial outlook, and—with the advantage of hindsight—level out the locations and instances the variables seem to have damaged. In some circumstances, that could also be a helpful train. More often than not, it isn’t. It is very important word the place the economic system has been solely within the context of the place it might be going. Fortunately, there’s the Atlanta Fed’s GDPNow metric. It’s a kind of “wayback” machine for the U.S. economic system.

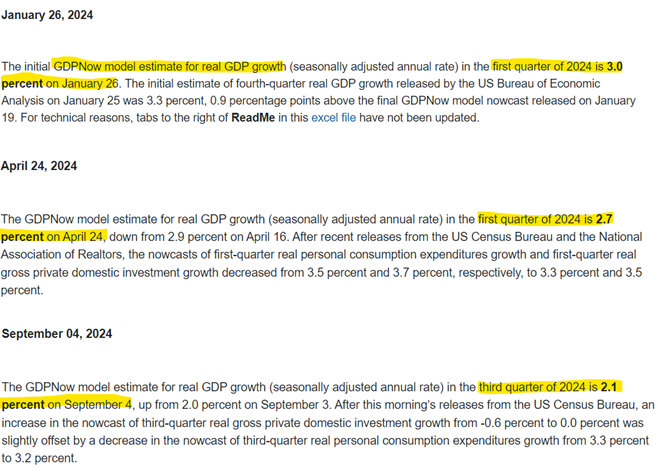

Supply: Atlanta Fed (emphasis added).

In late January, the GDPNow Mannequin for the primary quarter—mainly, a pseudo real-time estimate of GDP progress—was exhibiting a 3% progress charge. That was the preliminary estimate for progress within the first quarter. By the point the quarter closed, it was right down to 2.7%. Right now, the estimate for the third quarter is 2.1% progress. The takeaway is simple: there was a sluggish and regular deceleration from the start of the yr to at the moment.

GDPNow

Supply: Atlanta Fed, as of 9/4/24.

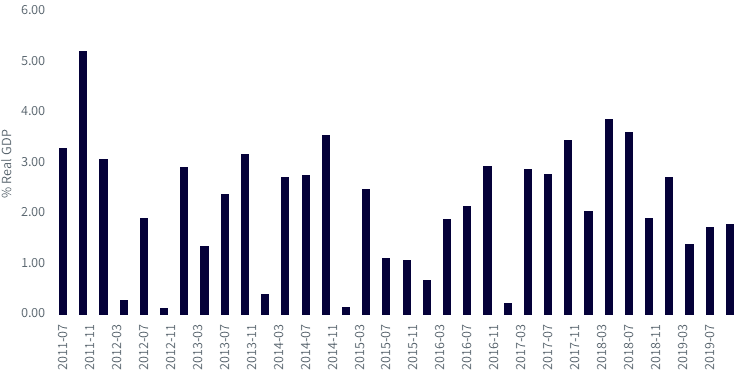

What does 2.1% actual GDP progress imply? Trying on the pre-COVID interval (from the start of the GDPNow dataset), the common quarter-end studying was 2.1%. That perspective issues solely in framing the present outlook. The present slowdown isn’t all that disturbing inside this context. It would even be described as regular. And, after the final 4 years, “regular” is an odd factor for the economic system.

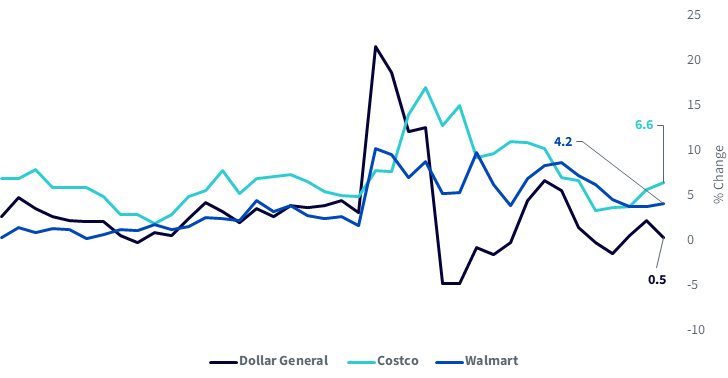

To not point out, there have been loads of one-off earnings reviews to boost eyebrows in regards to the well being of the U.S. client and economic system. The feedback from Greenback Basic (DG) pointed to their core customers, these making underneath $35,000, being underneath strain. That shouldn’t be ignored, however it also needs to be closely caveated. Greenback Basic has not precisely been one of many higher operators within the post-COVID period.

Similar Retailer Gross sales Final 10 Years

Supply: Greenback Basic Firm Filings, as of 9/4/24.

Within the grand scheme of retail, Greenback Basic’s feedback are solely doubtlessly necessary on the margin. Costco (COST, COST:CA) and Walmart (WMT, WMT:CA) are having none of it. In truth, they’re going in the other way with both steady or accelerating comparable gross sales. The mix of Walmart and Costco rising their gross sales is way extra necessary than Greenback Basic’s feedback. Taking Greenback Basic as a sign of a broad financial issues would have despatched quite a few false positives. Incorporating a wider swathe of outlets would have averted these points. That’s doubtless the case at the moment.

Perception into the Rural Economic system?

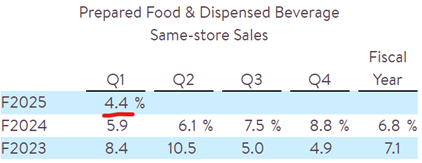

Supply: Casey’s Basic Retailer, as of 9/5/24 (emphasis added).

Casey’s Basic Retailer (CASY) is a gasoline station. That additionally occurs to be the fifth-largest pizza firm within the U.S. The corporate targets smaller inhabitants cities in Center America and flyover nation. If there’s a public firm with perception into the agricultural economic system, it’s Casey’s. Its outcomes confirmed one thing much like the remainder of the economic system: a normalization. A 4.4% same-store gross sales determine in ready meals and beverage isn’t a blowout determine. However it isn’t disturbing, both. Center America stays in respectable form.

The U.S. economic system is muddling via the center of normalizing. It feels unusual. And that’s okay.

Samuel Rines, Macro Strategist, Mannequin Portfolios

Sam Rines serves as a Macro Strategist, Mannequin Portfolios at WisdomTree extending the agency’s customized mannequin portfolio administration capabilities. Previous to WisdomTree, Samuel was a Managing Director of CORBU, a analysis agency we struck up a relationship with to ship mannequin portfolios. Samuel is a worldwide macro knowledgeable targeted on the funding implications of politics and coverage. His PolyMacro analysis has been broadly adopted by giant household workplaces, institutional traders and the media. Previous to becoming a member of CORBU, Samuel was the Chief Economist and Funding Strategist at Avalon Advisors. Earlier than becoming a member of Avalon, Samuel was a portfolio supervisor at Chilton Capital Administration, the place he launched the Chilton ESG Fairness Technique and a protracted/brief know-how portfolio. Samuel began his profession because the cross-asset analyst for a small hedge fund. He’s the writer of the e book “After Regular: Making Sense of the World Economic system ”.

Unique Submit